HALIFAX, NS / ACCESSWIRE / February 22, 2024 / Silver Tiger Metals Inc. (TSXV:SLVR)(OTCQX:SLVTF) ("Silver Tiger" or the "Company") is pleased to provide an update on the Company's ongoing Pre-feasibility Study ("PFS") drilling program on the Stockwork gold deposit on its El Tigre Project in Sonora, Mexico. The Company continues to advance and de-risk the Stockwork Deposit. A 25,000 metre drilling program focused on Mineral Resource expansion and classification, metallurgical and geotechnical as it progresses from an exploration to a development project. The value-added PFS progresses on schedule for publication in H2-2024.

Goals of the PFS drilling programs are to:

| a) | de-risk the project with enhanced metallurgical and geotechnical review; |

| b) | increase confidence of the Mineral Resource with in-fill drilling in the near-surface ‘Starter Pit'; and |

| c) | expand the known Mineral Resource through targeted drilling. |

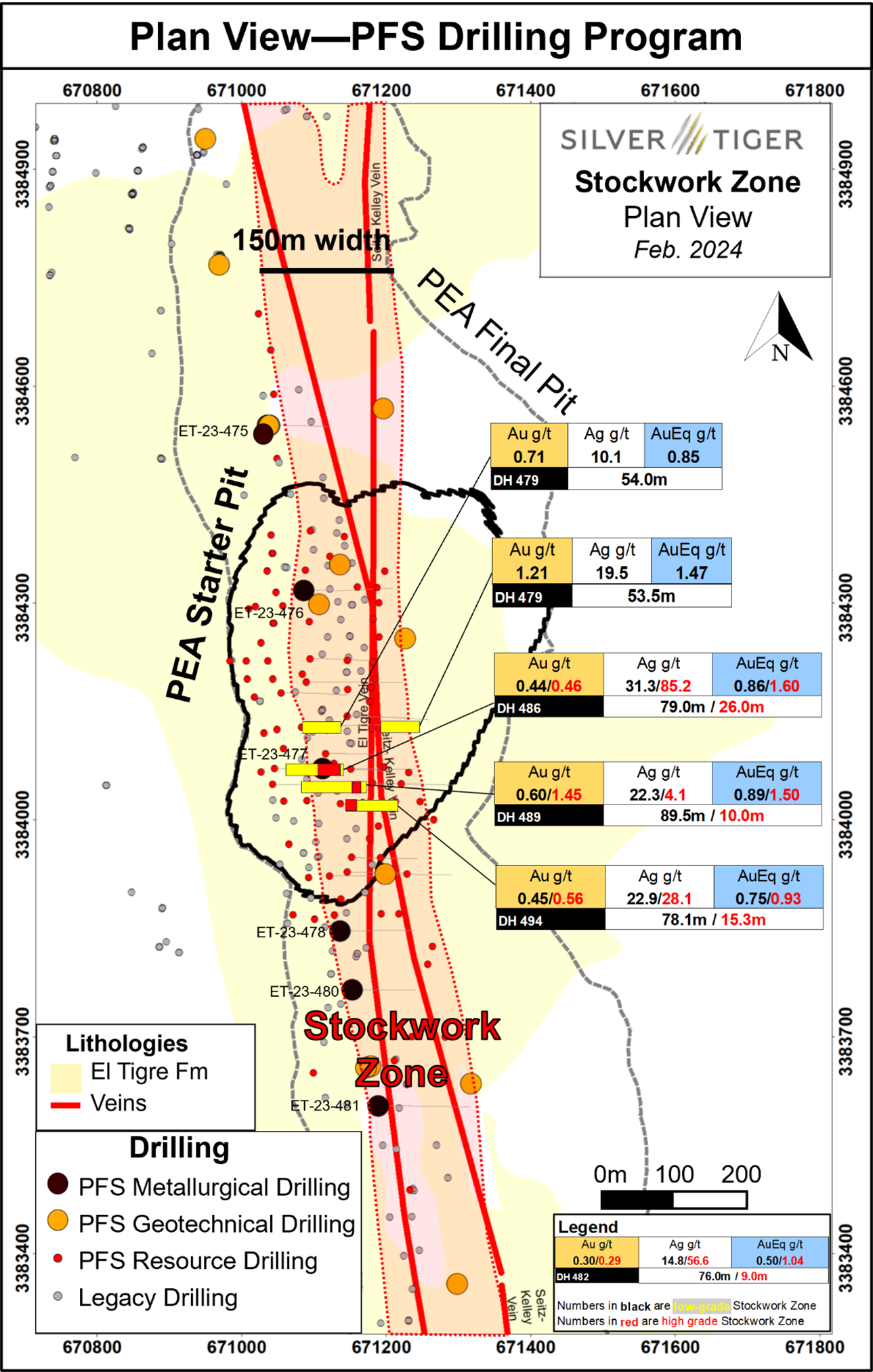

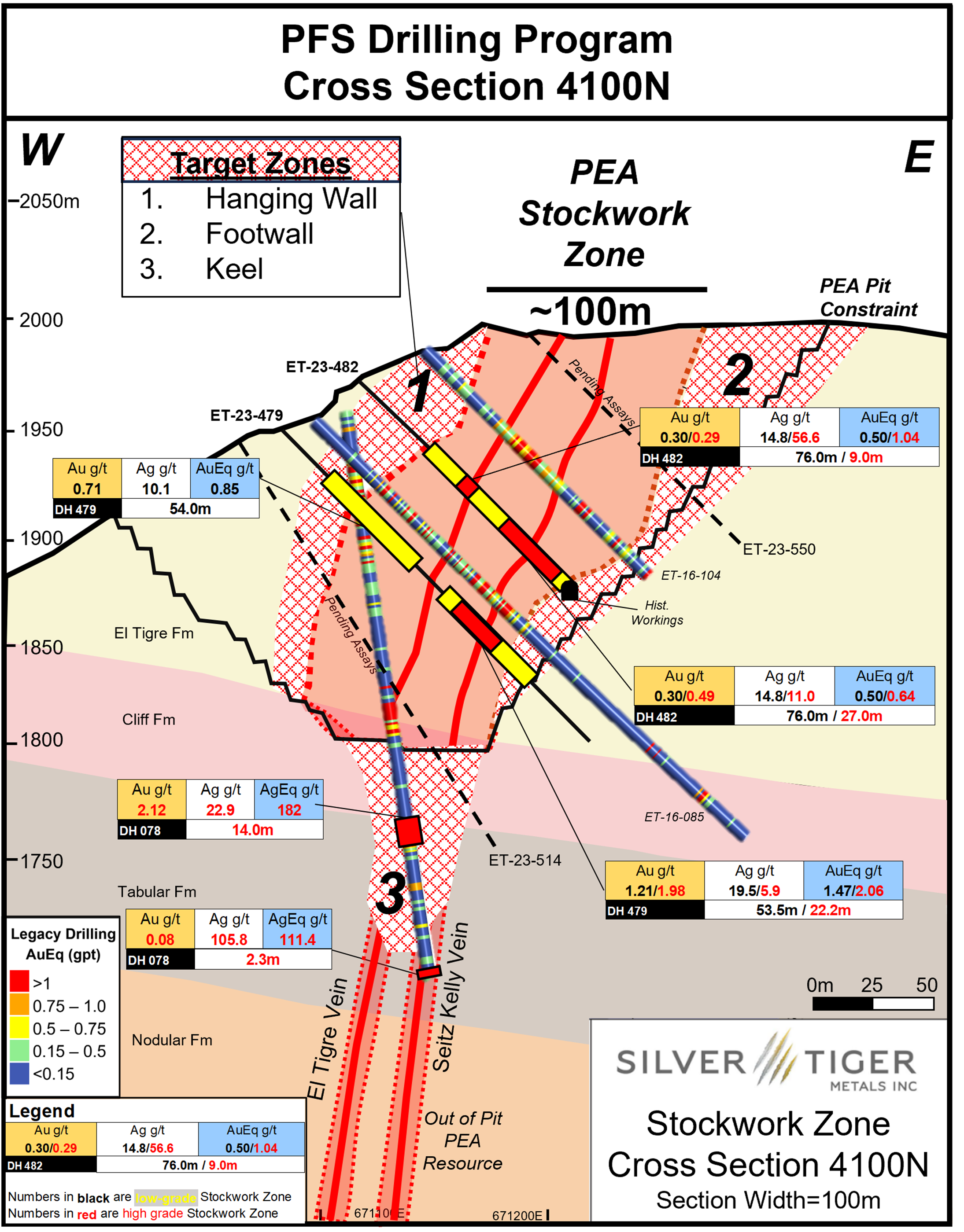

During the PEA review, it was observed that three main areas of the Stockwork mineralization lacked adequate drilling and had potential for expansion: a) the footwall, b) the hanging wall and c) bottom ‘keel'. Now, after releasing the first 15 drill holes of the program, the Company is pleased to announce conversion, expansion and de-risking of the potential ‘Starter Pit'.

Silver Tiger's CEO, Glenn Jessome, stated, "We are excited to announce that initial results are both confirming and expanding the near-surface potential ‘Starter Pit'. These promising assay results help to further de-risk the project in conjunction with the underway PFS-level geotechnical and metallurgical studies." Mr. Jessome further stated, "We also continue the work to deliver a PEA for the permitted underground MRE during H2-2024."

Near-surface, Stockwork Zone, seen in below highlighted intercepts:

- Drill hole ET-23-479: 54.0 metres grading 0.85 g/t gold equivalent or 63.7 g/t silver equivalent or from 22.0 metres to 76.0 metres, consisting of 10.1 g/t silver and 0.71 g/t gold and 53.5 metres grading 110.0 g/t 1.47 g/t gold equivalent or silver equivalent from 96.5 metres to 150.0 metres consisting of 19.5 g/t silver and 1.21 g/t gold including 22.1 metres grading 2.06 g/t gold equivalent or 154.4 g/t silver equivalent from 97.9 metres to 120.0 metres consisting of 5.9 g/t silver and 1.98 g/t gold in the Stockwork Zone;

- Drill hole ET-23-486: 79.0 metres grading 0.86 g/t gold equivalent or 64.5 g/t silver equivalent from 104.0 metres to 183.0 metres, consisting of 31.3 g/t silver and 0.44 g/t gold including 26.0 metres grading 1.60 g/t gold equivalent or 119.7 g/t silver equivalent from 158.0 metres to 184.0 metres consisting of 85.2 g/t silver and 0.46 g/t gold in the Stockwork Zone;

- Drill hole ET-23-489: 89.5 metres grading 0.89 g/t gold equivalent or 67.1 g/t silver equivalent from 101.0 metres to 190.5 metres, consisting of 22.3 g/t silver and 0.60 g/t gold including 10.0 metres grading 1.50 g/t gold equivalent or 112.6 g/t silver equivalent from 110.0 metres to 120.0 metres consisting of 4.1 g/t silver and 1.45 g/t gold in the Stockwork Zone; and

- Drill hole ET-23-494: 78.1 metres grading 0.75 g/t gold equivalent or 56.5 g/t silver equivalent from 0.0 metres to 78.1 metres, consisting of 22.9 g/t silver and 0.45 g/t gold including 15.3 metres grading 0.93 g/t gold equivalent or 70.1 g/t silver equivalent from 3.0 metres to 18.3 metres consisting of 28.1 g/t silver and 0.56 g/t gold in the Stockwork Zone.

Figure 1 : Stockwork Zone - Plan View

Figure 2: Stockwork Zone-Cross Section 4100N

Highlights from the on-going Pre-feasibility Study Drilling Program include the following:

- Expanding known mineralization by 10-15%; to the footwall and hanging wall zones, as well as the higher-grade ‘keel' at PEA pit bottom associated with the El Tigre and SK Veins;

- Converting first three years of material in the potential ‘Starter Pit' from Indicated Mineral Resource to Measured;

- Converting a significant portion of the 2km strike length ‘ultimate' PEA pit-constrained Inferred Resource to Indicated;

- Completion of enhanced PFS Metallurgical Drilling, with samples underway comminution and leach testing; and

- Completion of enhanced PFS Geotechnical Drilling, with samples undergoing testing.

Mineral Resource Drilling

P&E Mining Consultants ("P&E") of Brampton, Ontario completed the intial MRE in 2017. In late 2023, P&E released an the updated El Tigre Project MRE with a pit-constrained Indicated Mineral Resource totaling 43.0 million tonnes containing 818 thousand ounces AuEq grading 0.59 g/t AuEq; and a pit-constrained Inferred Mineral Resource of 11.5 million tonnes containing 267 thousand ounces AuEq grading 0.72 g/t AuEq (see update MRE press release dated September 12th 2023).

PEA-level bench optimization of the Pit-constrained Mineral Resource highlighted the higher-grade (~0.80 gpt AuEq), low strip ratio (~0.3) potential Starter Pit which contains 5.7 million tons of ore material (see PEA press release dated November 1st 2023). Recommendations of the PEA-level study included increasing Mineral Resource confidence in potential ‘Starter Pit' and additional exploratory drilling to target the 1) footwall, 2) hanging wall and 3) ‘keel' areas of the Stockwork Zone. P&E were again retained to lead the current El Tigre PFS-level study with 17,000m of the program complete (Figure 1). Complete and final assay results from the first fifteen (15) drill holes are listed in Table 1.

Below, highlighted intersections are enumerated with reference to the three (3) zones targeted:

- Drill hole ET-23-479: Confirms higher-grade Tiger Vein area in starter pit, and expands HW and FW (Fig. 2);

- Drill hole ET-23-486: Downhole intersection expands ‘keel' associated with Tiger and SK veins at bottom of PEA pit floor;

- Drill hole ET-23-489: Downhole intersection expands ‘keel' associated with Tiger and SK veins at bottom of PEA pit floor; and

- Drill hole ET-23-494: Shows at surface in ‘Starter Pit'.

Metallurgical Studies

The Company retained D.E.N.M. Engineering Ltd. (DENM), of Burlington, Ontario for the PFS-level metallurgical test work. After review of the PEA-level metallurgical studies completed, DENM recommended drilling six (6) new PQ-sized drill holes over a one-kilometre strike length of the designed PEA Stockwork (Figure 1). DENM selected McClelland Laboratories Inc. of Sparks, Nevada complete the independent PFS metallurgical testing of the gold and silver mineralization at the El Tigre project. Over 3,000 kg of mineralized material from six (6) 85 mm PQ drill holes were shipped to the laboratory for metallurgical testing with column leach testing underway. All metallurgical holes were subsequently assayed were appropriate to be included in PFS-level updated MRE with results listed in Table 2.

Geotechnical Studies

The company retained Golder/WSP for the PFS-level Stockwork design criteria. After an extensive desktop review and site visit, Golder recommended drilling thirteen (13) HQ-sized oriented drill holes in the western and eastern slopes over a two-kilometre strike length of the designed PEA Stockwork (Figure 1). Geotechnical drilling is completed with point load testing underway. All geotechnical holes will be assayed were appropriate to be included in PFS-level updated MRE.

Upcoming Mining Conference Attendance

- Silver Tiger will also be attending the BMO Global Metals, Mining and Critical Metals Conference from February 25 to February 28, 2024 in Hollywood, Florida.

- Silver Tiger will also be attending PDAC in Toronto from March 3 to March 6, 2024. Our booth number will be 3206.

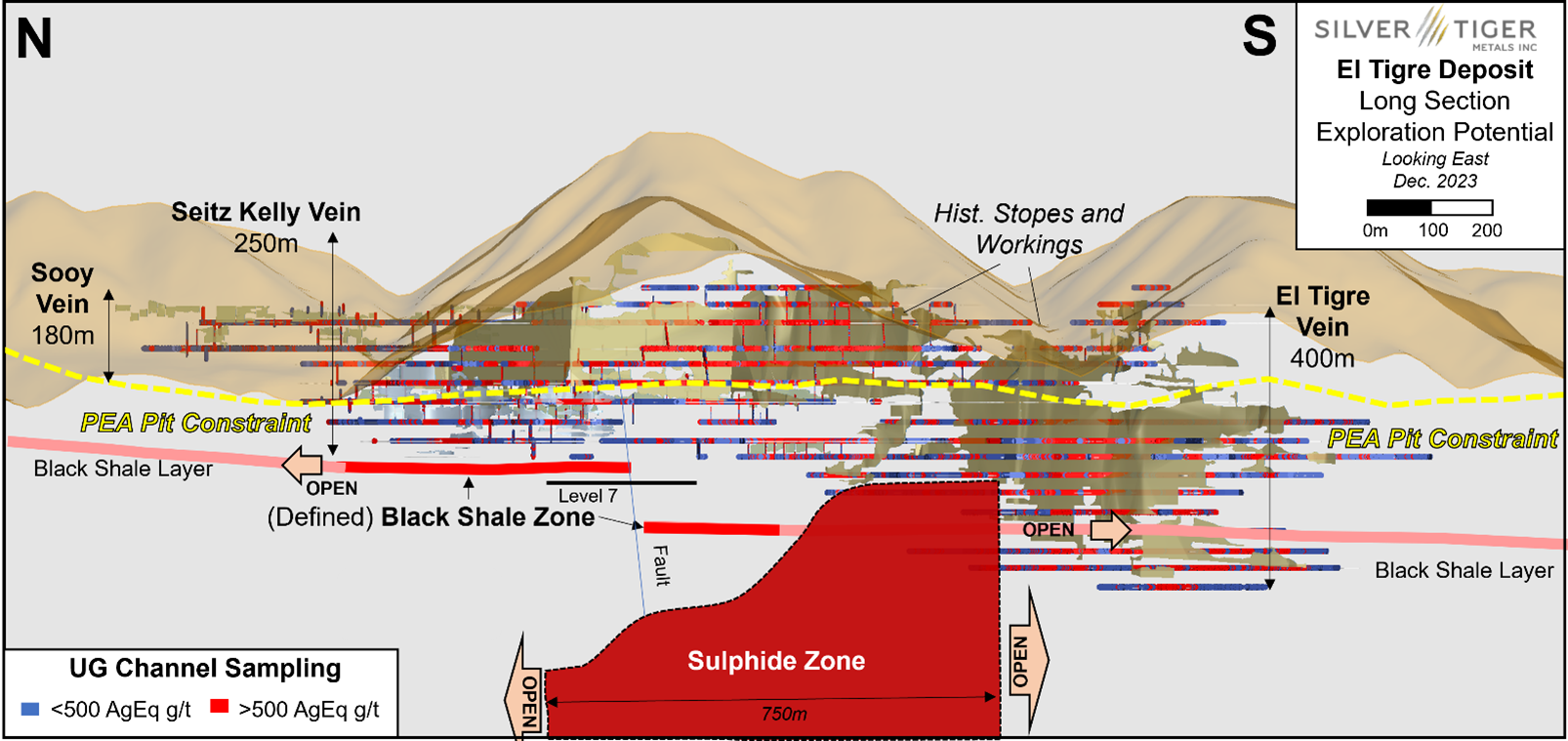

Underground Mineral Resource to Preliminary Economic Assessment - H2-2024

The Corporation will also continue to work on this substantial, permitted underground Mineral Resource Estimate and advance this towards a Preliminary Economic Assessment by H2-2024. The Indicated Out-of-Pit Mineral Resource at El Tigre is 21 Moz AgEq grading 279 g/t AgEq contained in 2.3 Mt and the Inferred Mineral Resource is 70 Moz AgEq grading 235 g/t AgEq contained in 9.2 Mt. For higher grade sensitivity cases refer to the Company's updated MRE press release dated September 12, 2023.

Table 1-Mineral Resource Drill Hole Results

AuEq Total (2) |

AgEq Total (2) |

|||||||

Drill Hole ID |

Comment |

From |

To |

Length(1) |

Gold |

Silver |

||

m |

m |

m |

g/t |

g/t |

g/t |

g/t |

||

| ET-23-479 | STOCKWORK ZONE | 22.0 |

76.0 |

54.0 |

0.71 |

10.1 |

0.85 |

63.7 |

| STOCKWORK ZONE | 96.5 |

150.0 |

53.5 |

1.21 |

19.5 |

1.47 |

110.0 |

|

| including | 97.9 |

120.0 |

22.1 |

1.98 |

5.9 |

2.06 |

154.4 |

|

| including | 132.0 |

147.0 |

15.0 |

0.96 |

29.9 |

1.36 |

101.8 |

|

| and | 166.9 |

173.5 |

6.6 |

0.18 |

172.5 |

2.48 |

186.0 |

|

| ET-23-482 | STOCKWORK ZONE | 44.0 |

120.0 |

76.0 |

0.30 |

14.8 |

0.50 |

37.3 |

| including | 56.0 |

65.0 |

9.0 |

0.29 |

56.6 |

1.04 |

78.3 |

|

| including | 93.0 |

120.0 |

27.0 |

0.49 |

11.0 |

0.64 |

47.7 |

|

| ET-23-483 | STOCKWORK ZONE3 | 18.0 |

70.5 |

52.5 |

0.58 |

16.4 |

0.79 |

59.6 |

| Including | 12.0 |

29.0 |

17.0 |

0.70 |

16.3 |

0.92 |

68.9 |

|

| STOCKWORK ZONE | 121.0 |

129.0 |

8.0 |

0.49 |

1.1 |

0.50 |

37.9 |

|

| STOCKWORK ZONE | 157.5 |

170.0 |

12.5 |

0.76 |

1.4 |

0.78 |

58.3 |

|

| ET-23-484 | STOCKWORK ZONE | 45.0 |

110.5 |

65.5 |

0.34 |

32.0 |

0.77 |

57.4 |

| Including | 91.5 |

107.5 |

16.0 |

0.58 |

104.3 |

1.97 |

147.6 |

|

| ET-23-485 | STOCKWORK ZONE | 65.0 |

136.0 |

71.0 |

0.72 |

2.8 |

0.76 |

56.9 |

| Including | 114.0 |

136.0 |

22.0 |

0.89 |

3.3 |

0.93 |

69.9 |

|

| Mining VOID | 136.9 |

141.0 |

4.1 |

* |

* |

* |

* |

|

| ET-23-486 | STOCKWORK ZONE4 | 104.0 |

183.0 |

79.0 |

0.44 |

31.3 |

0.86 |

64.5 |

| Mining VOID | 155.0 |

158.0 |

3.0 |

* |

* |

* |

* |

|

| Including | 158.0 |

184.0 |

26.0 |

0.46 |

85.2 |

1.60 |

119.7 |

|

| ET-23-487 | STOCKWORK ZONE | 0.0 |

23.0 |

23.0 |

0.35 |

15.7 |

0.56 |

42.2 |

| STOCKWORK ZONE | 45.0 |

49.0 |

4.0 |

1.80 |

7.3 |

1.89 |

141.9 |

|

| STOCKWORK ZONE5 | 62.0 |

84.5 |

22.5 |

0.20 |

15.2 |

0.40 |

30.1 |

|

| Mining VOID | 69.5 |

70.5 |

1.0 |

* |

* |

* |

* |

|

| ET-23-488 | STOCKWORK ZONE | 4.5 |

23.4 |

18.9 |

0.59 |

3.1 |

0.63 |

47.2 |

| STOCKWORK ZONE | 36.0 |

100.1 |

64.1 |

0.40 |

15.0 |

0.60 |

45.1 |

|

| including | 49.5 |

61.5 |

12.0 |

0.74 |

29.9 |

1.14 |

85.5 |

|

| Mining VOID | 100.1 |

102.0 |

1.9 |

* |

* |

* |

* |

|

| STOCKWORK ZONE | 114.6 |

142.5 |

27.9 |

0.68 |

12.8 |

0.85 |

63.7 |

|

| ET-23-489 | STOCKWORK ZONE6 | 101.0 |

190.5 |

89.5 |

0.60 |

22.3 |

0.89 |

67.1 |

| Including | 110.0 |

120.0 |

10.0 |

1.45 |

4.1 |

1.50 |

112.6 |

|

| Including | 142.5 |

151.4 |

8.9 |

1.69 |

14.3 |

1.88 |

141.0 |

|

| Mining VOID | 173.9 |

174.6 |

0.7 |

* |

* |

* |

* |

|

| ET-23-490 | STOCKWORK ZONE | 1.3 |

45.0 |

43.7 |

0.45 |

27.8 |

0.83 |

61.9 |

| Including | 32.0 |

43.5 |

11.5 |

0.49 |

75.8 |

1.50 |

112.4 |

|

| STOCKWORK ZONE | 66.0 |

94.5 |

28.5 |

0.09 |

36.3 |

0.57 |

43.0 |

|

| Including | 83.5 |

90.5 |

7.0 |

0.19 |

103.0 |

1.56 |

117.3 |

|

| ET-23-491 | STOCKWORK ZONE7 | 20.0 |

101.0 |

81.0 |

0.50 |

9.5 |

0.62 |

46.7 |

| Mining VOID | 95.2 |

96.7 |

1.5 |

* |

* |

* |

* |

|

| STOCKWORK ZONE | 118.1 |

130.1 |

12.0 |

0.59 |

59.8 |

1.39 |

104.3 |

|

| ET-23-492 | STOCKWORK ZONE | 16.0 |

67.5 |

51.5 |

0.53 |

8.2 |

0.63 |

47.6 |

| Including | 36.5 |

49.1 |

12.6 |

0.86 |

2.0 |

0.88 |

66.2 |

|

| Including | 59.0 |

67.5 |

8.5 |

0.91 |

6.3 |

1.00 |

74.9 |

|

| ET-23-493 | Footwall Vein | 8.2 |

12.0 |

3.8 |

0.17 |

22.4 |

0.47 |

35.1 |

| El Tigre Vein | 48.0 |

53.0 |

5.0 |

1.03 |

2.4 |

1.07 |

79.9 |

|

| SK Vein | 67.5 |

73.5 |

6.0 |

1.21 |

53.8 |

1.92 |

144.2 |

|

| ET-23-494 | STOCKWORK ZONE | 0.0 |

78.1 |

78.1 |

0.45 |

22.9 |

0.75 |

56.5 |

| including | 3.0 |

18.3 |

15.3 |

0.56 |

28.1 |

0.93 |

70.1 |

|

| including | 67.0 |

75.0 |

8.0 |

0.67 |

69.8 |

1.60 |

120.2 |

|

| Mining VOID | 78.1 |

81.7 |

3.6 |

* |

* |

* |

* |

|

| ET-23-495 | STOCKWORK ZONE | 0.0 |

27.0 |

27.0 |

0.29 |

15.9 |

0.50 |

37.6 |

| Mining VOID | 61.5 |

62.8 |

1.3 |

* |

* |

* |

* |

|

| STOCKWORK ZONE | 62.8 |

77.1 |

14.3 |

0.16 |

38.8 |

0.68 |

50.9 |

Notes:

- Not true width.

- Silver Equivalent ("AgEq") ratios are based on a silver to gold price ratio of 75:1 (Au:Ag).

