Transaction Significantly Expands SSR Mining's Presence in Saskatchewan While Consolidating Ownership and Unencumbering the Fisher Properties

DENVER, CO / ACCESSWIRE / December 2, 2021 / SSR Mining Inc. (NASDAQ: SSRM)(TSX:SSRM)(ASX:SSR) ("SSR Mining" or the "Company") and Taiga Gold Corp. (CSE:TGC) ("Taiga Gold") are pleased to announce that they have entered into a definitive arrangement agreement (the "Agreement") whereby SSR Mining will acquire all of the issued and outstanding common shares of Taiga Gold pursuant to a plan of arrangement (the "Transaction") at a price of C$0.265 per Taiga Gold share (the "Offer Price"). The Transaction implies an equity value of approximately C$27 million (US$21 million) on a fully diluted in-the-money basis and has been unanimously approved by the Board of Directors of each of SSR Mining and Taiga Gold.

The Offer Price represents a premium of approximately 36% to the closing price of the Taiga Gold common shares on the Canadian Securities Exchange ("CSE") on December 1st, 2021, the day prior to the announcement of the Transaction, and a premium of 39% to the 20-day VWAP of the Taiga Gold common shares traded on the CSE prior to announcement of the Transaction.

Strategic Rationale for SSR Mining

- As the only gold producer in the highly prospective province of Saskatchewan, the Transaction materially expands SSR Mining's presence in a core jurisdiction by adding five new properties (34,569 hectares), which provide new exploration targets stretching south from the Seabee mine to SSR Mining's 100%-owned Amisk property. The Company will leverage its existing teams and infrastructure to advance the development of the newly acquired assets

- Consolidates a 100% interest in the Fisher property contiguous to the Seabee mine, currently operated under joint venture comprised of SSR Mining (80%) and Taiga Gold (20%)

- Unencumbers the Fisher property through the elimination of a 2.5% net smelter return ("NSR") royalty covering the majority of the Fisher property

- The Fisher property provides future potential ore sources to extend the operating life of the Seabee property, particularly given the excess capacity at the Seabee mill and the recently completed tailings facility expansion which provides capacity through 2031 at current production levels

Rod Antal, President and CEO said, "With this transaction, we will successfully redeploy a portion of the proceeds from the recent non-core royalty portfolio sale into new growth opportunities in a core jurisdiction. The acquisition of Taiga Gold reiterates our commitment to the Seabee gold mine and ongoing investment for future resource discoveries as we aim to extend Seabee's mine life into the next decade. Additionally, the acquisition of new greenfields exploration properties across the province of Saskatchewan should allow SSR Mining to build upon our regional expertise in a region we consider exceptionally prospective geologically and underexplored."

Benefits to Taiga Gold Shareholders

- All-cash consideration of C$0.265 per Taiga Gold share represents an attractive premium of 36% to Taiga Gold's closing price on the CSE on December 1st, and a 39% premium to Taiga Gold's 20-day VWAP, solidifying value for Taiga Gold shareholders

- All-cash offer that is not subject to any financing conditions

- Strong shareholder support with voting support agreements from Eagle Plains Resources Ltd. and the management and directors of Taiga Gold, for the common shares, options and warrants held by such parties which collectively represent approximately 19.05% of Taiga Gold's issued and outstanding common shares

- The Transaction provides certainty of value, removing potential future equity dilution as well as exploration, development and execution risk

Tim Termuende, P.Geo., President and CEO of Taiga Gold said "This transaction with SSR Mining fulfils the goal we set out to accomplish upon Taiga Gold's formation in 2018. The diligence and skill of our technical team has allowed Taiga Gold to maximize the value of our portfolio of exploration properties in Saskatchewan, and we are pleased to see those efforts recognized by SSR Mining in today's announcement. Management and the Board of Directors view this transaction as beneficial for all shareholders and a positive culmination of Taiga Gold's efforts to-date."

Overview of Properties

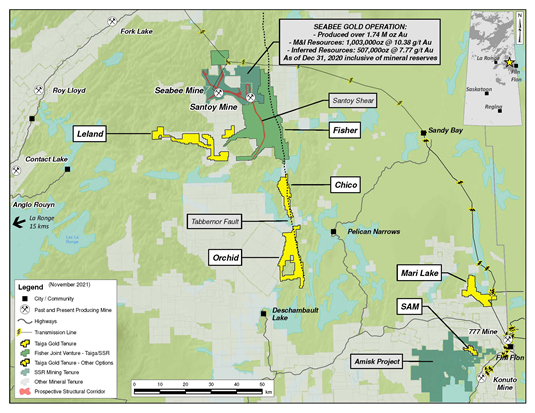

Figure 1. Regional map showcasing the 6 properties included in the Transaction in relation to SSR Mining's Seabee gold project.

Fisher (33,171 hectares)

- Operated under joint venture by SSR Mining (80%) and Taiga Gold (20%). The Transaction would eliminate a 2.5% NSR royalty on a large portion of the Fisher property

- Contiguous to SSR Mining's Seabee property, with the potential to provide additional ore sources to extend the life of the currently operating Seabee mill

- Recent (September 2021) exploration results announced by SSR Mining at Fisher included 22.99 g/t Au over 1.46 meters at the Mac North target and 10.03 g/t Au over 2.5 meters at the Yin target

- Additional surface sampling results announced (November 2021) by Taiga Gold including 55.62 g/t Au and 33.88 g/t Au at the George East target

Leland (11,761 hectares)

- 100% owned by Taiga Gold

- Potential satellite deposit to the Seabee property, located ~23 km south-southwest

- Hosts ~25 km extension what is currently interpreted as a structural splay of the Tabbernor fault, the major deep-seated crustal shear system that is associated with the Seabee-Santoy mineralization

- Numerous historical grab samples up to 60 g/t and limited prior drilling

- As of December 1, 2021, Taiga Gold has terminated its option agreement with SKRR Exploration Inc. ("SKRR") whereby SKRR had the right to earn up to a 75% interest in Leland

Chico (4,716 hectares)

- 100% owned by Taiga Gold

- Located ~6 km south of the Fisher Property and ~45 km southeast of the Seabee gold mine. Covers ~15 km of north-south trending Tabbernor Fault strike with multiple gold showings

- Potential satellite deposits to Seabee with open pit potential

- Quartz veining and gold mineralization up to 100m wide at Chico/Royex/Main structural zone

- Surface sample returned 113.5 g/t Au, and prior drilling included a 0.5 meter intercept at 36.3 g/t Au

- In early November 2021, Taiga Gold terminated its option agreement with Aben Resources Ltd. ("Aben") whereby Aben had the right to earn up to an 80% interest in Chico

Orchid (11,179 hectares)

- 100% owned by Taiga Gold

- Located ~70 km southeast of the Seabee gold mine

- Numerous gold showings and encouraging historical drill results from multiple targets

- Historical surface sampling data includes 61.3 g/t Au at the Orchid zone, 52.4 g/t Au from Tim's Showing

Mari Lake (5,909 hectares)

- 100% owned by Taiga Gold

- Located ~25 km northeast of Flin Flon and ~20 km from SSR Mining's Amisk property

- Positive historical grab samples including 14.4 g/t Au and 12.69 g/t Au, limited prior drilling

- Additional targets for potential VMS mineralization on property

SAM (1,004 hectares)

- 100% owned by Taiga Gold

- Tactical Resources Corp. (a private BC corporation) holds option to earn a 60% interest in the property

- Located ~15 km west of Flin Flon, and within the Amisk property (100% owned by SSR Mining) claim block

- Historical trench sampling results include 24.61 g/t Au over 1.0 meter and 9.61 g/t Au over 1.55 meters

- Numerous gold showings with limited historical drilling

Transaction Conditions & Timing

Taiga Gold intends to call a meeting of shareholders to be held on or before March 15, 2022 to seek shareholder approval for the Transaction (the "Meeting"). The Transaction will be effected by way of a court-approved plan of arrangement under Section 193 of the Business Corporations Act (Alberta) and will require:

- approval of at least 662/3% of the votes cast by Taiga Gold shareholders; and

- a simple majority of the votes cast by Taiga Gold shareholders, excluding votes from certain shareholders, as required under Multilateral Instrument 61-101 - Protection of Minority Securityholders in Special Transactions.

The completion of the transaction is also subject to the receipt of court, stock exchange and any other required regulatory approvals, and is subject to certain customary closing conditions for transactions of this nature. The Transaction does not require the approval of the shareholders of SSR Mining.

The Agreement provides for, among other things, non-solicitation covenants, with "fiduciary out" provisions that allow Taiga Gold to consider and accept a superior proposal, subject to a "right to match period" in favour of SSR Mining. The Agreement also provides for: (i) a termination fee of C$1.5 million to be paid by Taiga Gold to SSR Mining if the Agreement is terminated in certain specified circumstances; and (ii) an expense reimbursement fee of C$425,000 to be paid by SSR Mining to Taiga Gold if the Transaction fails to close as a result of specified breaches of the Agreement by SSR Mining.

The Transaction is expected to close in the first half of 2022.

Voting Support Agreements, Board Approval and Recommendation

Officers and directors of Taiga Gold, along with Eagle Plains Resources Ltd., which together hold approximately 19.05% of the outstanding Taiga Gold common shares, have entered into voting support agreements pursuant to which they have agreed, among other things, to vote their Taiga Gold common shares in favour of the Transaction.

The Transaction has been unanimously approved by the Board of Directors of each of SSR Mining and Taiga Gold. The Board of Directors of Taiga Gold unanimously recommends that its shareholders vote in favour of the Transaction.

Taiga Gold has received an opinion from McKnight Mineral Advisor Services that, based upon and subject to the limitations, assumptions and qualifications of and other matters considered in connection with the preparation of such opinion, the consideration to be received by Taiga Gold shareholders pursuant to the Transaction is fair, from a financial point of view, to the Taiga Gold shareholders (the "Fairness Opinion"). The full text of the Fairness Opinion will be included in the management information circular of Taiga Gold which will be mailed to Taiga Gold shareholders prior to the Meeting.

Warrants and Options

Pursuant to the Transaction, each Taiga Gold stock option and warrant (each, a "Taiga Gold Option and Warrant") outstanding immediately prior to the effective time of the Transaction (the "Effective Time") shall automatically vest and be immediately cancelled in exchange for a cash payment equal to the excess, if any, of the C$0.265 consideration over the applicable aggregate exercise price of such Taiga Gold Options and Warrants.

Leland Option Termination

Taiga Gold has entered into a termination agreement with SKRR whereby Taiga Gold and SKRR have mutually agreed to terminate the Option Agreement on the Leland property, dated May 20th, 2020 between SKRR and Taiga Gold (the "Option Agreement"). Under the terms of the termination agreement, Taiga Gold has agreed to pay SKRR C$900,000 in cash to terminate the Option Agreement, effective immediately. SKRR no longer has any rights to the Leland Property nor the obligation to make cash payments, issue common shares or incur exploration expenditures. Moving forward, Taiga Gold will control a 100% interest in the Leland property.

Qualified Person

The scientific and technical disclosure in this news release has been reviewed and approved by C.C. Downie, P.Geo., a director and officer of Taiga Gold Corp., identified as the "Qualified Person" under National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About SSR Mining

SSR Mining Inc. is a leading, free cash flow focused intermediate gold company with four producing assets located in the USA, Turkey, Canada, and Argentina, combined with a global pipeline of high-quality development and exploration assets in the USA, Turkey, Mexico, Peru, and Canada. In 2020, the four operating assets produced approximately 711,000 gold-equivalent ounces. SSR Mining is listed under the ticker symbol SSRM on the NASDAQ and the TSX, and SSR on the ASX.

About Taiga Gold

Taiga Gold Corp was created through a plan of arrangement with Eagle Plains Resources Ltd. in April, 2018 and is listed on the CSE under the symbol "TGC". Taiga Gold has ownership in 6 projects targeting gold located within the Trans Hudson Corridor in the area near the Seabee Gold Operation, owned and operated by SSR Mining. Taiga's flagship "Fisher" property is currently being explored by the Fisher Joint Venture between SSR Mining and Taiga Gold (80%/20% respectively). Taiga Gold continues to advance its 100%-owned Chico, Orchid, Leland and Mari Lake projects, while its' 100%-owned SAM property is currently under option to Tactical Resources (formerly DJ1 Capital).

Advisors and Counsel

Stikeman Elliott LLP is acting as legal counsel for SSR Mining in connection with the Transaction.

McLeod Law LLP is acting as legal counsel for Taiga Gold in connection with the Transaction.

SSR Mining Contacts:

F. Edward Farid, Executive Vice President, Chief Corporate Development Officer

Alex Hunchak, Director, Corporate Development and Investor Relations

SSR Mining Inc.

E-Mail: invest@ssrmining.com

Phone: +1 (416) 306-5789

Taiga Gold Contacts:

Tim J. Termuende, P.Geo., President and Chief Executive Officer

Mike Labach

Phone: +1 (866) 486-8673

Email: info@taigagold.com

http://taigagold.com

To receive SSR Mining's news releases by e-mail, please register using the SSR Mining website at www.ssrmining.com.

SOURCE: SSR Mining Inc.

