As markets gear up for another flurry of corporate earnings, all eyes are turning to FedEx Corporation (FDX). The global logistics giant is set to report Q2 Fiscal Year 2026 results after market close on Thursday, Dec. 18, and investors are bracing for a potentially market-moving event. FedEx’s performance often reflects deeper currents in shipping, freight, and e-commerce activity, making it a bellwether for broader business sentiment and economic momentum.

From shifting trade patterns to rising operational costs and the evolving landscape of online shopping demand, FedEx’s earnings could offer a real-time snapshot of the global economy as 2025 winds down. This week’s report may well set the tone for its direction into 2026.

About FedEx Stock

FedEx Corporation is one of the world’s largest and most recognized logistics and freight companies, providing integrated air and ground transportation, e-commerce shipping, express delivery, and supply chain solutions across more than 220 countries and territories.

Headquartered in Memphis, Tennessee, FedEx operates a massive global network that moves millions of packages daily and serves as a critical backbone for businesses and consumers alike. The company’s scale and reach make it a bellwether for global trade and economic activity, since shifts in shipping volumes often reflect broader trends in manufacturing, retail, and e-commerce demand. FedEx’s market cap sits near $66.64 billion.

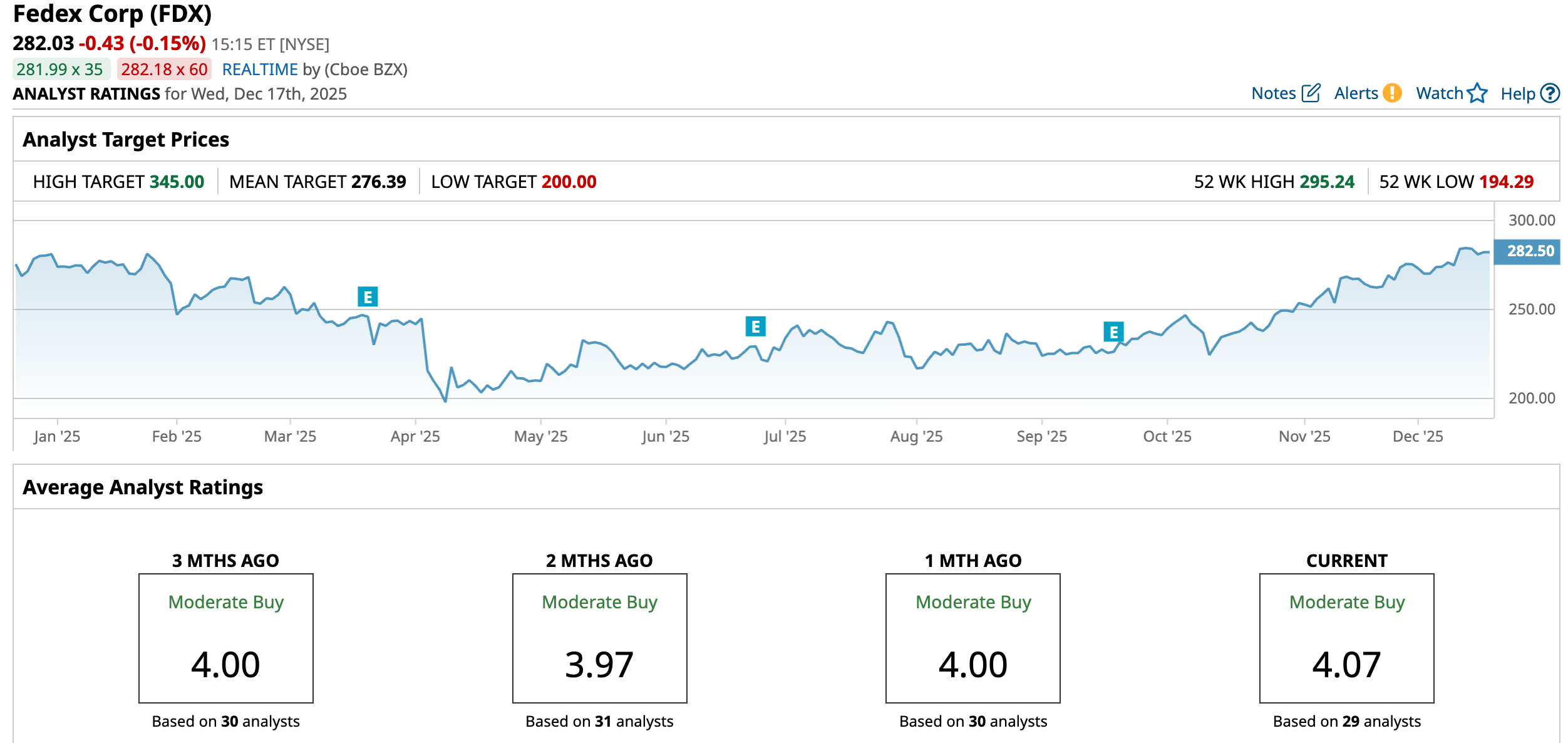

When looking at FedEx’s price performance, it tells a story of volatility in which this week’s earnings report is a focal point for investors. Over the past 52 weeks, FDX returns have been just slightly positive and significantly trailing broader market benchmarks; the stock’s price has climbed 1.83%, just marginally over the past year, while the S&P 500 Index ($SPX) posted 14.48%, double-digit gains over the same period.

Year-to-date (YTD), FDX’s performance has been similarly muted, with gains barely in the green, roughly up around 0.42%, a sign that investors have remained cautious even as the stock clawed back from earlier sell-offs.

Headwinds such as softness in freight demand and concerns about weaker business-to-business volumes have weighed on sentiment. FDX’s performance this year feels like a stock waiting for clearer signals, and this week’s earnings could act as just that, giving traders fresh conviction one way or the other.

The stock is evidently trading at a discount compared to its industry peers at 15.63 times forward earnings.

Q1 Results Surpassed Projections

FedEx’s first-quarter fiscal 2026 results, released on Sept. 18, painted a picture of cautious progress in a challenging macro backdrop. In that quarter, the logistics giant reported adjusted earnings per share of $3.83, up about 6.4% year-over-year (YOY), comfortably beating consensus forecasts while revenue climbed 2.8% to $22.2 billion, also ahead of estimates.

Digging deeper into the numbers, FedEx’s adjusted operating income climbed to $1.3 billion, representing a 7.4% YOY increase, with adjusted operating margins expanding modestly to around 5.8%, up from about 5.6% in Q1 2025.

Segment-level trends were mixed, with the FedEx Express (Federal Express) unit reporting roughly 4% higher revenues YOY, while FedEx Freight saw a modest decline in revenue, reflecting ongoing challenges amid softer industrial demand.

Meanwhile, FedEx remains on track to spin off its Freight unit into a separate, publicly traded company by June 2026. Following the separation, FedEx Freight will trade independently on the New York Stock Exchange under the ticker FDXF.

Management provided full-year guidance for fiscal 2026, calling for revenue growth of about 4% to 6% and projected adjusted earnings per share in the range of approximately $17.20 to $19.00. This outlook, framed against a backdrop of ongoing cost optimization efforts and the strategic transformation of its network, reflects both confidence in underlying business improvements and caution around persistent external pressures like global trade softness.

For the soon-to-be-reported quarter, analysts expect EPS to remain flat at $4.05. Revenue is expected to come in at $22.8 billion, indicating a 3.8% YOY rise. Moreover, the consensus estimate for the full year is $18, indicating a marginal decline, while EPS is expected to rise 13.8% YOY to $20.48 in fiscal 2027.

What Do Analysts Expect for FedEx Stock?

This month, Wells Fargo reiterated its “Equal Weight” rating on FedEx but lifted its price target to $290 from $280, citing solid parcel fundamentals and expectations that the company will outperform current market forecasts.

Also, last month, Stifel maintained its “Buy” rating on FedEx and nudged its price target up to $297, showing confidence in a series of value-unlocking initiatives, including the DRIVE cost-savings program, Network 2.0 integration, and the planned spin-off next year.

