Huntington Bancshares Incorporated (HBAN) is a regional bank holding company headquartered in Columbus, Ohio. Through its banking subsidiary, The Huntington National Bank, it provides a full suite of consumer and business banking, mortgage, treasury management, equipment leasing, wealth & investment management, and brokerage services primarily across the U.S. Midwest and adjoining states. The company’s market cap is around $22.4 billion.

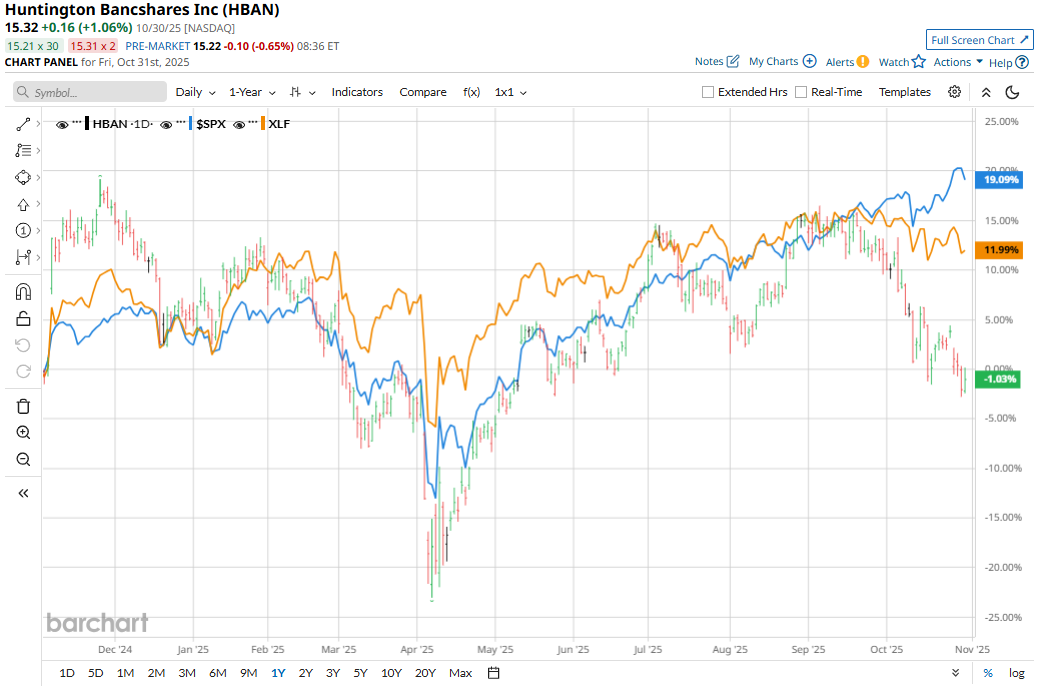

Shares of the regional bank have been underperforming the broader market. Over the past 52 weeks, HBAN stock has declined 3.1%, while the broader S&P 500 Index ($SPX) has rallied 17.4%. Moreover, shares of Huntington Bancshares are down 6.3% on a year-to-date (YTD) basis, compared to SPX’s 16% returns.

In addition, HBAN stock has lagged behind the Financial Select Sector SPDR Fund’s (XLF) 10.8% return over the past 52 weeks and 8.1% YTD gains.

The recent decline in HBAN stock can largely be attributed to investor concerns around its recently announced large acquisition of Cadence Bank, a $7.4 billion all-stock deal, which threatens near-term dilution of tangible book value and pauses share buybacks until integration is complete.

Coupled with broader caution in the regional banking sector due to margin pressures, funding cost risks and economic uncertainty, this has weighed on HBAN’s sentiment even though its fundamentals appear relatively stable.

For the current fiscal year, ending in December 2025, analysts expect HBAN’s EPS to grow 20.2% year-over-year to $1.49. The company’s earnings surprise history is promising. It beat or matched the bottom-line estimates in each of the past four quarters.

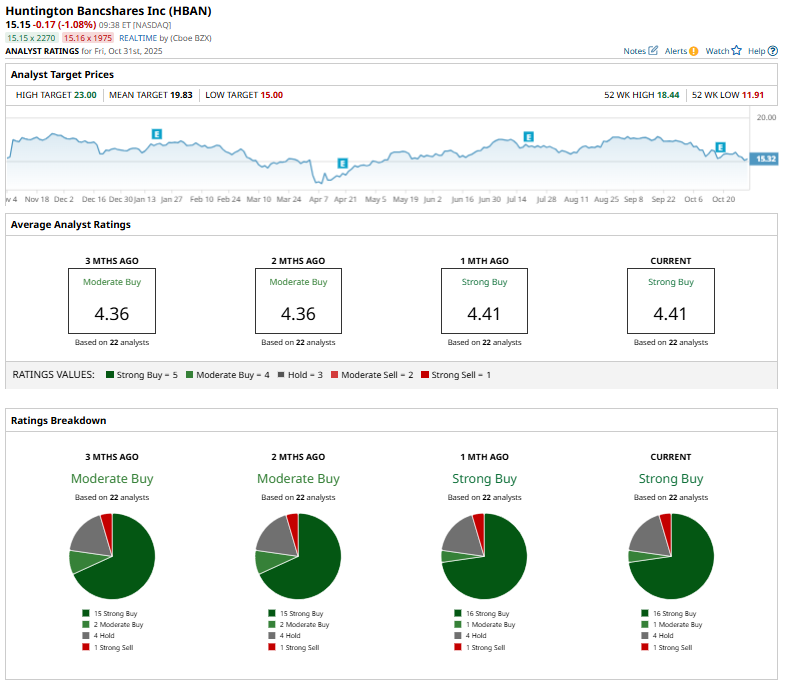

Among the 22 analysts covering the stock, the consensus rating is a “Strong Buy.” That's an upgrade from the “Moderate Buy” rating two months ago. The current rating is based on 16 “Strong Buy” ratings, one “Moderate Buy,” four “Holds,” and one “Strong Sell.”

This configuration is more bullish than it was two months ago, when 15 analysts had a “Strong Buy” rating.

Recently, JPMorgan reiterated its “Overweight” rating on Huntington Bancshares after the bank’s $7.4 billion Cadence Bank acquisition. However, JPMorgan cautioned that managing both the Cadence and recently closed Veritex acquisitions could heighten execution risks in the near term.

HBAN is trading 29.4% below the mean price target of $19.83. The Street-high price target of $23 implies a potential upside of 50.1% from the current price levels.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia CEO Jensen Huang Says You Can ‘Tokenize Anything’ But You’ll Need ‘Thousands of Chips.’ That’s Good News for NVDA Stock.

- This Analyst Just Slashed His Fiserv Stock Price Target by 55%. Should You Jump Ship Now?

- 'Aggressive' Spending Spooks Meta Platforms Investors. Should You Buy the Dip in META Stock?

- A $135 Billion Reason to Buy Microsoft Stock Now