The Houston, Texas-based EOG Resources, Inc. (EOG) is a premier oil and gas producer with a footprint stretching across major shale basins and Trinidad. Valued at roughly $60.8 billion, the company controls about 535,000 net acres in Eagle Ford and 160,000 in Dorado, while concentrating on high-return Wolfcamp, Bone Spring, and Leonard plays spanning oil, NGLs, and natural gas.

Over the past 52 weeks, EOG Resources’ shares slipped 13.6%, underperforming the S&P 500 Index ($SPX), which rose 14.3%. The short-term picture looks brighter, however, as the EOG stock has climbed 6.8% year-to-date (YTD), comfortably outpacing the index’s modest 1.4% gain.

Compared with its sector, EOG stock is trailing behind the State Street Energy Select Sector SPDR ETF (XLE) which has gained 13.2% over the past 52 weeks and 14.2% YTD.

However, price performance improved following the Nov. 6, 2025, Q3 2025 earnings release. The stock rose marginally on Nov. 7, 2025, and added 1.1% in the following trading session. During the quarter, revenue declined 2% year over year to $5.85 billion, slightly missing analyst estimates of $5.95 billion. Adjusted EPS also fell 6.2% from the year-ago value to $2.71 but surpassed the $2.43 analyst estimate.

Oil, NGL, and natural gas production came in above guidance midpoints, while the company generated $1.4 billion in free cash flow during the three-month period. Management also returned $545 million through dividends and repurchased $440 million in shares, reinforcing investor confidence and supporting the stock’s upward move even amid modest top-line weakness.

For fiscal year 2025, which ended in December, analysts pencil in diluted EPS of $10.11, a projected 13% year-over-year drop. Yet EOG has made a habit of outdelivering, topping earnings estimates in each of the past four quarters.

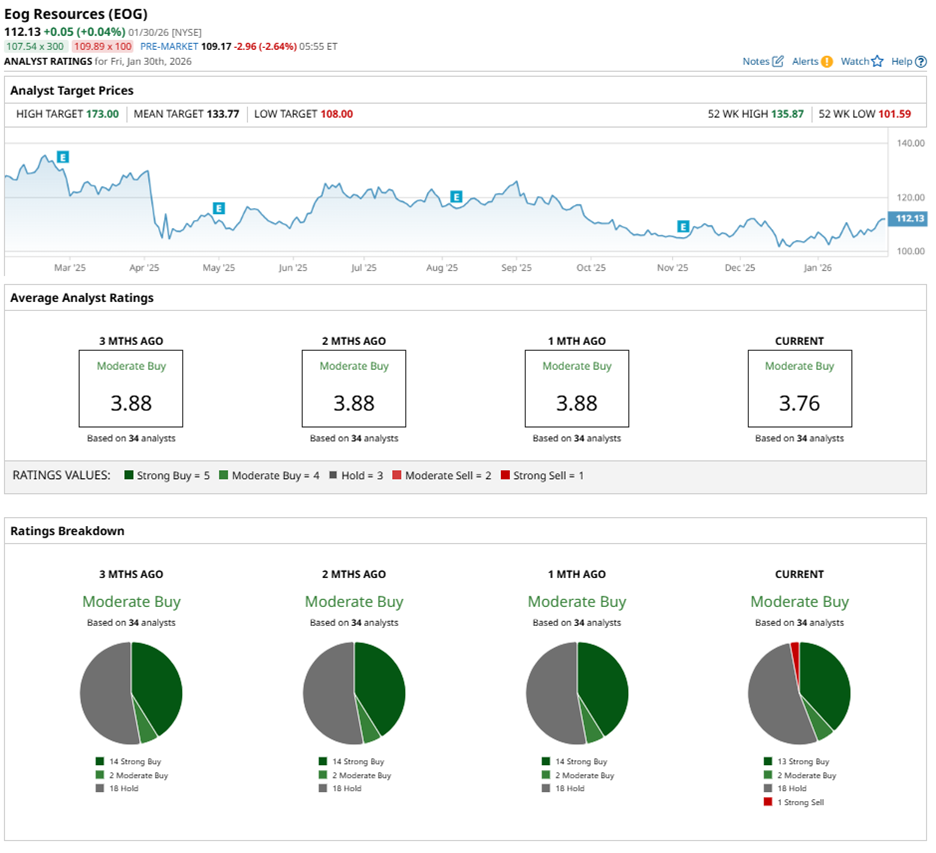

Wall Street maintains a positive outlook on EOG stock. Among 34 analysts, the consensus rating stands at “Moderate Buy,” comprising 13 “Strong Buy” ratings, two “Moderate Buy” calls, 18 “Hold” recommendations, and a single “Strong Sell.”

The current analyst sentiment has changed little over the past three months, when 14 analysts also labeled the stock a “Strong Buy.”

On Jan. 26, investment and trading firm Susquehanna trimmed its price target on EOG stock from $161 to $151 while maintaining a “Positive” rating. The firm cited a supply glut and softer demand weighing on oil prices, prompting a reduction in its 2026 WTI assumption from $65 to $60 per barrel. Even so, it remains optimistic about long-term natural gas demand tied to data centers and electrification.

That being said, the average price target of $133.77 implies potential upside of 19.3%, while the Street-high target of $173 suggest a gain of 54.3% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart