With a market cap of $17.7 billion, Aptiv PLC (APTV) is a technology company based in Dublin that serves the transportation, aerospace and defense, telecommunications, and industrial markets. The company designs and manufactures advanced vehicle components and technologies, focusing on electrical architecture, connectivity, and autonomous driving solutions.

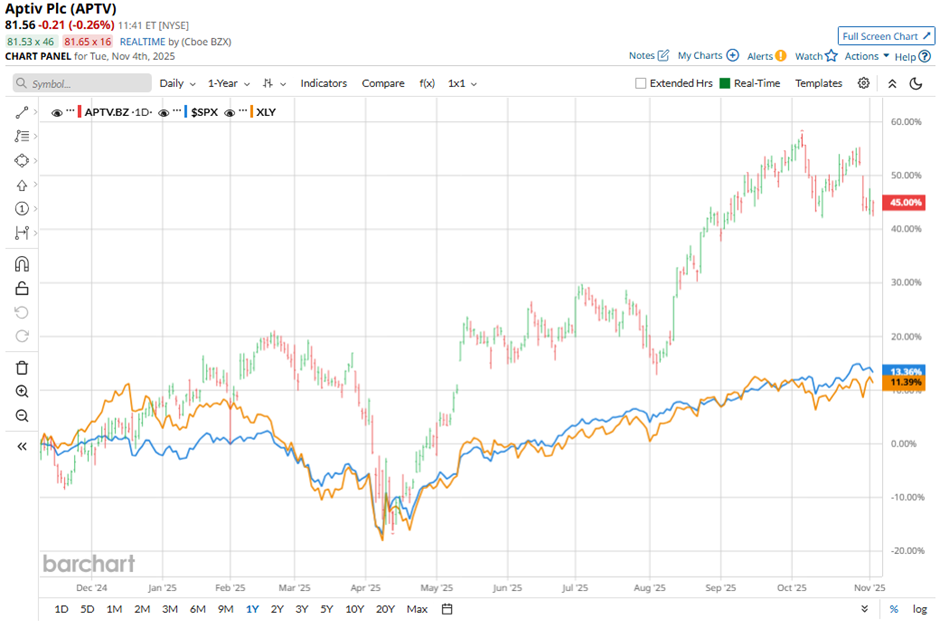

Shares of the Schaffhausen, Switzerland-based company have outpaced the broader market over the past 52 weeks. APTV stock has soared 45.2% over this time frame, while the broader S&P 500 Index ($SPX) has increased 19.1%. Moreover, shares of the company are up 34.3% on a YTD basis, compared to SPX’s 15.6% rise.

Focusing more closely, shares of Aptiv have surpassed the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 20.2% return over the past 52 weeks.

Shares of Aptiv fell 4.3% on Oct. 30 after the company reported a GAAP net loss of $355 million for Q3 2025, driven by a $648 million non-cash goodwill impairment charge related to its 2022 Wind River acquisition. Despite record revenue of $5.2 billion and adjusted EPS of $2.17, beating prior-year levels, investors were disappointed by the large impairment and continued weakness in the software unit tied to delays in 5G and software-defined vehicle adoption.

For the fiscal year ending in December 2025, analysts expect APTV’s adjusted EPS to grow 24.3% year-over-year to $7.78. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

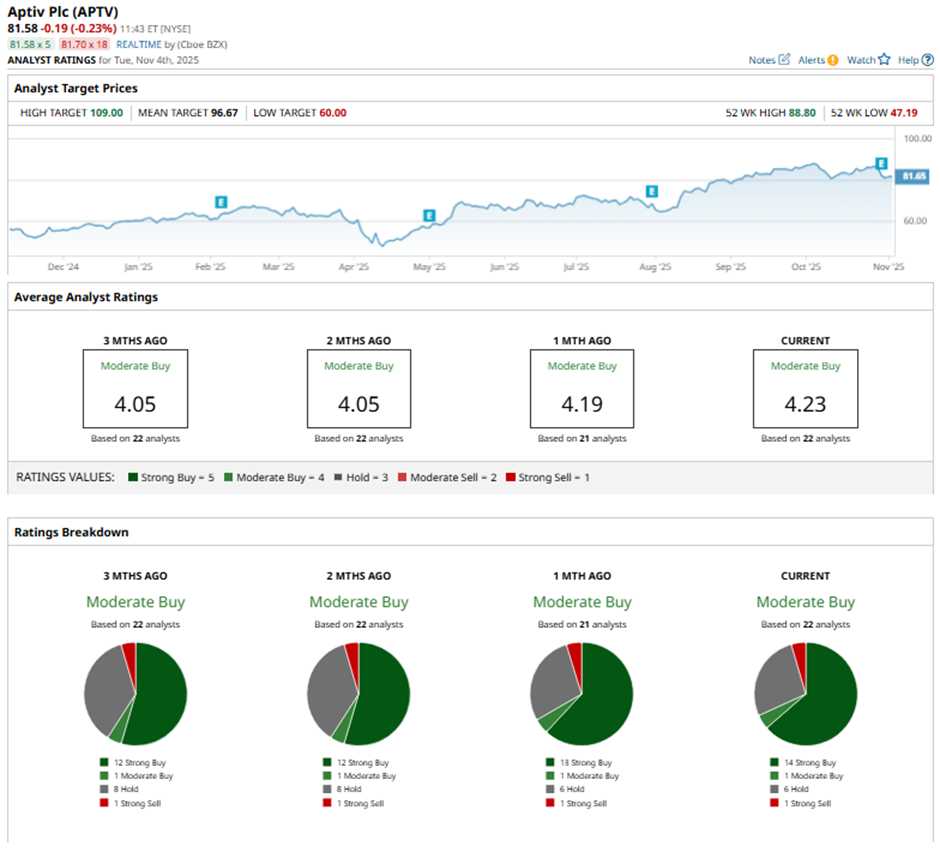

Among the 22 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 14 “Strong Buy” ratings, one “Moderate Buy,” six “Holds,” and one “Strong Sell.”

This configuration is more bullish than three months ago, with 12 “Strong Buy” ratings on the stock.

On Oct 31, TD Cowen maintained a “Buy” rating on Aptiv and raised its price target to $107.

The mean price target of $96.67 represents a premium of 18.5% to APTV's current price. The Street-high price target of $109 suggests a 33.6% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Getty Images Soared on a Perplexity AI Deal. Analysts Think GETY Stock Can Gain Another 123% from Here.

- Royal Caribbean’s (RCL) Options Implosion Offers Up a Massive Informational Arbitrage Trade

- Jane Street Is Buying Up Cipher Mining Stock. Should You Grab CIFR Shares Here?

- Bitcoin’s Weekly Structure Shows Signs of a Failed Auction. It’s a Warning for the Long-Term Trend.