Big bank earnings are stepping back into the spotlight just as markets brace for fresh Fed signals, new inflation data, and another reality check on the health of U.S. finance. This earnings season features updates from heavyweights like JPMorgan Chase (JPM), Bank of America (BAC), Wells Fargo (WFC), and Citigroup (C), giving a front‑row view into how major lenders are navigating tighter policy and shifting credit conditions.

One name stands out in that lineup. Citigroup has seen its stock surge nearly 43% over the past 52 weeks while management pursues a plan to cut 20,000 roles by the end of 2026, including about 1,000 jobs reportedly on the chopping block this week.

With CEO Jane Fraser preparing another round of layoffs in March, the key question practically writes itself. Does this aggressive reset strengthen the case for C stock and its 2% dividend or signal trouble ahead for the payout and share price? Let's dive in.

Can Citi’s Numbers Carry a Restructuring

Citigroup is a New York–based global bank providing consumer, corporate, and investment banking services, with roughly $203.2B in equity value and a forward annual dividend of $2.40, yielding 2.08%.

Its stock price stands at $113.67 as of Jan. 28, with a year-to-date (YTD) return of -2.3% and a 52‑week gain of 43%.

The market is valuing Citi at 11.29x forward earnings and 1.07x book value, versus sector medians of 11.20x and 1.30x, respectively, which points to earnings in line with peers while the balance sheet still trades at a discount.

Its most recent earnings snapshot for the quarter ending Dec. 25 shows reported EPS of $1.81 versus a $1.65 consensus, a $0.16 beat that translated into a 9.70% positive surprise. This same period also delivered quarterly sales of $40.9 billion with sales growth of -6.81%, signaling top‑line pressure as Citi exits non‑core businesses and recalibrates risk.

The figure on net income came in at $2.47 billion, but net income growth declined by 34.14%, showing how restructuring, credit costs, and transformation spending are weighing on profitability. Citi’s cash flow and balance sheet metrics add more context. Their operating cash flow for December 2025 was approximately -$94.2 billion, a stark negative figure despite operating cash flow growth of 1.15%.

This netted out to a positive net cash flow of about $71.5 billion, with a 17.37% improvement in net cash flow change, indicating active balance sheet and funding management to keep liquidity solid. The total assets line stood near $2.66 trillion, up 0.56%, while total liabilities were about $2.44 trillion, up 0.61%, showing a large but broadly stable balance sheet that management is trying to run with a leaner cost base.

What Citi Is Signaling

Citigroup’s job cuts are unfolding alongside some clear, numbers‑driven moves that speak to how management is reshaping the bank from the inside out. The company is pursuing a substantial workforce reduction plan, aiming to eliminate about 20,000 roles by the end of 2026, including roughly 1,000 positions already being cut as part of CEO Jane Fraser’s drive to create a “more efficient organization.”

Citigroup is also making a notable move on the funding side through the announced full redemption of $2.5 billion of its 1.122% Fixed Rate / Floating Rate Notes due 2027. The redemption is scheduled for January 28th and will occur at 100% of the principal amount, plus accrued and unpaid interest to, but excluding, the redemption date.

From that day, interest will stop accruing on those notes, effectively removing this specific slice of debt from the capital stack. This action is framed as part of the firm’s liability‑management activities, using optional redemptions to recalibrate the mix, maturity profile, and cost of its outstanding obligations.

What Wall Street Expects From C Stock Next

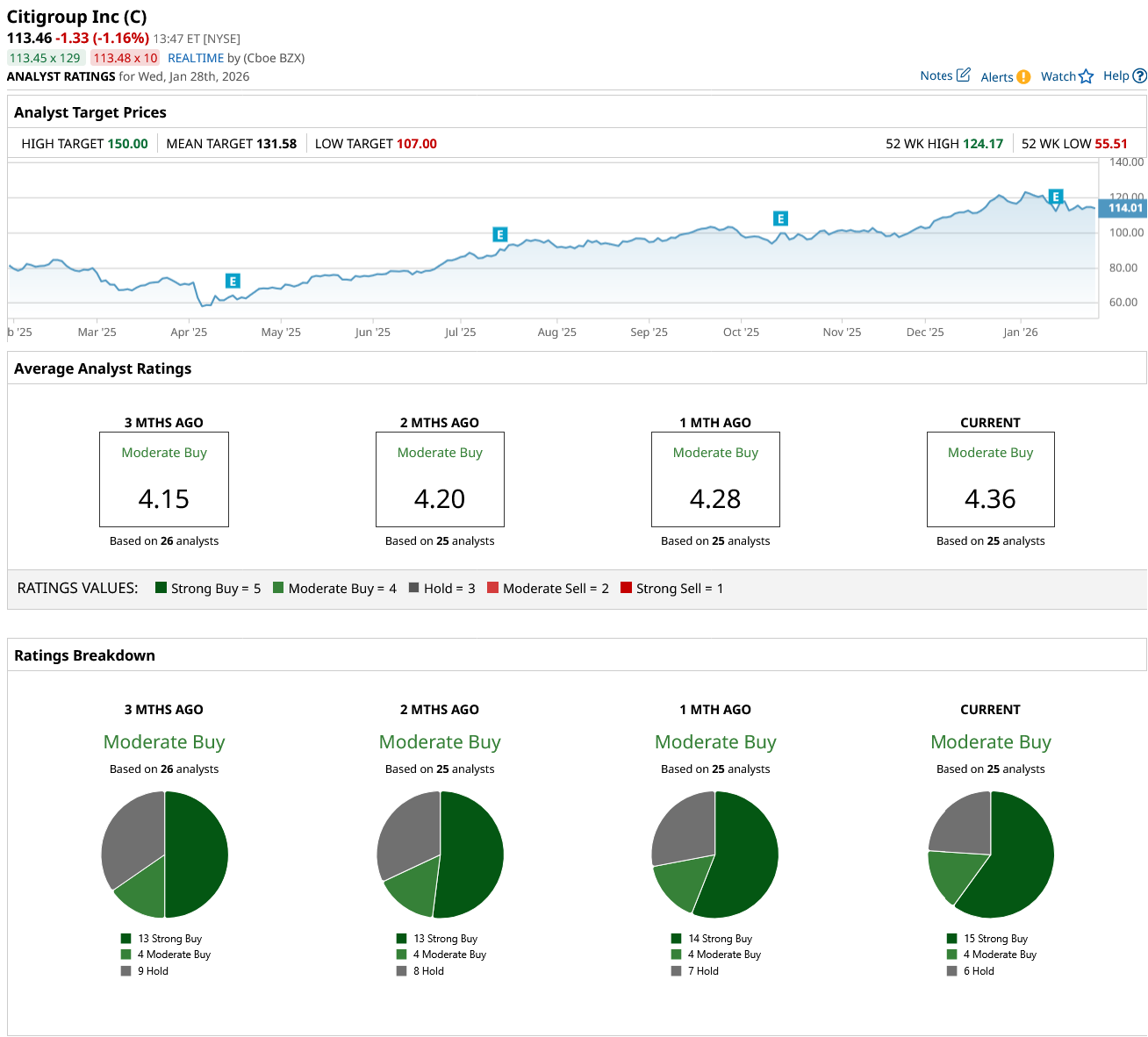

Analysts are looking past the noise of more layoffs and seeing meaningful earnings acceleration ahead for Citigroup. The next earnings release is slated for April 21, and for the current quarter ending in March, the average EPS estimate is $2.59 versus $1.96, implying 32.14% growth. That optimism extends beyond the near term, with full‑year 2026 EPS estimated at $10.17 versus $7.97 a year earlier, a projected 27.60% jump.

Sentiment lines up with those projections, as the stock carries a consensus “Moderate Buy” rating based on 25 analyst opinions, reflecting a generally constructive view. The average 12‑month price target stands at $131.58, which, against the current price, implies roughly 16% upside.

Conclusion

Citigroup’s next layoffs look like another step in a tough but financially driven reset, not an immediate threat to that 2% dividend. Cost cuts, rising earnings estimates, and active balance sheet moves all point to a leaner bank with more earnings power over time. Shares look more likely to grind higher than collapse, though execution missteps could easily slow that path. The base case is choppy but upward‑tilting performance as long as management keeps delivering on the numbers behind this overhaul.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- More Layoffs Are Coming at Citigroup in March. What Does That Mean for C Stock and Its 2% Dividend?

- 3 Dividend Stocks That Pay No Matter What the Economy Does

- 1 Dividend Stock to Buy Now as Trump Turns Up the Tariff Heat Again

- 2 International Dividend ETFs To Watch as the 'Sell America' Trade Gains Popularity