- Excludes 2.7m of Mining VOID

- Excludes 3.0m of Mining VOID

- Excludes 1.0m of Mining VOID

- Excludes 0.7m of Mining VOID

- Excludes 1.5m of Mining VOID

Table 2-Metallurgical Drill Hole Results

AuEq Total (2) |

AgEq Total (2) |

|||||||

Drill Hole ID |

Comment |

From |

To |

Length(1) |

Gold |

Silver |

||

m |

m |

m |

g/t |

g/t |

g/t |

g/t |

||

| ET-23-475 | STOCKWORK ZONE | 37.0 |

51.0 |

14.0 |

0.34 |

2.4 |

0.37 |

27.8 |

| STOCKWORK ZONE | 101.0 |

104.0 |

3.0 |

0.63 |

2.5 |

0.66 |

49.8 |

|

| STOCKWORK ZONE | 121.3 |

143.3 |

22.0 |

0.25 |

25.1 |

0.59 |

44.1 |

|

| including | 121.3 |

123.2 |

1.9 |

1.03 |

80.4 |

2.10 |

157.8 |

|

| including | 141.2 |

143.3 |

2.1 |

0.36 |

155.9 |

2.44 |

183.1 |

|

| Mining Void | 153.5 |

156.2 |

2.7 |

* |

* |

* |

* |

|

| ET-23-476 | STOCKWORK ZONE | 33.0 |

40.1 |

7.1 |

0.28 |

5.8 |

0.36 |

27.1 |

| STOCKWORK ZONE | 66.5 |

92.4 |

25.9 |

0.28 |

11.2 |

0.43 |

32.5 |

|

| including | 69.5 |

88.5 |

19.0 |

0.33 |

13.4 |

0.51 |

38.3 |

|

| Mining Void | 92.4 |

94.5 |

2.1 |

* |

* |

* |

* |

|

| STOCKWORK ZONE | 106.5 |

173.0 |

66.5 |

0.56 |

1.9 |

0.59 |

44.0 |

|

| including | 106.5 |

126.0 |

19.5 |

1.19 |

1.6 |

1.22 |

91.2 |

|

| including | 119.0 |

126.0 |

7.0 |

2.52 |

2.0 |

2.55 |

191.2 |

|

| Mining Void | 142.5 |

143.7 |

1.2 |

* |

* |

* |

* |

|

| ET-23-477 | STOCKWORK ZONE | 45.0 |

109.0 |

64.0 |

0.33 |

15.1 |

0.53 |

40.0 |

| including | 92.5 |

108.0 |

15.5 |

0.50 |

34.6 |

0.96 |

72.2 |

|

| including | 92.5 |

96.7 |

4.2 |

1.24 |

7.7 |

1.34 |

100.8 |

|

| and | 169.2 |

175.0 |

5.8 |

0.09 |

134.7 |

1.88 |

141.1 |

|

| ET-23-478 | STOCKWORK ZONE | 0.0 |

34.7 |

34.7 |

0.77 |

14.3 |

0.96 |

72.4 |

| including | 4.5 |

28.2 |

23.7 |

0.95 |

18.2 |

1.19 |

89.1 |

|

| STOCKWORK ZONE | 57.7 |

130.2 |

72.5 |

0.40 |

10.7 |

0.54 |

40.5 |

|

| including | 58.7 |

93.0 |

34.3 |

0.64 |

5.8 |

0.72 |

53.8 |

|

| including | 128.2 |

130.2 |

2.0 |

0.36 |

72.5 |

1.32 |

99.2 |

|

| ET-23-480 | STOCKWORK ZONE | 19.0 |

65.0 |

46.0 |

0.32 |

3.5 |

0.37 |

27.6 |

| STOCKWORK ZONE | 86.0 |

117.3 |

31.3 |

0.40 |

14.5 |

0.59 |

44.6 |

|

| including | 88.0 |

113.0 |

25.0 |

0.47 |

16.4 |

0.69 |

51.4 |

|

| ET-23-481 | STOCKWORK ZONE | 139.0 |

162.0 |

23.0 |

0.88 |

43.8 |

1.46 |

109.5 |

| including | 140.0 |

145.5 |

5.5 |

1.36 |

43.7 |

1.94 |

145.6 |

|

| including | 151.0 |

152.9 |

1.9 |

3.14 |

301.0 |

7.16 |

536.9 |

Notes:

- Not true width.

- Silver Equivalent ("AgEq") ratios are based on a silver to gold price ratio of 75:1

Table 3-Drill Hole Locations

Drill Hole ID |

Easting (UTM) |

Northing (UTM) |

Elevation (masl) |

Azimuth (o) |

Dip (o) |

Length (m) |

ET-23-475 |

671,036.0 |

3,384,546.1 |

2097.7 |

90 |

-60 |

176.0 |

ET-23-476 |

671,085.8 |

3,384,317.5 |

1978.3 |

90 |

-45 |

175.1 |

ET-23-477 |

671,111.8 |

3,384,070.9 |

1958.3 |

90 |

-45 |

176.0 |

ET-23-478 |

671,136.2 |

3,383,846.2 |

1893.8 |

90 |

-45 |

150.7 |

ET-23-479 |

671,082.8 |

3,384,128.3 |

1943.8 |

90 |

-45 |

190.0 |

ET-23-480 |

671,153.3 |

3,383,764.8 |

1931.7 |

90 |

-45 |

122.3 |

ET-23-481 |

671,188.6 |

3,383,604.5 |

2033.1 |

90 |

-50 |

202.0 |

ET-23-482 |

671,116.3 |

3,384,091.7 |

1971.0 |

90 |

-45 |

120.0 |

ET-23-483 |

671,146.1 |

3,384,143.4 |

1983.3 |

90 |

-50 |

170.0 |

ET-23-484 |

671,112.3 |

3,384,070.5 |

1958.3 |

90 |

-45 |

180.0 |

ET-23-485 |

671,054.7 |

3,384,175.7 |

1921.0 |

90 |

-51 |

141.0 |

ET-23-486 |

671,045.6 |

3,384,070.9 |

1951.2 |

90 |

-45 |

212.0 |

ET-23-487 |

671,146.1 |

3,383,927.6 |

1868.4 |

90 |

-45 |

111.0 |

ET-23-488 |

671,094.7 |

3,384,222.9 |

1939.9 |

90 |

-57 |

165.0 |

ET-23-489 |

671,042.9 |

3,384,049.3 |

1942.6 |

90 |

-45 |

220.0 |

ET-23-490 |

671,121.6 |

3,383,922.4 |

1862.3 |

90 |

-45 |

123.0 |

ET-23-491 |

671,089.4 |

3,384,190.6 |

1932.6 |

90 |

-45 |

180.0 |

ET-23-492 |

671,181.1 |

3,384,050.9 |

1949.4 |

90 |

-47 |

170.0 |

ET-23-493 |

671,206.1 |

3,383,925.4 |

1893.8 |

90 |

-45 |

120.0 |

ET-23-494 |

671,136.7 |

3,384,022.2 |

1931.8 |

90 |

-50 |

122.0 |

ET-23-495 |

671,152.4 |

3,383,948.0 |

1881.8 |

90 |

-46 |

130.5 |

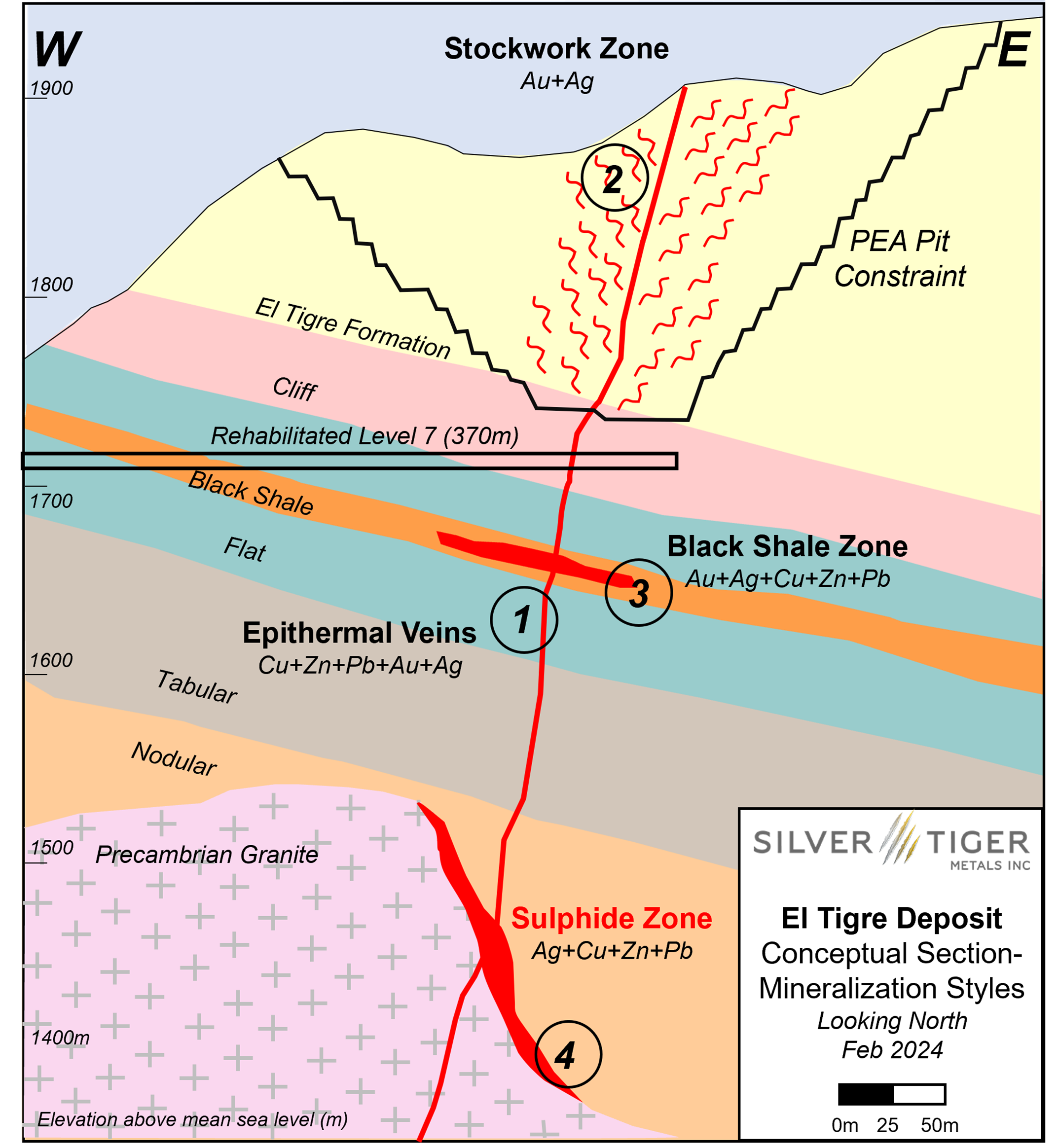

Figure 3: El Tigre - Conceptual Cross-Section Showing Mineralization Styles

Figure 4: El Tigre-Longitudinal Projection Showing Exploration Potential

About Silver Tiger and the El Tigre Historic Mine District

Silver Tiger Metals Inc. is a Canadian company whose management has more than 25 years' experience discovering, financing and building large hydrothermal silver projects in Mexico. Silver Tiger's 100% owned 28,414 hectare historic El Tigre Mining District is located in Sonora, Mexico. Principled environmental, social and governance practices are core priorities at Silver Tiger.

