If chips were the dominant “chips and shovels” trade for the AI revolution so far, energy can be the next. The AI buildout across data centers by hyperscalers requires massive amounts of energy, as evidenced by this report from the International Energy Agency (IEA), which expects electricity consumption to double for data centers by 2030 to a staggering 945 TWh.

And with Meta's (META) sky-high ambitions to build AI superintelligence, it would not be far-fetched to say that the social media giant will duly play its part to augment this energy capacity buildout. To that end, the company recently forged partnerships with some key energy companies in the land for Prometheus, its supercomputing cluster, purpose-built, large-scale system designed to train and run frontier AI models across Meta’s products.

While the partnerships with pure-play nuclear technology and development companies, such as TerraPower and Oklo (OKLO), were certainly noteworthy, the Mark Zuckerberg-led company also roped in Vistra Energy (VST) as a partner in this endeavor, which stands out. Why so? Let's find out.

About Vistra Energy

Unlike TerraPower and Oklo, Vistra Energy is a diversified electric company. Founded in 2016 with its roots tracing back to 1882, Vistra operates across the electricity value chain with interests in electricity generation (including natural gas, solar, nuclear, coal, and storage systems) and retail services such as electricity retail, natural gas retail, and fuel production and logistics services.

Valued at a market cap of $56.4 billion, the VST stock is up just 5% over the past year. And without the Meta news pop, the shares would have performed negatively. Meanwhile, the stock offers a modest dividend yield of 0.54%.

In the deal with Meta, the company has announced that it will support Vistra's nuclear power plans in Ohio and Pennsylvania, aiming to increase energy production and extend the lifespan of these facilities. Notably, Vistra will partner with Meta in powering Prometheus, with the focus squarely on delivering consistent, high-volume electricity to support frontier-scale computing needs. Under the terms disclosed by both parties, Meta has secured two 20-year power purchase agreements covering a total of 2,609 MW of carbon-free generation and capacity from Vistra's nuclear fleet in the PJM market.

So, will this be the much-needed jolt that the VST stock required? More broadly, how does the VST stock, armed with this significant partnership with Meta, stack up as a long-term investment now? Let's find out.

Financials Not Exciting

A glance at Vistra's financials gives us an idea as to why the stock has been almost flat over the past year. The company has been missing its quarterly earnings estimates consecutively over the past two years, with wild yearly swings in the bottom line.

The results for the most recent quarter lived up to the tradition, with both revenue and earnings missing estimates.

While operating revenues for the third quarter of 2025 came in at $4.97 billion, they were down 21% from the previous year. Earnings declined even more sharply to $1.75 per share from $5.25 per share in the year-ago period. It also widely missed the EPS estimates of $2.08.

Additionally, cash from operations fell to $2.64 billion from $3.21 billion for the nine months ended Sept. 30, 2025. However, the company remains relatively shielded from liquidity concerns in the short term, as it closed the quarter with a cash balance of $602 million, higher than its short-term debt levels of $231 million.

Finally, the VST is also trading at elevated levels, with its forward P/E, P/S, and P/CF of 26.32, 2.87, and 11.62, all being above the sector medians of 18.77, 2.59, and 8.54, respectively.

Growth Story Is Exciting

Vistra's current financials look a bit muted, but the longer-term setup for the company is shaping up quite nicely. Demand for electricity is ramping up hard, especially from data centers and broader electrification. And Vistra has leaned into that with more solar and battery storage projects, fresh gas-fired plants in Texas, and the recent pickup of seven modern gas units.

Notably, nuclear is getting a lot of attention now for AI power needs, and the closing of the Comanche Peak deal has cleared up most of the big question marks around hyperscaler conversions. The 20-year PPA more than triples the plant's output, with power ramping from late 2027 through 2032. It's solid proof that hyperscaler demand is real and Vistra can win its share against other players.

Moreover, the Lotus Infrastructure buy adds another layer, bringing in 2.6 GW of natural gas capacity. That helps balance the renewables side and lets Vistra meet immediate data-center power requests while the clean-energy projects keep building out.

The company also has deals moving forward with Amazon (AMZN) and Microsoft (MSFT) that are expected to start delivering in 2026, plus a 1,200 MW agreement from an unnamed nuclear buyer.

Overall, management sees a lasting step-up in power demand from AI growth and electrification overall. To handle it, they're mixing gas peakers and batteries with more renewables.

On the gas side, Vistra is pushing capacity higher to catch both near-term and medium-term load growth. The view from leadership is that gas-fired generation is still the best way to bridge the gap between rising demand and intermittent renewables, scalable and always ready when needed. The recent gas asset buys, plus the Cogentrix Energy deal (around 5.5 GW), give Vistra a much stronger position in attractive wholesale markets.

For shareholders, this matters. Modern combined-cycle gas plants run at high utilization, offer good spark spreads, and can be built relatively quickly, letting Vistra turn demand into cash flow faster than new nuclear or big renewable builds. The company has directly tied this growth to AI power needs, highlighting the reliability that hyperscalers insist on.

Analysts' Opinion on VST Stock

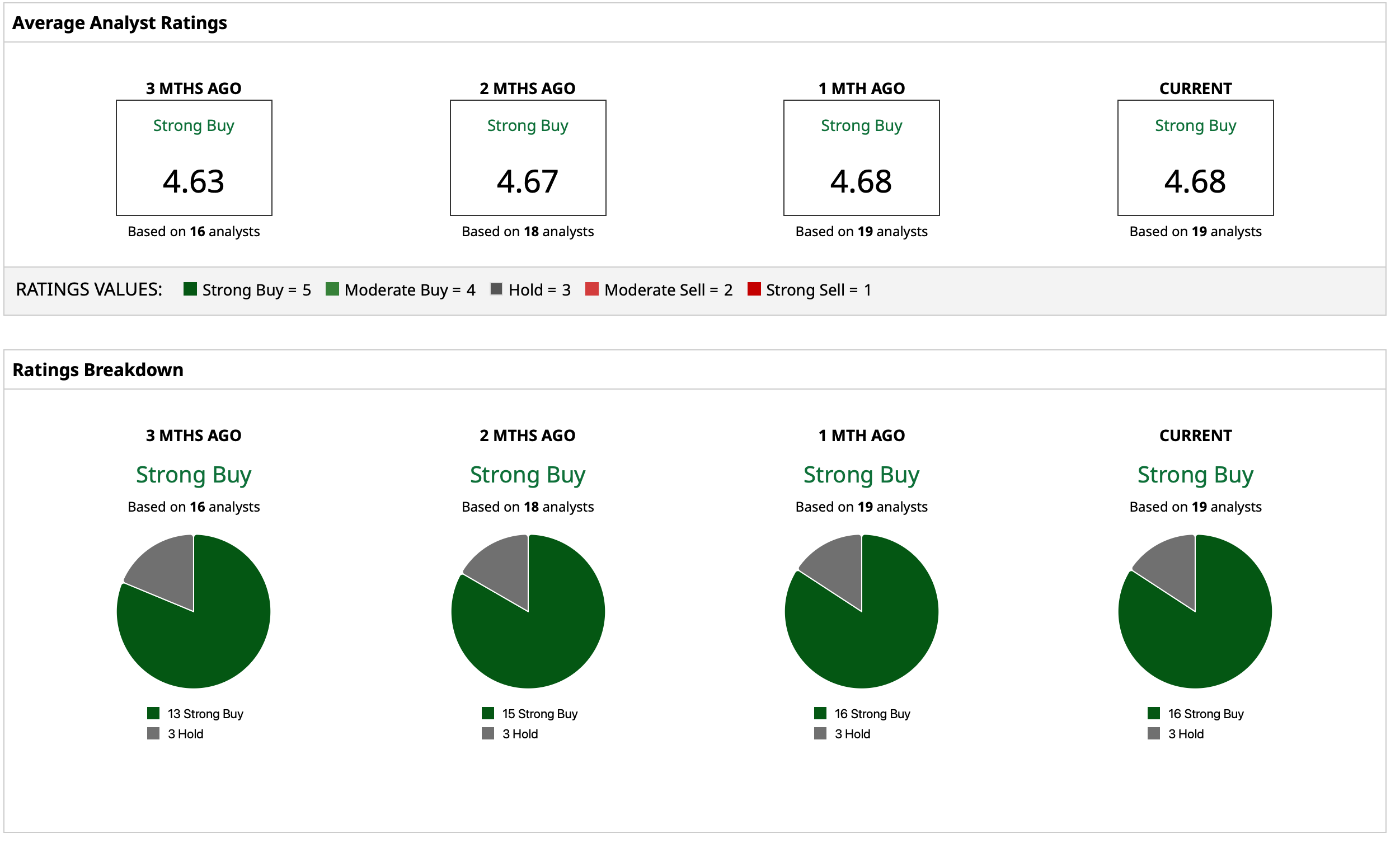

Thus, analysts have attributed a rating of “Strong Buy” for the stock with a mean target price of $242.33. This denotes an upside potential of about 39% from current levels. Out of 19 analysts covering the stock, 16 have a “Strong Buy” rating, and three have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart