NerdWallet has had an impressive run over the past six months as its shares have beaten the S&P 500 by 8.1%. The stock now trades at $13.51, marking a 20% gain. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy NRDS? Or are investors being too optimistic? Find out in our full research report, it’s free for active Edge members.

Why Does NRDS Stock Spark Debate?

Born from founder Tim Chen's frustration with the lack of transparent credit card information when helping his sister in 2009, NerdWallet (NASDAQ: NRDS) is a digital platform that provides financial guidance to help consumers and small businesses make smarter decisions about credit cards, loans, insurance, and other financial products.

Two Things to Like:

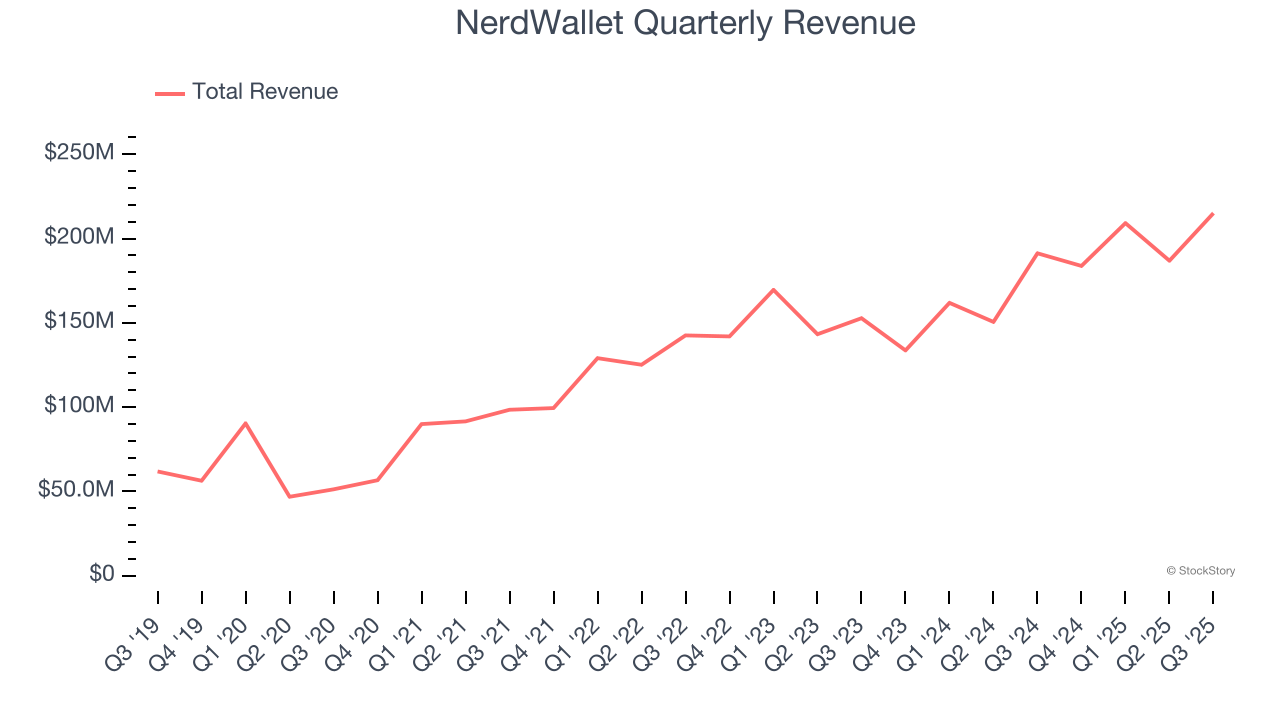

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Luckily, NerdWallet’s revenue grew at an incredible 26.5% compounded annual growth rate over the last five years. Its growth surpassed the average financials company and shows its offerings resonate with customers.

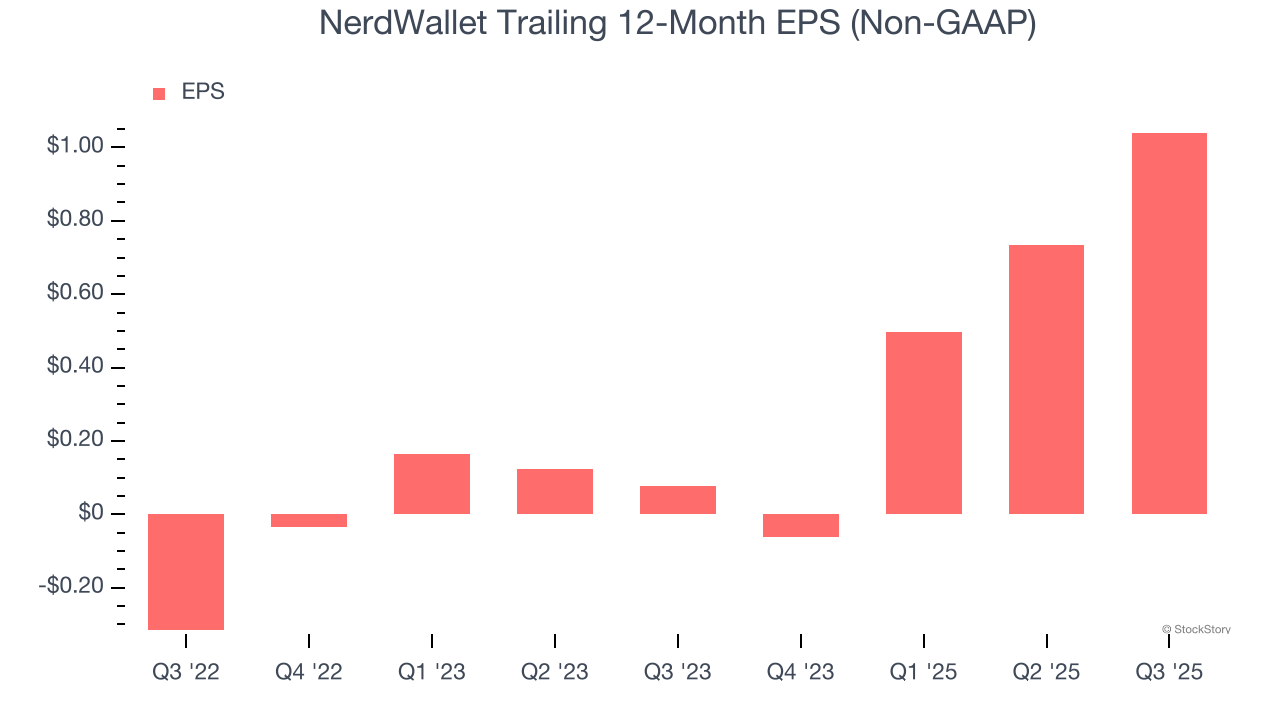

2. Outstanding Long-Term EPS Growth

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

NerdWallet’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

One Reason to be Careful:

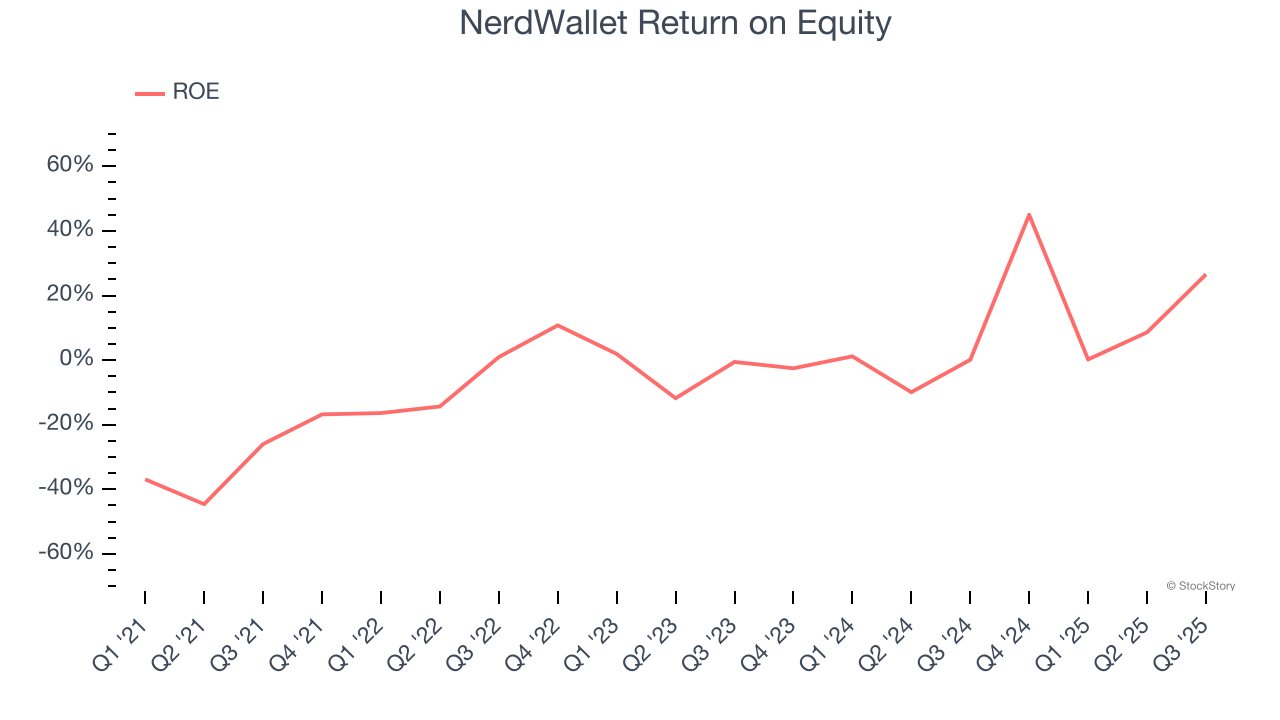

Previous Growth Initiatives Have Lost Money

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, NerdWallet has averaged an ROE of negative 4.4%, a disappointing result relative to the majority of firms putting up 25%+. But we wouldn’t write off NerdWallet given its success in other measures of financial health.

Final Judgment

NerdWallet’s positive characteristics outweigh the negatives, and with its shares beating the market recently, the stock trades at 9.7× forward P/E (or $13.51 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free for active Edge members .

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.