When stock or crypto prices go down, volumes generally dry up, especially those coming from retail traders. With the recent crypto downturn wreaking havoc with people’s portfolios, Coinbase (COIN) is feeling the heat. The company’s stock was already in a downtrend, but recent downward EPS revisions from Argus Research have only added fuel to the fire.

Argus has argued that COIN stock is overvalued compared to its peers and does not merit a “Buy” rating at current high valuations. The 2026 EPS estimate has been revised down to $6.55 from $9.56, a 31% reduction from prior estimates. This should clarify one thing for investors: it is extremely challenging to have a reliable earnings visibility into the company’s profits, mainly because it relies on a very volatile asset class for its earnings. This is unlikely to change anytime soon.

About COIN Stock

Coinbase is a financial services platform that owns the largest cryptocurrency exchange in the United States. It was founded in 2012 and is headquartered in New York. The company operates globally and not only allows retail traders to buy and sell cryptocurrencies on its platform but also offers institutional investors the right tools to invest and developers the required tools to build decentralized applications.

The company’s stock has lost 13.36% value in the last one year, a significant underperformance compared to the S&P 500’s 12.36% returns. Between April and July, COIN stock went up 3x before beginning a downtrend. The stock price has been very volatile, just like most of the assets people trade on the company’s platform.

COIN trades at a 2026 P/E ratio of 31.56x, which is significantly higher than those of some of its listed peers like the London Stock Exchange (LSEGY) at 21.54x and the Nasdaq (NDAQ) at 26x. However, compared to its own five-year historic average, the stock trades at a 24% discount. This is a dilemma for investors, but something traditional metrics cannot explain. A stock that is closely associated with what’s popular among retail traders will get a high multiple. The traditional stock exchanges therefore cannot be taken as true peers when looking at multiples alone. Argus’ comments on such peers are valid, but they should not trigger selling among investors because what they have pointed out is nothing new and has always been true, as the five-year average P/E clearly shows.

One aspect where COIN loses out to its peers, though, is the dividend yield. Traditional stock exchanges have a very reliable earnings model as they cater to most of the money that flows into the markets. LSEGY’s forward dividend yield of 1.09% and NDAQ’s 1.21% therefore provide investors with a safety net that cannot be expected from COIN, which doesn’t pay any dividend.

COIN Tops Q3 Earnings Expectations

Coinbase reported its Q3 earnings report at the end of October and comfortably beat earnings estimates. The earnings per share of $1.5 vs. consensus estimates of $1.1 was not enough to convince investors, though, as the stock continued to slide.

One thing that could be driving the negative sentiment is the increasing expenses. This subject was raised on the Q3 earnings call, and the management cited the Deribit and Echo acquisitions as the reasons for the higher expenses, which are expected to be $100 million higher at the midpoint in Q4. The company’s headcount is also likely to continue increasing, though the growth rate may slow down.

The management also pointed out that a pro-crypto political environment was helping on the regulatory and M&A front. However, as more players enter the space, the competition is increasing, making execution all the more important for the company. The competition will drive down the company's margins, another factor that could be contributing to the ongoing negative sentiment.

What Are Analysts Saying About COIN Stock

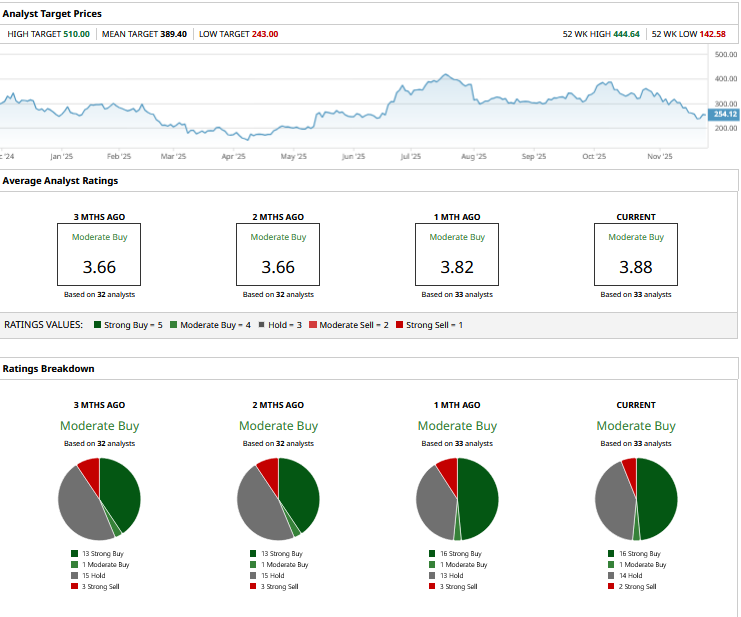

COIN is covered by 33 analysts on Wall Street. The bullish sentiment is well reflected by the 16 “Strong Buy” ratings, with 14 analysts rating the stock a “Hold.” Going by analyst estimates, the stock looks severely undervalued. The mean price target of $389 represents upside of 53%, while the most bullish analyst sees upside of more than 100% with the price target of $510.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Argus Just Slashed Its Earnings Estimates for Coinbase. Should You Dump COIN Stock Here?

- Big Money is Betting on Natural Gas Prices to Break Out. Here’s the Setup.

- Is This Under-the-Radar High-Yield AI Stock a Buy Now?

- Wall Street Likes Server Stocks After Nvidia’s Q3. Is DELL or HPE Stock a Better Buy Here?