Thanks to the recent selloff in tech and artificial intelligence (AI) plays, some of the quality stocks have fallen to attractive levels. Among them is SoFi (SOFI), which has shed over 20% from its peaks and is in bear market territory.

To be sure, the stock’s valuations had started to look a bit stretched at price levels above $30, and as I noted in my previous article, I used the rally to exit the bulk of my positions. However, as SOFI stock has now fallen amid the market selloff, I capitalized on the opportunity to add more shares. Here’s why I find SOFI stock a table pounder near $25 price levels.

Why Has SoFi Stock Fallen?

While the recent selloff has primarily been into tech stocks, which had rallied sharply for almost three years amid optimism over AI, SoFi has been more or less collateral damage. That is, however, not to suggest that there weren’t company-specific issues that added fuel to the fire.

Firstly, Fed officials have given mixed signs of a December rate cut that have put pressure on growth names like SoFi. Notably, lower interest rates are theoretically positive for SoFi as they boost its student loan refinancing business—a segment that was once core for the company as it became the first company to refinance both federal and private student loans in 2012.

Secondly, the cryptocurrency crash also seems to be impacting SoFi, which relaunched its cryptocurrency trading business only this month. Other crypto plays like Robinhood (HOOD) and Coinbase (COIN) have also fallen hard amid the crash in digital assets.

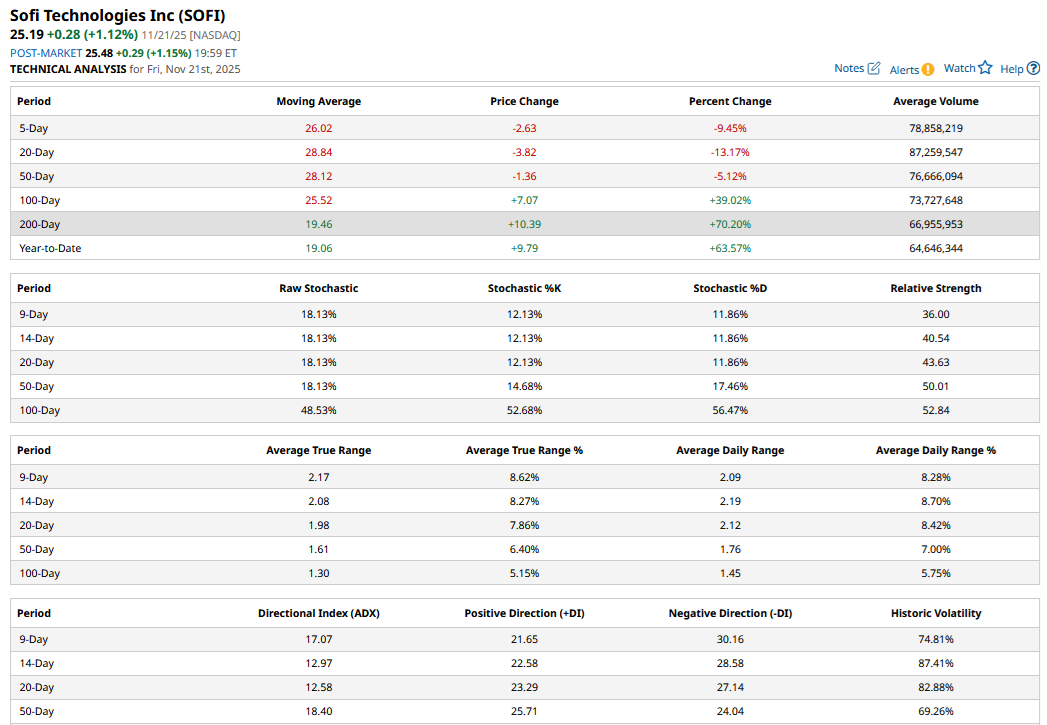

SoFi is a high-beta name, which basically means that its price action is more volatile than the broader markets. The stock fell below the 100-day moving average amid the recent crash, which is a bearish technical indicator that can trigger a sell call for some.

Finally, SoFi’s rich valuations made it vulnerable to a market pullback. However, the selloff has gone a bit too far, making SoFi’s risk-reward quite attractive here.

SoFi Stock Is a Good Buy After the Crash on Reasonable Valuations

I have been a SoFi bull for the last few years, even as I believe that the stock could be a trader’s paradise, given the frequent entry and profit-taking opportunities that it gives. At the current price levels, I find SoFi a good buy, as the valuations now look quite attractive, especially considering the kind of growth the company brings to the table.

During the Q3 2025 earnings call, SoFi forecast 2025 earnings per share (EPS) of $0.37 and had previously guided for 2026 EPS to be between $0.55 and $0.80. Going by the company’s guidance, we get a 2025 price-to-earnings (P/E) multiple of 68x, while the 2026 P/E at the top end of the guidance is 31.5x. The multiples might still seem a bit bloated, but they look quite reasonable considering the kind of growth SoFi has been witnessing.

SoFi’s Growth Story Is Far From Over

SoFi’s growth story is far from over, and it continues to surprise on the upside. In Q3 2025, it added 905,000 members, which was up 35% year-over-year (YoY) and lifted its total member count to 12.6 million.

The company’s member count has swelled over 10x over the last five years, and even at a higher base, it continues to grow in high double digits. The market opportunity is immense for SoFi, as its brand awareness is still quite low. The company has been growing at the expense of banks, most of whom lack the agility of fintech that SoFi has, despite having a banking charter. For instance, it is the only national bank in the U.S. offering crypto trading services.

Moreover, unlike traditional banks, SoFi originates loans for third parties through its loan platform business. According to SoFi, annually, it cannot lend to about $100 billion worth of potential loan applicants and anticipates that nearly a quarter of these loans could be serviced by other lenders, which is a major opportunity. These are customers who don’t meet SoFi’s credit standards, but by originating loans for other lenders, SoFi gets low-risk, high-margin revenues. During Q3, SoFi originated $3.4 billion of loans through its loan platform business, which helped it generate $534 million in non-lending revenues. I find SoFi’s business model quite attractive. The company is now adding nearly a million customers every quarter, to whom it then subsequently cross-sells other products. It does not shut doors even on customers not meeting its stringent credit standards and instead earns a fee by referring them to other customers.

SoFi has been quite innovative and has democratized the financial landscape by bringing products hitherto reserved for big investors to retail customers as well. For instance, the company has added private market funds, options trading, and international payments to its arsenal. It is betting big on blockchain and plans to integrate SoFi Pay with the yet-to-be-launched SoFi USD stablecoin.

While I have always admired SoFi as a company, its valuations have often been a breaking point for me. With the stock now back in the ballpark of $25—which, as I noted in a previous article, has been a floor of sorts—I am loading up on SOFI stock and would add more shares if prices plunge from these levels on a broader market meltdown.

On the date of publication, Mohit Oberoi had a position in: SOFI . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Under-the-Radar Tech Stocks to Buy as Nvidia Proves the AI Trade Has Staying Power

- Bridgewater Associates Just Bought QuantumScape Stock. Should You?

- Palo Alto Networks' Stock Has Tanked But Its FCF is Strong - Price Target is 15% Higher

- Should You Buy the 17% Pullback in Alibaba Stock Before November 25?