Last weeks was: "Toppy Tuesday – What More Can Powell Say or Do at this Point?"

Last weeks was: "Toppy Tuesday – What More Can Powell Say or Do at this Point?"

Today I can take the day off becuase here we are again, back at S&P 3,900 along with Dow 31,500, Nasdaq 13,250 and Russell 2,270 all trending lower than their previous two Tuesday's. Why Tuesday? Because Monday markets are very low-volume and easily manipulated with M&A Rumors and Analyst Upgrades along with Government Happy Talk and, of course, a healthy dose of 401K deposits rolling in from Friday's Payrolls.

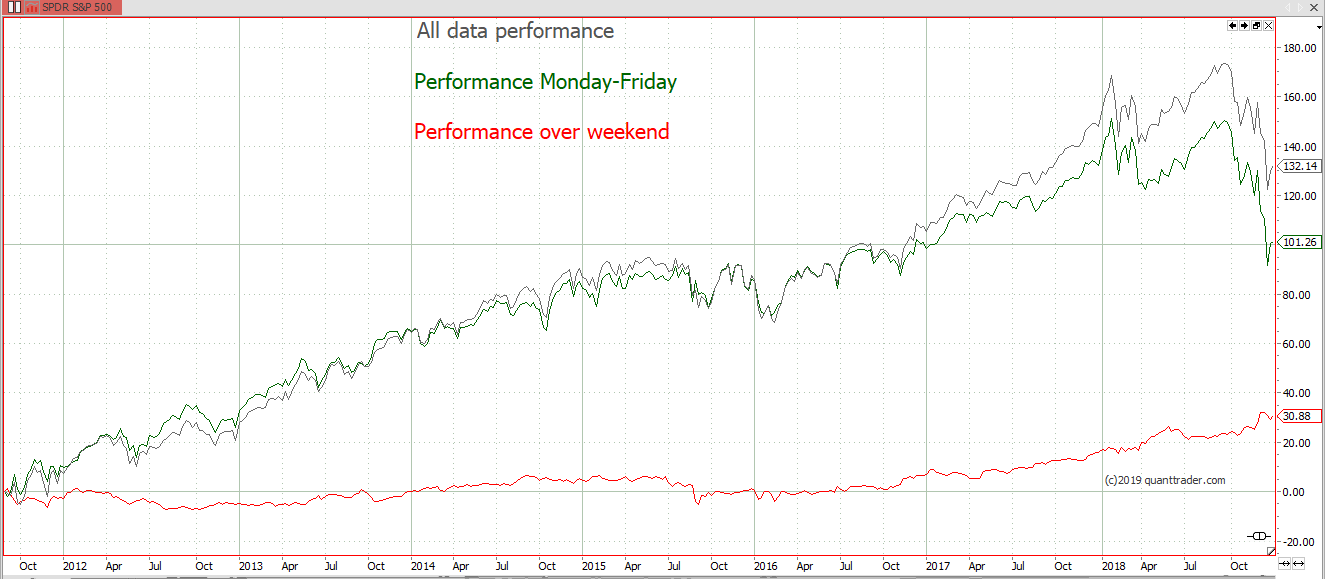

That allows "THEM" to take advantage on a weekly basis and overcharge long-term savers for their positions as they drip-feed their retirement accounts, In fact, Randers pointed out last week that the weekend performance of the S&P 500 (when no one is trading) accounted for about 25% of all gains over the past 10 years.

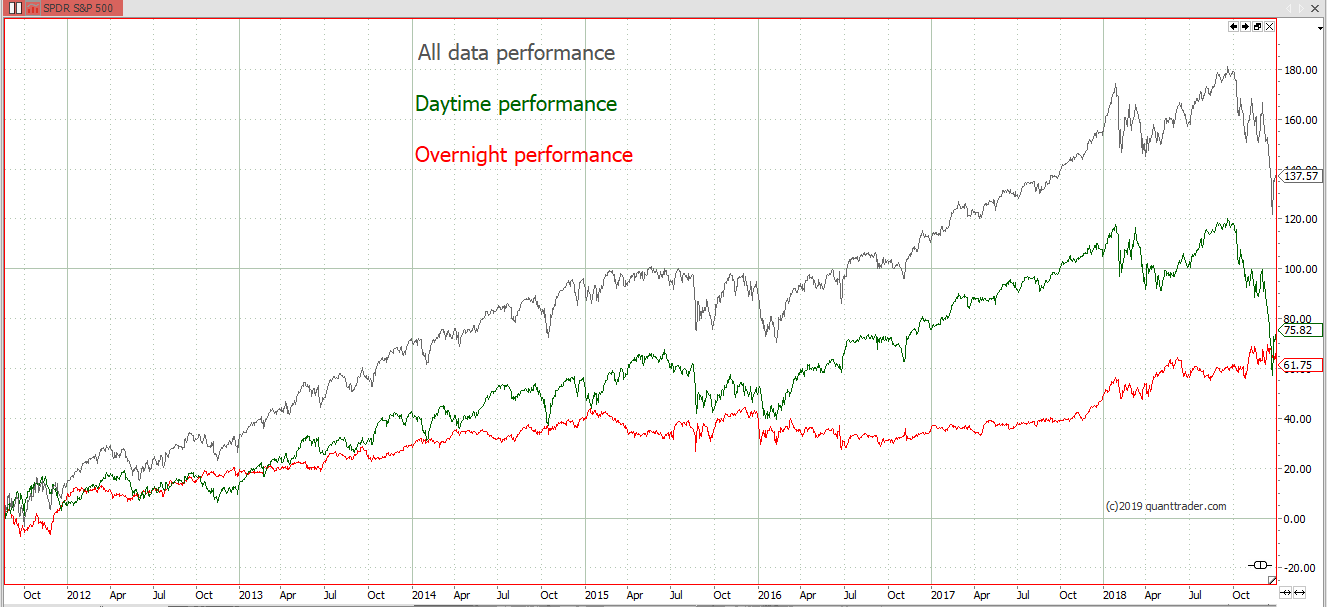

Even "better", overnight trading (when no one is looking) accounted for OVER 50% of the total market gains. So nights and weekends are when all the real money is being made, apparently.

That's why shorting on Tuesdays has been good to us – by Tuesday people are trading and, when there is volume in the market, it usually turns lower because there aren't that many real buyers out there – certainly not at these elevated prices! Guo Shuquing agrees with me and he's the Communist Party Boss at the People's Bank of China. Guo (last name) said this morning: "We are really afraid the bubble for foreign financial assets will burst someday." Guo is also the Chairman of China's Banking and Insurance Regulatory Commission – kind of a right wing Elizabeth Warren...

Investors, hedge fund managers and former central banking officials have all expressed concerns too, as Wall Street trades near record highs even as the United States continues to grapple with the effects of the coronavirus pandemic. Guo echoed such fears, adding that the rallies in US and European markets don't reflect the underlying economic challenges facing both regions as they try to recover from the brutal pandemic recession.

Guo's remarks shook markets in the region. The Shanghai Composite (SHCOM) and Hong Kong's Hang Seng Index (HSI) were both trending upward before Guo's speech, building on Wall Street's rally Monday. But both indexes reversed course soon after. Shanghai's benchmark was down 1.2%, while the Hang Seng fell 1.3%.

IN PROGRESS