In the last 12 to 18 months, stories that are even remotely linked to AI and data centers have turned into gold. Clearly, ideas that are closely linked to the AI growth story have created immense value. SanDisk (SNDK) stock is one name that has skyrocketed and continues to surprise.

To put things into perspective, SNDK stock has surged by over 60% within the first two weeks of 2026. This sharp upside comes after multi-fold returns in the prior year.

A key trigger for the new year rally is a report indicating that SanDisk can potentially double the price of 3D NAND for enterprise SSDs. Nomura opines that memory suppliers are likely to increase the pricing for enterprise-grade 3D NAND, both in the short-term and mid-term.

If this holds true, there will be a significant impact on growth, EBITDA margin, and cash flows in 2026 and beyond. The outlook therefore remains positive for SNDK stock even after a sharp rally.

About SanDisk Stock

Headquartered in Milpitas, California, SanDisk is a developer and manufacturer of storage devices based on NAND flash technology.

Further, the company’s solutions include solid-state drives (SSDs), embedded products, removable cards, and wafers, among others. SanDisk has a global presence and caters to a wide range of applications, with the recent surge in demand being driven by AI.

For Q1 2026, SanDisk reported revenue growth of 21% on a year-on-year (YoY) basis to $2.31 billion. At the same time, the company’s GAAP operating income increased by 878% to $176 million.

With industry tailwinds, strong growth, and firm pricing, SNDK stock has surged by 745% in the past six months.

Strong Growth Outlook and Cash Flow Upside

One of the highlights of the Q1 2026 results was a 26% YoY growth in data center end market revenue. According to SanDisk, investment in data centers and AI is expected to surpass $1 trillion by 2030. In Q1, SanDisk indicated that it’s engaging with five major hyperscale customers. This will ensure robust growth in the foreseeable future, and with the big addressable market, growth will be sustained in the following years.

Another important point to note is that SanDisk reported negative adjusted free cash flow of $150 million for Q1 2025. For the comparable quarter this FY, the adjusted FCF was $448 million. With the prospect of a significant increase in the price of NAND, cash flows will continue to swell and improve the company’s credit health. SanDisk ended Q1 with a strong cash buffer of $1.4 billion.

Innovation is yet another reason to be positive on SanDisk. As an example, the company’s BiCS8 technology is supporting the manufacture of power-efficient SSDs with a high capacity. For Q1 2026, BiCS8 technology accounted for 15% of total bits shipped. The company expects this technology to reach “majority of bit production” by the end of the fiscal year.

What Analysts Say About SNDK Stock

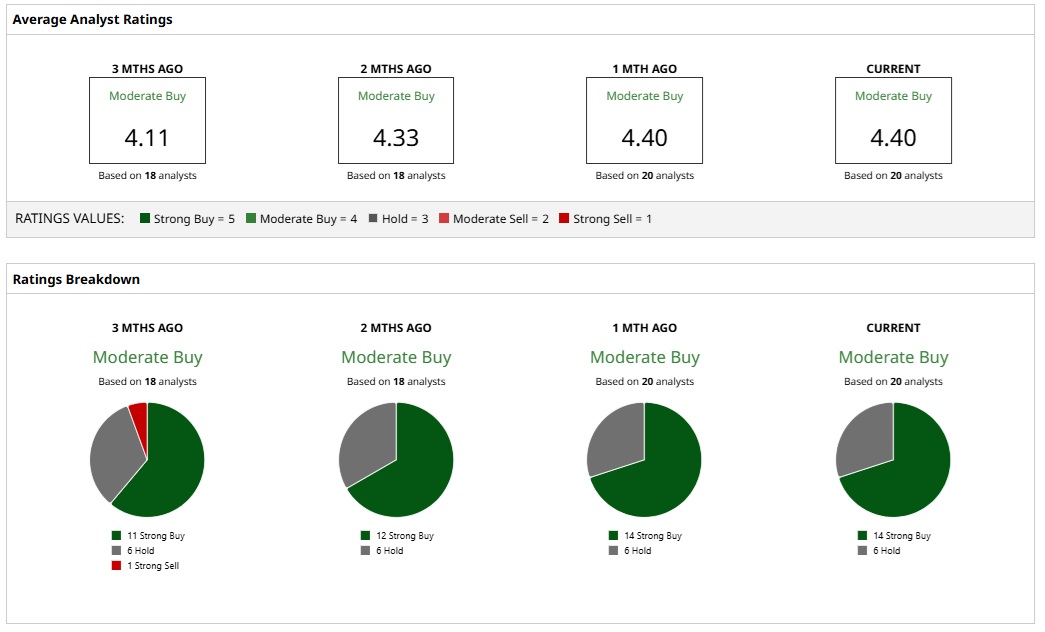

Based on the ratings of 20 analysts, SNDK stock is a consensus “Moderate Buy.” While 14 analysts assign a “Strong Buy” rating to SNDK, six analysts have a “Hold” rating.

Based on these ratings, analysts have a mean price target of $276.67 currently, which would imply a downside potential of 27%. Further, with the most bullish price target of $390, the upside potential for SNDK stock is 3%.

While SNDK stock has gone ballistic in the last few quarters, it’s important to note that analysts expect earnings growth of 551.7% and 110.6% for FY26 and FY27, respectively. As a result, the forward price-earnings ratio does not look stretched at 28.83.

Last month, BNP Paribas opined that the memory sector is entering a “historic upcycle.” This will continue to benefit companies like SanDisk and Micron Technology (MU). With strong demand coupled with a price surge for DRAM and NAND, the outlook remains positive.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Watch This Overlooked Stock Chart as the Secular Commodity Bull Run Heats Up

- A $107 Million Reason to Buy This Red-Hot Penny Stock Now

- China Is Stepping in to Help Alibaba Amid a Major Price War. Does That Make BABA Stock a Buy Here?

- As SanDisk Eyes Doubling Memory Prices, Should You Buy Red-Hot SNDK Stock?