New study finds 60% of consumers say shopping secondhand apparel gives them the most bang for their buck; 55% say they’ll spend more on secondhand if the economy doesn’t improve.

Branded resale saw continued momentum in 2023, with 31% year-over-year growth; 163 brands now offer resale shops.

40% of voters say they’re more likely to vote for a candidate that supports sustainable fashion in upcoming elections.

ThredUp (Nasdaq: TDUP, LTSE: TDUP), one of the largest online resale platforms for apparel, shoes, and accessories, today released the results of its 2024 Resale Report. Conducted by third-party retail analytics firm GlobalData, the 12th annual study serves as the most comprehensive measure of the secondhand market globally and in the U.S., with forward looking projections through 2033. It also includes new insights about trends driving online resale’s growth, momentum in branded resale, and a special section about the government’s role in reducing fashion’s impact and potential implications for this year’s election. The report’s findings are based on market sizing and growth estimates from GlobalData; a survey of 3,654 U.S. consumers over the age of 18; and a survey of 50 top U.S. fashion retailers and brands.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240327870684/en/

(Graphic: Business Wire)

“The global secondhand apparel market continues to burgeon - a testament to the intrinsic value shoppers find in the secondhand experience and proof of the seismic shift towards a more circular fashion ecosystem. As we celebrate this progress, we also recognize the powerful role the government can play in accelerating the transition to a more sustainable future for fashion. Now in its 12th year, the Resale Report shows some of the most promising signals of what that future could look like with increased levels of support. Until fashion is no longer one of the most damaging sectors of the global economy, we will continue to advocate for the government to help drive adoption and behavior change in fashion.” – James Reinhart, CEO, ThredUp

“With more than half of all consumers shopping for secondhand apparel last year, it’s evident that resale is now firmly embedded in the fashion landscape. Secondhand buying transcends generations, with the role of resale changing throughout consumers’ lives. Younger shoppers turn to secondhand for self-expression and to help create their personal style; parents rely on secondhand to outfit their families in a cost-effective and eco-conscious way; and older generations turn to secondhand to snag affordable, higher-end brands and for the thrill of the hunt. Secondhand’s flexibility in meeting such varied needs is a key reason it’s become so popular and has such a promising growth trajectory.” – Neil Saunders, Managing Director, GlobalData

The top five trends from ThredUp’s 2024 Resale Report include:

(all figures pertain to the U.S. unless otherwise noted)

The secondhand apparel market is outpacing the broader retail sector at a notable clip. Online resale is seeing accelerated growth.

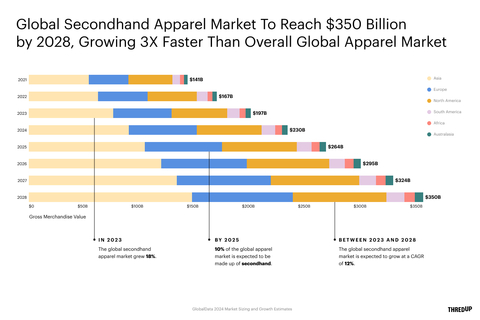

- The global secondhand apparel market is projected to reach $350 billion by 2028, growing at a compound annual growth rate (CAGR) of 12%.

- The U.S. secondhand apparel market grew 7 times faster than the broader retail clothing market in 2023. It’s expected to reach $73 billion by 2028.

- Online resale is expected to more than double in the next 5 years, reaching $40 billion by 2028 and growing at a CAGR of 17%.

Shoppers gravitate towards buying secondhand apparel online. For the first time ever, younger generations prefer buying online versus in a brick-and-mortar store.

- Nearly 2 in 3 consumers who made a secondhand apparel purchase in 2023 made at least one purchase online - up 17 points from 2022.

- 45% of younger generations prefer to buy secondhand apparel online, compared to 38% who prefer to buy in a brick-and-mortar store.

Resale thrives in a value-seeking environment where shoppers are buying on a deal.

- Nearly 3 in 4 consumers say when it comes to apparel spend, value is king.

- 60% of consumers say shopping secondhand apparel gives them the most bang for their buck.

- 55% of consumers say they’ll spend more on secondhand apparel if the economy doesn’t improve.

Branded resale is booming. Retailers are generating revenue, advancing sustainability goals, and acquiring new customers.

- 163 brands now offer resale shops, according to ThredUp’s Recommerce 100 - up 31% compared to 2022. New entrants in 2023 included J. Crew, American Eagle, and Kate Spade. FULLBEAUTY Brands, ELOQUII, Modcloth, and Betabrand all announced new resale programs powered by ThredUp’s Resale-as-a-ServiceⓇ (RaaSⓇ) today.

- Nearly 2 in 3 retail executives who offer resale say it will generate at least 10% of the company’s total revenue within five years.

- 87% of retail executives who offer resale say it’s advanced their sustainability goals.

- 38% of consumers say they shop secondhand to afford higher-end brands - up 11 points from 2022.

Government action could accelerate the transition to a more sustainable future for fashion. Voters say they’ll favor candidates who support circularity.

- 42% of consumers say the government should take legislative action to help promote sustainable fashion.

- 40% of consumers say they’re more likely to vote for a candidate that supports sustainable fashion.

- 52% of retail executives say they’d adopt circular business models if there were government-sponsored financial incentives for doing so.

To see the 2024 Resale Report, visit thredup.com/resale.

About the 2024 Resale Report

ThredUp’s annual Resale Report contains research and data from GlobalData, a third-party retail analytics firm. GlobalData’s assessment of the secondhand market is determined through consumer surveys, retailer tracking, official public data, data sharing, store observation, and secondary sources. These inputs are used by analysts to model and calculate market sizes, channel sizes, and market shares. Further, for the purpose of this report, GlobalData conducted a December 2023 survey of 3,654 American adults over 18, asking specific questions about their behaviors and preferences for secondhand. GlobalData also surveyed the top 50 U.S. fashion retailers and brands in December 2023 to gather their opinions on resale. In addition, ThredUp’s Resale Report also leverages data from the following sources: ThredUp’s Recommerce 100 and internal ThredUp customer and brand performance data.

About ThredUp

ThredUp is transforming resale with technology and a mission to inspire the world to think secondhand first. By making it easy to buy and sell secondhand, ThredUp has become one of the world's largest online resale platforms for apparel, shoes and accessories. Sellers love ThredUp because we make it easy to clean out their closets and unlock value for themselves or for the charity of their choice while doing good for the planet. Buyers love shopping value, premium and luxury brands all in one place, at up to 90% off estimated retail price. Our proprietary operating platform is the foundation for our managed marketplace and consists of distributed processing infrastructure, proprietary software and systems and data science expertise. With ThredUp’s Resale-as-a-Service, some of the world's leading brands and retailers are leveraging our platform to deliver customizable, scalable resale experiences to their customers. ThredUp has processed over 172 million unique secondhand items from 55,000 brands across 100 categories. By extending the life cycle of clothing, ThredUp is changing the way consumers shop and ushering in a more sustainable future for the fashion industry.

Forward-Looking Statements

This release contains forward-looking statements. Forward-looking statements include all statements that are not historical facts. The words "believe," "may," "will," "estimate," "continue," "anticipate," "intend," "expect," "predict" and similar expressions are intended to identify forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties and assumptions. Except as required by law, ThredUp has no obligation to update any of these forward-looking statements to conform these statements to actual results or revised expectations.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240327870684/en/

Contacts

Media Contact

Christina Berger

media@thredup.com

Investor Relations Contact

Lauren Frasch

ir@thredup.com

Resale-as-a-Service Contact

Ann Starodaj

raas@thredup.com