For years, Tesla (TSLA) led the global EV market in both scale and innovation. But in fast-moving industries, dominance is never guaranteed.

That shift became clear in 2026, when China’s BYD (BYDDY) officially surpassed Tesla as the world’s largest seller of battery-powered electric vehicles. Once brushed off by Elon Musk as a non-threat, BYD has steadily built manufacturing scale, expanded its global footprint, and posted consistent sales growth, even as Tesla’s vehicle deliveries declined year-over-year (YoY).

Now that BYD holds the No. 1 EV crown, investors face an important question heading into 2026: Is it better to stay the course with TSLA or start paying closer attention to the new global EV leader?

About BYD Stock

BYD is China’s largest new-energy vehicle and battery manufacturer. It builds a broad range of affordable EVs and plug‑in hybrids, from sub-$10,000 city cars to high-end luxury models, leveraging its in-house battery and semiconductor production. Berkshire Hathaway (BRK.A) (BRK.B) famously held BYD shares, exiting in late 2025, which shows even long-term investors were willing to take profits as risks increased.

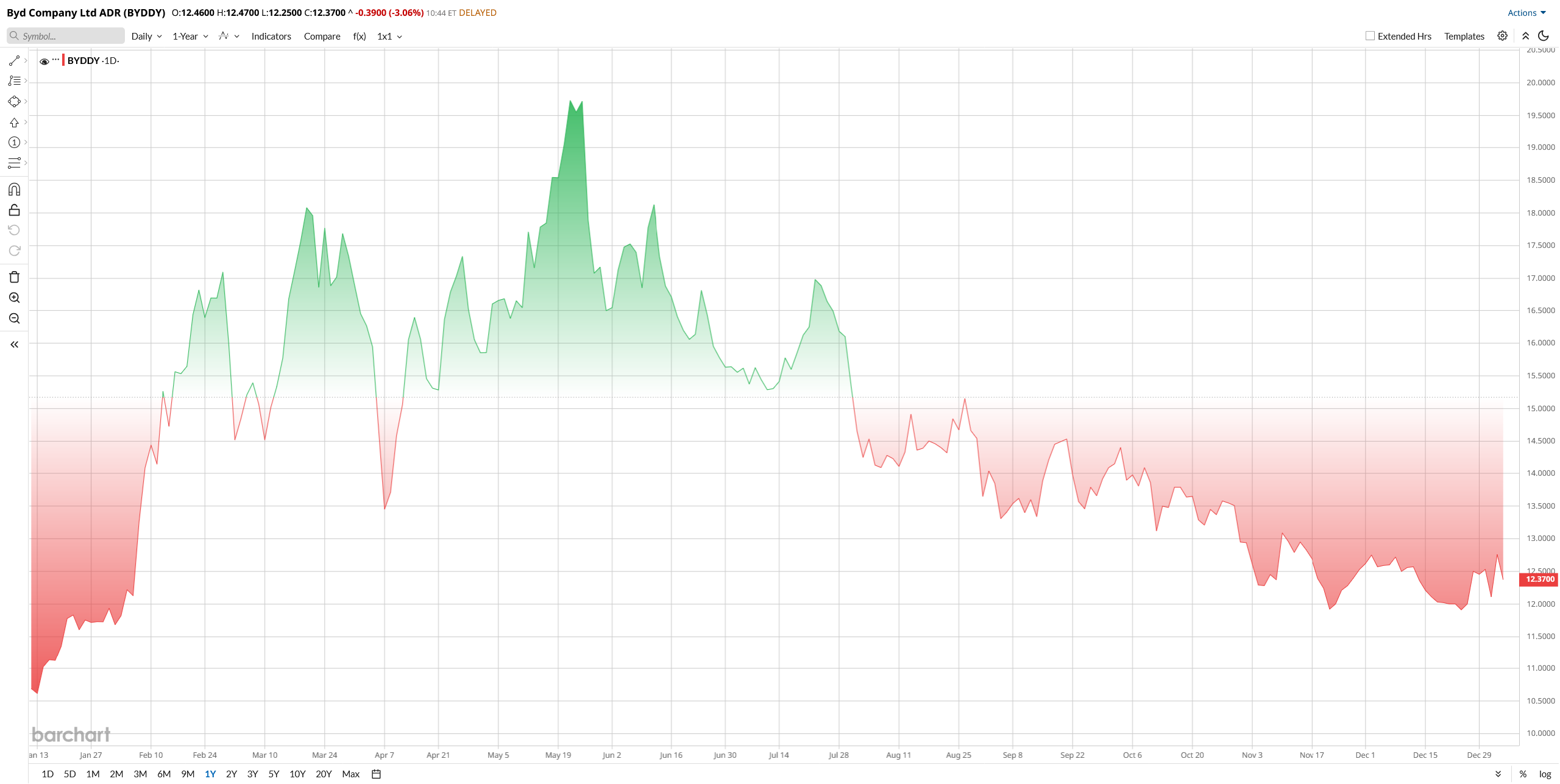

BYD’s stock has been a roller coaster for investors. The shares ripped higher in early 2025, at one point rallying as much as 74% by late May, before giving back much of those gains in the second half of the year. In simple terms, BYD has returned roughly 10% over the past 12 months, reflecting pockets of bullishness among American investors.

BYD’s valuation suggests the market is already assigning it a leadership premium. The stock trades at roughly 21 times trailing earnings, nearly double the broader auto industry average of around 11 times. On a price-to-sales basis, BYD sits near 1 times trailing revenue, broadly in line with large global automakers, but its price-to-book ratio of about 3.8 also stands out as relatively elevated.

BYD Tops Tesla

Latest figures indicated that global EV sales jumped 28% in 2025, led by China’s BYD. BYD reported selling about 2.26 million battery EVs last year, up 28% YoY, exceeding Tesla’s roughly 1.64 million, down 8.5%. Going forward, analysts say this milestone may bolster BYD’s international push (the company is rapidly expanding overseas) and put pressure on Tesla to refresh its lineup and margin profile.

BYD sold about 2.26 million fully electric vehicles in 2025, comfortably outpacing Tesla’s roughly 1.64 million deliveries. Including plug-in hybrid models, BYD’s total EV and PHEV sales reached about 4.6 million units, marking a milestone that was widely reported across global media as the Chinese automaker “easily outstripped” Tesla’s volumes. Tesla’s sales decline was partly attributed to reduced U.S. EV incentives and mounting political headwinds.

BYD’s rise underscores China’s growing dominance in the global electric vehicle market, though analysts note that BYD’s growth is cooling, with sales rising just 7.7% in 2025, the slowest pace in five years. December deliveries also fell sharply YoY amid intense price competition in China.

BYD Revenue Slumps in Q3

Despite the good news, BYD’s latest financials do not give a strong picture but show clear signs of strain. Revenue missed the estimate, coming in at $27.89 billion, down about 3% YoY, while net profit plunged to $1.12 billion, roughly a 32.6% drop versus the prior year. That translated into fully diluted EPS of $0.12 per share, down roughly 36% YoY. Operating cash flow also softened to about $5.85 billion, off nearly 27%, as inventories and investments rose.

Management has also narrowed its 2025 sales target to 4.6 million vehicles, a roughly 16% cut, and says future growth will rely on new models and expanding exports. CEO Wang Chuanfu called the slowdown temporary and pointed to “major innovations” in the pipeline, but the company will need to execute on both product launches and overseas expansion to restore momentum.

What Do Analysts Say About BYD Stock

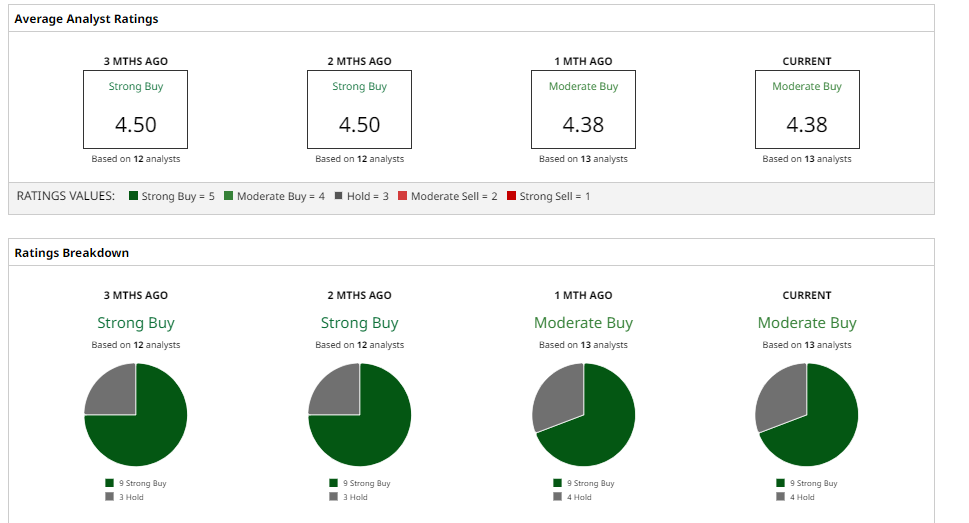

Wall Street remains broadly bullish on BYD stock. Barchart shows a “Moderate Buy” consensus among analysts on BYD, with an average 12-month target of $20, implying around 57% upside potential.

Furthermore, BYD has received recent price-target upgrades from major firms. Morgan Stanley just upgraded BYD to “Overweight” and sharply raised its target price, now seeing BYD’s Hong Kong shares reaching HK$438 from HK$307. The firm cited BYD’s structural growth runway and dominance in EVs, forecasting it will deliver 5.5 million vehicles in 2025.

Goldman Sachs likewise reaffirmed a “Buy” stance and in December lifted its target to HK$351, highlighting BYD’s overseas expansion as a key growth driver.

The Bottom Line

Tesla's loss of EV status is an immense event, but for investors, BYD's momentum is much more significant than a trophy. BYD is establishing itself as one of the best EV companies in the world with its enormous scale, increasing global presence, and strict control of the manufacturing expenses. The stock may remain volatile in the short term, but for long-term investors it'll be difficult to ignore.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Why ConocoPhillips Is One of the Top Oil Stocks to Buy After Venezuela

- Chevron, ConocoPhillips, and Gold: Your Critical Watchlist After the U.S.–Venezuela Oil Market Shock

- Tesla’s Deliveries Have Fallen for 2 Years: Should TSLA Investors Even Care Amid the AI Pivot?

- Analysts Love Salesforce Stock and Are Raising Their Price Targets - How to Play CRM