I’ve been investing for over 30 years, and it always comes back to one question. Where does value hide? Over the past decade, the answer shifted from products to platforms to technology stories. Anything that sounded novel captivated the market. In that world, large, gigantic companies could survive on slogans about synergy and reach. The market was patient.

This year it broke that spell. Higher rates changed the cost of waiting. Debt became expensive. Investors lost interest in stories without real shape. The market is now paying for clarity and refusing to subsidize structures that do not make sense. I have watched this pattern build for years. Finally, it appears poised to emerge into the open.

The next two years will belong to companies that split. The evidence is already here if you look at how the market rewarded breakups in 2025. Value did not disappear. The value was simply obscured by complexities that are no longer profitable. I previously highlighted a lot of these issues throughout the year. In the past, there were various catalysts that led to separations of businesses. Back in 2008, I remember experiencing an extreme dislike for financial businesses.

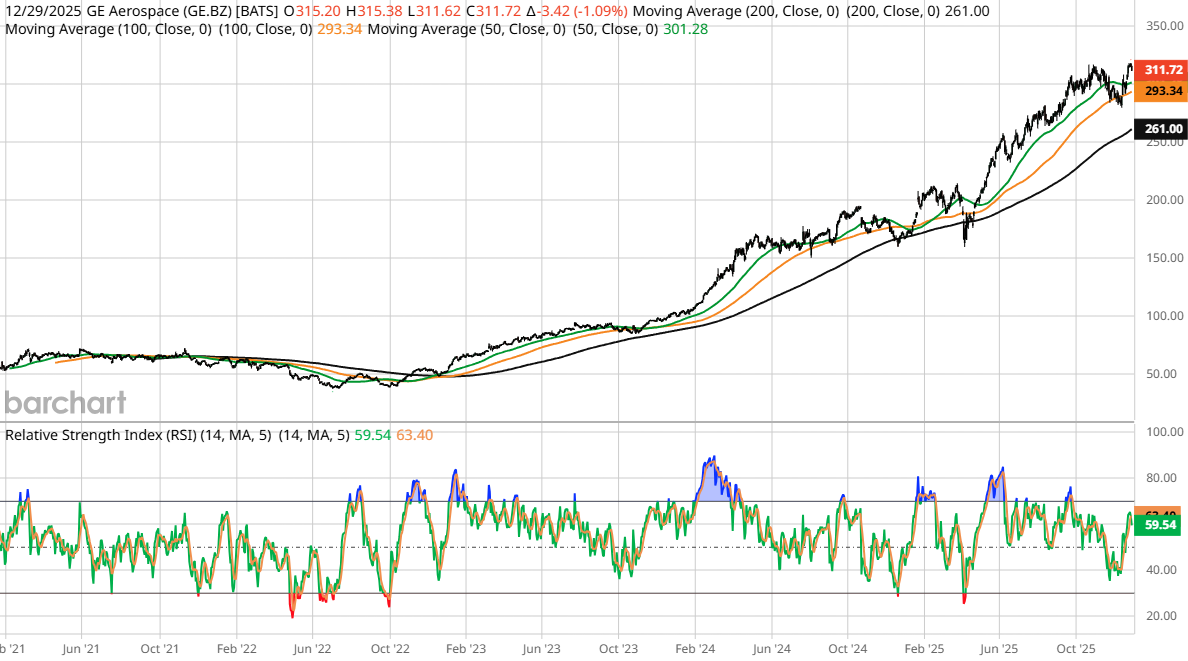

I will start with the most obvious example. (GE) For years, (GE) insisted on its mix of aviation, health care, and energy that formed a strategic ecosystem. The story always sounded impressive. It also became harder to justify the longer investors had to wait for the parts to shine. The complexity weighed on valuation. The debt raised questions. The business units had different demands. The entire company became a roundabout of internal transfers and capital decisions that were difficult to follow.

When GE finally began to separate its businesses, something changed. Investors could see distinct units with clearer economics. Aviation could breathe. Health care could run its own race. Energy could work inside a different time horizon. The share price responded not because of a marketing campaign, but because the market could finally value each unit on its terms.

This is the important point. Breakups are not magic. They destroy value. They reveal what was already there. If you followed GE closely, the parts were always stronger than the whole. The structure prevented the market from seeing it.

(WDC) and (SNDK) told a similar story. The split was not a headline moment in the tech world, yet the market reaction was tremendous. Owners who stayed close to the situation saw something the broad market did not. (SNDK) was a strong, focused business trapped behind a brand associated with hardware cycles and capital heaviness. The split freed (SNDK) from the legacy perception, enabling it to focus on growth and margin strength.

Investors often forget the lessons learned from experiencing many cycles. Markets are slow to abandon old narratives. The market continues to price the weak shell that entraps a strong business. You must be early to structural change if you want the reward. Some individuals argue that breakups are a cyclical trend. They point to previous years when activists pushed for spinoffs and not much happened afterward. I disagree. The conditions right now are different.

Three Forces Converging

- Higher rates make inefficient structures painful. Capital is not free. Money has a price again, and boards finally feel the pressure. Investors see through balance sheet games that once hid weak returns. If a business line cannot justify its capital, the rest of the company should not carry it.

- Passive capital plays a new role. Ten years ago, passive investors sat quietly in the background. Today they vote or at least influence how votes are read. Governance firms shape expectations. Boards cannot ignore proposals that ask for separation and transparency. Even if the board disagrees, the risk of standing still rises.

- Activists are returning to real work. I often speak to activists, and we consider ourselves activists in our own right through www.dinebrands.com The last five years have pushed many of them toward narrative trades. Everyone wanted to own the hot theme. Most of that ended in disappointment. Structural work is not fashionable, but it produces lasting results. It promotes simplification, separation, and accountability. These are not slogans. They change how a company uses capital. They create the conditions for compounding.

Put these forces together and you get pressure. The investor base is tired of complexity. Boards have fewer excuses. Management teams must justify every business line, not as part of a story, but as a contributor to value. Where will breakups go next? Look at companies where the parts do not belong together. I will not name tickers here, but you can spot them if you walk through the logic. These are conglomerates that established themselves during the period of low-cost capital. Their cost of money has changed and their structure has not.

Consumer brands that hold mass and premium products under one roof. One deserves a market premium for growth. The other belongs to a different buyer. Together they arrive at the middle. The market always pays the average. Industrial companies consist of a service unit that generates cash and a manufacturing arm that consumes it. The market punishes both. Media businesses are attempting to operate legacy assets alongside data platforms. We should not combine the valuations of these two types of businesses under a single ticker symbol, as they do not share a common future. The market recognizes these mismatches. Investors see it first when margins diverge and multiples no longer make sense. Boards see it when debt costs climb and talent leaves for simpler companies. That is usually when the first quiet conversations about restructuring begin.

In my experience, boards do not move because they want to. They move because they cannot avoid it. A business line that drags performance becomes a visible weight. If management defends it too long, the pressure increases. Investors eventually force clarity. When that happens, the split becomes unavoidable. Investors often ask how to position for breakups. My answer stays the same. Look for companies where the valuation of the whole does not match the implied value of the parts. You do not need exact numbers. You need a sense of internal friction. Read the segment performance with patience. Look at how the company talks about its units. Look at turnover in leadership. Look at where capital is allocated. Look at the company that management visits on investor days. The company that management visits on investor days is always the one that gives itself away. Sometimes you see it in language. When management starts discussing optionality or strategic autonomy, a significant change is underway. When they start discussing focus, discipline, or optimization, they are laying the foundation for change.

A good breakup trade needs time, but the reward can be worth the wait. In (WD)’s case, those who recognized the hidden strength of (SNDK) were paid well. In (GE)’s case, those who believed the parts were stronger than the whole finally saw that view rewarded. These are not isolated events. They are part of a pattern that will keep unfolding as long as capital remains costly and boards remain under pressure to justify every dollar. There is another angle that investors often miss. Breakups reshape management incentives. When leaders run smaller companies with clearer objectives, the noise falls away. Accountability rises. Talent thrives. If a business has a future, clarity exposes it. If it does not, clarity reveals that too.

Investors do not need perfection. They need visibility. Few will venture into things they don’t understand. A breakup trade gives exactly that. It is easier to buy a business when you can see what drives it. Clarity separates the durable from the faded. Breakups give the market a chance to reward the former and reject the latter. The market will always chase big themes. That is fine. But real money still sits in places where investors are not looking. The next two years belong to companies that choose separation over scale. Investors who stay alert to structural tension can get ahead of the rerating that follows. The rerating is not guaranteed, but the market is leaning in that direction again.

Alpha is not dead. Alpha is not waiting for the next headline to emerge. It is trapped in complexity and has outlived its usefulness. Companies that release what no longer serves them will unlock that value. Investors who recognize that direction early will not need luck. They will need patience and a willingness to look where others are not looking yet. Corporate structure never gets the attention it deserves. That is about to change. Breakups are coming because they must. Complexity has run out of time.

On the date of publication, Jim Osman did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Next Two Years Will Belong To Breakups: Investors Who Miss It Will Miss the Cycle

- As Mortgage Rates Remain High, This 1 Stock Has Been a Big Winner in 2025

- Robinhood Stock Was Red Hot in 2025. Should You Keep Buying Shares in 2026?

- Activist Investor Toms Capital Is Buying Up Target Stock. Should You?