PANAMA CITY, PANAMA / ACCESS Newswire / July 3, 2025 / LeveX is excited to announce the launch of Multi-Trade Mode - a powerful new feature for futures traders that enables the management of multiple independent positions, each with customizable leverage and margin settings. Designed to elevate user control, Multi-Trade Mode allows traders to execute diverse strategies within a single contract type, unlocking more advanced risk management and trading precision.

How to Use Multi-Trade Mode on LeveX

Step-by-step guide on how to activate and use Multi-Trade Mode for futures trading on LeveX. Learn to manage multiple independent positions with different leverage and margin settings.

Requirements Before Starting

A registered LeveX account (How to register an account on LeveX)

Funds in your futures wallet (How to transfer funds between wallets)

Basic understanding of futures trading (Understanding futures trading on LeveX)

Understanding of Multi-Trade Mode concepts (Understanding Multi-Trade Mode)

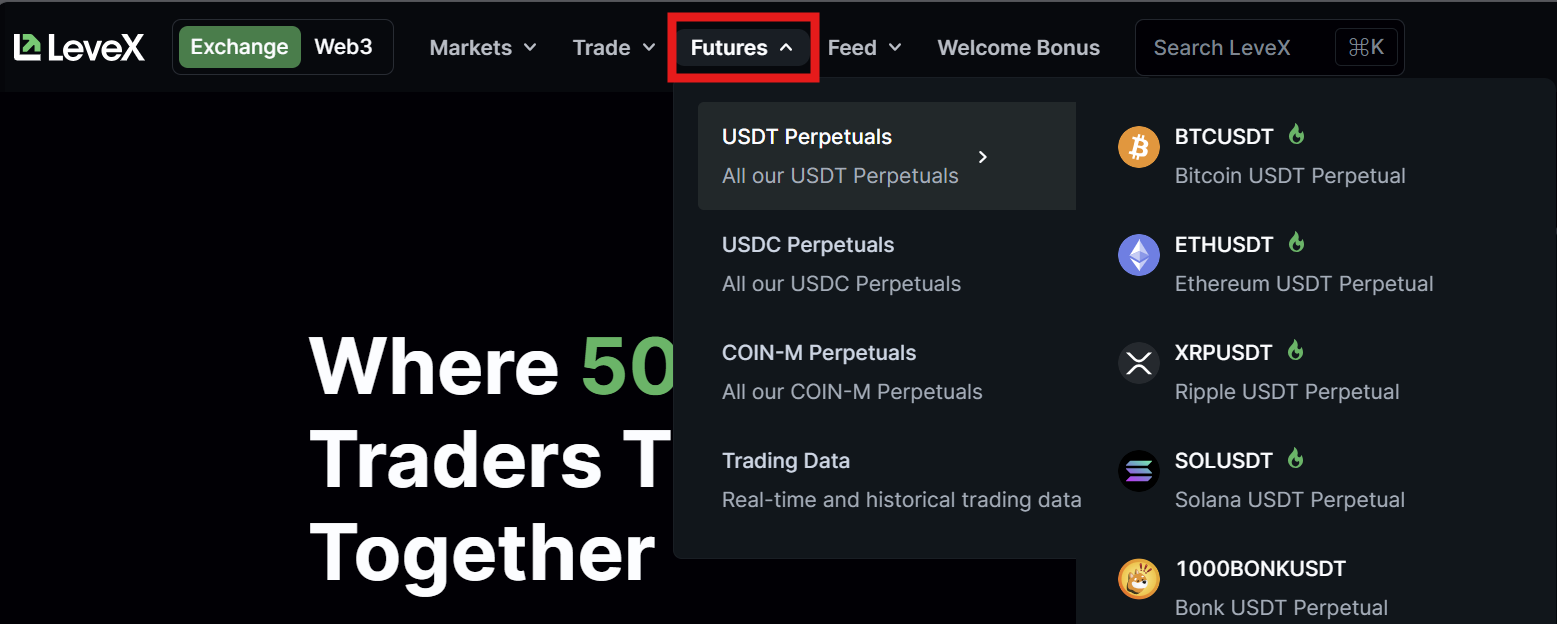

Step 1: Navigate to Futures Trading

Go to theLeveX homepage and hover over "Futures" in the top navigation menu, then selectUSDT Perpetuals,USDC Perpetuals, orCOIN-M Perpetuals depending on your preferred contract type.

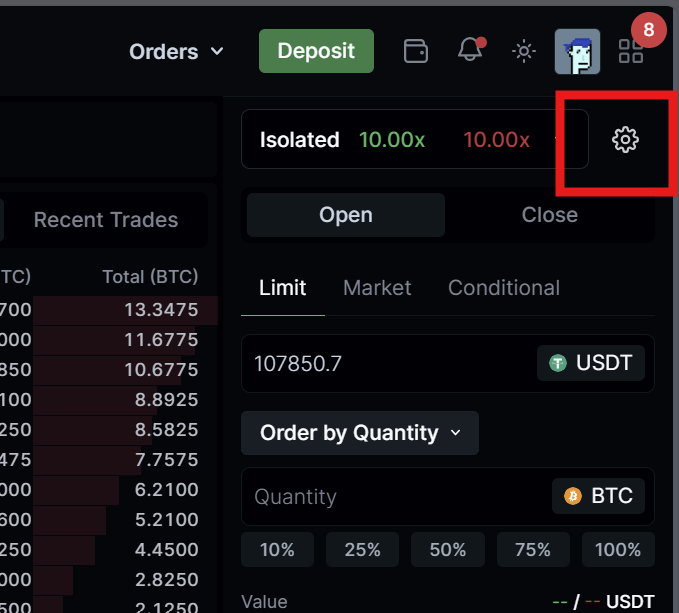

Step 2: Locate Position Mode Settings

On your futures trading interface, find the position mode selector. This is located near the top right of the trading panel, above the order placement area. Click the "Setting/Gear" icon.

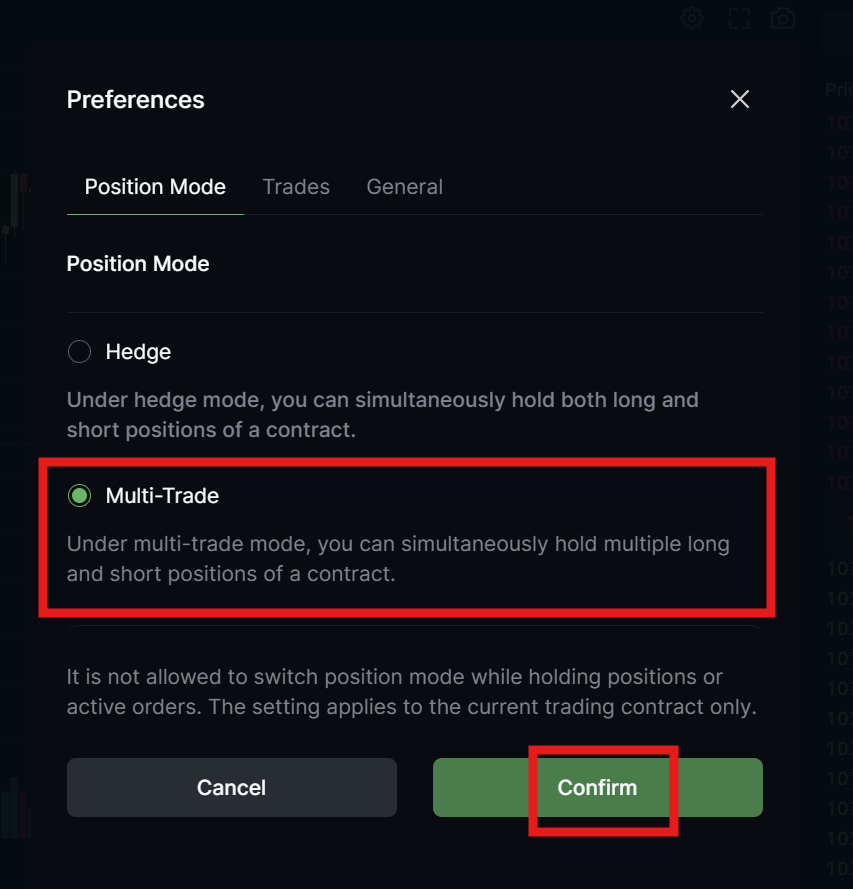

Step 3: Activate Multi-Trade Mode

The current position mode defaults to "Hedged)

Select "Multi-Trade Mode" instead

Click "Confirm" to activate Multi-Trade Mode

Step 4: Understand Interface Changes

After activating Multi-Trade Mode, your trading interface will show:

Individual position tracking for each order you place

Separate margin allocation for each position

Independent leverage settings per position

Individual profit/loss calculations for each trade

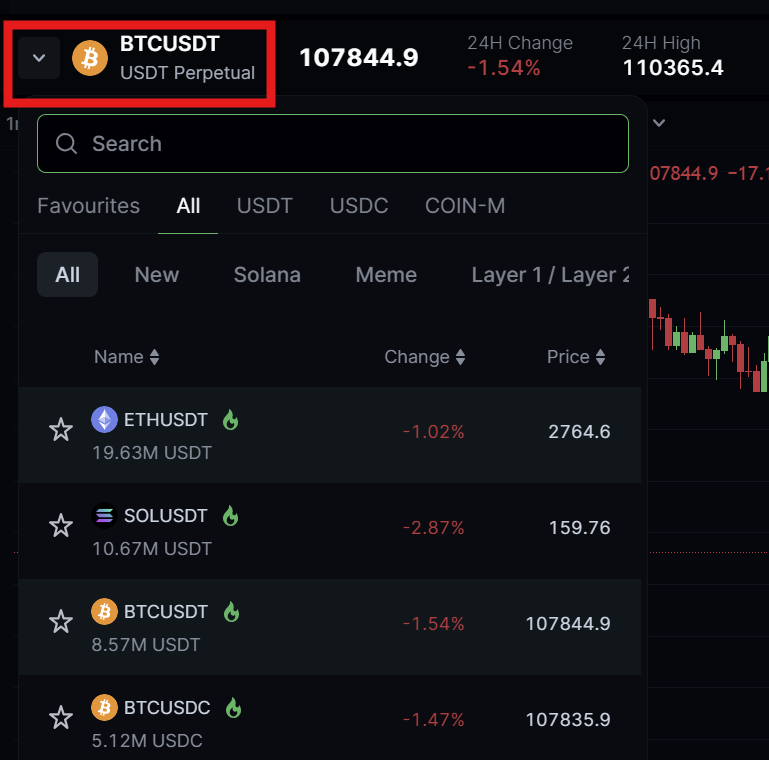

Step 5: Open Your First Multi-Trade Position

Select Your Trading Pair

Choose your desired futures contract from the trading pair selector (e.g., BTCUSDT).

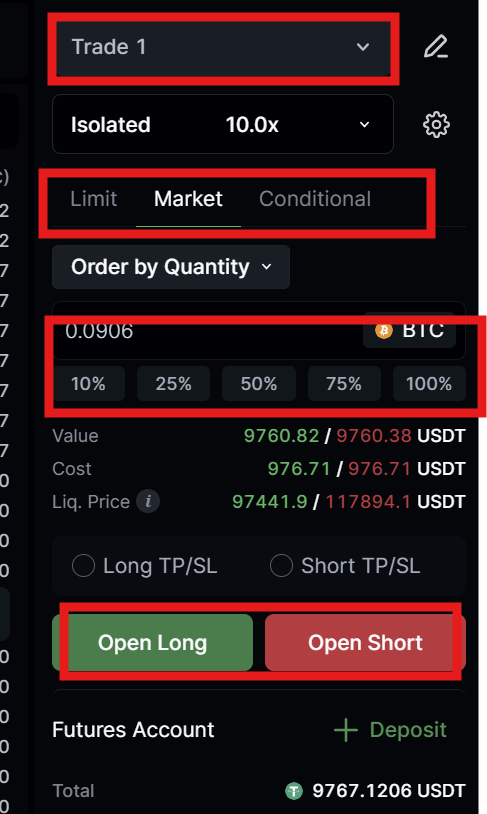

Configure Your First Position

Notice that the trading area now has an additional dropdown specifying which position you're opening/adjusting.

Choose your order type (Market, Limit, or Conditional)

Select your position direction (Long or Short)

Enter your position size in the Quantity field

Set your desired leverage for this specific position

Review your margin allocation for this trade

Place Your Order

Click "Open Long" or "Open Short" to create your first position in Multi-Trade Mode.

Step 6: Add Additional Independent Positions

Opening a Second Position in the Same Direction

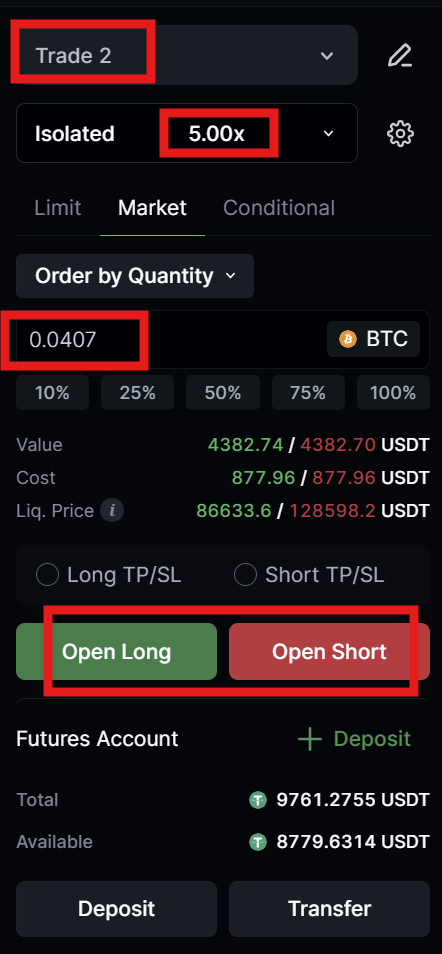

To demonstrate Multi-Trade Mode's capabilities, open another position in the same direction:

Wait for price movement or choose a different entry strategy

-

Configure different parameters:

Different leverage (e.g., 5x instead of 10x)

Different position size

Different order type if desired

Place the order - this creates a completely separate position

Opening Positions in Opposite Directions

Multi-Trade Mode allows simultaneous long and short positions:

Select the opposite direction from your existing position(s)

-

Configure the short position:

Choose appropriate leverage

Set position size based on your strategy

Consider this as a hedge or separate trade

Place the order to create an independent short position

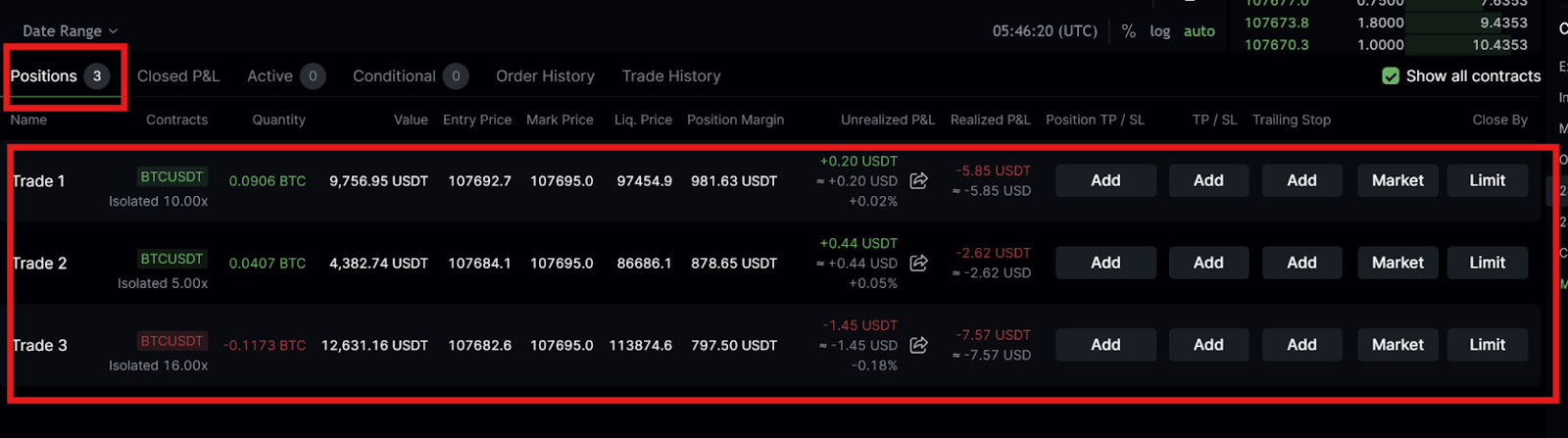

Step 7: Monitor Your Multiple Positions

Individual Position Tracking

Your positions will appear in the "Positions" tab below the trading interface:

Each position shows its own entry price, size, and leverage

Individual profit/loss calculations for each trade

Separate margin allocation per position

Independent liquidation prices

Managing Position-Specific Settings

For each position, you can:

Set individual take-profit levels based on each entry price

Configure separate stop-losses for different risk tolerances

Adjust leverage for individual positions if needed

Close positions independently without affecting others

Step 10: Advanced Multi-Trade Strategies

Scaling Into Positions

Build positions across multiple price levels:

Open initial position at current market price

Set limit orders at lower prices (for longs) or higher prices (for shorts)

Each filled order creates a new independent position

Manage each position with its own risk parameters

Hedging Specific Entries

Protect individual positions with targeted hedges:

Identify the position you want to hedge

Open an opposite position of appropriate size

Configure the hedge with suitable leverage and stops

Manage both positions independently

Multi-Trade Mode Best Practices

Start Small

Begin with 2-3 positions to understand the interface and management requirements before scaling up to more complex strategies.

Clear Documentation

Keep track of your strategy for each position to maintain clarity about your trading plan and risk management approach.

Regular Monitoring

Multi-Trade Mode requires more active management than traditional position modes, so plan for regular account monitoring.

Risk Management

Set position limits for yourself to prevent over-leveraging and maintain disciplined trading practices.

Next Steps

After mastering Multi-Trade Mode basics:

Exploreadvanced order types that work with multiple positions

Learn aboutmargin and leverage optimization for complex strategies

Practice withtrading tournaments to test Multi-Trade strategies in competitive environments

Reviewfunding fees impact on multiple position strategies

For additional support with Multi-Trade Mode, visit theLeveX Support Center or contact our support team directly.

Contact Details:

Website: https://levex.com/en

Email: Adil@levex.com

SOURCE: LeveX

View the original press release on ACCESS Newswire