Based in Denver, Colorado, Healthpeak Properties, Inc. (DOC) is a fully integrated healthcare-focused real estate investment trust (REIT) in the United States. The company commands an estimated market capitalization of nearly $11.3 billion, firmly placing it within the large-cap REIT universe, which includes companies valued above $10 billion.

The financial scale underpins a broad asset mix, including medical office buildings, research laboratories, and continuing care retirement communities across the United States.

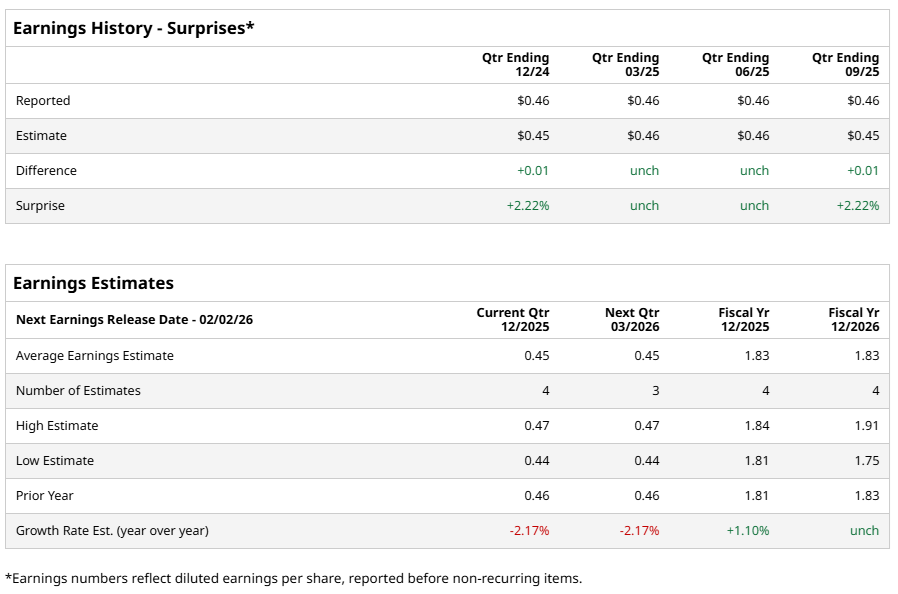

Attention is now on Healthpeak’s Q4 fiscal 2025 earnings release, scheduled for Monday, Feb. 2, after the closing bell. Analysts expect diluted EPS of $0.45, reflecting a 2.2% decline from $0.46 reported during the same quarter last year. Notably, the company exceeded EPS estimates in two of the last four quarters while matching expectations in the remaining two.

In the third quarter of fiscal 2025, reported on Oct. 23, 2025, Healthpeak exceeded analyst expectations, prompting a 1.2% stock gain the following session. Revenue marginally increased year over year to $705.9 million, surpassing Street forecasts of $696 million, while funds from operations (FFO) per share grew 2.2% from the year-ago value to $0.46, topping Street’s expectations of $0.45.

Strategically, Healthpeak internalized property management across 39 million square feet, strengthening tenant engagement and deepening market-level expertise. At the same time, management continues investing in technology initiatives, aiming to build a more digitally enabled operating platform that improves efficiency while opening incremental revenue channels.

Looking ahead, analysts forecast diluted EPS of $1.83 for fiscal 2025, representing 1.1% year-over-year growth. Projections call for earnings to remain unchanged at $1.83 in fiscal 2026, suggesting a stabilization phase as the company balances growth initiatives with macroeconomic uncertainty.

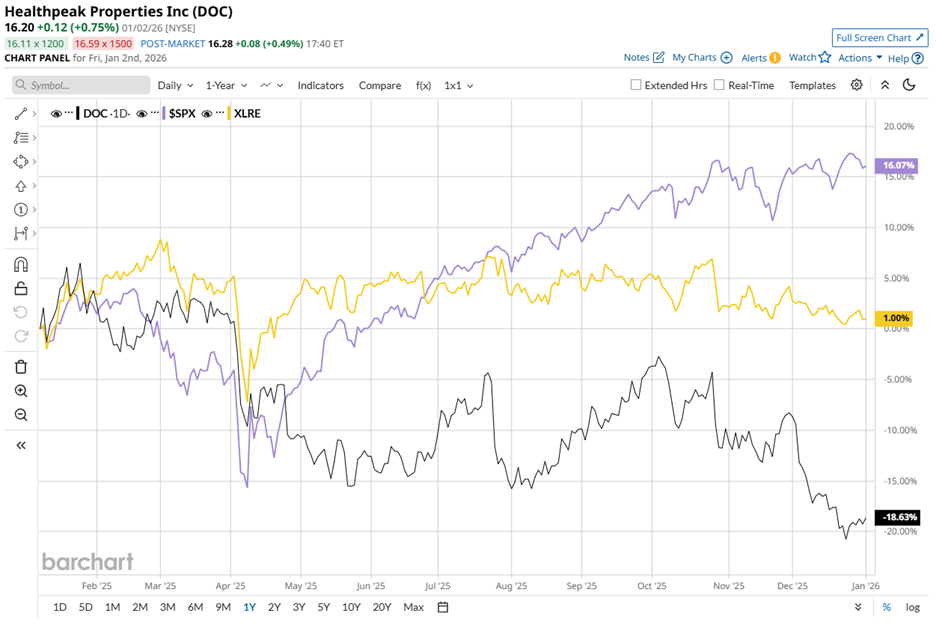

Share performance has reflected sector pressures. Over the past 52 weeks, DOC stock declined 19.6%, although it remains marginally positive year-to-date (YTD). In contrast, the S&P 500 Index ($SPX) advanced 16.9% during the same annual period while delivering only slight gains on a YTD basis.

When compared with the State Street Real Estate Select Sector SPDR ETF (XLRE), Healthpeak’s shares have modestly lagged, as the sector ETF generated marginal gains across both periods.

Persistent concerns around higher interest rates and shifting investor sentiment toward healthcare REITs have weighed on the entire space. Healthpeak has been pulled into that narrative, contributing to a 10.2% stock decline over the past month.

Even so, analyst conviction remains intact. DOC stock continues to carry a consensus “Moderate Buy” rating that has held steady for three months. Of 19 analysts, eight assign a “Strong Buy,” two recommend “Moderate Buy,” and nine maintain “Hold” ratings.

Price targets point to potential recovery. The mean price target of $20.35 implies potential upside of 25.6%, while the Street-High target of $29 represents approximately 79% appreciation from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- HOOD Option Trade Could Unlock a 49% Annualized Return

- Stocks Set to Open Higher as Investors Stay Calm Despite Venezuela Tumult, U.S. Jobs Data Awaited

- CES 2026, Sector Rotation and Other Key Things to Watch this Week

- Tesla Stock Has Been Flat For 2 Months - How to Make a 3.2% Yield in One-Month Puts