Lomiko Metals Inc. (TSX.V: LMR) (“Lomiko Metals” or the “Company”) announces the Company has received conditional approval and will apply to the TSX Venture Exchange (the “Exchange”) to close its non-brokered private placement (the “Private Placement”) of 9,765,400 flow-through units (the “FT Units”) at a price of $0.065 per FT Unit for aggregate gross proceeds of $634,751.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220721006067/en/

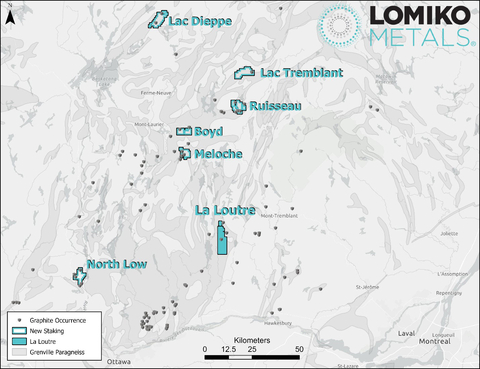

Figure 1 – New Lomiko Claims in relation to La Loutre (Graphic: Business Wire)

Each FT Unit consists of one common share that will qualify as a “flow-through share” within the meaning of the Income Tax Act (Canada) and the Taxation Act (Québec) and one-half (1/2) of a common share purchase warrant (a “Warrant”) with each whole Warrant exercisable at a price of $0.10 per share for a period of two years following closing.

Subject to regulatory approval, the Company will pay a cash finder’s fees of $31,737.55 and issue 580,182 finder warrants (the “Finder’s Warrants”) to three parties. Each Finder’s Warrant is non-transferable and exercisable at a price of $0.10 per share for a period of two years following closing.

Pursuant to applicable Canadian securities laws, all securities issued pursuant to this private placement are subject to a hold period of four months and one day. The private placement remains subject to the final approval of the TSX Venture Exchange.

The Company intends to use the gross proceeds of the private placement to incur Canadian Exploration Expenses and “flow-through mining expenditures” as defined in the Income Tax Act (Canada) and the Taxation Act (Québec) on the Company’s Laurentides regional graphite exploration program and the Bourier Lithium property, which will be incurred on or before December 31, 2023, and renounced with an effective date no later than December 31, 2022 to the initial purchasers of FT Units in an aggregate amount not less than the gross proceeds from the sale of the FT Units.

CEO and Director Belinda Labatte commented: “We are pleased to secure Flow-Through Financing and applying the new critical minerals Flow Through credit in this financing which is pending further details and qualifications of the new credit announced in the 2022 budget. The Critical Minerals Exploration Tax Credit (CMETC) is a new tax credit proposed in budget 2022 on April 7, 2022. The 30% tax credit would be applicable to eligible expenses in the exploration of critical minerals in Canada aligned with the government’s new critical mineral strategy. The announced critical mineral strategy and tax credit is important and directly aligned with our ongoing regional strategy to develop the natural flake graphite claims and to advance our Bourier lithium exploration program. At La Loutre we continue to advance our diamond drill program in the EV Zone, environmental baseline studies and metallurgical studies continue. This program will replicate commercial processing and purification steps to evaluate the performance of the La Loutre flake graphite in battery anode applications.

Regional Graphite Exploration Program in the Grenville Province

Lomiko has initiated helicopter-borne geophysical surveys on its six regional graphite properties for the purpose of data acquisition aiming to identify areas of prospective graphite mineralization for future field follow-up. The program will cover approximately 14,255 hectares of mineral claims, and 236 claims in total. These new claims lie within a 100 km radius of the Company’s flagship La Loutre graphite and were previously announced on May 16, 2022. With this work, the Company aims to identify near surface conductors which will help guide the field work in the future and further define the regional prospectivity for natural flake graphite. Please refer to Figure 1 for details.

Bourier Exploration Update

In addition, at the Company’s Bourier prospect, Lomiko and Critical Elements Lithium Corporation (Operator) have commenced the 2022 field exploration program. The field program is expected to last four weeks. The lithium-tantalum-cesium anomalies are of particular interest because they represent an unprecedented discovery in the Bourier claim. This anomaly spans along a 2.5 km long NE-trending mica-rich white pegmatites system. Structural interpretation by GoldSpot suggest this lithium-tantalum-cesium trend may extend to the Lemare Li showing. Please refer to Figure 2 for details.

About Lomiko Metals Inc.

