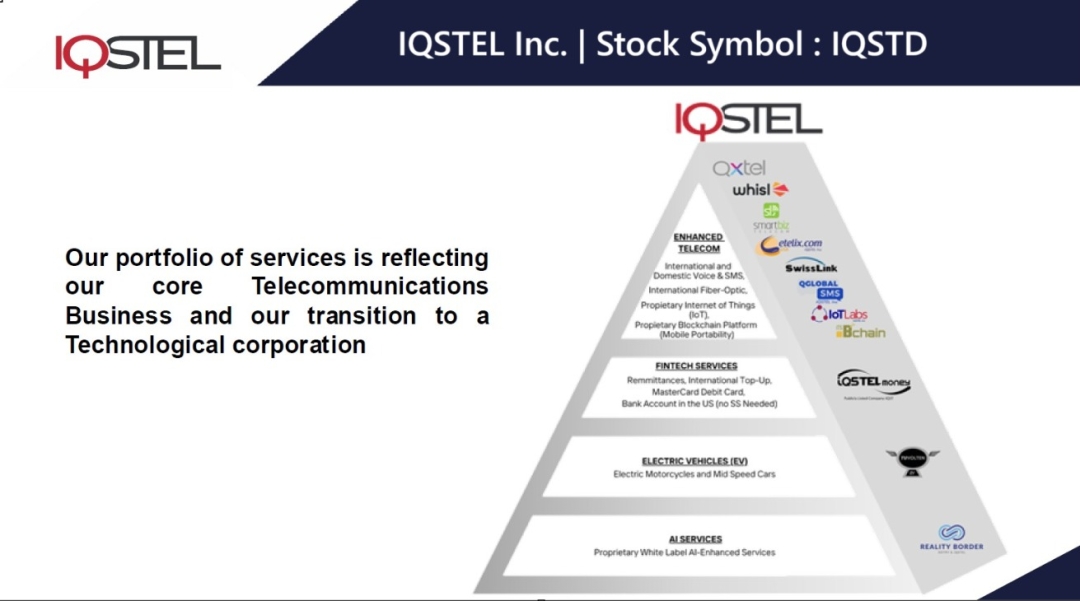

- Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

- $340 Million Revenue Forecast for 2025.

- Positioned to Achieve $1 Billion in Revenue by 2027 Through Organic Growth, Acquisitions and High-Margin Product Expansion.

- New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

- Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

- Preliminary Q1 2025 Delivering Net Revenue of $57.6 million, a 12% increase from $51.4 million in Q1 2024.

- Strategic Decision to Uplist to NASDAQ for Multiple Corporate Advantages Utilizing Reverse Stock Split to Meet Minimum Listing Requirements.

- MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Driving Fintech Expansion and Strengthening Revenue Outlook.

- MOU for Strategic Sale of BChain Subsidiary to Accredited Solutions, Inc. (ASII).

- IQSTD Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

iQSTEL, Inc. (Symbol: IQSTD, previously and soon to be again symbol IQST) is a US-based multinational company in the final stages of the path to becoming listed on Nasdaq. IQSTD offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQSTD delivers high-value, high-margin services to its extensive global customer base. IQSTD projects $340 million in revenue for FY-2025, building on its strong business platform.

IQSTD has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQSTD is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Strong Preliminary Q1 2025 Results: Revenue Growth, Margin Expansion and Strategic Progress Toward NASDAQ Uplisting

On May 6th IQSTD announced its preliminary first quarter 2025 financial results, delivering strong double-digit growth in revenue and a 40% increase in gross profit, reflecting continued improvements toward achieving profitability. These results reinforce the company’s commitment to long-term value creation through strategic initiatives, including its planned NASDAQ uplisting and acquisition-driven growth strategy.

IQSTD has a successful track record of improving year over year across key operational financial metrics—including revenue, gross profit, EBITDA, assets, among others—while growing at a gigantic pace of 96% year-over-year. This performance demonstrates consistent execution and the scalability of its business model.

Preliminary Q1 2025 Financial Highlights

Net Revenue: $57.6 million, a 12% increase from $51.4 million in Q1 2024.

Gross Profit: $1.93 million, a 40% increase from $1.38 million in Q1 2024.

Gross Margin: Improved to 3.36%, a 25% increase from 2.68% in Q1 2024.

Adjusted EBITDA (Telecom Division): $593,604.

Q4 2024 Revenue Reference: $98.8 million, highlighting the company’s strong momentum heading into 2025. Historically, IQSTEL’s second-half performance has significantly outpaced the first half, reinforcing confidence in continued growth.

The IQSTD business platform is the result of years of sustained effort, technological development, and commercial trust-building. Establishing this platform required securing interconnection agreements with the largest telecommunications networks worldwide—a process that is highly complex, resource-intensive, and not easily replicated.

IQSTD has successfully built a global network of trusted customers and vendors, exchanging hundreds of millions of dollars annually. This level of commercial reliability and mutual trust has created a resilient and strategically valuable operating ecosystem.

IQSTD has built a stable and scalable business model. With the platform firmly in place, IQSTD is now leveraging it to offer high-tech, high-margin products—including AI-powered tools, fintech services, and cybersecurity solutions—through its existing global customer base.

Strategic Decision to Uplist to NASDAQ Utilizing Reverse Stock Split to Meet Minimum Listing Requirements

On May 2nd IQSTD announced the strategic decision to uplist to the NASDAQ stock exchange. As part of this process, IQSTD has executed a reverse stock split at a ratio of 80:1 to meet the minimum share price required for listing. With $283 million in revenue reported for 2024 and a 96% year-over-year growth rate, IQSTD is poised to enter a new phase of growth and recognition on a national exchange.

The Company's common stock began trading on a split-adjusted basis on the OTCQX under the trading symbol "IQSTD" as of May 2nd. The fifth character "D" will be removed from the Company's trading symbol after 20 business days if the stock is still trading on the OTCQX, or upon the listing of the Company's common stock on Nasdaq, whichever occurs first. At that time, the Company's trading symbol will revert to "IQST."

As a result of the reverse split, there will be approximately 2,633,878 shares of common stock outstanding. Upon the effectiveness of the reverse split, there will also be a proportional decrease of the Company's authorized shares of common stock at the same ratio of 1-for-80, resulting in approximately 3,750,000 authorized shares of common stock following the action. Stockholders should direct any questions concerning the reverse stock split to their broker or the Company's transfer agent, Vstock Transfer, at https://www.vstocktransfer.com/.

Leandro Jose Iglesias President & CEO of IQSTD stated, “Our management team firmly believes that IQSTEL's current market capitalization on the OTC market does not reflect the true value of our company, especially considering our outstanding performance and solid financial foundation. We are confident that a NASDAQ listing will bring our market value more in line with our real business strength.”

Key Facts Supporting the IQSTD NASDAQ Uplisting

Revenue Growth:In 2024, IQSTD reported $283 million in revenue, yet market capitalization remains at only about 10% of that figure. Explosive Growth: IQSTD achieved 96% year-over-year revenue growth, but valuation has not kept pace with performance.

Strong Asset Base: With $79 million in assets, IQSTD valuation still reflects only a fraction of its balance sheet strength.

Proven Profitability: The IQSTD core telecom division generates positive adjusted EBITDA and net income, confirming the scalability of the Company’s business model. Revenue Per Share vs. Stock Price: IQSTD reported $1.40 in revenue per share in 2024, while the stock price trades at less than 10% of that figure.

Global Reach: With operations in over 20 countries and direct B2B relationships with major telecom operators, a NASDAQ listing is expected to enhance IQSTD global visibility and allow partners, customers, and vendors worldwide to invest in the Company — opening the door to thousands of new potential shareholders.

NASDAQ listing opens a new era of opportunities for IQSTD

Enhanced Credibility:The IQSTD uplisting solidifies relationships with key customers who value transparency and the governance standards of a national exchange.

Accelerated M&A: The uplisting enables acquisitions and mergers with larger, high-quality companies as IQSTD persues its roadmap to become a $1 billion revenue company with sustainable profitability.

Institutional Access: IQSTD will be on the radar of institutional investors and leading technology firms—many of whom are restricted by their investment policies from investing in OTC-listed or sub-$3 stocks.

Visibility to Tech Buyers: Increased exposure to global tech corporations seeking to acquire fast-growing, revenue-generating platforms. IQSTD has built a world-class, scalable, and hard-to-replicate global connectivity infrastructure that is ready for expansion. A NASDAQ listing helps solidify and highlight the intrinsic value of the Company’s business infrastructure.

Short Seller Protection: The current uplisting also helps mitigate the negative effects of short selling, thanks to NASDAQ's stronger regulatory framework.

A Direct Listing—With No Dilution

IQSTD is not raising capital as part of the uplisting because it already meets the required stockholders' equity requirement. This approach avoids dilution and preserves shareholder value. Additionally, the Company’s main investors have extended the maturity of their instruments to Q1 2026, providing greater stability and reaffirming their confidence in the IQSTD long-term trajectory.

IQSTD is actively seeking new acquisitions in telecom, new telecom technologies and fintech that contribute positive EBITDA and align with its long-term vision of building a profitable $1 billion revenue company.

In 2025 and beyond, IQST will leverage this established platform to accelerate expansion into high-tech, high-margin industries, unlocking new revenue streams and maximizing profitability.

Cybersecurity Solutions: Providing cutting-edge security services tailored for global telecom operators and enterprises.

Advanced Telecom Services: Expanding high-value offerings such as next-generation voice, messaging, and connectivity solutions.

Fintech Innovation: Strengthening financial technology services, including digital payments, mobile banking, and international remittances.

AI-Driven Technologies: Integrating artificial intelligence to enhance customer experience, automation, and operational efficiencies.

IQSTD plans to distribute common stock in ASII to its shareholders as a dividend. The Company believes this decision not only rewards current investors but also aligns with IQSTD broader efforts to enhance shareholder participation and liquidity.

For more information on $IQSTD visit: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Media Contact

Company Name: IQSTEL Inc.

Contact Person: Leandro Jose Iglesias, President and CEO

Email: Send Email

Phone: +1 954-951-8191

Address:300 Aragon Avenue Suite 375

City: Coral Gables

State: Florida 33134

Country: United States

Website: www.iQSTEL.com