Selling cash secured puts on stocks an investor is happy to take ownership of is a great way to generate some extra income. A cash-secured put involves writing an at-the-money or out-of-the-money put option and simultaneously setting aside enough cash to buy the stock. The goal is to either have the put expire worthless and keep the premium, or to be assigned and acquire the stock below the current price. It’s important that anyone selling puts understands that they may be assigned 100 shares at the strike price.

Why Trade Cash Secured Puts?

Selling cash secured puts is a bullish trade but slightly less bullish than outright stock ownership. If the investor was strongly bullish, they would prefer to look at strategies like a long call, a bull call spread, or a poor man’s covered call. Investors would sell a put on a stock they think will stay flat, rise slightly, or at worst not drop too much.

Cash secured put sellers set aside enough capital to purchase the shares and are happy to take ownership of the stock if called upon to do so by the put buyer. Naked put sellers, on the other hand, have no intention of taking ownership of the stock and are purely looking to generate premium from option selling strategies.

The more bullish the cash secure put investor is, the closer they should sell the put to the current stock price. This will generate the most amount of premium and also increase the chances of the put being assigned. Selling deep-out-of-the-money puts generates the smallest amount of premium and is less likely to see the put assigned.

PYPL Cash Secure Put Example

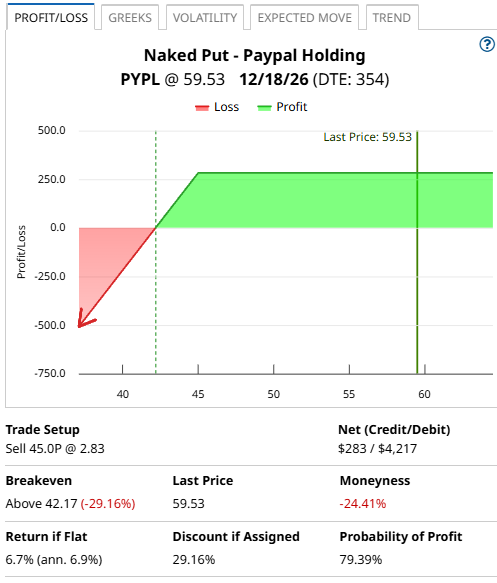

Yesterday, with PayPal Holdings (PYPL) trading at $59.49, the December 2026 put option with a strike price of $45 was trading around $2.83. Traders selling this put would receive $283 in option premium. In return for receiving this premium, they have an obligation to buy 100 shares of PYPL for $45. By December 18, if PYPL is trading for $44, or $40, or even $30, the put seller still has to buy 100 shares at $45.

But, if PYPL is trading above $45, the put option expires worthless, and the trader keeps the $283 option premium. The net capital at risk is equal to the strike price of $45, less the $2.83 in option premium. So, if assigned, the net cost basis will be $42.17. That’s a 29.16% discount from the price it was trading yesterday.

If PYPL stays above $45, the return on capital is:

$283 / $4,217 = 6.7% in 354 days, which works out to 6.9% annualized.

Either the put seller achieves a 6.9% annualized return or gets to buy PYPL stock for a significant discount. You can find other ideas like this using the Naked Put Screener.

Normally we look at shorter-term cash secured puts, but yearly put sales like this can also make sense in some cases.

Company Details

The Barchart Technical Opinion rating is a 100% Sell with a Strongest short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

Of 42 analysts covering PYPL, 9 have a Strong Buy rating, 2 have a Moderate Buy rating, 26 have a Hold rating, 1 has a Moderate Sell rating and 4 have a Strong Sell rating.

Implied volatility is currently 28.51% compared to a 12-month high of 72.14% and a low of 26.59%. The IV Percentile is 9% and the IV Rank is 4.20%.

PayPal is one of the largest online payment solutions providers that enables it to offer smooth and secure transaction facility to both customers and merchants.

The company's peer-to-peer payment service, Venmo, is the key catalyst behind the solid growth in its total payment volume.

The company offers domestic and international person-to-person payment facilities with the help of PayPal and Xoom products.

PayPal allows customers to send payments in more than 200 markets globally.

It has connections with financial service providers worldwide.

Further, the company supports withdrawal of funds from bank accounts in 56 currencies and holding balances in PayPal accounts in 25 currencies.

Additionally, transfer of funds supports more than 100 currencies globally.

Additionally, this San Jose, CA-based company is gaining from strategic acquisitions including Hyperwallet, Braintree and iZettle that are helping it in delivering better payment experience.

Summary

While this type of strategy requires a lot of capital, it is a great way to generate an income from stocks you want to own. If you end up being assigned, you can sit back and collect the nice 2.08% dividend on offer from PYPL. You can do this on other stocks as well but remember to start small until you understand a bit more about how this all works.

Risk averse traders might consider buying an out-of-the-money put to protect the downside.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart