With a market cap of $206.2 billion, Salesforce, Inc. (CRM) is a global leader in customer relationship management (CRM) technology, providing a comprehensive platform that connects companies and customers through AI-powered solutions like Agentforce, Data Cloud, Slack, Tableau, and industry-specific applications. It delivers innovative tools for sales, marketing, commerce, service, and analytics, including strategic integrations such as its partnership with Google Workspace.

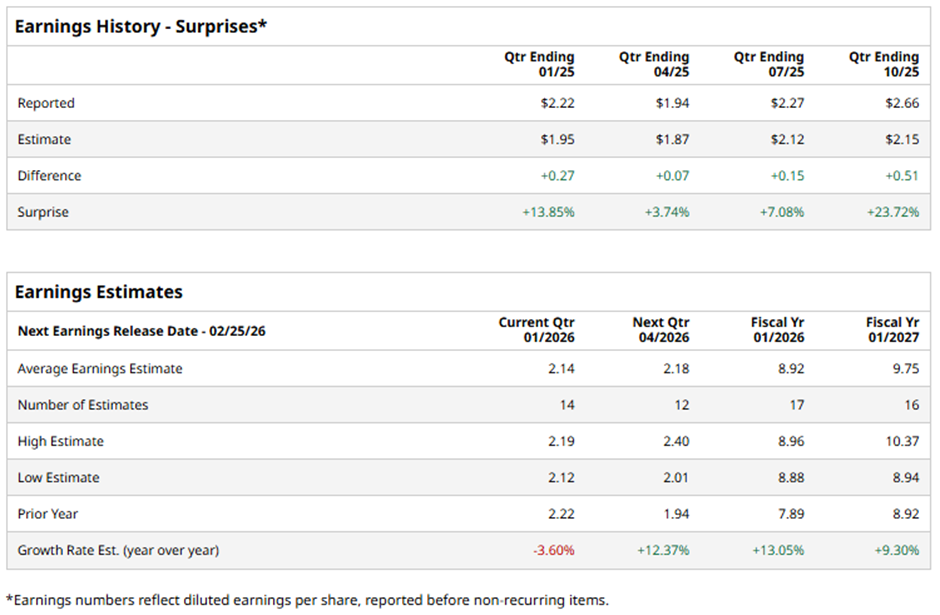

The San Francisco, California-based company is slated to announce its fiscal Q4 2026 results soon. Ahead of this event, analysts expect Salesforce to report an EPS of $2.14, a 3.6% decline from $2.22 in the year-ago quarter. However, it has exceeded Wall Street's earnings expectations in the past four quarters.

For fiscal 2026, analysts predict the customer-management software developer to report EPS of $8.92, an increase of 13.1% from $7.89 in fiscal 2025.

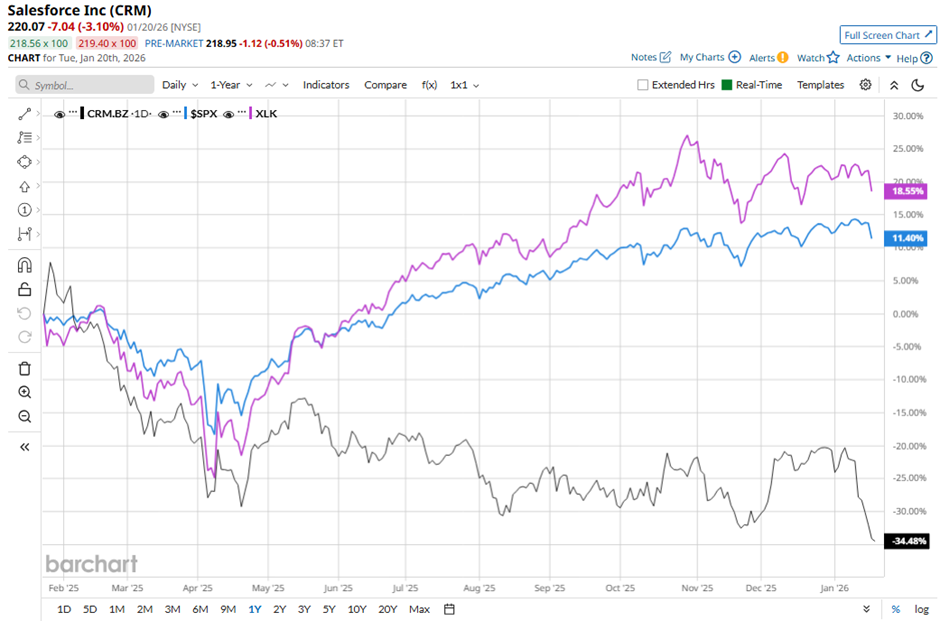

Shares of Salesforce have decreased 32.2% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 13.3% gain and the State Street Technology Select Sector SPDR ETF's (XLK) 21.2% return over the same period.

Shares of Salesforce rose 3.7% following its strong Q3 2026 results on Dec. 3, with revenue of $10.26 billion and adjusted EPS of $3.25. Additionally, Salesforce raised full-year 2026 revenue guidance to $41.45 billion - $41.55 billion and reported explosive growth in Agentforce and Data 360 ARR to nearly $1.4 billion, up 114% year-over-year, driven by over 9,500 paid Agentforce deals and 3.2 trillion tokens processed.

Analysts' consensus view on CRM stock remains bullish, with a "Strong Buy" rating overall. Out of 51 analysts covering the stock, 36 recommend a "Strong Buy," two "Moderate Buys," 12 "Holds," and one "Strong Sell." The average analyst price target for Salesforce is $331.25, suggesting a potential upside of 50.5% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart