Slot machine and terminal operator Accel Entertainment (NYSE: ACEL) announced better-than-expected revenue in Q3 CY2024, with sales up 5.1% year on year to $302.2 million. Its GAAP profit of $0.06 per share was 48.2% below analysts’ consensus estimates.

Is now the time to buy Accel Entertainment? Find out by accessing our full research report, it’s free.

Accel Entertainment (ACEL) Q3 CY2024 Highlights:

- Revenue: $302.2 million vs analyst estimates of $297 million (1.7% beat)

- EPS: $0.06 vs analyst expectations of $0.12 ($0.06 miss)

- EBITDA: $45.88 million vs analyst estimates of $44.61 million (2.8% beat)

- Gross Margin (GAAP): 30.2%, in line with the same quarter last year

- Operating Margin: 7.2%, down from 8.7% in the same quarter last year

- EBITDA Margin: 15.2%, in line with the same quarter last year

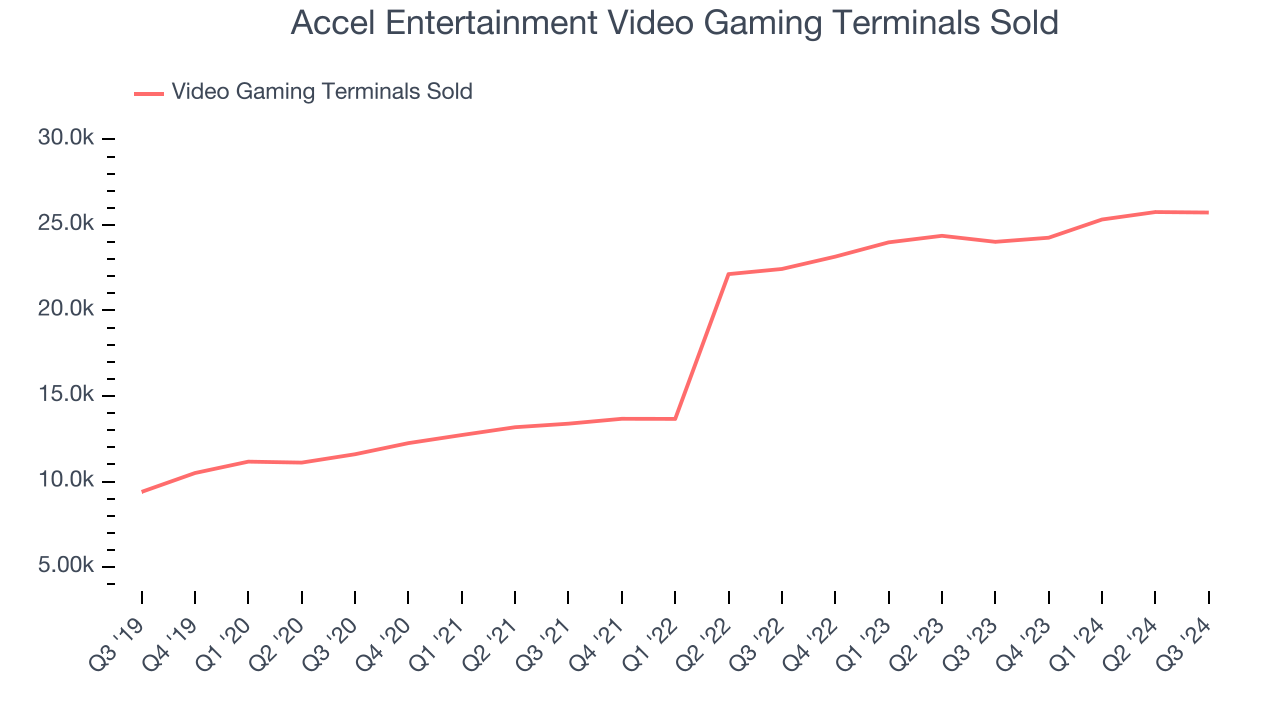

- Video Gaming Terminals Sold: 25,729, up 1,713 year on year

- Market Capitalization: $947.8 million

Accel CEO Andy Rubenstein commented, “I am happy to report that we delivered another strong quarter and are making substantial progress closing our acquisition of FanDuel Sportsbook & Horse Racing, a natural extension of our convenient, local gaming platform. We continue to outperform casinos in our largest market, Illinois, and posted significant revenue increases in our fastest growing market, Nebraska. By strengthening our core and expanding our offerings, we believe we can continue to generate attractive low-teens returns on capital and improve our trading multiples, making Accel a compelling investment opportunity.”

Company Overview

Established in Illinois, Accel Entertainment (NYSE: ACEL) is a provider of electronic gaming machines and interactive amusement terminals to bars and entertainment venues.

Gaming Solutions

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

Sales Growth

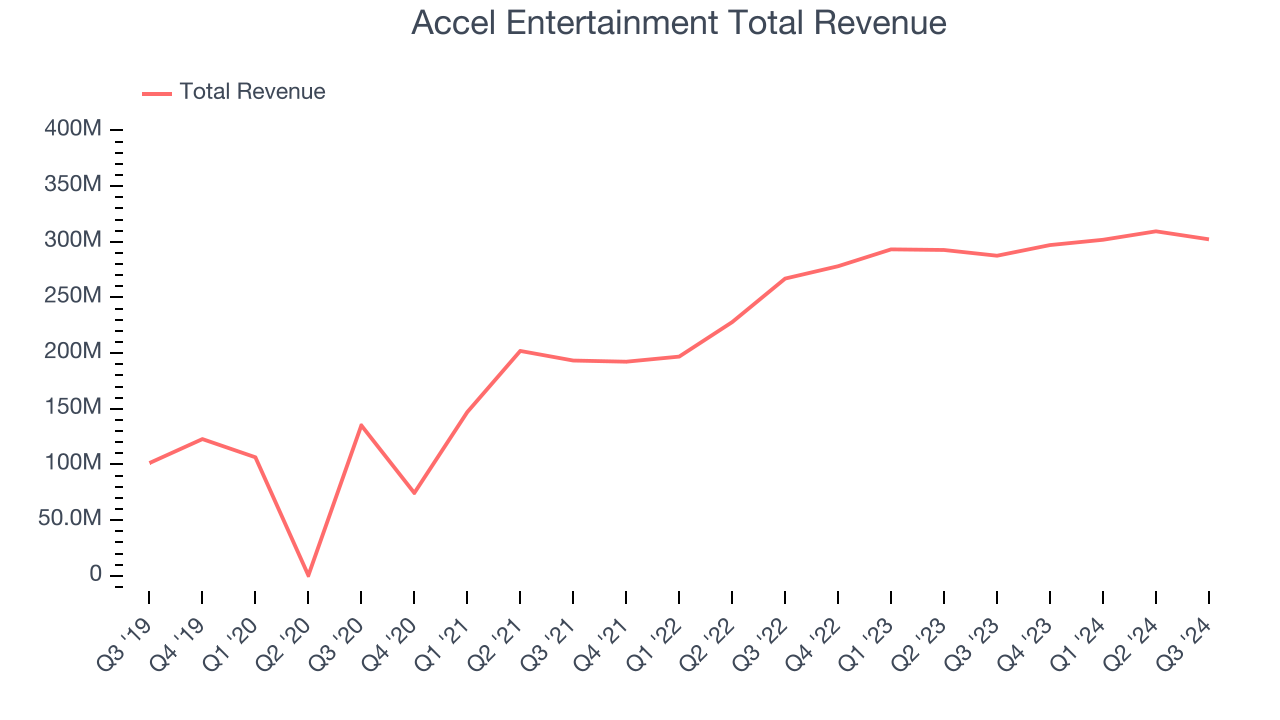

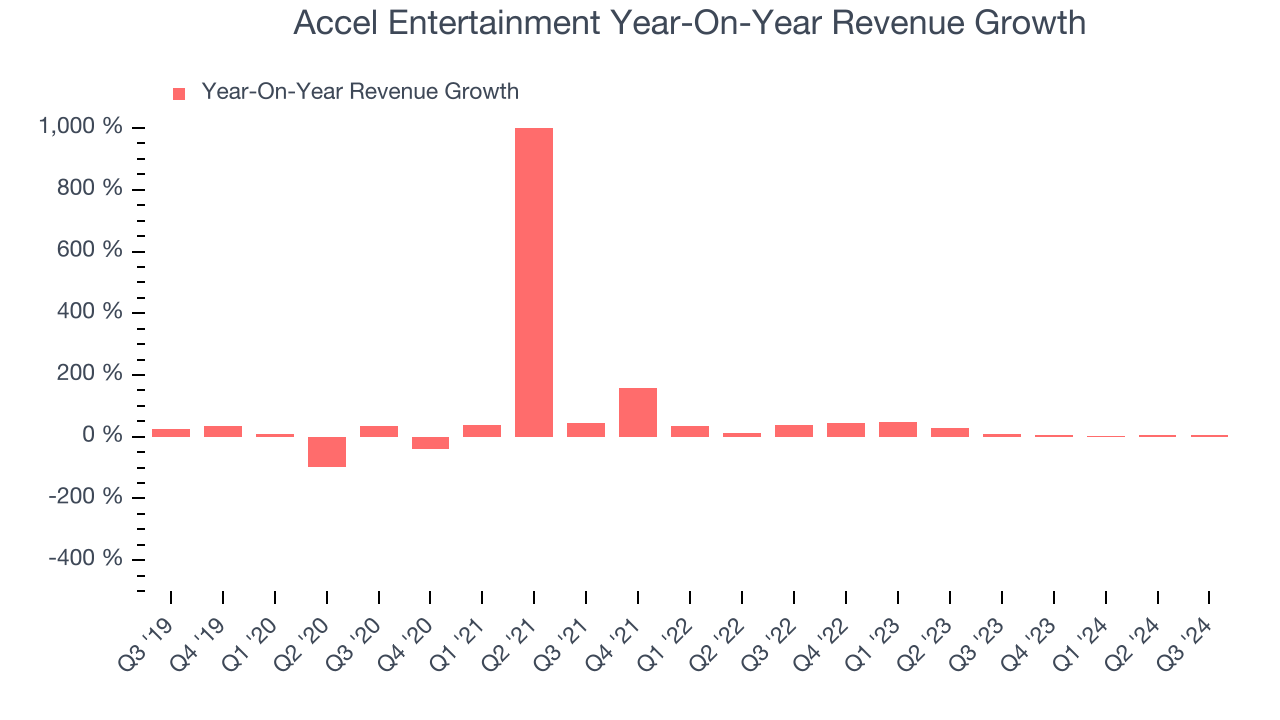

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Accel Entertainment grew its sales at an excellent 25.2% compounded annual growth rate. This is a useful starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Accel Entertainment’s annualized revenue growth of 17% over the last two years is below its five-year trend, but we still think the results were respectable.

We can dig further into the company’s revenue dynamics by analyzing its number of video gaming terminals sold, which reached 25,729 in the latest quarter. Over the last two years, Accel Entertainment’s video gaming terminals sold averaged 23.2% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Accel Entertainment reported year-on-year revenue growth of 5.1%, and its $302.2 million of revenue exceeded Wall Street’s estimates by 1.7%.

Looking ahead, sell-side analysts expect revenue to grow 2.9% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and shows the market believes its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

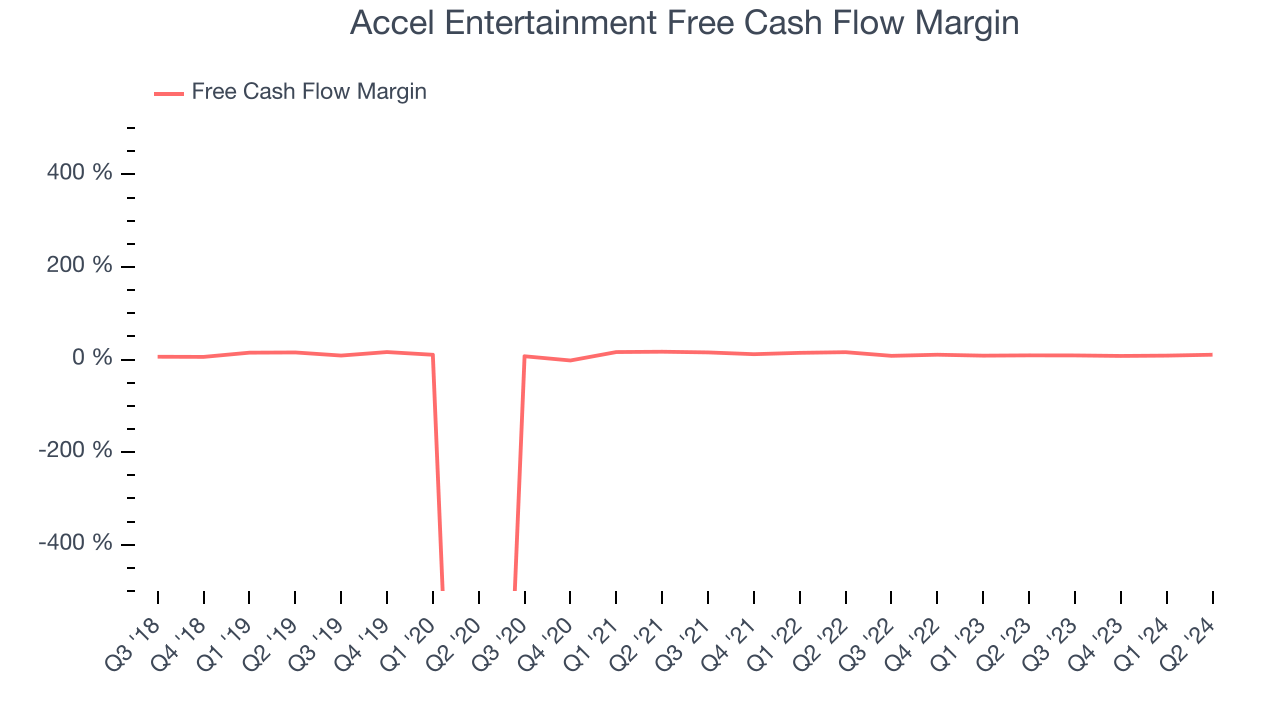

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Accel Entertainment has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 9%, subpar for a consumer discretionary business.

Key Takeaways from Accel Entertainment’s Q3 Results

It was good to see Accel Entertainment beat analysts’ revenue expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its EPS missed. Overall, this was a weaker quarter. The stock traded down 1.6% to $11.20 immediately after reporting.

The latest quarter from Accel Entertainment’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.