Cautionary Note Regarding Forward-Looking Information

Except for statements of historical fact relating to the Company and/or Taiga Gold, certain statements contained in this press release constitute forward-looking information, future oriented financial information, or financial outlooks (collectively "forward looking information") within the meaning of Canadian securities laws. Forward-looking information may be contained in this document and the Company's or Taiga Gold's other public filings. Forward-looking information relates to statements concerning the Company's or Taiga Gold's outlook and anticipated events or results and in some cases, can be identified by terminology such as "may", "will", "could", "should", "expect", "plan", "anticipate", "believe", "intend", "estimate", "projects", "predict", "potential", "continue" or other similar expressions concerning matters that are not historical facts. Forward-looking information in this press release is based on certain key expectations and assumptions made by the Company and Taiga Gold. Although the Company and Taiga Gold believes that the expectations and assumptions on which such forward-looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because neither the Company nor Taiga Gold can give any assurance that they will prove to be correct. Forward-looking information is subject to various risks and uncertainties which could cause actual results and experience to differ materially from the anticipated results or expectations expressed in this press release. The key risks and uncertainties include, but are not limited to: local and global political and economic conditions; governmental and regulatory requirements and actions by governmental authorities, including changes in government policy, government ownership requirements, changes in environmental, tax and other laws or regulations and the interpretation thereof; developments with respect to COVID-19 pandemic, including the duration, severity and scope of the pandemic and potential impacts on mining operations; and other risk factors detailed from time to time in the Company's and Taiga Gold's reports filed with the Canadian securities regulatory authorities.

Forward-looking information in this press release include statements concerning, among other things: the timing for the Meeting, successful receipt of Court orders, successful receipt of Taiga Gold shareholders' approval for the Transaction, the ability to successfully close the Transaction or within the expected timeframe, successful receipt of regulatory approvals (if any), including approvals from the Canadian securities authorities and the applicable stock exchanges; the Company's plans and expectations for its properties and operations; and all other timing, exploration, development, operational, financial, budgetary, economic, legal, social, environmental, regulatory, and political matters that may influence or be influenced by future events or conditions.

Such forward-looking information is based on a number of material factors and assumptions, including, but not limited in any manner to, those disclosed in any other of the Company's or Taiga Gold's filings, and include: the inherent speculative nature of exploration results; the ability to explore; communications with local stakeholders; maintaining community and governmental relations; status of negotiations and potential transactions, including joint ventures; weather conditions at the Company's operations; commodity prices; the ultimate determination of and realization of Mineral Reserves; existence or realization of Mineral Resources; the development approach; availability and receipt of required approvals, titles, licenses and permits; sufficient working capital to develop and operate the mines and implement development plans; access to adequate services and supplies; foreign currency exchange rates; interest rates; access to capital markets and associated cost of funds; availability of a qualified work force; ability to negotiate, finalize, and execute relevant agreements; lack of social opposition to the Company's mines or facilities; lack of legal challenges with respect to the Company's properties; the timing and amount of future production; the ability to meet production, cost, and capital expenditure targets; timing and ability to produce studies and analyses; capital and operating expenditures; economic conditions; availability of sufficient financing; the ultimate ability to mine, process, and sell mineral products on economically favorable terms; and any and all other timing, exploration, development, operational, financial, budgetary, economic, legal, social, geopolitical, regulatory and political factors that may influence future events or conditions. While the Company considers these factors and assumptions to be reasonable based on information currently available to the Company, they may prove to be incorrect.

The above list is not exhaustive of the factors that may affect any of the Company's or Taiga Gold's forward-looking information. You should not place undue reliance on forward-looking information. Forward-looking information is only a prediction based on the Company's and Taiga Gold's current expectations and the Company's and Taiga Gold's projections about future events. Actual results may vary from such forward-looking information for a variety of reasons including, but not limited to, risks and uncertainties disclosed in the Company's and Taiga Gold's filings on the Company's website at www.ssrmining.com and Taiga Gold's website at www.taigagold.com, respectively, on SEDAR at www.sedar.com, and for the Company, on EDGAR at www.sec.gov and on the ASX at www.asx.com.au and other unforeseen events or circumstances. Other than as required by law, neither the Company nor Taiga Gold intend, and undertake no obligation to update any forward-looking information to reflect, among other things, new information or future events.

All references to "$" in this press release are to Canadian dollars unless otherwise stated. This press release includes Mineral Reserves and Mineral Resources classification terms that comply with reporting standards in Canada and the Mineral Reserves and the Mineral Resources estimates are made in accordance with NI 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ significantly from the requirements of the SEC set out in the SEC rules that are applicable to domestic United States reporting companies. Consequently, Mineral Reserves and Mineral Resources information included in this press release may not be comparable to similar information that would generally be disclosed by domestic U.S. reporting companies subject to the reporting and disclosure requirements of the SEC. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards.

SOURCE: Taiga Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/675652/SSR-Mining-and-Taiga-Gold-Announce-Friendly-Acquisition-of-Taiga-Gold