Halliburton (HAL) shares soared on Monday morning after the U.S. launched a surprise military strike on Venezuela, capturing both its President Nicolás Maduro and his wife Cilia Flores.

The rally this morning pushed HAL’s relative strength index (9-day) to over 85 today, indicating overbought conditions that often trigger a correction in the near term.

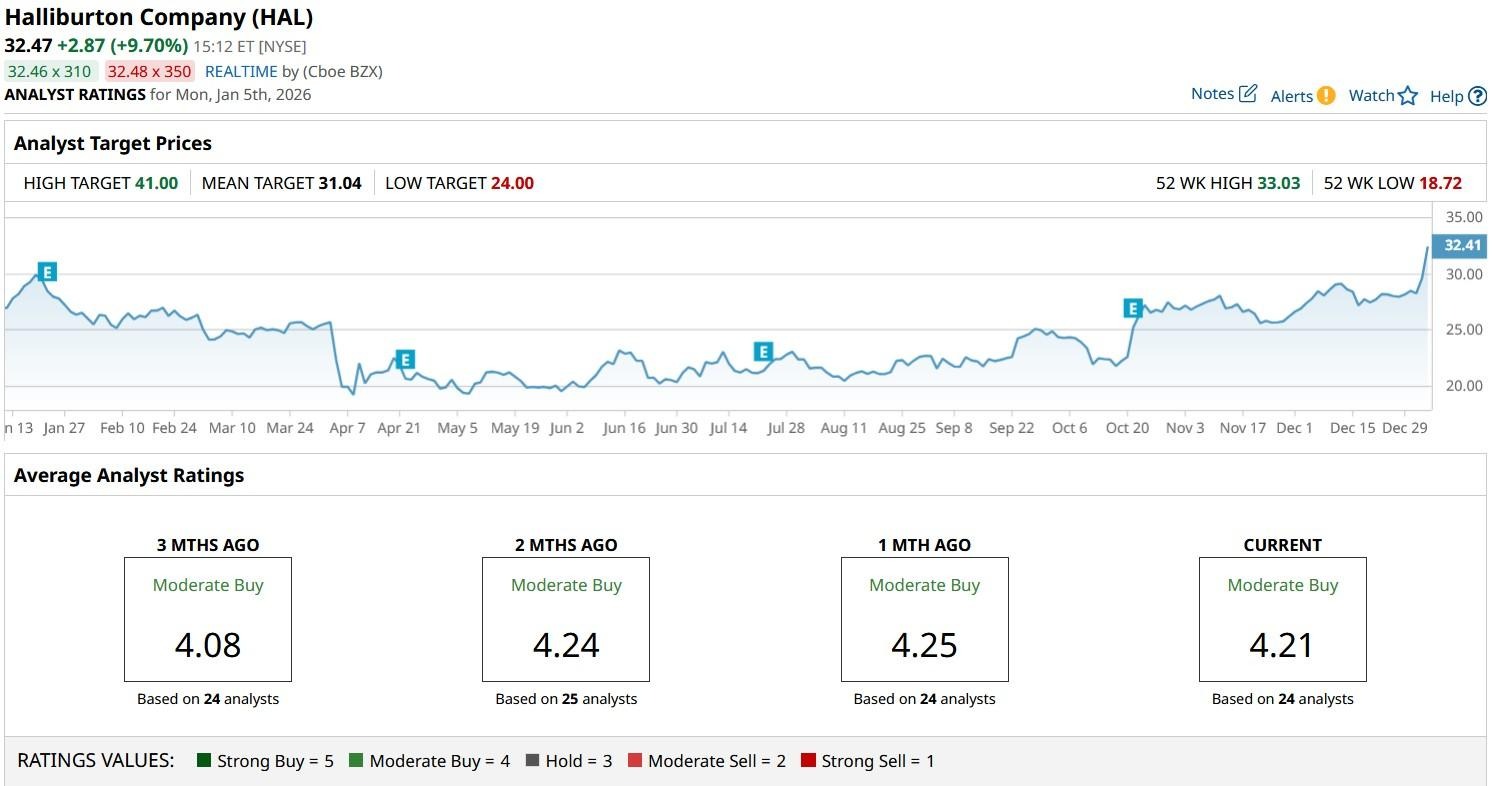

Following today’s gains, Halliburton stock is up more than 70% versus its 52-week low.

Why U.S.-Venezuela Conflict Pushed Halliburton Stock Higher

HAL shares rallied on Jan. 5 mostly because President Donald Trump’s administration’s strike on Venezuela could boost demand for the U.S. oilfield services company in 2026.

By detaining Nicolás Maduro and his wife Cilia Flores and disrupting the country’s political leadership, the U.S. effectively cast doubt on Venezuela’s ability to maintain stable crude (CLG26) exports.

Given the South American nation currently holds the world’s largest proven oil reserves, the shake-up could tighten global supply, creating significant opportunities for American energy companies.

In short, Halliburton could be a prime beneficiary of increased U.S. and allied exploration activity after the Venezuela attack, which is why it pushed higher today despite the geopolitical uncertainty.

HAL Shares Are Still Trading at an Attractive Valuation

Halliburton warrants an investment for the strength of its fundamentals as well. In Q3, the company came in handily above Street estimates for both its top and bottom line.

Still, the oilfield services specialist is trading at about 1.15x sales only, which is rather inexpensive compared to some of its industry peers, including Houston-headquartered Schlumberger (SLB).

Importantly, HAL is trading decisively above all of its major moving averages (MAs), indicating continued bullish momentum ahead.

Note that Halliburton shares currently pay a healthy dividend yield of 2.3% as well, which makes them even more attractive to own for income-focused investors in 2026.

What’s the Consensus Rating on Halliburton?

While HAL stock has been in a sharp uptrend over the past eight months, Wall Street firms remain convinced that it will push higher still over the next 12 months.

According to Barchart, the consensus rating on Halliburton shares currently sits at “Moderate Buy” with price targets going as high as $41 indicating potential upside of more than 25% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Halliburton Stock Just Pushed into Overbought Territory Amid Venezuela Tumult. Is There Still Time to Buy HAL?

- Betting on Popular 2025 ETFs Could Produce Wicked Results in 2026. Don’t Get Caught Chasing the Hype.

- Warren Buffett’s Legacy Includes an Emphasis on Industrials. This ETF Reminds Us Why.

- 2025 Wasn’t an Easy Year for Tesla Stock, but Baird Says It’s a ‘Core Holding’ for 2026 Anyways