Natural gas traders have been waiting months for a real catalyst, and it may have just arrived.

In the latest Market on Close livestream, Senior Market Strategist John Rowland, CMT, broke down a developing weather anomaly that could dramatically tighten natural gas supply and ignite a major move into winter.

It’s not hype, either – read on to learn more about how this forecast is rooted in atmospheric science, price structure, and real positioning happening inside the futures market.

The Weather Catalyst: A Weakening Polar Vortex

John highlights a major atmospheric shift: A weakening polar vortex.

Normally, the polar vortex acts like a lid, trapping extreme cold air in the Arctic. But when it weakens — which current models show happening in late November into early December — that cold air spills downward into North America.

Cold air translates into higher heating demand, which typically results in bullish pressure on natural gas.

That’s why energy traders have been laser-focused on weather models. Historically, some of the biggest nat-gas rallies happen when sudden cold-weather events collide with supportive technical indicators.

And this time, the setup may be even stronger.

The Technical Setup: Structure Supports the Story

In the clip, John describes a recent dip in natural gas prices that lines up with the kind of tidy pullback he’d like to see.

Price pulled back into the mean, held support cleanly, and is now pushing higher. This is classic trend-continuation behavior in a seasonal market that strengthens into winter.

John laid out the key price levels, with a bullish trigger on a break above $4.89 and an upside target at $5.25.

Since then, this past Monday was natural gas expiration day, when the market typically runs contratrend as traders roll off profitable positions. Geopolitical headlines were also a confounding factor, with fresh news out of Russia-Ukraine negotiations – though it would be months, moving more into years, before their supply would be impactful on our domestic gas situation, says Rowland.

Against this backdrop, nat gas dripped lower to start the week, leaving us waiting for positive momentum.

“With prices stable at or about the mean and above the 50-day moving average, that lowers the entry to above $4.80,” says Rowland.

Meanwhile, some traders are betting far bigger – with a huge target above $7.17.

The Insider Clue: Someone Is Betting Nat Gas Could Double

John mentions something unusual:

“A large trader bought $7/$10 call spreads in the March contract… expecting nat gas to potentially double between now and February.”

March futures are around $3.73 today.

For someone to buy call spreads that target $7–$10, they’re betting on a massive spike — likely driven by:

- Cold weather

- Inventory drawdowns

- Incremental demand spikes

- Leveraged volatility

This doesn’t guarantee a moonshot. But it tells us how aggressively some institutional traders are positioning.

How Traders Can Play the Trend: BOIL, Futures, or Stocks

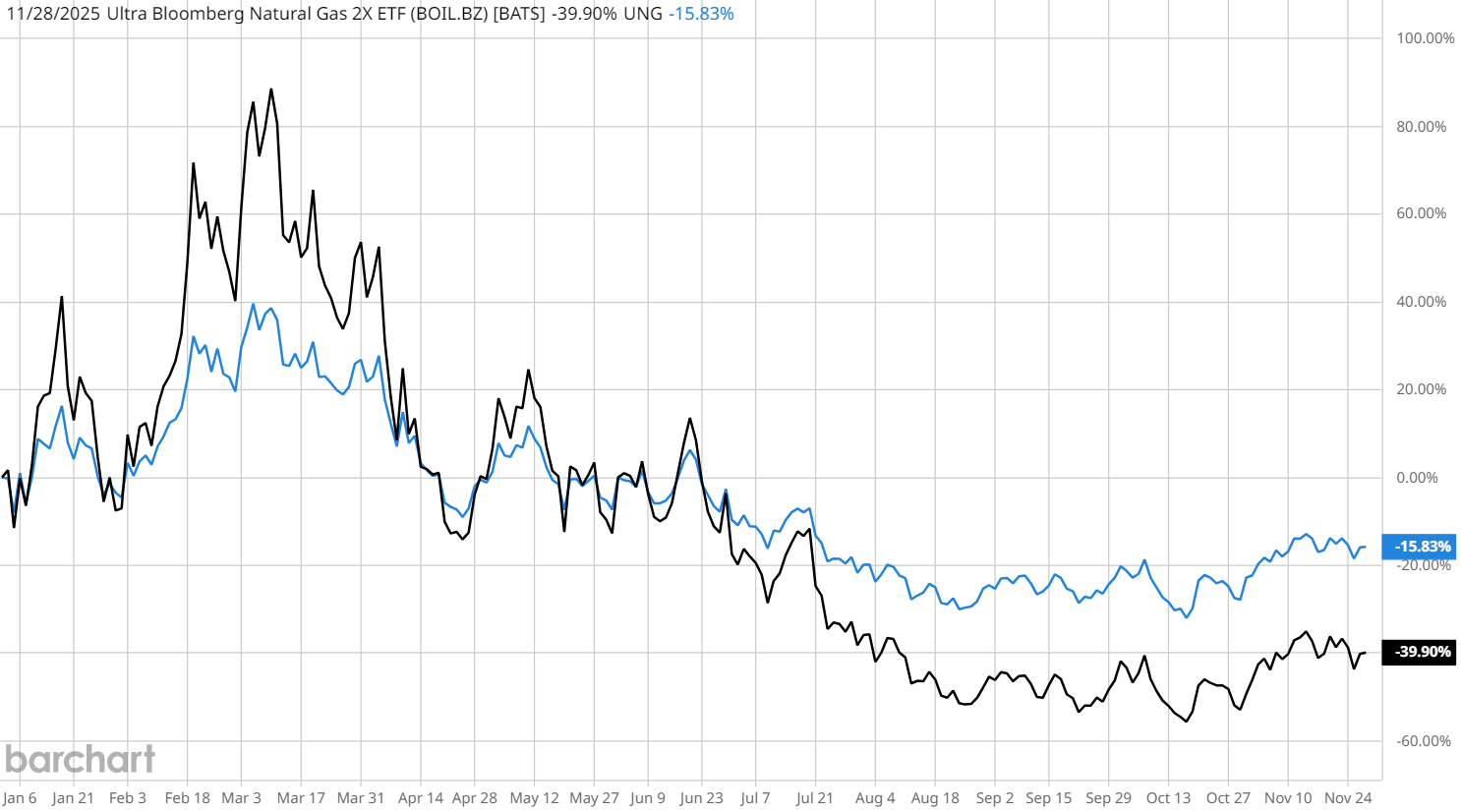

If you want to participate in the move without trading futures, John suggests the leveraged ETF BOIL (UltraBloomberg Natural Gas 2x), but with a strong warning:

“BOIL is only for short-term momentum, because derivative decay eats long-term returns.”

This is essential. BOIL can swing aggressively in your favor during strong directional moves, but holding it for months is structurally dangerous.

That’s because the underlying asset primarily consists of natural gas futures that require consistent rolling, which exposes the strategy to negative roll yield anytime the market is in contango – the most common market condition.

However, when the market moves to backwardation – as with natural gas rolling from December to January, where the front-month contract is the most expensive – it opens up favorable derivative decay.

That means BOIL and leveraged vehicles like it are typically best used as a short-term tactical instrument, not a long-term position. John suggests a time frame of about two weeks, at the most.

Bottom Line: Nat Gas Could Be Setting Up for a High-Conviction Winter Trade

In short, the outlook for natural gas checks a lot of bullish boxes right now:

✔ Weather catalyst

✔ Technical momentum

✔ Deep pullback and rebound

✔ Institutional bullish positioning

✔ Seasonal tailwinds

✔ Key breakout levels approaching

It’s certainly not a guarantee, especially when weather forecasting is involved. However, it’s the kind of promising setup that traders should keep on the radar when trying to catch a winter move in energy.

Watch the Clip: The Natural Gas Trade That Could Explode This Winter

- Analyze Seasonal Returns for Natural Gas

- Stream the Full Market on Close Episode

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart