Dime Community Bancshares has been treading water for the past six months, recording a small loss of 0.9% while holding steady at $26.25. The stock also fell short of the S&P 500’s 21% gain during that period.

Is now the time to buy Dime Community Bancshares, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is Dime Community Bancshares Not Exciting?

We're sitting this one out for now. Here are three reasons you should be careful with DCOM and a stock we'd rather own.

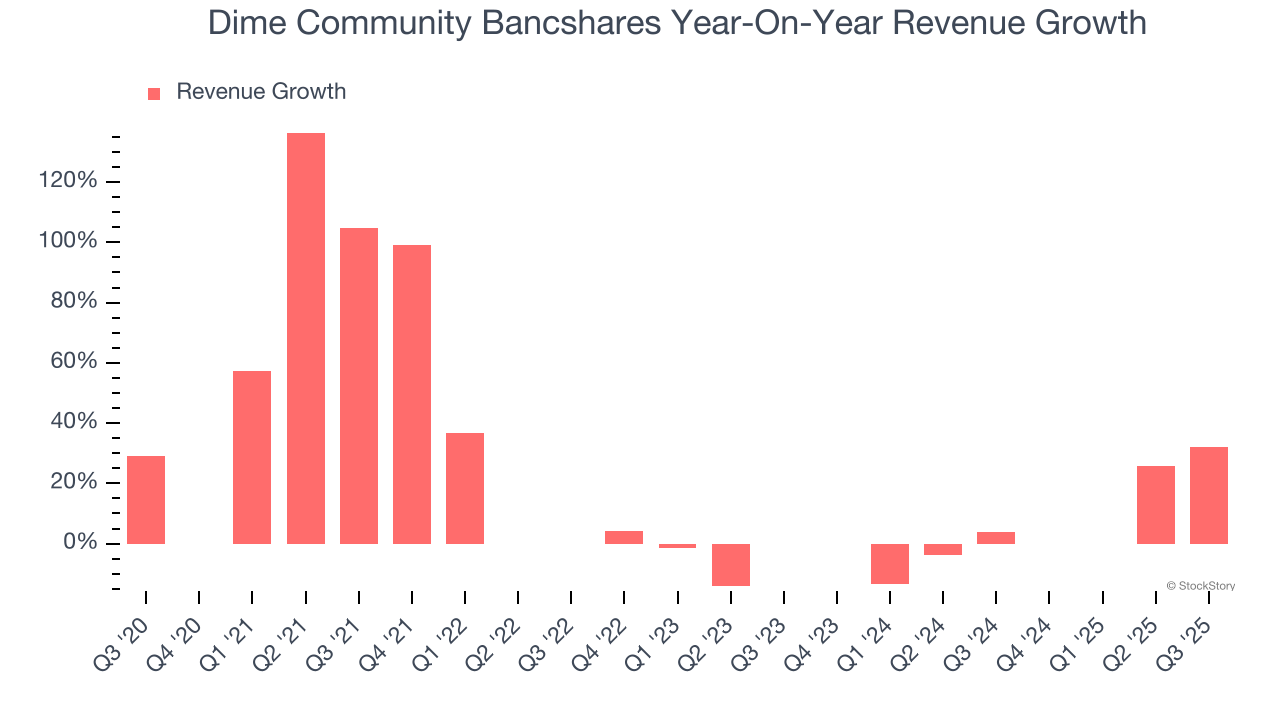

1. Lackluster Revenue Growth

Long-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and market returns. Dime Community Bancshares’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 1.4% over the last two years was well below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

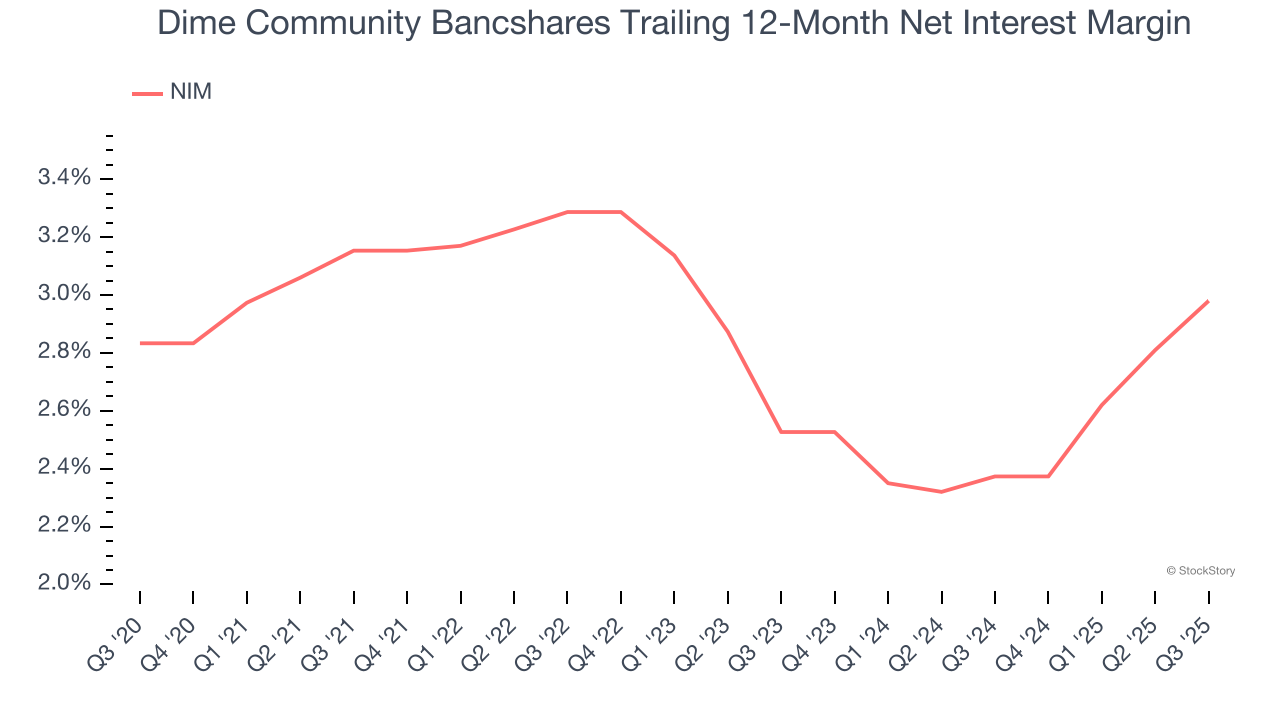

2. Low Net Interest Margin Reveals Weak Loan Book Profitability

Net interest margin (NIM) serves as a critical gauge of a bank's fundamental profitability by showing the spread between interest income and interest expenses. It's essential for understanding whether a firm can sustainably generate returns from its lending operations.

Over the past two years, we can see that Dime Community Bancshares’s net interest margin averaged a poor 2.7%, reflecting its high servicing and capital costs.

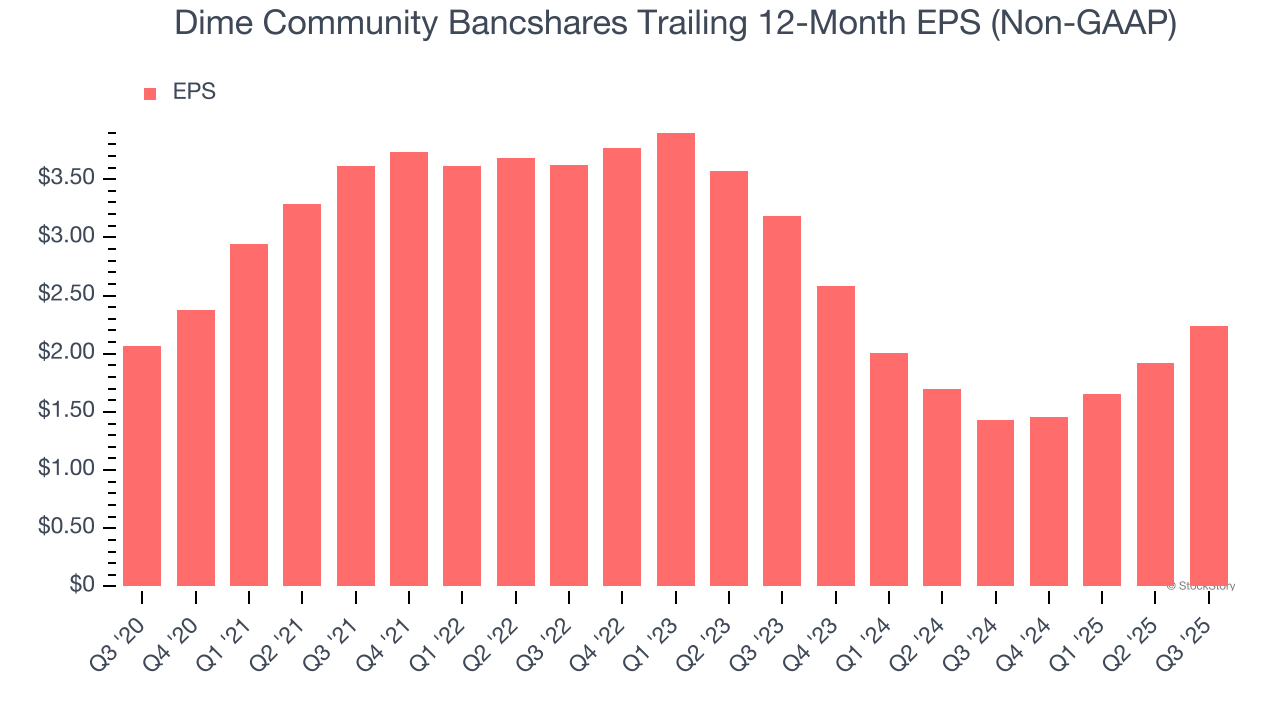

3. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Dime Community Bancshares’s EPS grew at an unimpressive 1.6% compounded annual growth rate over the last five years, lower than its 15.2% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Dime Community Bancshares’s business quality ultimately falls short of our standards. With its shares lagging the market recently, the stock trades at 0.8× forward P/B (or $26.25 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

High-Quality Stocks for All Market Conditions

Fresh US-China trade tensions just tanked stocks—but strong bank earnings are fueling a sharp rebound. Don’t miss the bounce.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.