New research from Metapack highlights the impact of COVID-19 amid home working shift

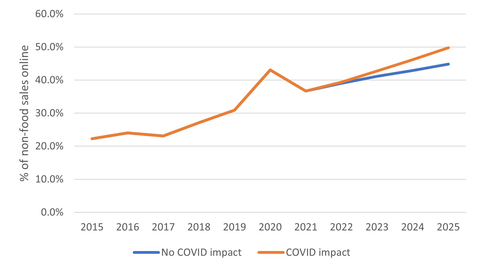

UK retailers are bracing for an additional £19.6 billion of online home deliveries by 2025 as a result of the pandemic, new research from ecommerce delivery technology leader Metapack in partnership with research consultancy Retail Economics suggests. This comes as online is expected to account for 49.7% of total non-food sales by 2025 amid persistent home working.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220210005073/en/

Figure 1: Online expected to account for half of UK non-food sales by 2025. Source: Retail Economics

Permanent shift online

Metapack’s new Ecommerce Delivery Benchmark report shows that 27.3% of UK consumers now expect to permanently shift more of their shopping online on the back of new behaviours formed since the pandemic.

A new wave of ‘digital shifters’ (the consumer cohort permanently switching to shopping more online) is expected to support an additional £22.4 billion in online sales compared to a scenario where the pandemic had no impact on shopping behaviours. This acceleration online is projected to lead to £19.6 billion of additional sales going through home deliveries alone by 2025, compared to a scenario where the pandemic had no impact.

However, the lasting impact of COVID-19 will not be felt equally across all retail categories. The research predicts that apparel, homewares and health & beauty will experience a greater permanent shift online, brought about by online discovery since the pandemic.

A consequence of the shift online means that 35.8% of UK consumers expect to visit physical stores less in the future, ahead of those expecting to cut back in the US (28.7%), Germany (20.8%) and France (17.2%).

Working from home disrupting retail

Disruption is being felt by consumers working from home – driving both an uplift in online spend and putting pressure on footfall to stores.

A quarter (24.8%) of UK consumers work from home more since the pandemic, of which half (50.6%) expect to shop more online permanently (denoted in green dots in figure 2), compared to around a quarter (27.1%) of those whose place of work has not been impacted from the pandemic (shown in red dots in figure 2).

As more consumers work from home, it has boosted the success rate of first-time deliveries and opened a much larger number of possible delivery slots. By 2025, UK home workers expect their proportion of online orders delivered to their home to rise by 11.5%, compared to an average of 7.5% among those that haven’t faced change in their work.

New wave of online shoppers demand speed

The report delves into key consumer types and finds that the new wave of online shoppers is more demanding of speed of delivery when considering their most important factors. Across the markets analysed, 37.5% of ‘digital shifters’ value speed ahead of convenience, cost and carbon footprint of deliveries.

Duncan Licence, VP of Global Product at Metapack says: “Driven by the pandemic, online consumer shopping expectations have changed significantly over the last few years, and a lot of these changes are here to stay. Our new report takes a closer look at these developments and their lasting impact on both consumers and retailers. It is expected that, as home working becomes the norm for more and more people, their appetite for fast, convenient, and easy deliveries that fit their lifestyle, will continue to increase. Retailers have reached a crossroads, they need to diversify their delivery options and invest in the right infrastructure and technology to meet the new needs of their consumers, or they will struggle to compete, especially as the shopping experience becomes synonymous with the delivery experience. The retail industry has evolved beyond bricks and mortar, it’s time to step into the age of ecommerce.”

Richard Lim, Chief Executive of Retail Economics says: “A permanent shift in consumer behaviour and vast investment across the ecommerce ecosystem has accelerated the shift to online. Structural changes in the labour market, with persistently higher levels of home working across households, has unlocked greater demand for home deliveries. Although the demand for speed will put pressure on supply chains, home workers have both a greater ability and greater willingness to pay for delivery and returns compared to average online shoppers, which is critical for profitability amid rising costs and elevated customer expectations.”

NOTES TO EDITORS

Express permission is granted for a link to Metapack and Retail Economics to be included in online news articles, blogs and posts.

https://www.retaileconomics.co.uk/

Research methodology

Research findings were supported by nationally representative consumer panels across four countries including the US, UK, France and Germany. The sample comprised more than 6,000 consumers, with survey data collected in November 2021 and analysed by Retail Economics. Market intelligence and forecast data has been modelled by Retail Economics.

For more information please contact: Amy Yates (amy.yates@retaileconomics.co.uk)

About Metapack

Metapack helps ecommerce and delivery professionals meet consumers’ growing expectations of delivery, while maintaining and optimizing operational efficiency. Metapack’s solution offers a wide range of personalized services, from delivery options to tracking and returns, through a catalogue of 400+ carriers and 4,900+ services available that span every country in the world. Thanks to Metapack, more than 550 million packages are sent annually by many of the world’s leading ecommerce retailers. Metapack is a member of the Auctane family of companies and is headquartered in London. Auctane brands include ShipStation, Stamps.com, Packlink, ShippingEasy, ShipWorks, ShipEngine, Endicia, Shipsi, GlobalPost and Metapack, with offices in El Segundo, Austin, London, Madrid, Sunnyvale, Zielona Gora, Atlanta, and St. Louis. Find out more at www.metapack.com.

About Retail Economics

Retail Economics is an independent economics research consultancy focused on the consumer and retail industry. We provide independent thought leadership on major economic and retail trends and analyse their impact on the industry.

Retail Economics provides proprietary data on sector growth, behavioural trends, channel performance and forecasts.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220210005073/en/

Contacts

Munveer Garcha

PR & Communications Manager, Metapack

munveer.garcha@metapack.com