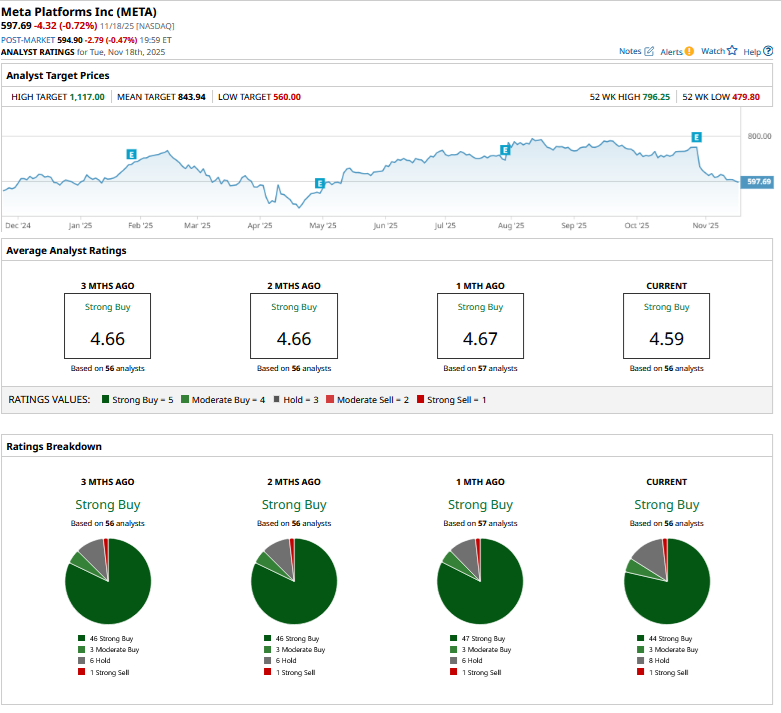

Meta Platforms (META), which not long ago was the year's best-performing constituent of the “Magnificent Seven” and briefly joined the $2 trillion market cap club, has since pared gains and has lost nearly a quarter of its value from the peak. The stock is in a bear market now and is barely in the green for the year, as it plunged below $600.

The stock fell below the $700 price level following the Q3 2025 earnings release last month as the company raised the midpoint of its 2025 capex guidance. It further discussed further “upward pressure” on capex and expenses in 2026 and said that the outlay will be “notably larger in 2026 than 2025.” Markets have become fairly apprehensive of tech companies' burgeoning artificial intelligence (AI) capex, and Meta shares fell following the confessional despite an otherwise strong earnings report.

Meta’s AI Capex Has Risen Considerably

Meta has incidentally been aggressive with AI capex, and its 2025 capex is expected to be around 36% of the $199 billion in revenue that analysts predict it will generate this year. The social media giant was among the flag bearers of the AI trade as the company showed good progress on monetization. However, the rally in AI stocks has come under scrutiny, and Michael Burry of “The Big Short” fame has joined the chorus on AI being a bubble. He has accused the Big Tech giants of accounting fraud by understating their depreciation by extending the useful life of their computing assets, predominantly Nvidia (NVDA) chips.

Michael Burry Would Release More Details on November 25

Burry estimates that hyperscalers will understate depreciation by $176 billion between 2026 and 2028, while specifically calling out Oracle (ORCL) and Meta Platforms for overstating earnings by 26.9% and 20.8%, respectively, by 2028.

Burry, who subsequently deregistered his Scion Asset Management, plans to release more details on Nov. 25, which seems to be putting pressure on AI plays. Meanwhile, on the other side of the “AI bubble” debate is Wedbush analyst Dan Ives, who has a $920 target price on Meta and finds the stock a “table pounder.”

In some ways, I find Burry and Ives to be mirror images of GLJ Research founder Gordon Johnson and Morgan Stanley analyst Adam Jonas, who are on the bearish and bullish extremes on Tesla (TSLA). Meanwhile, I am in the bullish camp on Meta, and while Ives has the propensity to overuse “table pounding” for tech stocks, this time around, I agree with him and find Meta a good buy here.

Why META Stock Looks Like a Good Buy

I find Meta shares quite attractive here and believe that while there are signs of exuberance in some pockets, AI is set to redefine numerous things, just as the internet did. However, like in the dot-com days, there would be winners and losers. Companies like Meta and Alphabet (GOOG) (GOOGL) have a captive user base and have a much higher probability of making it big with AI. As Mark Zuckerberg said during the Q3 2025 earnings call, “Even if we deliver even a fraction of the opportunity ahead for our existing apps and the new experiences that are possible, then I think that the next few years will be the most exciting period in our history.” While the statement would sound like rhetoric, Meta is already witnessing the positive impact of AI in the form of higher engagement and better-targeted ads, which are flowing to its income statement.

AI initiatives have helped power Meta’s growth, and the Q3 revenue growth was the highest since Q1 2024. Meta’s core digital ad business is doing remarkably well, with AI only turbocharging growth. Meta also has monetization opportunities in WhatsApp and Threads. The company has a strong track record on monetization, as aptly demonstrated with Reels, which is now running at an annual run rate of over $50 billion.

Hardware could be another growth frontier for Meta, and the company has taken the lead in smart glasses. The company is not alone in betting on glasses as the next big computing platform, as Apple (AAPL) and Alphabet are also working on smart glasses.

Finally, at a forward price-to-earnings (P/E) multiple of just over 21x, Meta looks like a screaming buy despite concerns over AI capex taking a toll on short-term earnings in the form of higher depreciation.

While regulatory issues are a recurring theme for Meta, among others, its less personalized ads offering in the EU has been in the crosshairs of regulators; the company got a major reprieve after it won the Federal Trade Commission (FTC) antitrust lawsuit. The lawsuit focused on Meta’s acquisition of Instagram and WhatsApp, with the FTC accusing Meta of having a monopoly in social networking. The legal victory removes a significant uncertainty for Meta, even as no one really expected the company to be broken up.

Overall, while Burry might drop more details on Nov. 25, I find the risk-reward balance tilted in Meta stock’s favor at these price levels and have used the dip to add to my existing positions.

On the date of publication, Mohit Oberoi had a position in: META , AAPL , GOOG , TSLA , NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- David Tepper Is Betting Big on This High-Yield Dividend Stock. Should You?

- As Musk Hints That Tesla Could Make Its Own AI Chips, Should You Buy TSLA Stock?

- Loop Capital Says Ride the ‘Waves of AI Optimism’ and Buy Google Stock Here

- Is Meta Stock a Buy or a Sell Before Michael Burry Drops His Bombshell on November 25?