The El Tigre historic mine district is located in Sonora, Mexico and lies at the northern end of the Sierra Madre silver and gold belt which hosts many epithermal silver and gold deposits, including Dolores, Santa Elena and Las Chispas at the northern end. In 1896, gold was first discovered on the Property in the Gold Hill area and mining started with the Brown Shaft in 1903. The focus soon changed to mining silver veins in the area with production coming from 3 parallel veins the El Tigre Vein, the Seitz Kelley Vein and the Sooy Vein. Underground mining on the middle El Tigre Vein extended 1,450 metres along strike and was mined on 14 levels to a depth of approximately 450 metres. The Seitz Kelley Vein was mined along strike for 1 kilometre to a depth of approximately 200 metres. The Sooy Vein was only mined along strike for 250 metres to a depth of approximately 150 metres. Mining abruptly stopped on all 3 of these veins when the price of silver collapsed to less than US20¢ per ounce with the onset of the Great Depression. By the time the mine closed in 1930, it is reported to have produced a total of 353,000 ounces of gold and 67.4 million ounces of silver from 1.87 million tons (Craig, 2012). The average grade mined during this period was over 2 kilograms silver equivalent per ton.

The El Tigre silver and gold deposit is related to a series of epithermal veins controlled by a north-south trending structure cutting across the andesitic and rhyolitic tuffs of the Sierra Madre Volcanic Complex within a broad silver and gold mineralized prophylitic alteration zone developed in the El Tigre Formation that can be up to 150 metres wide. The veins dip steeply to the west and are typically 0.5 metre wide; however, locally can be up to 5 metres in width. The veins, structures and mineralized zones outcrop on surface and have been traced for 5.3 kilometres along strike in our brownfield exploration area. Historical mining and exploration activities focused on a 1.6 kilometre portion of the southern end of the deposits, principally on the El Tigre, Seitz Kelly and Sooy veins. The under explored Caleigh, Benjamin, Protectora and the Fundadora exposed veins continue north for more than 3 kilometres. Silver Tiger has delivered its updated NI 43-101 compliant Mineral Resource Estimate and PEA, and is currently drilling to update its Mineral Resource Estimate and publish a PFS.

VRIFY Slide Deck and 3D Presentation - Silver Tiger's El Tigre Project

VRIFY is a platform being used by companies to communicate with investors using 360° virtual tours of remote mining assets, 3D models and interactive presentations. VRIFY can be accessed by website and with the VRIFY iOS and Android apps.

Access the Silver Tiger Metals Inc. Company Profile on VRIFY at: https://vrify.com

The VRIFY Slide Deck and 3D Presentation for Silver Tiger Metals Inc. can be viewed at: https://vrify.com/explore/decks/492 and on the Corporation's website at: www.silvertigermetals.com.

Procedure, Quality Assurance / Quality Control and Data Verification

The diamond drill core (HQ size) is geologically logged, photographed and marked for sampling. When the sample lengths are determined, the full drill core is sawn with a diamond blade drill core saw with one half of the drill core being bagged and tagged for assay. The remaining half portion is returned to the drill core trays for storage and/or for metallurgical test work.

The sealed and tagged drill core sample bags are transported to the Bureau Veritas facility in Hermosillo, Mexico. Bureau Veritas crushes the samples (Code PRP70-250) and prepares 200-300 gram pulp samples with ninety percent passing Tyler 200 mesh (Code PUL85). The pulps are assayed for gold using a 30-gram charge by fire assay (Code FA630) and over limits greater than 10 grams per tonne are re-assayed using a gravimetric finish (Code FA530). Silver and multi-element analysis is completed using total digestion (Code MA200 Total Digestion ICP). Over limits greater than 100 grams per tonne silver are re-assayed using a gravimetric finish (Code FA530).

Quality assurance and quality control ("QA/QC") procedures monitor the chain-of-custody of the samples and includes the systematic insertion and monitoring of appropriate reference materials (certified reference materials, blanks and duplicates) into the sample strings. The results of the assaying of the QA/QC material included in each batch are tracked to ensure the integrity of the assay data. All results stated in this announcement have passed Silver Tiger's QA/QC protocols.

Qualified Person

David R. Duncan, P. Geo., V.P. Exploration of the Corporation, is the Qualified Person for Silver Tiger as defined under National Instrument 43-101. Mr. Duncan has reviewed and approved the scientific and technical information in this press release.

For further information, please contact:

Glenn Jessome

President and CEO

902 492 0298

jessome@silvertigermetals.com

CAUTIONARY STATEMENT:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This News Release includes certain "forward-looking statements". All statements other than statements of historical fact included in this release, including, without limitation, statements regarding potential mineralization, Mineral Resources and Mineral Reserves, the ability to convert Inferred Resources to Indicated Resources, the ability to complete future drilling programs and infill sampling, the ability to extend Mineral Resource blocks, the similarity of mineralization at El Tigre to Delores, Santa Elena and Chispas, exploration results, and future plans and objectives of Silver Tiger, are forward-looking statements that involve various risks and uncertainties. Forward-looking statements are frequently characterized by words such as "may", "is expected to", "anticipates", "estimates", "intends", "plans", "projection", "could", "vision", "goals", "objective" and "outlook" and other similar words. Although Silver Tiger believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, there can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from Silver Tiger's expectations include risks and uncertainties related to exploration, development, operations, commodity prices and global financial volatility, risk and uncertainties of operating in a foreign jurisdiction as well as additional risks described from time to time in the filings made by Silver Tiger with securities regulators.

SOURCE: Silver Tiger Metals Inc.

View the original press release on accesswire.com