Abbott Laboratories (NYSE: ABT) share price fell following its Q4 2023 results, but investors should be cheering the news. The decline is a response to a report that was largely as expected, with the expectation being healthcare industry normalization and return to growth. The takeaway is that COVID-19 has become a thing of the past. COVID-19-related sales will continue to impact the business but are no longer a driver of sales or sales declines, which have ended.

Because the core business is solid and growing by double-digits, system-wide growth should accelerate over the next few quarters as COVID data falls out of the comparisons.

MedTech underpins Abbott's strength

Abbott had a solid quarter, with revenue and earnings coming in as expected. The company reported $10.24 billion in sales for a gain of 1.4% over last year, including COVID-19. COVID sales impacted the Diagnostic unit by 2400 basis points to offset strength in the non-COVID business. On a core, non-COVID basis, organic revenue is up 11% on strength in MedTech.

MedTech is up 17.5% and is expected to remain solid for the foreseeable future because of demand for procedures and services. This is echoed in reports from Johnson & Johnson (NYSE: JNJ) and Intuitive Surgical (NASDAQ: ISRG), which both reported strong sales in MedTech led by gains in wound closure for JNJ and Instruments and Accessories for Intuitive Surgical. Nutrition is another area of strength, up 14%, aided by the return of infant formula. The company reports it has regained its pre-recall market share in this category.

The margin was also solid, if only as expected. The company’s margin widened over the last year on revenue leverage and cost control to deliver healthy improvement in earnings. The GAAP $0.91 is up 54% YOY, and the adjusted 15.5% with margin expected to hold up over the next year. Guidance is equally favorable to shareholder value but as expected and provided no catalyst for higher price action today.

Abbott’s solid guidance supports a healthy dividend

Abbott’s guidance favors investors because it calls for another year of sustained high-single to low-double-digit revenue growth in its core segments compounded by margin strength. The company forecasted 8% to 10% top-line growth in core segments, with GAAP earnings flat to slightly higher and adjusted up 2.2% at the range's low end, sufficient to sustain distribution payments.

The earnings guidance is also sufficient to keep the payout ratio low enough to sustain annual distribution increases for the next few years. As it is, ABT has been increasing at a high-single-digit rate and may sustain that pace at the end of the fiscal year.

Analysts are on board the Abbott train and raising their price targets following the Q4 release. At least four firms, including Raymond James (NYSE: RJF), Bernstein and JPMorgan Chase (NYSE: JPM), have come out to raise their price targets. All new targets are above the current consensus, which is rising and forecasts at least a 10% upside for the market. Abbott shares could fall further, but the decline will be limited if this trend continues.

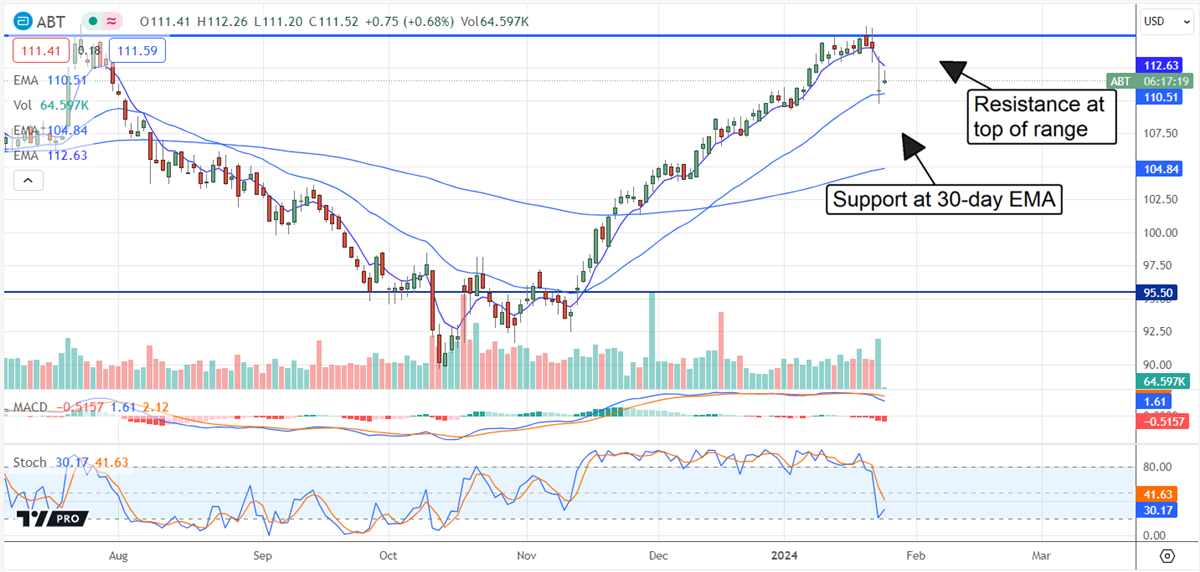

The technical outlook: Abbott Laboratories stuck in a range?

The price action in Abbott Laboratories has been range-bound for the last five going on six quarters, but a breakout is brewing. The new analysts' targets and the consensus have this market trading above the range’s high-end, and support is already showing on the chart.

The market fell sharply following the release but found support at the 30-day moving average. Assuming this support holds and the market follows through on the signal, ABT price action should soon rebound to retest the $115 level. A move above there would be very bullish, possibly leading this market to the $140 level in 2024.