Williams-Sonoma, Inc. (WSM) operates as a leading omni-channel specialty retailer specializing in premium home furnishings, kitchenware, and decor. Headquartered in San Francisco, California, the company oversees a portfolio of iconic brands such as Williams Sonoma, Pottery Barn, West Elm, and Rejuvenation.

It delivers products through e-commerce platforms, catalogs, and international franchises, prioritizing cooking essentials, furniture, bedding, and custom furnishings. The company has a market capitalization of $22.17 billion, which classifies it as a “large-cap” stock.

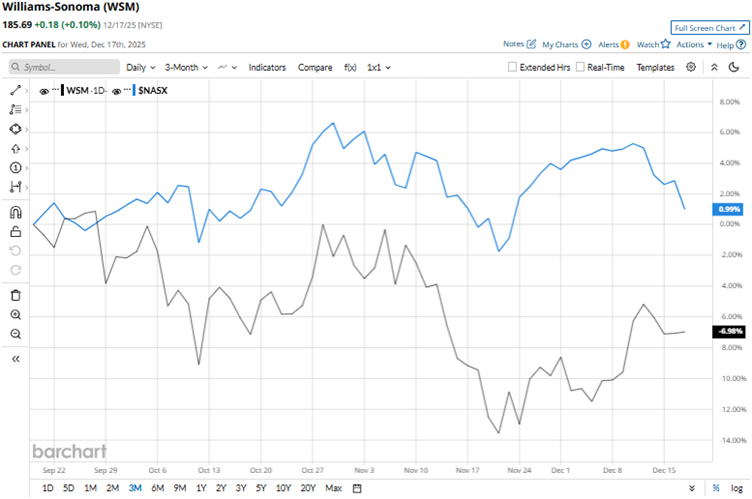

Williams-Sonoma’s shares had reached a 52-week low of $130.07 in April, but are up 42.8% from that level. Due to tariff concerns and tepid sentiments surrounding it, the stock has declined 5.6% over the past three months. On the other hand, the broader Nasdaq Composite ($NASX) index gained 1.9% over the same period.

Over the past 52 weeks, Williams-Sonoma’s stock has dropped 6.3%, while the Nasdaq Composite index is up 12.9% over the same period. However, over the past six months, the stock has gained 18.3%, while the broader index has increased by 16.3%. The stock has been trading above its 200-day moving average since early December and is currently near its 50-day moving average.

On Nov. 19, Williams-Sonoma reported its third-quarter results for fiscal 2025 (quarter ended Nov. 2). The company recorded a positive topline comp, as its comparable brand revenue increased by 4%. Its net revenues grew 4.6% year-over-year (YOY) to $1.88 billion, exceeding the $1.85 billion that Wall Street analysts had expected. Its EPS was $1.96, up 4.8% YOY and higher than the $1.87 that analysts had expected. Based on its modest growth, the stock dropped 3.4% intraday on Nov. 19.

We compare Williams-Sonoma’s performance with that of another specialty retail stock, Best Buy Co., Inc. (BBY), which has declined 18.3% over the past 52 weeks, but gained 3% over the past six months. Therefore, Williams-Sonoma has been the clear outperformer over these periods.

Wall Street analysts are moderately bullish on Williams-Sonoma’s stock. The stock has a consensus rating of “Moderate Buy” from the 20 analysts covering it. The mean price target of $203.61 indicates a 9.7% upside compared to current levels. The Street-high price target of $230 indicates a 23.9% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart