With a market cap of $160.7 billion, Arista Networks Inc (ANET) develops and sells data-driven client-to-cloud networking solutions for AI, data center, campus, and routing environments worldwide. Its offerings center around its Extensible Operating System (EOS) and include cloud and AI networking, cognitive network software, and comprehensive customer support services.

Companies valued over $10 billion are generally described as “large-cap” stocks, and Arista Networks fits right into that category. The company serves a wide range of industries and sells through distributors, resellers, OEM partners, and a direct sales force.

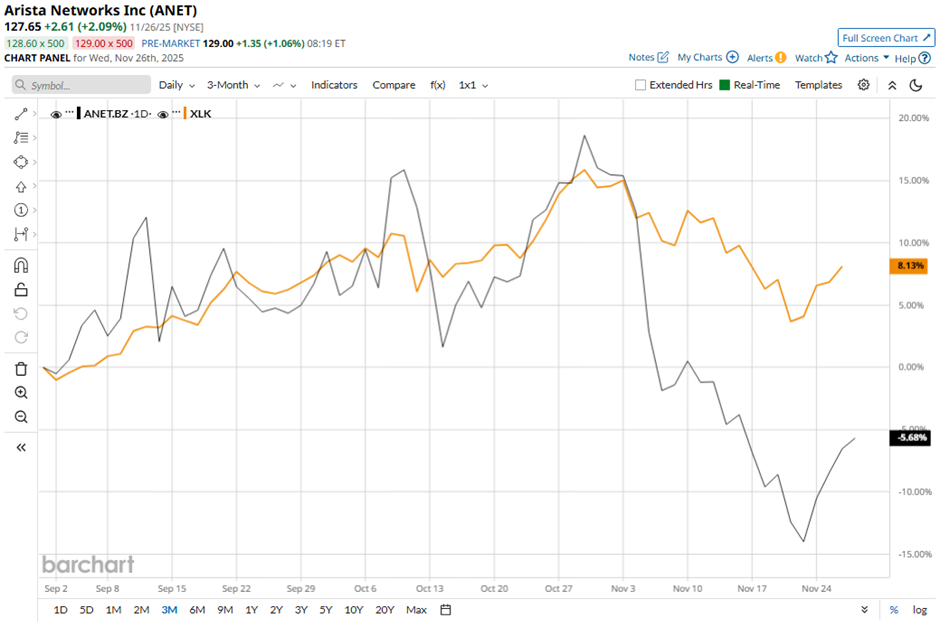

Shares of the Santa Clara, California-based company have dipped 22.6% from its 52-week high of $164.94. Over the past three months, ANET stock has decreased 4.9%, lagging behind the Technology Select Sector SPDR Fund's (XLK) rise of 7.9% during the same period.

In the longer term, shares of the cloud networking company have increased 15.5% on a YTD basis, underperforming XLK’s 22.1% return. However, ANET stock has soared 25.1% over the past 52 weeks, outpacing XLK’s 20.9% gain over the same time frame.

Despite recent fluctuations, the stock has been trading above its 50-day moving average since May. In addition, it has moved above its 200-day moving average since late-June.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $0.75 and revenue of $2.31 billion on Nov. 4, shares of ANET tumbled 8.6% the next day. Total operating expenses jumped sharply to $512 million, and management guided Q4 non-GAAP gross margin down to 62% - 63%, below the Q3 level of 65.2%.

In comparison, rival Dell Technologies Inc. (DELL) has slightly outpaced ANET stock on a YTD basis, returning 15.6%. However, DELL stock has declined nearly 6% over the past 52 weeks, lagging behind ANET stock.

Due to the stock’s outperformance over the past year, analysts are strongly optimistic about its prospects. The stock has a consensus rating of “Strong Buy” from the 24 analysts covering the stock, and the mean price target of $166.75 is a premium of 30.6% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Argus Just Slashed Its Earnings Estimates for Coinbase. Should You Dump COIN Stock Here?

- Big Money is Betting on Natural Gas Prices to Break Out. Here’s the Setup.

- Is This Under-the-Radar High-Yield AI Stock a Buy Now?

- Wall Street Likes Server Stocks After Nvidia’s Q3. Is DELL or HPE Stock a Better Buy Here?