Commanding a market capitalization of $80.7 billion, The Sherwin-Williams Company (SHW) is a global leader in the development, manufacture, distribution, and sale of paints, coatings, and related products for professional, commercial, industrial, and retail customers. Founded in 1866 and headquartered in Cleveland, Ohio, it operates through three core segments: Paint Stores Group, Consumer Brands Group, and Performance Coatings Group.

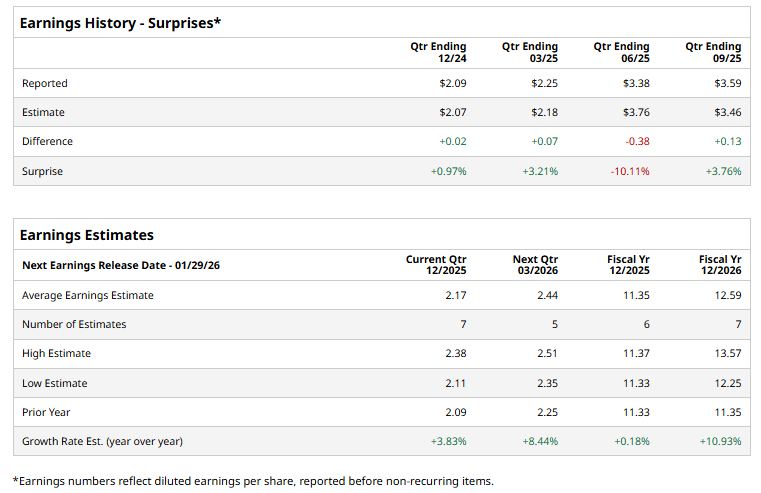

Sherwin-Williams is set to report its fourth-quarter results soon, with consensus estimates calling for an EPS of $2.17, up 3.8% year over year. The company’s earnings track record has been mixed, having exceeded Street expectations in three of the past four quarters while falling short once.

For the fiscal year 2025, Sherwin-Williams’ profit is expected to grow marginally annually to $11.35 per share.

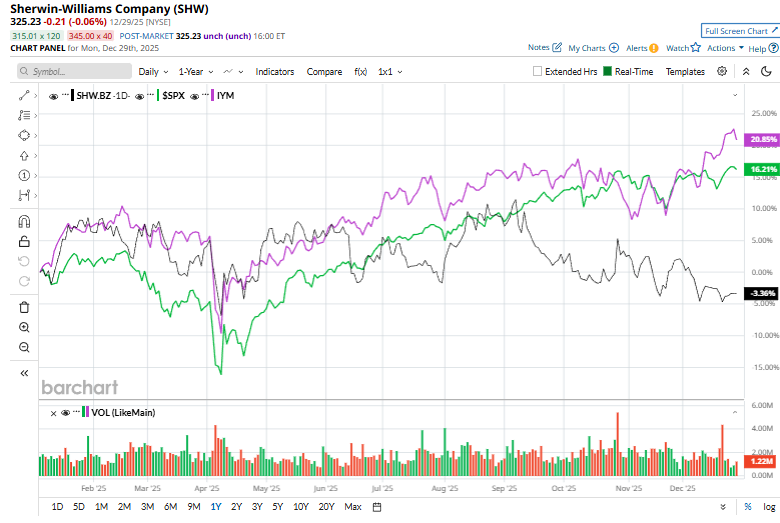

Sherwin-Williams stock has lagged the broader market over the past year, falling 5.3%, while the S&P 500 Index ($SPX) has gained 16.9%. The stock has also underperformed its sector, as the iShares U.S. Basic Materials ETF (IYM) posted an 18.8% gain over the same 52-week period.

On December 19, shares of Sherwin-Williams rose more than 1% after Citigroup upgraded the stock to “Buy” from “Neutral” and set a price target of $390. The upgrade reflected improved confidence in the company’s earnings outlook and margin resilience, with Citi citing Sherwin-Williams’ pricing discipline, strong professional contractor demand, and long-term growth prospects as key drivers supporting the more constructive stance.

Among the 26 analysts covering the stock, the consensus rating is a “Moderate Buy” overall. That includes 14 “Strong Buy” ratings, two “Moderate Buy” ratings, and 10 “Holds.” The mean price target of $391.38 indicates a 20.3% upside from current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart