With a market cap of $19.3 billion, Quest Diagnostics Incorporated (DGX) is a leading provider of diagnostic testing and information services, offering routine, advanced, and specialty clinical testing to healthcare providers, patients, and organizations in the United States and internationally. It operates under brands such as Quest Diagnostics, AmeriPath, Dermpath Diagnostics, ExamOne, and Quanum, delivering services through an extensive network of laboratories and healthcare professionals.

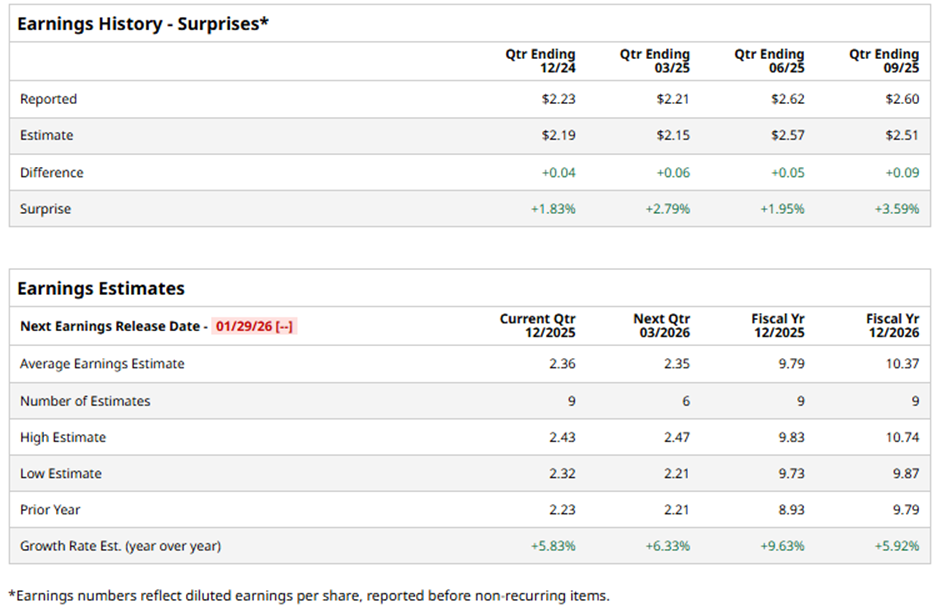

The Secaucus, New Jersey-based company is slated to announce its fiscal Q4 2025 results soon. Ahead of the event, analysts expect DGX to report an adjusted EPS of $2.36, up 5.8% from $2.23 in the year-ago quarter. It has surpassed Wall Street's bottom-line estimates in the past four quarterly reports.

For fiscal 2025, analysts forecast the medical laboratory operator to post adjusted EPS of $9.79, a rise of 9.6% from $8.93 in fiscal 2024.

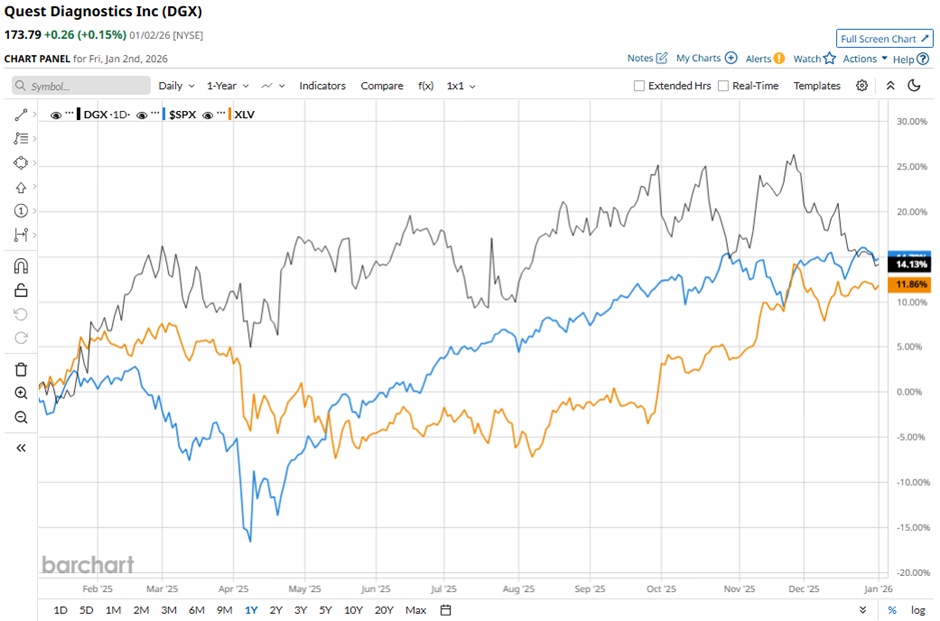

Shares of Quest Diagnostics have increased 15.1% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 16.9% rise. However, the stock has outpaced the State Street Health Care Select Sector SPDR ETF's (XLV) 13% gain over the same period.

Quest Diagnostics reported Q3 2025 results on Oct. 21 that beat expectations, with adjusted EPS of $2.60 and revenue of $2.82 billion. The quarter showed strong momentum, including 13.1% year-over-year revenue growth, 13% growth in adjusted EPS, and year-to-date operating cash flow of $1.4 billion, up 63.1% from 2024. The company also raised its full-year 2025 guidance, projecting adjusted EPS of $9.76 to $9.84. However, the stock fell over 3% on that day.

Analysts' consensus rating on DGX stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 18 analysts covering the stock, eight recommend a "Strong Buy” and 10 give a "Hold" rating. The average analyst price target for Quest Diagnostics is $199.47, suggesting a potential upside of 14.8% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart