--News Direct--

By Spotlight Growth

U.S. stocks surged in January 2023, as Q4 2022 financial results were not quite as bad as many analysts and experts feared. As a result, the S&P 500 (NYSE: SPY) jumped 6.18%, Dow Jones Industrial Average (NYSE: DIA) climbed 2.83% and the Nasdaq (NASDAQ: QQQ) shot up a whopping 10.6% in January 2023 alone.

According to S&P Global, the somewhat better-than-expected Q4 results, combined with a late Santa Claus rally and early-year bargain hunting after a brutal 2022, are seen as the key catalysts that drove U.S. stocks to impressive returns to kick off the first month of 2023.

However, as we approach March 2023, the “big three” stock indices have since given up nearly all of their gains. As of this writing, the S&P 500 and the Dow Jones Industrial Average have turned slightly negative on the year, while the Nasdaq barely holds on to a 0.08% gain YTD.

Despite the continued volatility and “kangaroo market” conditions in early 2023, Asure Software (NASDAQ: ASUR) is picking up right where it left off in 2022. The Human Capital Management (HCM) solutions provider has continued its outperformance, as the company continues to collaborate and leverage key partnerships and provide small-to-medium businesses (SMBs) with the tools needed to remain nimble during the economic uncertainty, while still attracting top-tier employee talent.

Asure’s strong 2022 performance and strong start to 2023 are certainly turning heads in the institutional investor community. Let’s dive deeper to understand Asure’s early accomplishments so far this year.

New ASUR Collaboration: TurboTax, H&R Block, & ZayZoon

Kicking off 2023, Asure sought to bolster its tax prep integrations and features to help employees of SMBs to streamline their tax filing process. To accomplish this task, Asure Software teamed up with the two biggest consumer tax preparation companies in the United States: Intuit (NASDAQ: INTU) TurboTax and H&R Block (NYSE: HRB).

The TurboTax and H&R Block integrations are a massive milestone for Asure. Not only does the integration help boost Asure’s profile, but it is also a tremendous win for the company’s clients, which now can offer their employees with streamlined integration of their W-2 tax forms directly into the number 1 and 2 market leaders in the consumer tax prep industry.

According to AccountingToday, TurboTax is the number one consumer tax prep company, with an estimated market share of around 30%. Slintel notes that H&R Block is second with a 24.48% market share.

“Our goal is to simplify HR and payroll processes for small businesses, which includes identifying ways to help our clients attract new employees now that the war for talent has hit Main Street,” said Pat Goepel, Chairman and CEO of Asure. “We are thrilled to partner with Intuit and offer employees of our clients a seamless and efficient solution for tax filing.”

Intending to help SMB clients continue increasing their competitiveness for top-tier employee talent, Asure’s most recent partnership with ZayZoon is a perfect match. ZayZoon is engaged as a market leader in earned wage access and employee financial wellness services.

Under the partnership, ZayZoon will integrate its tech solutions with Asure’s payroll and time & attendance solutions to enable employees to obtain real-time wage data. The goal of this integration is to provide SMBs with tools to help employees stay engaged, reduce financial stress and increase retention and productivity.

“Financial pressures can impact employees across all industries and job types. By partnering with ZayZoon we can help ease that burden by offering small business employees the option to access the funds they've earned faster when they need them most," said Pat Goepel, Chairman and CEO of Asure. “Earned wage access is fast becoming a necessity in the war for talent and we’re pleased to join forces with ZayZoon to deliver this competitive advantage to main street.”

