Valued at a market cap of $10.1 billion, Norwegian Cruise Line Holdings Ltd. (NCLH) is a leading cruise company that offers freestyle and luxury cruising experiences. The Miami, Florida-based company is known for its innovative ship designs, flexible onboard experiences, and premium service.

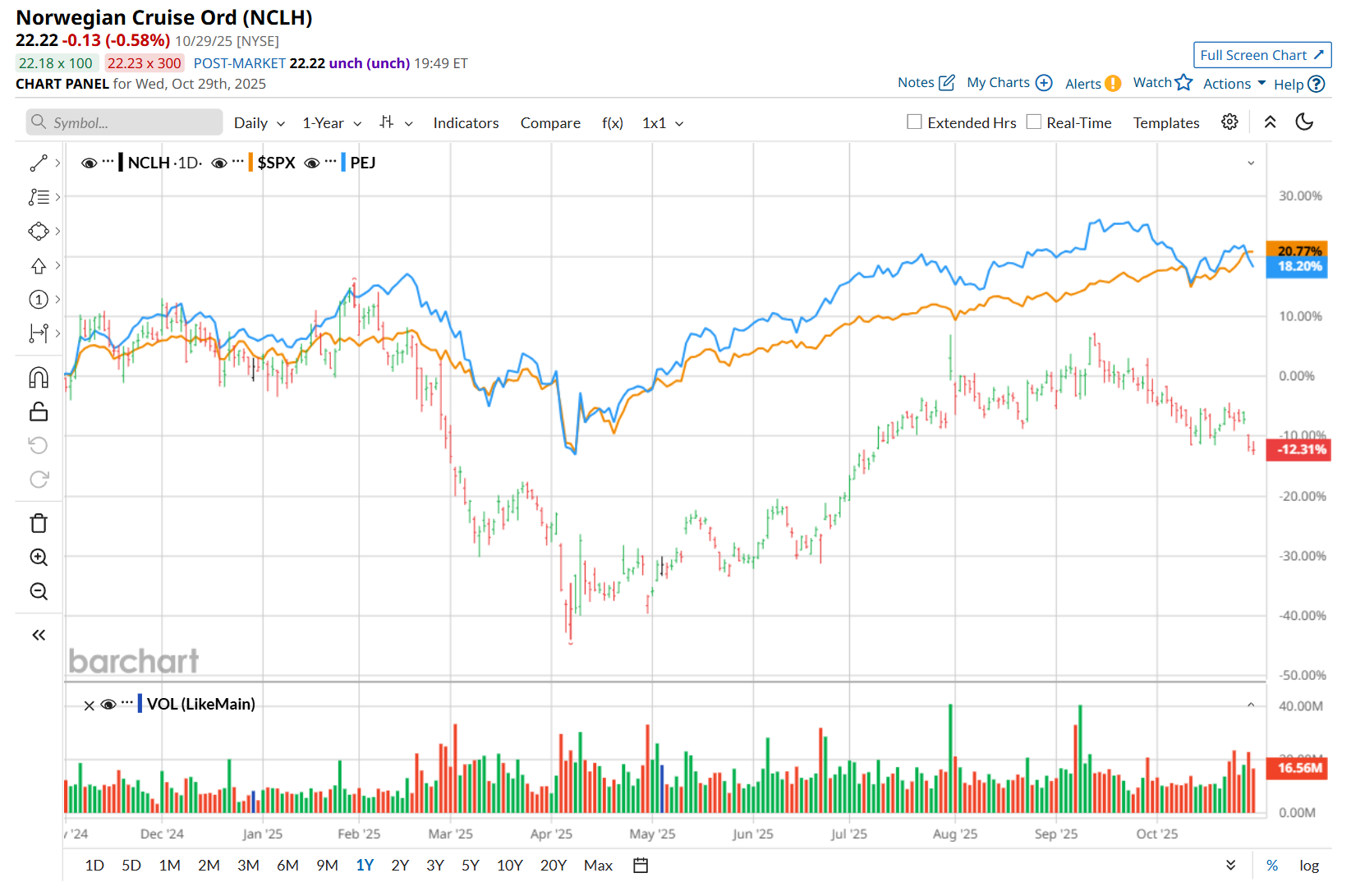

This cruise company has considerably lagged behind the broader market over the past 52 weeks. Shares of NCLH have declined 7.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 18.1%. Moreover, on a YTD basis, the stock is down 13.6%, compared to SPX’s 17.2% surge.

Narrowing the focus, NCLH has also underperformed the Invesco Dynamic Leisure and Entertainment ETF’s (PEJ) 17.2% uptick over the past 52 weeks and 11.6% rise on a YTD basis.

On Oct. 28, shares of NCLH fell 4.9% after its competitor Royal Caribbean Cruises Ltd. (RCL) reported weaker-than-expected third-quarter revenue, triggering broader concerns across the cruise industry. The disappointing results from one of the industry’s key players were seen as a sign of softening demand, prompting investors to reassess the near-term outlook for cruise operators. As a result, pessimism spread across the industry, weighing on shares of other major cruise lines as well.

For the current fiscal year, ending in December, analysts expect NCLH’s EPS to grow 15.2% year over year to $1.89. The company’s earnings surprise history is mixed. It exceeded or met the consensus estimates in three of the last four quarters, while surpassing on another occasion.

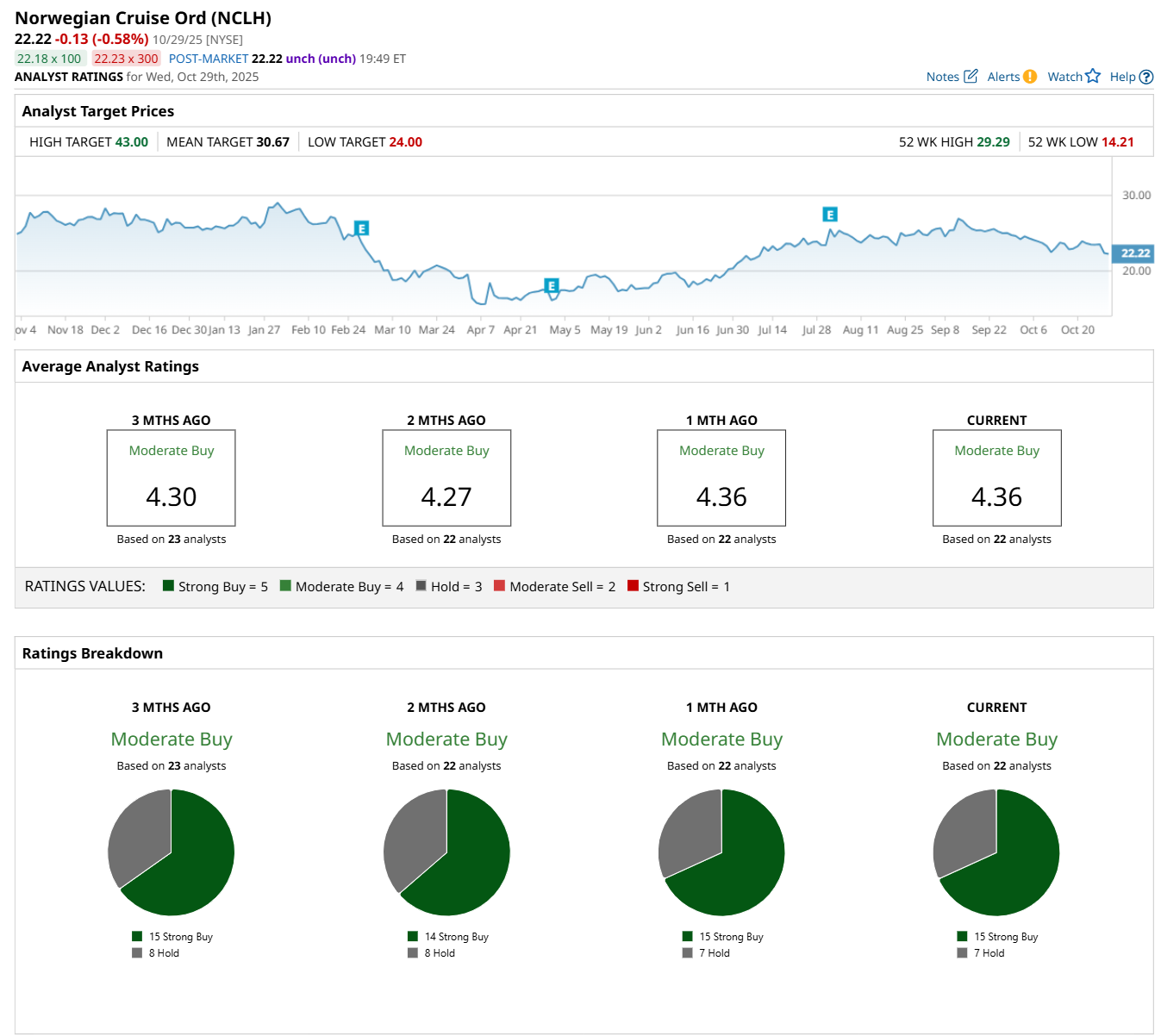

Among the 22 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 15 “Strong Buy,” and seven “Hold” ratings.

This configuration is more bullish than two months ago, with 14 analysts suggesting a "Strong Buy” rating.

On Oct. 26, Benjamin Chaiken from Mizuho Financial Group, Inc. (MFG) maintained a "Buy" rating on NCLH, with a price target of $23.48, indicating a 5.7% potential upside from the current levels.

The mean price target of $30.67 represents a 38% premium from NCLH’s current price levels, while the Street-high price target of $43 suggests an upside potential of 93.5%.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart