Mastercard currently trades at $567.50 per share and has shown little upside over the past six months, posting a middling return of 3.5%. The stock also fell short of the S&P 500’s 18.8% gain during that period.

Is now the time to buy MA? Find out in our full research report, it’s free.

Why Is Mastercard a Good Business?

Recognizable by its iconic "Priceless" advertising campaign that has run in over 120 countries, Mastercard (NYSE: MA) operates a global payments network that connects consumers, financial institutions, merchants, and businesses, enabling electronic transactions and providing payment solutions.

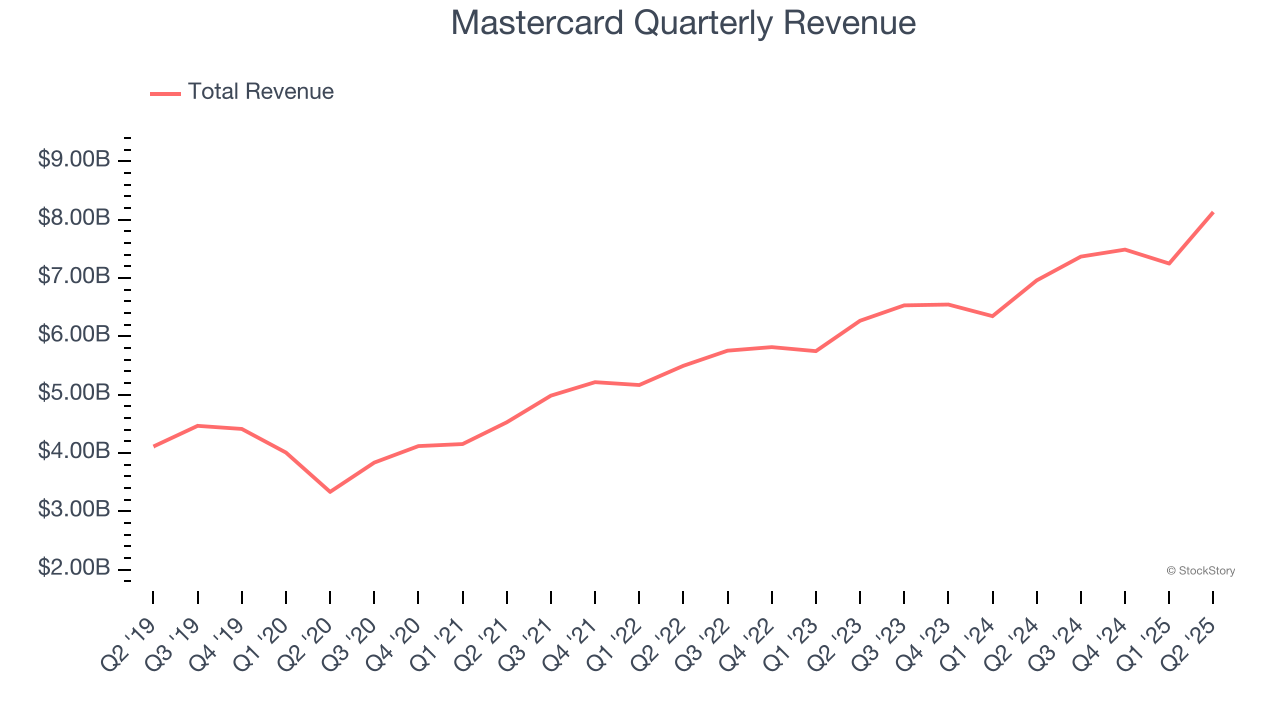

1. Long-Term Revenue Growth Shows Strong Momentum

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Over the last five years, Mastercard grew its revenue at a solid 13.3% compounded annual growth rate. Its growth surpassed the average financials company and shows its offerings resonate with customers.

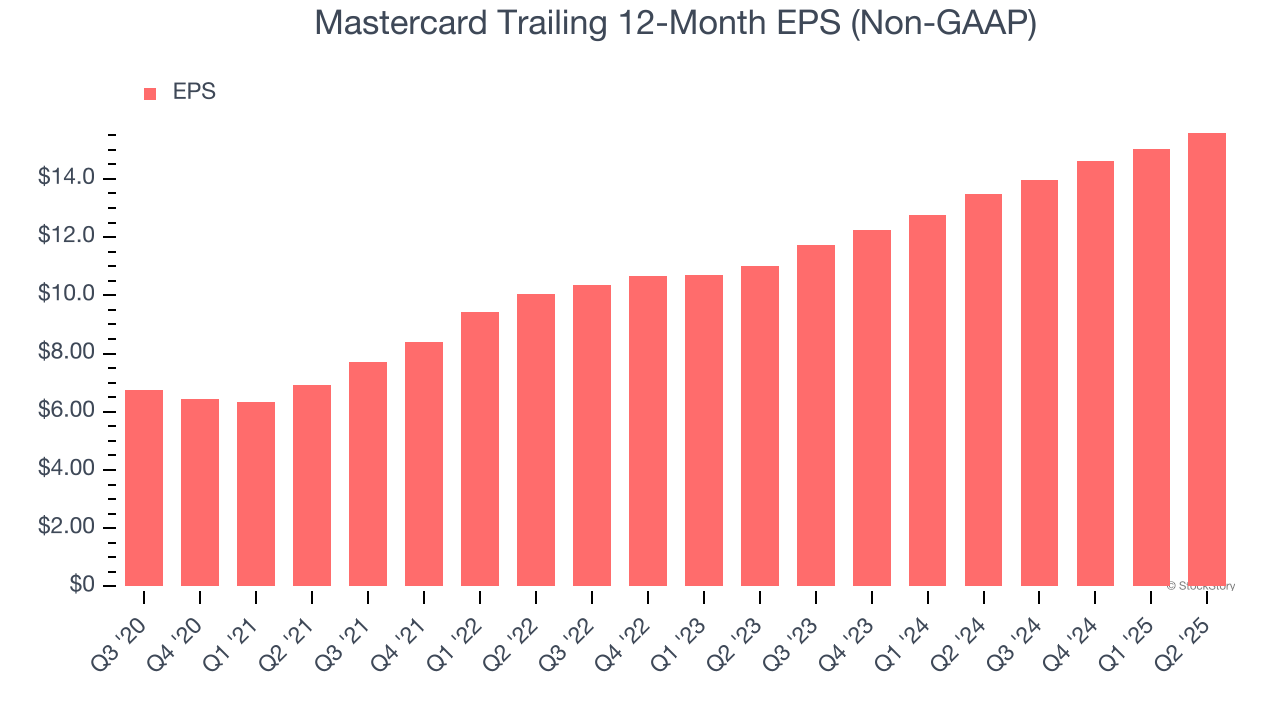

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Mastercard’s EPS grew at a remarkable 17.8% compounded annual growth rate over the last five years, higher than its 13.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

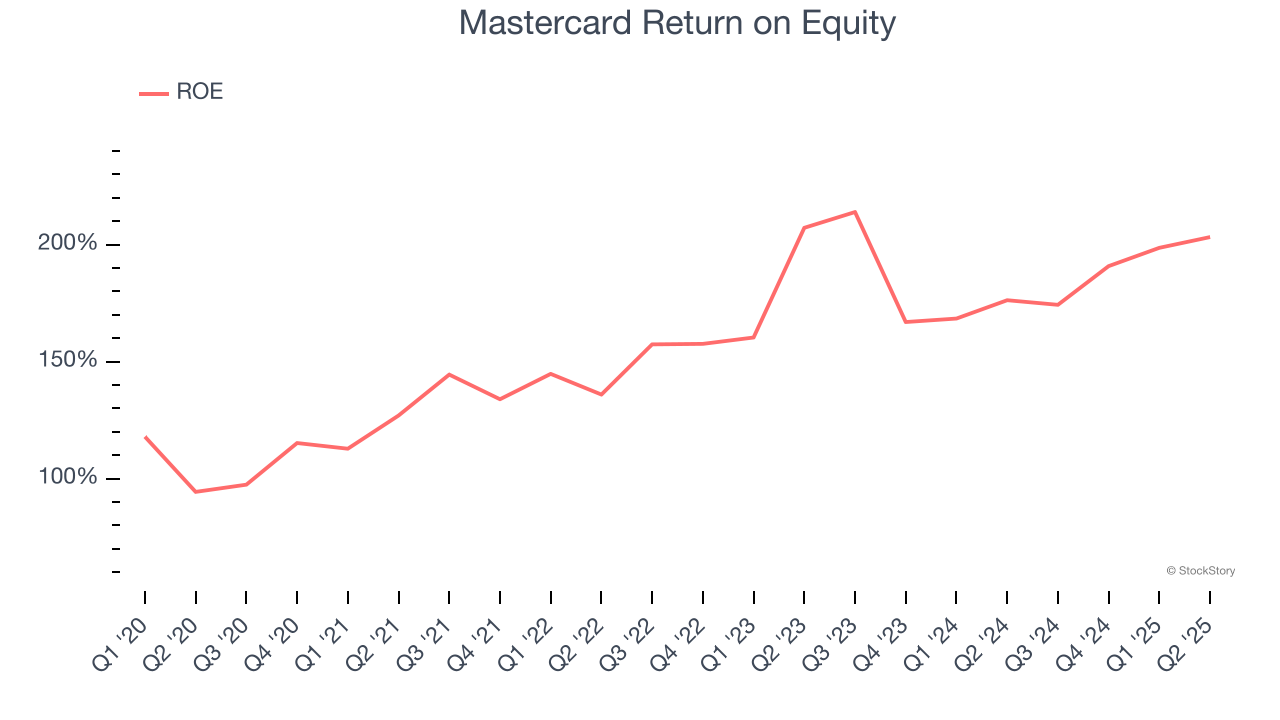

3. Stellar ROE Showcases Lucrative Growth Opportunities

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Mastercard has averaged an ROE of 159%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Mastercard has a strong competitive moat.

Final Judgment

These are just a few reasons why Mastercard is a cream-of-the-crop financials company. With its shares lagging the market recently, the stock trades at 33.2× forward P/E (or $567.50 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.