Let’s dig into the relative performance of AIG (NYSE: AIG) and its peers as we unravel the now-completed Q2 insurance earnings season.

The insurance industry absorbs and diversifies risk, providing financial protection against unforeseen life, health, property, and liability events. Profits come from underwriting—collecting more in premiums than paid in claims—and investing the 'float'. This cyclical industry benefits from 'hard markets' with strong pricing power and higher interest rates that enhance investment income. AI adoption is improving underwriting through sophisticated data analysis and reducing costs via automation. However, 'soft markets' and low rates create headwinds, while the industry faces elevated claims costs from climate catastrophes, inflation, and rising litigation expenses.

The 57 insurance stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.4%.

In light of this news, share prices of the companies have held steady as they are up 4.1% on average since the latest earnings results.

AIG (NYSE: AIG)

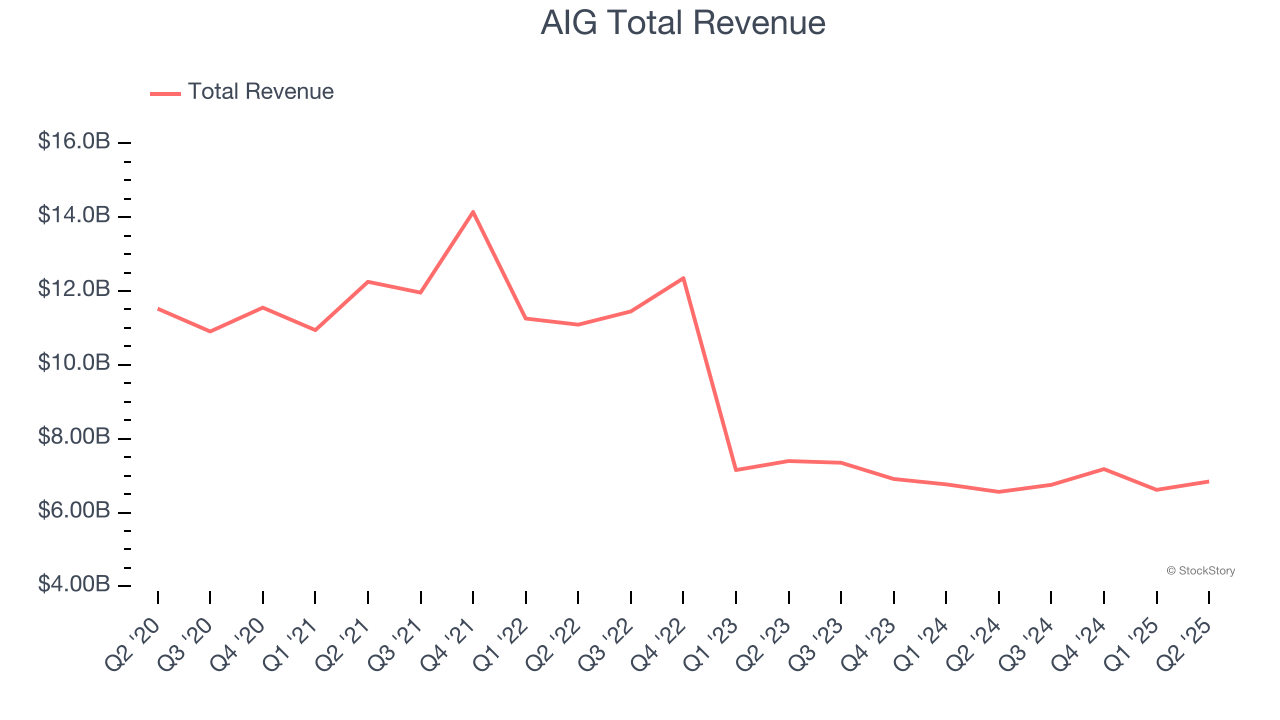

With roots dating back to 1919 when it began as a small insurance agency in Shanghai, China, AIG (NYSE: AIG) is a global insurance organization that provides commercial and personal insurance solutions to businesses and individuals across more than 200 countries.

AIG reported revenues of $6.84 billion, up 4.3% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a beat of analysts’ EPS estimates but a miss of analysts’ book value per share estimates.

Interestingly, the stock is up 1.2% since reporting and currently trades at $79.98.

Read our full report on AIG here, it’s free.

