Valued at a market cap of around $10 billion, EPAM Systems, Inc. (EPAM) is a global provider of digital platform engineering and software development services. The company delivers a wide range of solutions including cloud and data services, customer experience design, cybersecurity, and full-cycle product development for industries such as financial services, retail, technology, healthcare, and media.

Shares of the Newtown, Pennsylvania-based company have lagged behind the broader market over the past 52 weeks. EPAM stock has declined 26.2% over this time frame, while the broader S&P 500 Index ($SPX) has risen 11%. Moreover, shares of the company have dipped 22.6% on a YTD basis, compared to SPX's 12.3% return.

Looking more closely, shares of the IT services provider have underperformed the Technology Select Sector SPDR Fund's (XLK) over 17% increase over the past 52 weeks and a 17.5% YTD gain.

Shares of EPAM rose 4.4% on Nov. 6 after the company reported stronger-than-expected Q3 2025 adjusted EPS of $3.08 and revenue of $1.39 billion. The company also raised its full-year adjusted EPS forecast to $11.36 - $11.44 and increased its expected 2025 revenue growth to 14.8% - 15.2%, above prior guidance. Additionally, EPAM cited strong demand driven by AI, cloud, automation, and modernization spending.

For the fiscal year ending in December 2025, analysts expect EPAM's EPS to rise 1.9% year-over-year to $9.04. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

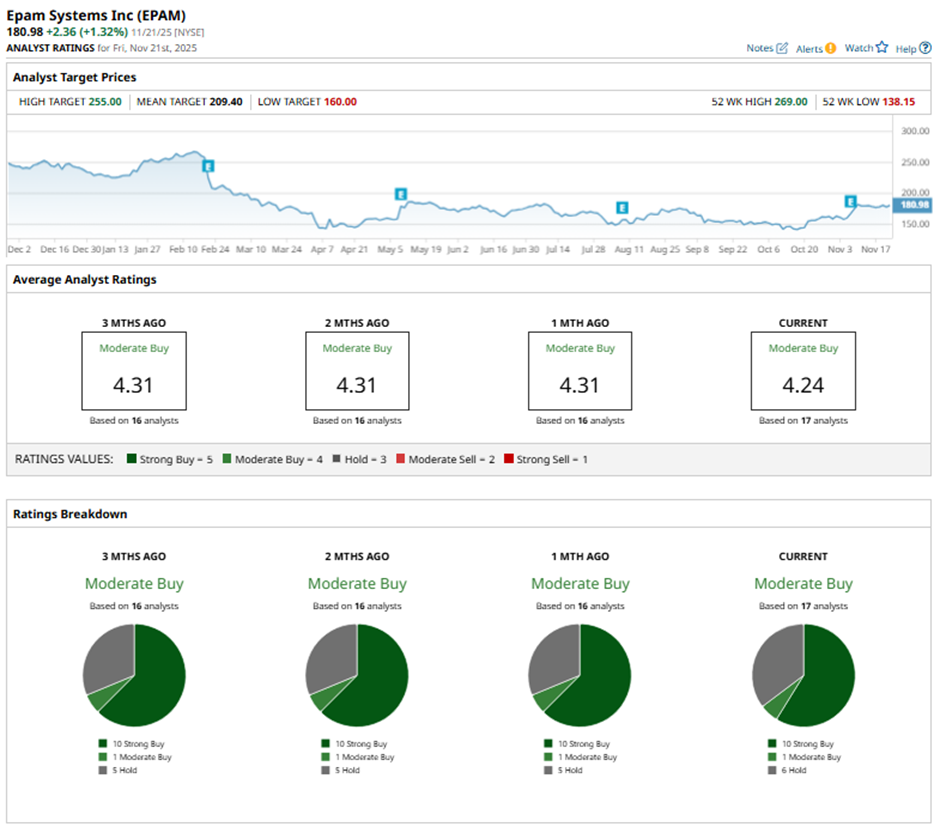

Among the 17 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, one “Moderate Buy,” and six “Holds.”

On Nov. 11, Mizuho analyst Sean Kennedy increased Epam Systems’ price target to $228 and maintained an Outperform rating.

The mean price target of $209.40 represents a 15.7% premium to EPAM’s current price levels. The Street-high price target of $255 suggests a 40.9% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart