Cheesecake Factory (NASDAQ: CAKE) needs to catch up to the sit-down restaurant group regarding the restaurant rebound, but it may surprise investors with the next earnings report. Trends in the group suggest strength for Cheesecake Factory, and the company has been working to reclaim lost margin.

The question is whether the price increases will scare customers away or if the company’s offerings are enough to keep them returning. The company’s enormous menu is great for consumers but a burden for the company regarding food and other costs.

“2022 was undeniably an extremely challenging year with respect to our margin performance. And clearly, the cost environment remains heightened relative to historical standards, and there can be no guarantees it will abate in 2023,” CFO Matt Clark told analysts during the Q4 conference call. “That said, in December, our pricing actions appear to have caught up with our costs, and while some degree of volatility and uncertainty should still be expected quarter-to-quarter, it is our goal to keep a tighter correlation between pricing and the inflation we experience going forward.”

Analysts Expect Growth, But Bar Is Falling

The analysts expect significant growth in top and bottom line results when the company reports on May 5th. The top line consensus reported by Marketbeat.com is $871.32 million, which is a gain of 9.7% YOY but down slightly sequentially, which is a low bar to beat. Competitors like Bloomin’ Brands (owner of Carrabba's) (NASDAQ: BLMN) and Darden Restaurants (Olive Garden) (NYSE: DRI) are expected to post at least flat revenue compared to last year, with Bloomin’ Brands looking at sequential growth as well.

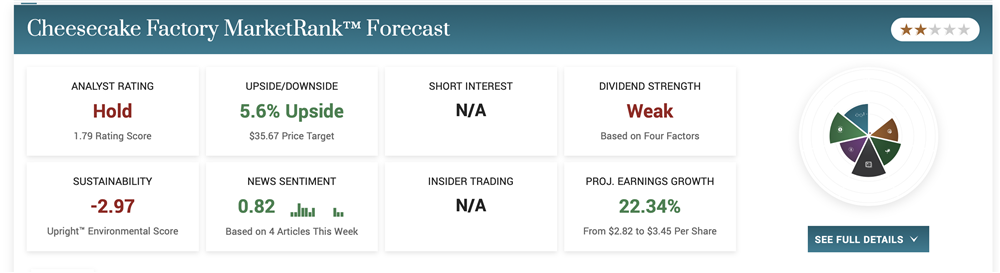

On the earnings end, all 3 are expected to grow earnings sequentially and YOY, but The Cheesecake Factory should outperform. The analysts expect 25% YOY growth, which may be a cautious estimate given the combined impacts of higher pricing, cost-saving effort and traffic.

The analyst rate Cheesecake Factor a firm Hold compared to Moderate Buys for BLMN and DRI. BLMN has the highest projected upside at 15%, but even The Cheesecake Factory’s price target is trending higher in the near term. The analysts began increasing their targets after the last earnings report, and the most recent are all above the consensus figure. The high price target is included in this group and assumes about a 30% upside for the stock.

The Market Dynamics Are Set For A Price Surge

Given the proper catalyst, the combination of short interest and institutional activity sets this stock up for a price surge. Notably, UBS called the stock out as the Most Popular Short in the sector with its 17% short interest. Regarding the institutions, their activity is mixed over the past year and net-bearish on balance.

However, the 2 most recent quarters include a spike in buying during Q4 and a pause in Q1 that suggests the group is waiting to see what will happen. They own about 88% of the stock, so good news could get them buying and the shorts covering. In this scenario, a squeeze is possible.

The chart is iffy. The market hit bottom but is range bound and trading down to the middle of the range. This echoes the wait-and-see sentiment telegraphed by the institutions and could lead to a move in either direction. The targets are $40 and $25. Investors are cautioned to avoid knee-jerk reactions to the news once it comes out. If this market is moving higher, it will present ample buying opportunities.