The AI megatrend has not been beneficial just to the likes of poster child Nvidia (NVDA) or the hyperscalers such as Amazon (AMZN), Microsoft (MSFT), and Meta (META). Players involved in building the infrastructure for this revolutionary tech are playing critical roles and have earned the reputation of multibaggers as well, with names like Vertive (VRT), Nebius (NBIS), and GE Vernova (GEV) being glaring examples of lucrative bets on the “picks and shovels” of the AI trade.

However, a significant aspect of this “picks and shovels” space in the domain of AI that has not seen much limelight is the suppliers of optical components.

Valued at about $287.3 billion in 2023, the global optical components market is projected to soar to $628.8 billion by 2032, implying a CAGR of 9.2% during the period. Enabling faster data movement and lower power consumption, optical components are pivotal for building AI at scale. Optical fibers transmit data at extremely high speeds over long distances with much lower signal loss than copper. Further, optical fibers use photons instead of electrons, reducing heat, energy use, and cooling requirements.

Notably, Nvidia's strong showing in the networking segment (up 162% YoY) for the most recent quarter has also made the bullish case for investing in optical components companies stronger.

Thus, with the drivers established, which stocks can be suitable picks from this space? Here are three names to consider for the investors.

Under-the-Radar Tech Stock #1: Coherent Corp. (COHR)

Founded in 1971, Coherent (COHR) is a global technology company focusing on photonics, optical materials & devices, lasers, and compound semiconductors. The company's operations span across segments such as materials & components (compound semiconductors, optics), networking/communications photonics (e.g., optical interconnects for data centers), and lasers/laser systems (industrial, scientific, and defense).

Valued at a market cap of $21.9 billion, the COHR stock is up 60% on a year-to-date (YTD) basis.

Meanwhile, the company's fundamentals also look solid, with its earnings never missing estimates over the past two years. In the most recent quarter as well, Coherent reported a beat on both revenue and earnings. Revenues for Q1 2025 came in at $1.58 billion, up 17% from the previous year, while earnings at $1.16 per share represented an annual growth of 73.1%, ahead of the Street expectations of $1.04.

Net cash from operating activities turned into a positive flow of $296.8 million, compared to an outflow of $65.7 million in the year-ago period. Overall, Coherent closed the quarter with a cash balance of $852.8 million, much higher than its short-term debt levels of about $90 million.

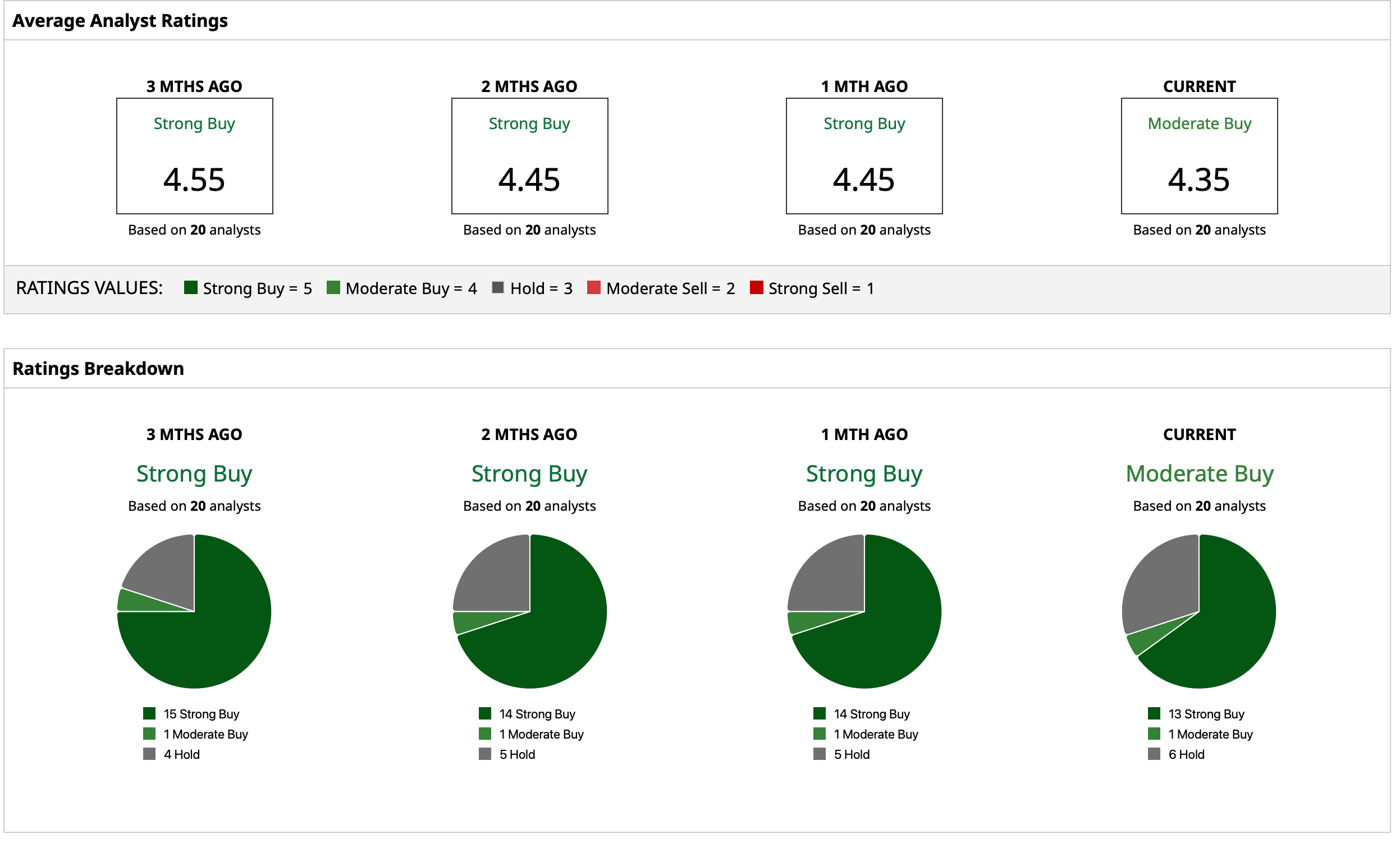

Overall, analysts remain cautiously optimistic about the COHR stock, assigning it a consensus rating of “Moderate Buy.” The mean target price of $158.94 denotes an upside potential of about 4% from current levels. Out of 20 analysts covering the stock, 13 have a “Strong Buy” rating, one has a “Moderate Buy” rating, and six have a “Hold” rating.

Under-the-Radar Tech Stock #2: Fabrinet (FN)

Founded in 2000 as a low-volume, high-mix service provider for manufacturing complex optical components, Fabrinet (FN) is a contract manufacturing services provider (CMS/EMS) specializing in precision manufacturing, optical packaging, electro-optical modules/components, complex printed circuit board assemblies (PCBAs), and electro-mechanical process technologies.

With a current market cap of around $14 billion, the FN stock has soared by almost 85% on a YTD basis.

Notably, revenue and earnings for Q1 2025 both surpassed estimates, with the latter reporting a beat consecutively for the past two years. In the latest quarter, the company reported revenues of $978.1 million, up 21.6% from the previous year. Earnings per share grew to $2.92 from 42.39 in the prior year, while coming in ahead of the consensus estimate of $2.82.

Net cash from operating activities in the quarter increased as well to $102.6 million from $83.2 million in the prior year. Overall, Fabrinet's liquidity position at the end of the quarter was robust, with a cash balance of about $305 million and negligible short-term debt of roughly $4 million.

