With a market cap of $15.7 billion, New York-based Omnicom Group Inc. (OMC) is a global advertising, marketing, and corporate communications company that offers a comprehensive range of services, including media and advertising, precision marketing, public relations, healthcare, branding, retail commerce, and digital transformation. It operates across North and Latin America, EMEA, and the Asia Pacific, serving clients through extensive integrated marketing and communications solutions.

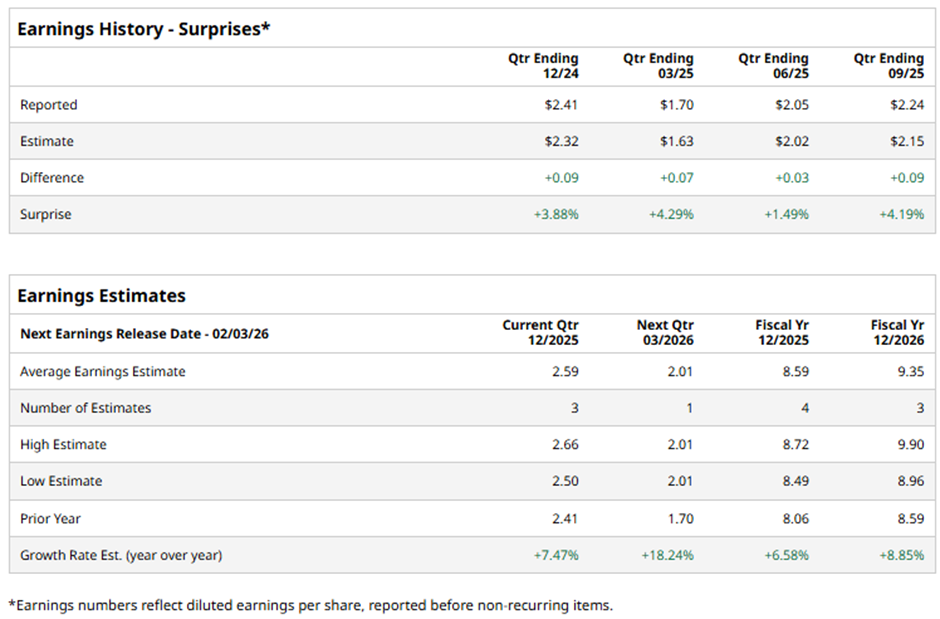

Omnicom is expected to unveil its fiscal Q4 2025 results soon. Before the event, analysts anticipated the advertising company to report an adjusted EPS of $2.59, up 7.5% from $2.41 in the same quarter last year. The company has consistently surpassed Wall Street's earnings projections over the previous four quarters.

For fiscal 2025, analysts forecast OMC to post adjusted EPS of $8.59, a 6.6% rise from $8.06 in fiscal 2024. Looking forward to fiscal 2026, its adjusted EPS is expected to grow 8.9% year-over-year to $9.35.

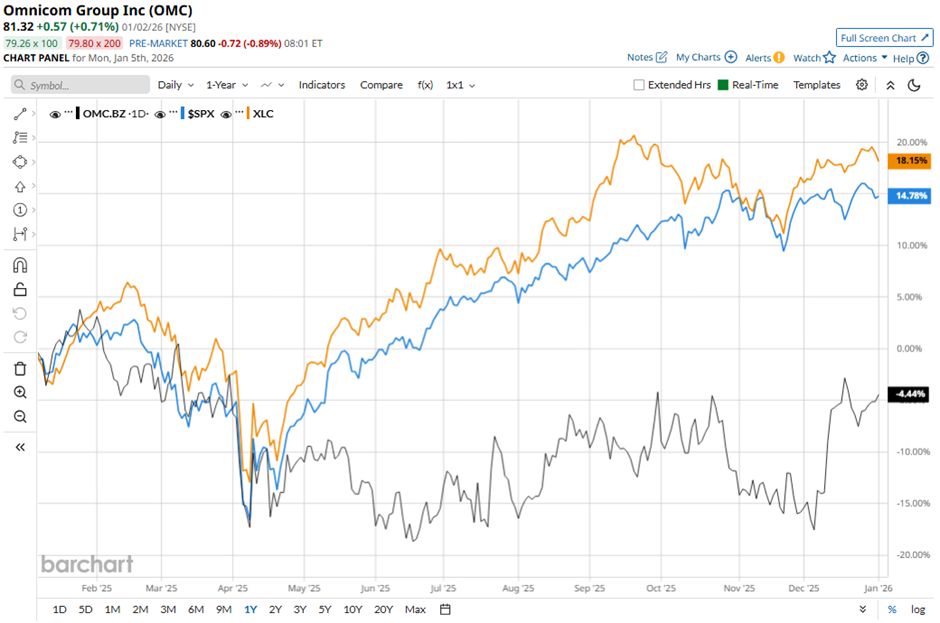

OMC's shares have declined 6.2% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 16.9% gain and the State Street Communication Services Select Sector SPDR ETF's (XLC) 19.1% increase over the same period.

Shares of Omnicom rose 3.2% following its Q3 2025 results on Oct. 21, with adjusted earnings of $2.24 per share, beating Wall Street expectations, alongside revenue of $4.04 billion that also exceeded forecasts. Investor sentiment was further supported by solid organic revenue growth of 2.6%, driven by strong performance in Media & Advertising and U.S. revenue growth of 4.6%, as well as improved adjusted EBITA of $651.0 million with a healthy 16.1% margin.

Analysts' consensus rating on OMC stock is cautiously optimistic, with a "Moderate Buy" overall rating. Out of 10 analysts covering the stock, opinions include five "Strong Buys" and five "Holds." The average analyst price target for Omnicom is $97.44, suggesting a potential upside of 19.8% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart