With a market cap of $12.9 billion, Erie Indemnity Company (ERIE) serves as the managing attorney-in-fact for the subscribers of the Erie Insurance Exchange. The company provides a wide range of services, including policy issuance and renewal, sales and advertising support, and agent compensation.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Erie Indemnity fits this criterion perfectly. It also delivers underwriting, customer service, administrative support, and information technology services.

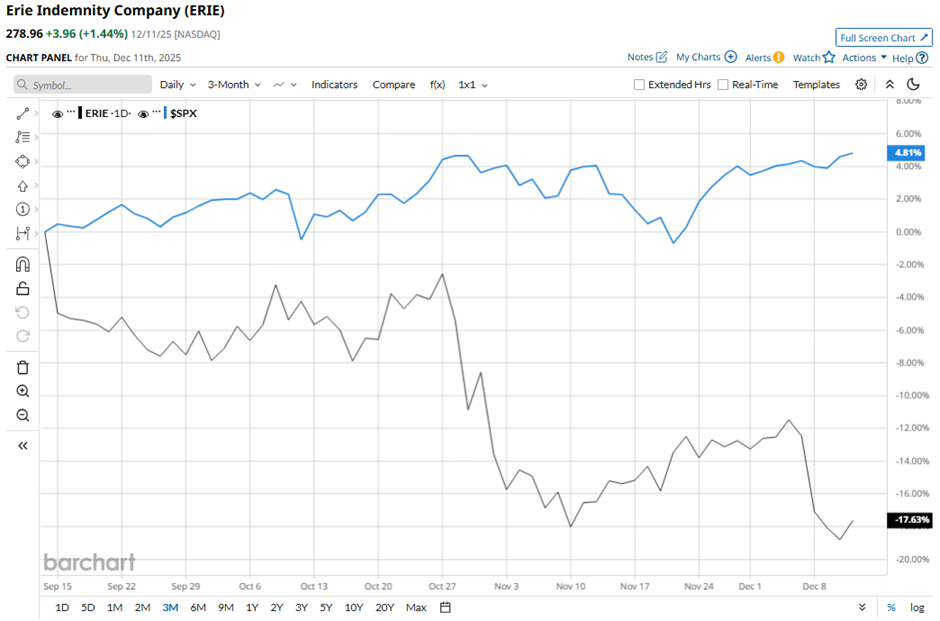

Shares of the Erie, Pennsylvania-based company have fallen nearly 39% from its 52-week high of $456.93. Erie Indemnity’s shares have decreased 17.5% over the past three months, lagging behind the broader S&P 500 Index’s ($SPX) 4.8% gain over the same time frame.

In the longer term, ERIE stock is down 32.3% on a YTD basis, underperforming SPX’s 17.3% rise. Moreover, shares of the insurance company have dropped 31.5% over the past 52 weeks, compared to the 13.4% return of the SPX over the same time frame.

The stock has been trading below its 50-day and 200-day moving averages since last year.

Despite beating Q3 2025 EPS expectations with $3.50 on Oct. 30, Erie Indemnity’s shares fell 5.5% the next day as revenue of $1.07 billion missed estimates. Investors were also cautious about rising commission costs, which increased $41 million year-over-year, outpacing the 7.3% growth in management fee revenue.

In comparison, rival Aon plc (AON) has shown a less pronounced decline than ERIE stock. AON stock has dipped 3.3% on a YTD basis and 4.2% over the past 52 weeks.

Despite the stock’s weak performance over the past year, analysts remain moderately optimistic on ERIE. It has a consensus rating of “Moderate Buy” from the three analysts in coverage, and as of writing, the stock is trading above the mean price target of $73.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 2 ‘Strong Buy’ Biotech Stocks With 208% to 329% Upside Potential

- Nasdaq Futures Slip as Broadcom Results Fail to Ease AI Fears, Fed Speak on Tap

- As Trump Takes a Stand Against Deere, How Should You Play the Blue-Chip Dividend Stock?

- Archer Aviation Is Bringing Its Flying Cars to Saudi Arabia. Is ACHR Stock a Buy Here?