Best Q2: Root (NASDAQ: ROOT)

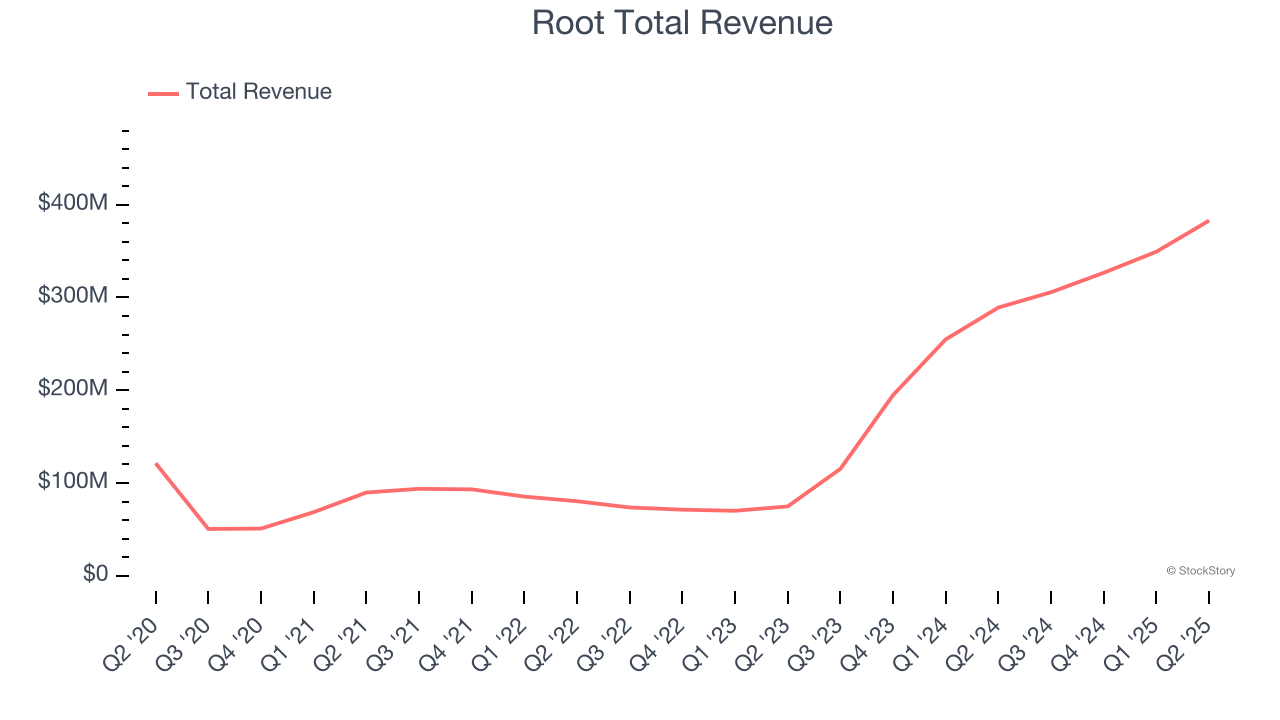

Pioneering a data-driven approach that rewards good driving habits, Root (NASDAQ: ROOT) is a technology-driven auto insurance company that uses mobile apps to acquire customers and data science to price policies based on individual driving behavior.

Root reported revenues of $382.9 million, up 32.4% year on year, outperforming analysts’ expectations by 7.5%. The business had an incredible quarter with a beat of analysts’ EPS and net premiums earned estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 26.1% since reporting. It currently trades at $90.96.

Is now the time to buy Root? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Equitable Holdings (NYSE: EQH)

Tracing its roots back to 1859 as one of America's oldest financial institutions, Equitable Holdings (NYSE: EQH) provides retirement planning, asset management, and life insurance products through its two main franchises, Equitable and AllianceBernstein.

Equitable Holdings reported revenues of $3.80 billion, up 5.1% year on year, falling short of analysts’ expectations by 4.5%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 1.1% since the results and currently trades at $50.36.

Read our full analysis of Equitable Holdings’s results here.

Assurant (NYSE: AIZ)

With roots dating back to 1892 when it was founded by a Civil War veteran, Assurant (NYSE: AIZ) provides specialized insurance products and services that protect major consumer purchases like mobile devices, vehicles, homes, and appliances.

Assurant reported revenues of $3.16 billion, up 8% year on year. This print beat analysts’ expectations by 1.4%. Overall, it was a very strong quarter as it also recorded a beat of analysts’ EPS estimates.

The stock is up 15.5% since reporting and currently trades at $218.36.

Read our full, actionable report on Assurant here, it’s free.

Trupanion (NASDAQ: TRUP)

Born from a vision to help pet owners avoid economic euthanasia when faced with expensive veterinary bills, Trupanion (NASDAQ: TRUP) provides medical insurance for cats and dogs through data-driven, vertically-integrated products priced specifically for each pet's unique characteristics.

Trupanion reported revenues of $353.6 million, up 12.3% year on year. This number topped analysts’ expectations by 1.1%. Overall, it was a very strong quarter as it also logged a solid beat of analysts’ book value per share estimates.

The stock is down 11.4% since reporting and currently trades at $43.26.

Read our full, actionable report on Trupanion here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.