The global artificial intelligence market is valued at nearly $260 billion in 2025 and is expected to climb past $1.2 trillion by 2030, according to Statista Market Insights. Big tech names like Amazon (AMZN), Microsoft (MSFT), Meta Platforms (META), and Alphabet (GOOG) (GOOGL) are pouring billions into AI infrastructure, and Alphabet recently reported its first‑ever $100 billion revenue quarter, with 16% year‑over‑year (YoY) growth, helped in large part by AI. While these giants grab most of the attention, dividend-focused investors may be missing a smaller company that is quietly using AI to drive its own growth.

For investors looking to tap into this longer-term AI trend through a high-income angle, Shutterstock (SSTK) offers an interesting case. The stock photography and creative content platform has shifted into AI data licensing and currently sits among the highest‑yielding AI-related names, with a forward dividend yield above 6.1%.

But can a stock trading 45% below its 52‑week high and dealing with pressure in its older Content segment really deliver both steady income and meaningful growth, or is that elevated yield more of a warning sign than an opportunity? Let’s take a closer look.

What Shutterstock’s Numbers Really Say

Shutterstock runs a global online marketplace that licenses stock photos, videos, music, and data to businesses and creators, and it is steadily adding AI tools and services so customers can create content faster and more easily.

Over the past year, SSTK stock is down about 31%, and year-to-date (YTD) it has fallen roughly 29%, which has kept sentiment muted even though the business still generates solid cash.

That weak price action is what makes the current valuation stand out. The stock trades at a forward price-to-earnings ratio of 6.87x, which is less than half the sector average of 15.01x and suggests investors are heavily discounting future earnings despite the move toward higher-margin AI services.

On top of this, the income profile is unusually strong for a tech-related name: the company has a market cap of about $718.8 million with roughly 35.5 million shares outstanding, pays an annual dividend of $1.29 per share for a 6.37% yield, and most recently paid a quarterly dividend of $0.33 on Sept. 4. The forward payout ratio sits at 49.71%; the firm has raised its dividend for six straight years, and it pays quarterly, compared with an average yield of just 2.62% across the communications sector.

In the third quarter of 2025, revenue increased to $260.1 million from $250.6 million, while net income slipped to $13.4 million from $17.6 million and diluted EPS fell from 0.50 to 0.37 as higher costs and business mix weighed on margins.

On an adjusted basis, net income declined from $46.4 million to $36.4 million and adjusted EPS from 1.31 to 0.99, pointing to margin compression once one-off items are removed. At the same time, adjusted EBITDA rose from $70.0 million to $79.4 million, which shows that cash generation is actually improving even as reported earnings move lower, helping to support the current dividend.

How AI Is Rewiring Shutterstock’s Growth Engine

Shutterstock is leaning hard into AI by using its large content library and data-licensing expertise to build a full set of services for model builders. The company has introduced AI tools focused on training and testing models, pulling together specialized training datasets and tailored evaluation tools so AI teams can work faster on next‑generation systems instead of piecing together their own data from different sources. This shift moves Shutterstock from being just a data supplier to acting as a hands-on partner in model design, training, and evaluation, offering custom content and insights that fit each model’s use case, human preferences, and creative goals rather than relying on generic stock assets.

At the same time, Shutterstock is reshaping its brand around this mix of AI and creative services. After more than twenty years supporting campaigns and creative projects, it has rolled out a new visual identity that presents the company as the “universal ingredient” businesses need to make their work more effective and positions it clearly as a family of brands focused on creative and GenAI solutions.

In practical terms, that means telling customers they can go to one platform for multimedia creative content, professional studio production, newer ad channels like GIPHY, data licensing, and AI tools that are meant to drive real business results, not just produce attractive images or videos.

What the Street Sees Next for Shutterstock

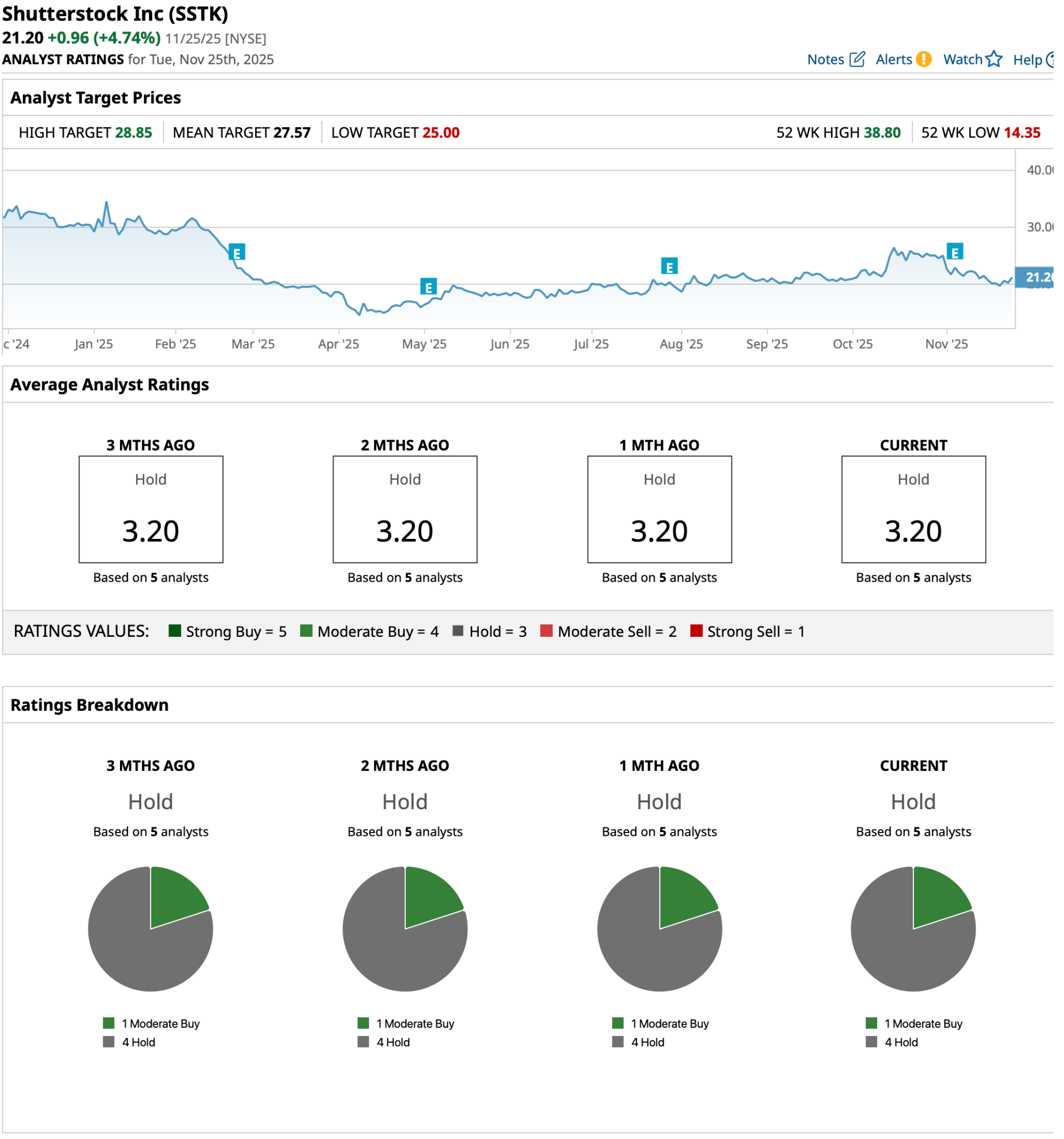

For the full year 2025, analysts expect $3 per share, up from 2.61 in 2024, a 14.94% growth rate. Within that setup, analysts views split a bit. Needham’s Bernie McTernan remains the most vocal bull, keeping a “Buy” rating while trimming his price target three times this year, from $55 to $45 in January, then to $30 in March, and finally to $25 in June, where it stands. A steady rating with a lower target signals conviction in Shutterstock’s AI and data opportunity while recognizing the broader de‑rating and pressure on the stock’s multiple.

On the other side, JMP Securities’ Andrew Boone has repeatedly reaffirmed a “Market Perform” view, most recently on May 5, and has not set a formal target, which reads as a “show me” stance until the AI ramp is clearer. In aggregate, the tone is neutral: all five analysts sit at a consensus “Hold,” with an average price target of $27.57. From the current price, that implies about 30% upside.

Conclusion

Putting it all together, Shutterstock looks less like a broken story and more like a misunderstood, higher‑risk income play in a structurally growing AI environment.

With SSTK stock down sharply from its highs, trading at a steep discount to sector valuations, yet still growing earnings, investing heavily in AI data services, and supporting a dividend yield north of 6% that’s backed by solid cash generation, the setup leans more “opportunity” than “yield trap” for patient investors who can stomach volatility. Over the next couple of years, the most likely path is a gradual grind higher rather than a moonshot, with total returns driven by that fat yield and a reasonable chance of multiple expansion if the AI and data‑licensing story keeps showing up in the numbers.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Argus Just Slashed Its Earnings Estimates for Coinbase. Should You Dump COIN Stock Here?

- Big Money is Betting on Natural Gas Prices to Break Out. Here’s the Setup.

- Is This Under-the-Radar High-Yield AI Stock a Buy Now?

- Wall Street Likes Server Stocks After Nvidia’s Q3. Is DELL or HPE Stock a Better Buy Here?