Wall Street Taking Notice of Asure Software

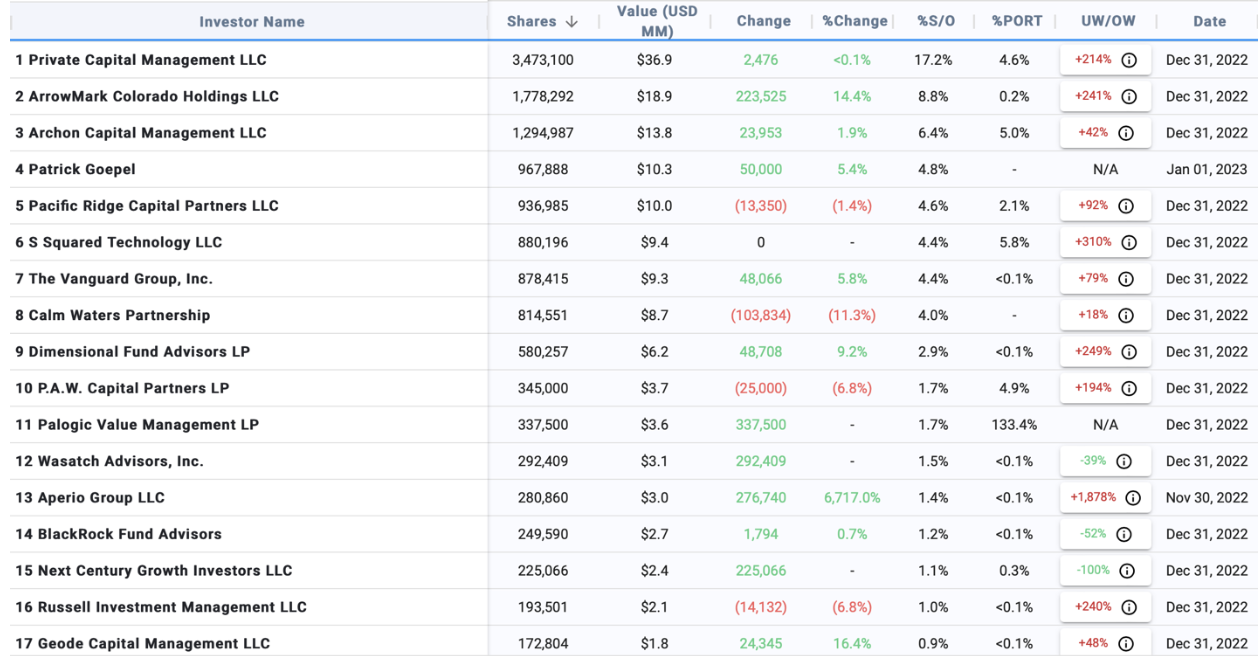

One of the greatest forms of validation a public company can receive is strong support from the Wall Street community. Before October 2022, Asure’s top investors were mostly corporate insiders and managers. By the end of 2022, institutions were piling into the HCM provider. Aside from institutional investors, the Wall Street analyst community has been very bullish and supportive of Asure Software as well.

Between November 2022 and February 2023, 50 institutions, insiders and big private investors added to their Asure Software positions, while 29 entities cut their positions in the HCM provider. This is a very good parity, which nearly shows there were two investors adding shares for each seller during the period.

Top Institutional Shareholders

1. Private Capital Management, LLC: 3,797,305 shares of ASUR

Private Capital Management, LLC is a Florida-based asset manager and the largest institutional shareholder of Asure Software, as of December 31, 2022, with a total stake of just under 3.8 million shares. This gives the investor 18.84% control of the company, as noted in a recent 13G filing.

2. ArrowMark Colorado Holdings, LLC: 1,778,292 shares

ArrowMark Colorado Holdings aggressively added to its position in late 2022. The Denver, Colorado-based investor increased their stake by an additional 223,525 shares to reach a new total position of 1,778,292 shares, as of December 31, 2022. This represents an 8.82% ownership of Asure Software.

3. Archon Capital Management, LLC: 1,294,987 shares

Based out of Seattle, Washington, Archon Capital Management is the third largest shareholder of the HCM provider, with a total stake of 1,294,987 shares, as of the end of 2022. This gives the asset manager a 6.42% stake in Asure.

Analyst Updates

Since the start of 2023, three analysts covering Asure stock have held their "buy" ratings and increased their price targets in the range of $12 to $14. Joshua Reilly of Needham reiterated his “buy” rating and a $14 price target in early January 2023. Four-star analyst, Eric Martinuzzi of Lake Street, also took the opportunity to reiterate a “buy” rating and a $12.00 price target in January.

Vincent Colicchio, a five-star analyst from Barrington, assigned Asure a “buy” rating and a $12 price target in February 2023. Mr. Colicchio joins Richard Baldry of Roth Capital as the only two five-star analysts covering the HCM provider. Mr. Baldry last reiterated a “buy” rating and a $16 price target in March 2022.

Overall, Asure Software is finally beginning to gain the recognition from Wall Street it has rightfully deserved. The company’s operational success and resilience amid a very volatile market and uncertain economic environment have certainly caught the attention of the investment community.

Furthermore, Asure’s continued partnership outreach and integrations are not only giving SMB clients a notable edge in their HCM efforts but also serving as a validation for Asure as a business. Think about it…not too many other small-caps can say they have partnerships with major, household entities like Intuit TurboTax, H&R Block, Equifax (NYSE: EFX), and more.

With 2023 shaping up to feature similar macroeconomic uncertainties as 2022, SMBs will likely continue to heavily rely on HCM services, like those offered by Asure, to help cut costs, streamline operations, and remain competitive in the employee talent search. Overall, 2023 is shaping up to be another break-out year for Asure Software.

Disclaimer:

Spotlight Growth is compensated, either directly or via a third party, to provide investor relations services for its clients. Spotlight Growth creates exposure for companies through a customized marketing strategy, including design of promotional material, the drafting and editing of press releases and media placement.

All information on featured companies is provided by the companies profiled, or is available from public sources. Spotlight Growth and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever and we are not qualified to give financial advice. The information contained herein is based on external sources that Spotlight Growth believes to be reliable, but its accuracy is not guaranteed. Spotlight Growth may create reports and content that has been compensated by a company or third-parties, or for purposes of self-marketing. Spotlight Growth was compensated five thousand dollars cash by Asure Software for the creation and dissemination of this content by the company.

This material does not represent a solicitation to buy or sell any securities. Certain statements contained herein constitutes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements may include, without limitation, statements with respect to the Company's plans and objectives, projections, expectations and intentions. These forward-looking statements are based on current expectations, estimates and projections about the Company's industry, management' beliefs and certain assumptions made by management.

The above communication, the attachments and external Internet links provided are intended for informational purposes only and are not to be interpreted by the recipient as a solicitation to participate in securities offerings. Investments referenced may not be suitable for all investors and may not be permissible in certain jurisdictions.

Spotlight Growth and its affiliates, officers, directors, and employees may have bought or sold or may buy or sell shares in the companies discussed herein, which may be acquired prior, during or after the publication of these marketing materials. Spotlight Growth, its affiliates, officers, directors, and employees may sell the stock of said companies at any time and may profit in the event those shares rise in value. For more information on our disclosures, please visit: https://spotlightgrowth.com/disclosures/

Contact Details

Benzinga

+1 877-440-9464

Company Website

View source version on newsdirect.com: https://newsdirect.com/news/asure-software-nasdaq-asur-sets-the-tone-for-2023-with-intuit-nasdaq-intu-turbotax-and-zayzoon-collaborations-while-institutional-investors-boost-positions-382779808