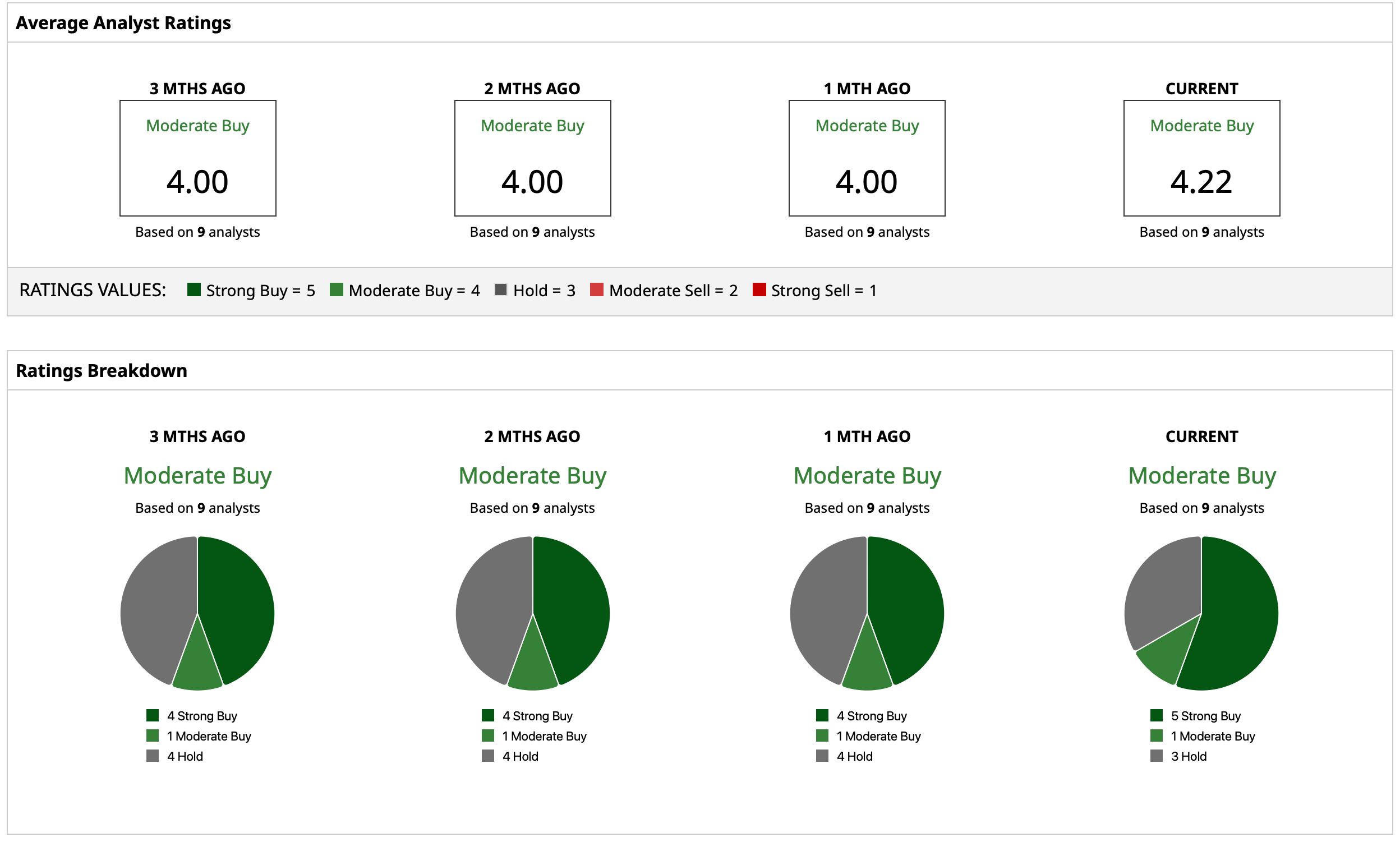

Thus, analysts have deemed the stock to be a “Strong Buy” with a mean target price of $481.43. This indicates an upside potential of about 17% from current levels. Out of nine analysts covering the stock, five have a “Strong Buy” rating, one has a “Moderate Buy” rating, and three have a “Hold” rating.

Under-the-Radar Tech Stock #3: Lumentum Holdings (LITE)

We sign off with Lumentum Holdings (LITE), which was incorporated in 2015 when it was spun off from JDS Uniphase Corporation. Lumentum designs and manufactures optical and photonics-based solutions that serve high-speed communications (telecom, enterprise, data centers) and commercial laser-based applications (industrial manufacturing, sensing).

The company's current market cap stands at $18.1 billion, and its stock is up a mammoth 245% on a YTD basis.

And just like its peers above, Lumentum's quarterly earnings have outpaced Wall Street expectations consecutively over the past two years. Meanwhile, the latest quarter of Q1 2025 saw the company reporting net revenues of $533.8 million, up 58.4% from the previous year. Further, earnings saw a substantial leap to $1.10 per share from $0.18 per share in the prior year, outpacing the consensus estimate of $1.03 per share.

Net cash from operating activities went up to $57.9 million from $39.6 million in the prior year as the company closed the quarter with a cash balance of $772.9 million. However, this was less than the company's short-term debt levels of about $1.2 billion.

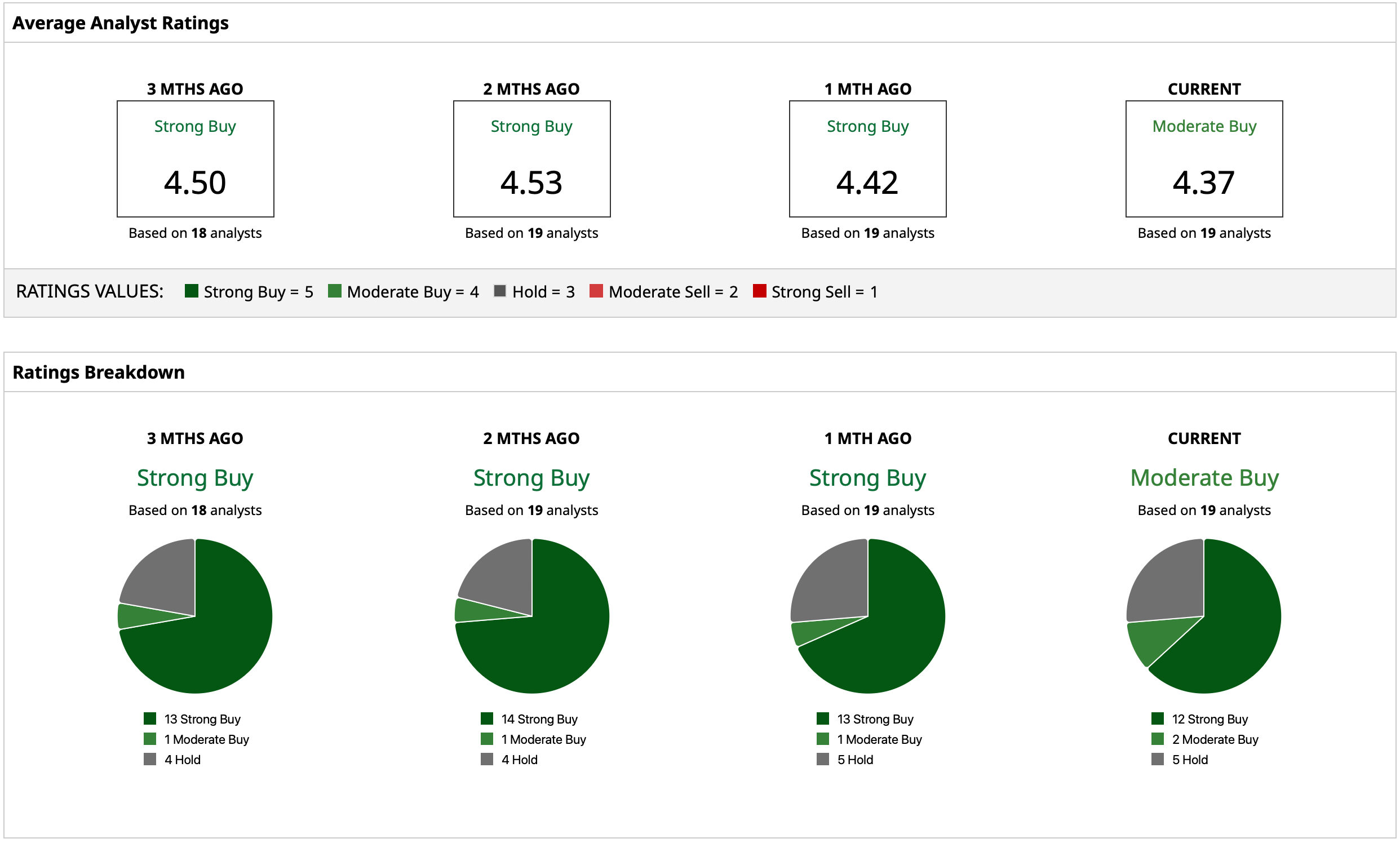

Thus, analysts have attributed a consensus rating of “Moderate Buy” for the stock, with a mean target price that has already been surpassed. Even the high target price of $290 has been surpassed as of this writing. Out of 19 analysts covering the stock, 12 have a “Strong Buy” rating, two have a “Moderate Buy” rating, and five have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The QQQ ETF Points to What’s Next for Stocks… And You Probably Won’t Like the Answer

- Down 11% Last Week, Should You Buy the Robinhood (HOOD) Discount? Here’s What You Need to Know

- 3 Under-the-Radar Tech Stocks to Buy as Nvidia Proves the AI Trade Has Staying Power

- Bridgewater Associates Just Bought QuantumScape Stock. Should You?