Lomiko Metals has a new vision and a new strategy in new energy. Lomiko represents a company with a purpose: a people-first company where we can manifest a world of abundant renewable energy with Canadian and Quebec critical minerals for a solution in North America. Our goal is to create a new energy future in Canada where we will grow the critical minerals workforce, become a valued partner and neighbour with the communities in which we operate, and provide a secure and responsibly sourced supply of critical minerals. Lomiko is ECOLOGO certified.

The Company holds a 100% interest in its La Loutre graphite development in southern Quebec. The La Loutre project site is located within the Kitigan Zibi Anishinabeg (KZA) First Nations territory. The KZA First Nations are part of the Algonquin Nation and the KZA territory is situated within the Outaouais and Laurentides regions. Located 180 kilometres northwest of Montreal, the property consists of 1 large, continuous block with 76 minerals claims totaling 4,528 hectares (45.3 km2). Lomiko Metals published a Preliminary Economic Assessment (“PEA”) on September 10, 2021 which indicated the project had a 15-year mine life producing per year 100,000 tonnes of the graphite concentrate at 95%Cg or a total of 1.5Mt of the graphite concentrate. This report was prepared as National Instrument 43-101 Technical Report for Lomiko Metals Inc. by Ausenco Engineering Canada Inc., Hemmera Envirochem Inc., Moose Mountain Technical Services, and Metpro Management Inc., collectively the Report Authors. The Bourier project site is located near Nemaska Lithium and Critical Elements south-east of the Eeyou Istchee James Bay territory in Quebec which consists of 203 claims, for a total ground position of 10,252.20 hectares (102.52 km2), in Canada’s lithium triangle near the James Bay region of Quebec that has historically housed lithium deposits and mineralization trends.

Mr. Mike Petrina, Project Manager, a Qualified Person (“QP”) under National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has reviewed and approved the technical disclosure in this news release.

For more information on Lomiko Metals, review the website at www.lomiko.com, contact Belinda Labatte at 647-402-8379 or email: info@lomiko.com.

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. The information in this news release about the Company; and any other information herein that is not a historical fact may be "forward-looking information" (“FLI”). All statements, other than statements of historical fact, are FLI and can be identified by the use of statements that include words such as "anticipates", "plans", "continues", "estimates", "expects", "may", "will", "projects", "predicts", “proposes”, "potential", "target", "implement", “scheduled”, "intends", "could", "might", "should", "believe" and similar words or expressions. FLI in this new release includes, but is not limited to: the Company’s objective to become a responsible supplier of critical minerals, exploration of the Company’s projects, including expected costs of exploration and timing to achieve certain milestones, including satisfactory completion of due diligence and ability to reach an agreement with third party owners in connection with projected acquisitions, timing for completion of exploration programs; the Company’s ability to successfully fund, or remain fully funded for the implementation of its business strategy and for exploration of any of its projects (including from the capital markets); any anticipated impacts of COVID-19 on the Company’s business objectives or projects, the Company's financial position or operations, and the expected timing of announcements in this regard. FLI involves known and unknown risks, assumptions and other factors that may cause actual results or performance to differ materially. This FLI reflects the Company’s current views about future events, and while considered reasonable by the Company at this time, are inherently subject to significant uncertainties and contingencies. Accordingly, there can be no certainty that they will accurately reflect actual results. Assumptions upon which such FLI is based include, without limitation: potential of future acquisitions presently evaluated by the Company; current market for critical minerals; current technological trends; the business relationship between the Company, local communities and its business partners; ability to implement its business strategy and to fund, explore, advance and develop each of its projects, including results therefrom and timing thereof; the ability to operate in a safe and effective manner; uncertainties related to receiving and maintaining exploration, environmental and other permits or approvals in Quebec; any unforeseen impacts of COVID-19; impact of increasing competition in the mineral exploration business, including the Company’s competitive position in the industry; general economic conditions, including in relation to currency controls and interest rate fluctuations.

The FLI contained in this news release are expressly qualified in their entirety by this cautionary statement, the “Forward-Looking Statements” section contained in the Company’s most recent management’s discussion and analysis (MD&A), which is available on SEDAR at www.sedar.com, and on the investor presentation on its website. All FLI in this news release are made as of the date of this news release. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

On behalf of the Board,

Belinda Labatte

CEO and Director, Lomiko Metals Inc.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220721006067/en/

Contacts

For more information:

Kimberly Darlington

Investor Relations, Lomiko Metals Inc.

k.darlington@lomiko.com

514-771-3398