President Donald Trump has signed a funding bill into law, which effectively ended the longest federal government shutdown in U.S. history. This measure will fund the government’s operations through the end of January.

The ending of the shutdown was seen as a prospect for beaten-down restaurant operator Sweetgreen (SG). Citi Research analyst Jon Tower believes there is a chance the stock could skyrocket. Tower believes that with low expectations surrounding SG stock, signs of improving sales data following the government reopening could lead to a “short-covering rally.” Today's 10% spike in SG stock's price says the market concurs with this assessment.

In light of this, we take a closer look at the company’s fundamentals.

About Sweetgreen Stock

Sweetgreen is a prominent fast-casual restaurant brand dedicated to serving salads and bowls crafted from scratch each day using quality ingredients sourced directly from local farms. Currently headquartered in Los Angeles, California, Sweetgreen oversees a network of more than 250 stores spread across 24 states and Washington, D.C.

Its operations depend on efficient supply chains and real-time digital ordering platforms, prioritizing sustainability and community engagement. The company integrates innovative practices such as automated kitchens and flexible menus to enhance productivity, ensuring timely and fresh meal delivery at scale. The company has a market capitalization of $634.80 million.

Over the past 52 weeks, Sweetgreen’s stock has declined 83%, while it has been down 62% over the past six months. SG stock reached a 52-week low of $5.14 on Nov. 11 but is up 16% from that level.

The company has faced issues, including reduced customer traffic, as it navigates a challenging macroeconomic backdrop. Sweetgreen also faced transition issues with its loyalty program. This year, the company introduced a points-based loyalty program called SG Rewards to replace Sweetpass, a tiered subscription program.

The selloff has made Sweetgreen’s stock cheap. Its price-to-sales (P/S) ratio of 0.92 is just marginally higher than the industry average of 0.91.

Sweetgreen’s Third-Quarter Financials Missed Estimates

On Nov. 6, Sweetgreen reported its third-quarter results for fiscal 2025, which failed to impress investors. The company’s revenue dropped marginally year-over-year (YoY) to $172.39 million. The figure also fell short of Wall Street analysts’ estimate of $177.90 million.

The revenue decline was primarily due to a decrease in comparable restaurant base revenue of $16.20 million, resulting in a 9.5% decline in same-store sales. While menu prices increased during the quarter, this was more than offset by a decrease in traffic and a shift in product mix.

Due to the topline performance, the bottom-line losses also continued to accumulate. Sweetgreen’s loss per share grew from $0.18 in Q3 2024 to $0.31 in Q3 2025. Analysts were expecting a loss per share of $0.18.

Sweetgreen highlighted its Infinite Kitchen strategy, a food automation technology that is expected to drive efficiency. The company announced the opening of its first-ever Infinite Kitchen Sweetlane location in Costa Mesa, California, this month. Sweetgreen also carried out a strategic sale of Spyce, the business that is responsible for launching Infinite Kitchens. However, as per the agreement, Sweetgreen retains the right to continue to deploy Infinite Kitchens across its restaurants.

Wall Street analysts have a mixed view on Sweetgreen’s bottom-line trajectory. For the fourth quarter, the company’s loss per share is expected to deepen by 24% YoY to $0.31. For the current year, the loss per share is expected to increase by 8.9% to $0.86, followed by a 16.3% improvement to a loss per share of $0.72 in the subsequent year.

What Do Analysts Think About SG Stock?

Wall Street analysts have a mixed view about Sweetgreen’s prospects currently. Recently, analysts at Barclays, led by Jeffrey Bernstein, maintained their “Equal-Weight” rating on SG stock while lowering the price target from $8 to $5. On the other hand, Anthony Trainor from Wells Fargo lowered Sweetgreen’s price target from $13 to $10 but maintained an “Overweight” rating for the company.

Analysts at Goldman Sachs downgraded Sweetgreen’s stock from “Neutral” to “Sell.” They cited a challenging operating environment affecting the company’s top and bottom line as a reason for this downgrade. They also cut the price target from $10 to $5.

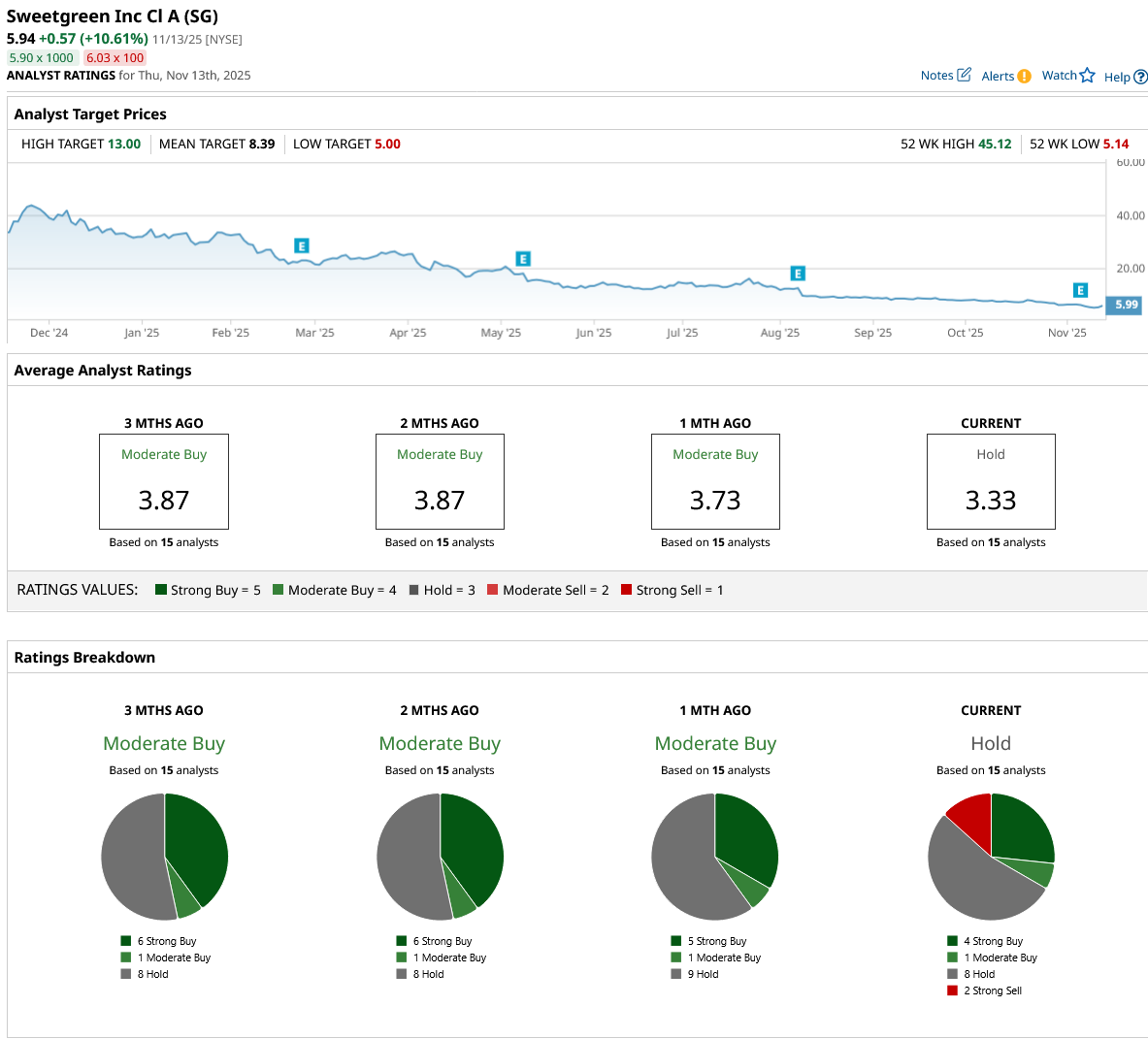

Wall Street analysts are taking a cautious stance on SG stock now, with a consensus “Hold” rating overall. Of the 15 analysts rating the stock, four analysts gave a “Strong Buy” rating, one analyst gave a “Moderate Buy” rating, while a majority of eight analysts are playing it safe with a “Hold” rating, and two analysts gave a “Strong Sell” rating. The consensus price target of $8.39 represents a 41% upside from current levels. The Street-high price target of $13 indicates a 119% upside from current levels.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Who Is Phil Clifton? Michael Burry Names Successor as Famed Investor Deregisters Hedge Fund.

- Michael Burry Slams NVDA, PLTR, META, ORCL. Here’s What the Charts Say About His Tech-Focused ‘Big Short.’

- Get Ready for a Short Squeeze in Sweetgreen Stock

- Stablecoin Issuer Circle Faces ‘an Uphill Battle.’ Is It Time to Give Up on CRCL Stock?