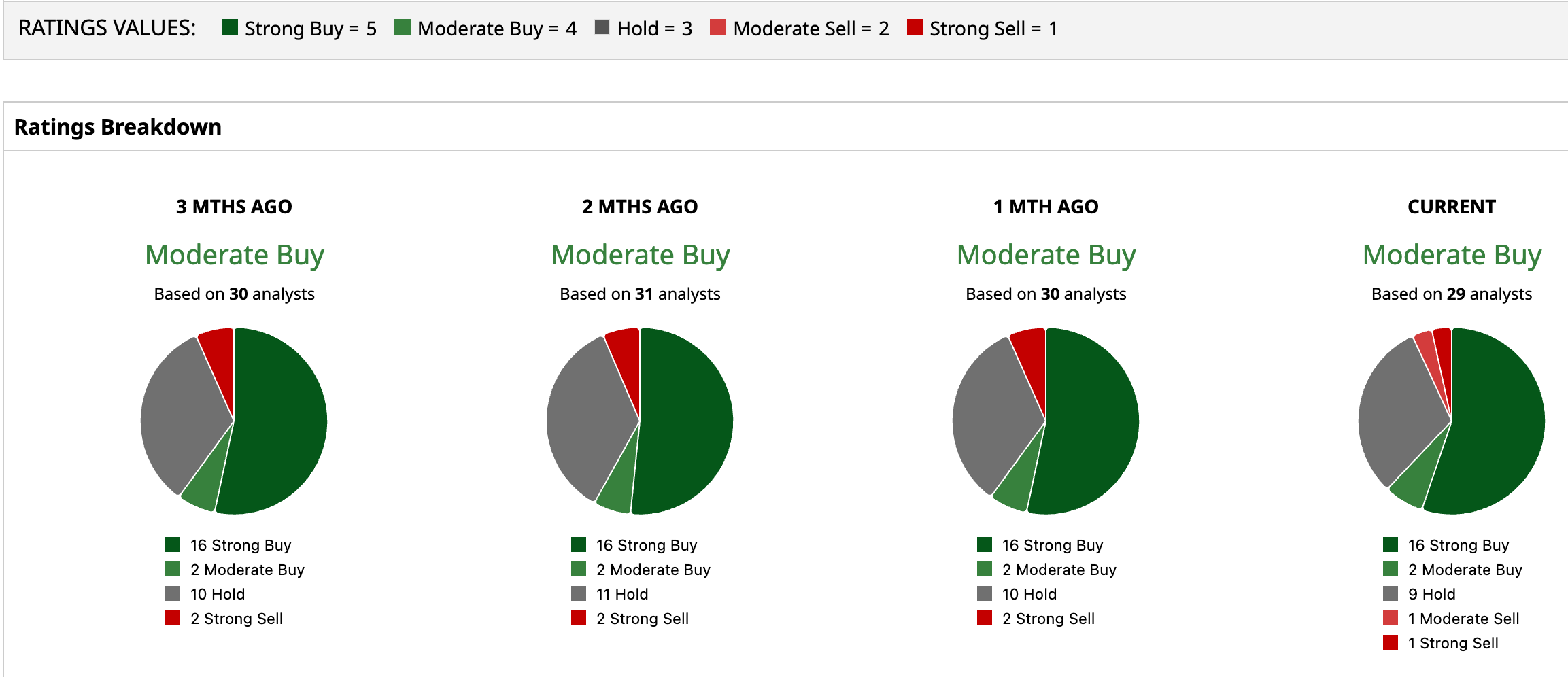

Overall, FDX has a consensus “Moderate Buy” rating. Of the 29 analysts covering the stock, 16 advise a “Strong Buy,” two suggest a “Moderate Buy,” nine analysts are on the sidelines, giving it a “Hold” rating, one gives a “Moderate Sell,” and one recommends “Strong Sell.”

FDX is currently at a premium to the average analyst price target of $276.39, while the Street-high target price of $345 suggests that the stock could rally as much as 22.3%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Analyst Says IonQ Stock Can Gain Over 75% from Here. Should You Buy It Now?

- 3 Barchart Stock Screeners to Help You Find Better Call Option Trades

- ‘You Didn’t Want to Be in Jamestown’: Elon Musk Warns Mars Won’t Be A Billionaire Vacation Spot; It Will Be ‘Very Dangerous’ and ‘You Might Die’

- Why You Need to Watch FedEx Stock This Week