Aerospace and defense technology solutions provider Astronics Corporation (NASDAQ: ATRO) met Wall Streets revenue expectations in Q3 CY2025, with sales up 3.8% year on year to $211.4 million. The company expects next quarter’s revenue to be around $230 million, close to analysts’ estimates. Its non-GAAP profit of $0.49 per share was 17.6% above analysts’ consensus estimates.

Is now the time to buy Astronics? Find out by accessing our full research report, it’s free for active Edge members.

Astronics (ATRO) Q3 CY2025 Highlights:

- Revenue: $211.4 million vs analyst estimates of $212.1 million (3.8% year-on-year growth, in line)

- Adjusted EPS: $0.49 vs analyst estimates of $0.42 (17.6% beat)

- Adjusted EBITDA: $32.72 million vs analyst estimates of $30.62 million (15.5% margin, 6.8% beat)

- Revenue Guidance for Q4 CY2025 is $230 million at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 10.9%, up from 3.8% in the same quarter last year

- Free Cash Flow Margin: 9.9%, up from 3.2% in the same quarter last year

- Backlog: $646.7 million at quarter end, up 5.7% year on year

- Market Capitalization: $1.74 billion

Company Overview

Integrating power outlets into many Boeing aircraft, Astronics (NASDAQ: ATRO) is a provider of technologies and services to the global aerospace, defense, and electronics industries.

Revenue Growth

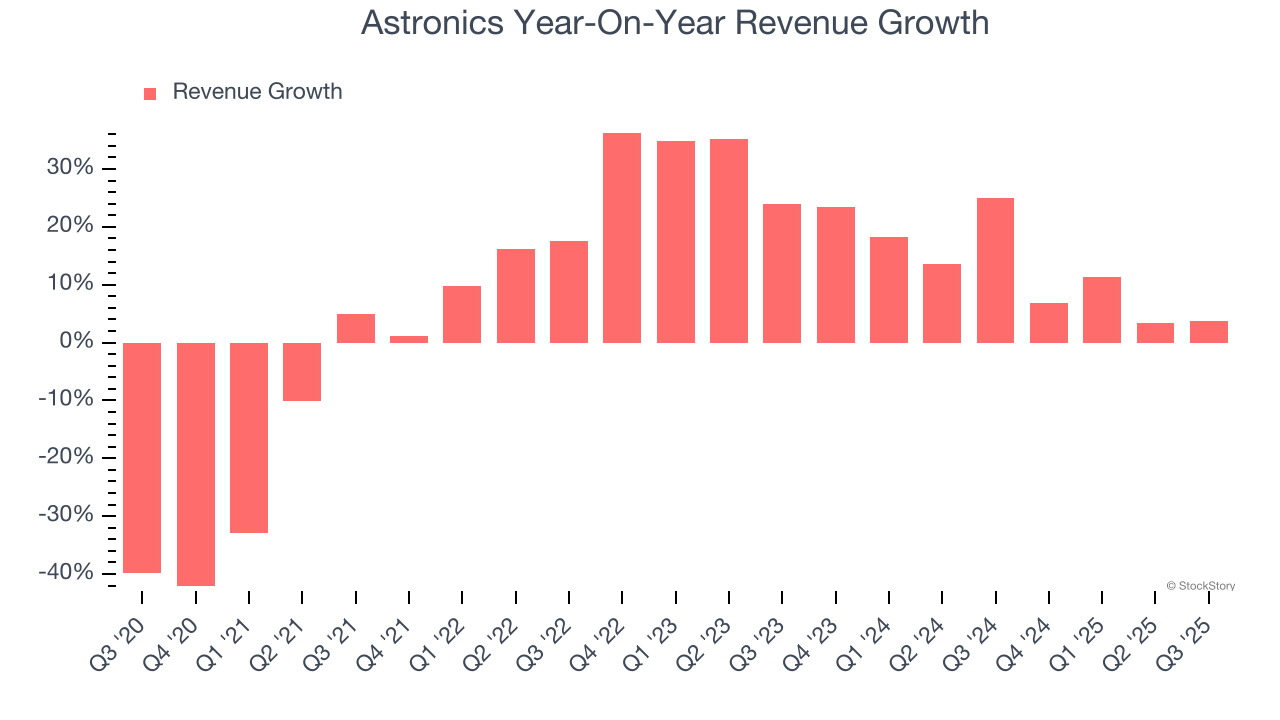

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Astronics’s 7.2% annualized revenue growth over the last five years was mediocre. This wasn’t a great result compared to the rest of the industrials sector, but there are still things to like about Astronics.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Astronics’s annualized revenue growth of 12.9% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

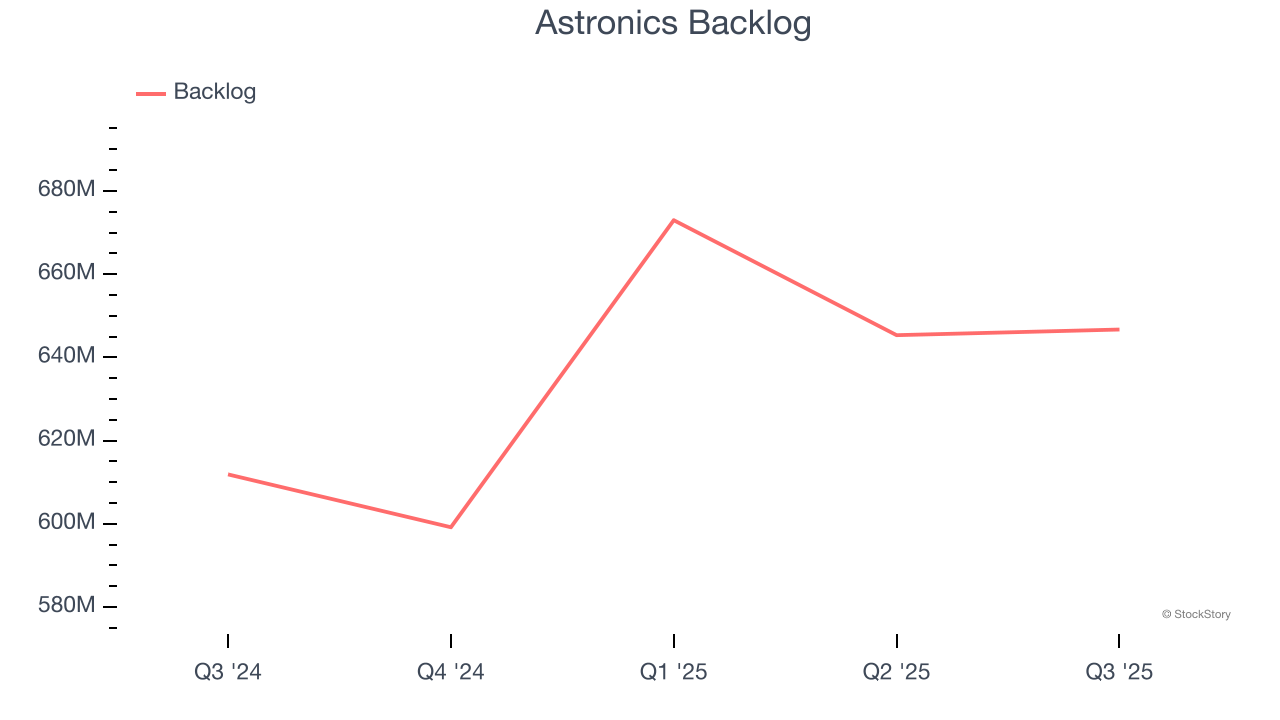

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Astronics’s backlog reached $646.7 million in the latest quarter and averaged 5.7% year-on-year growth over the last two years. Because this number is lower than its revenue growth, we can see the company fulfilled orders at a faster rate than it added new orders to the backlog. This implies Astronics was operating efficiently but raises questions about the health of its sales pipeline.

This quarter, Astronics grew its revenue by 3.8% year on year, and its $211.4 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 10.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.8% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above average for the sector and indicates the market is baking in some success for its newer products and services.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

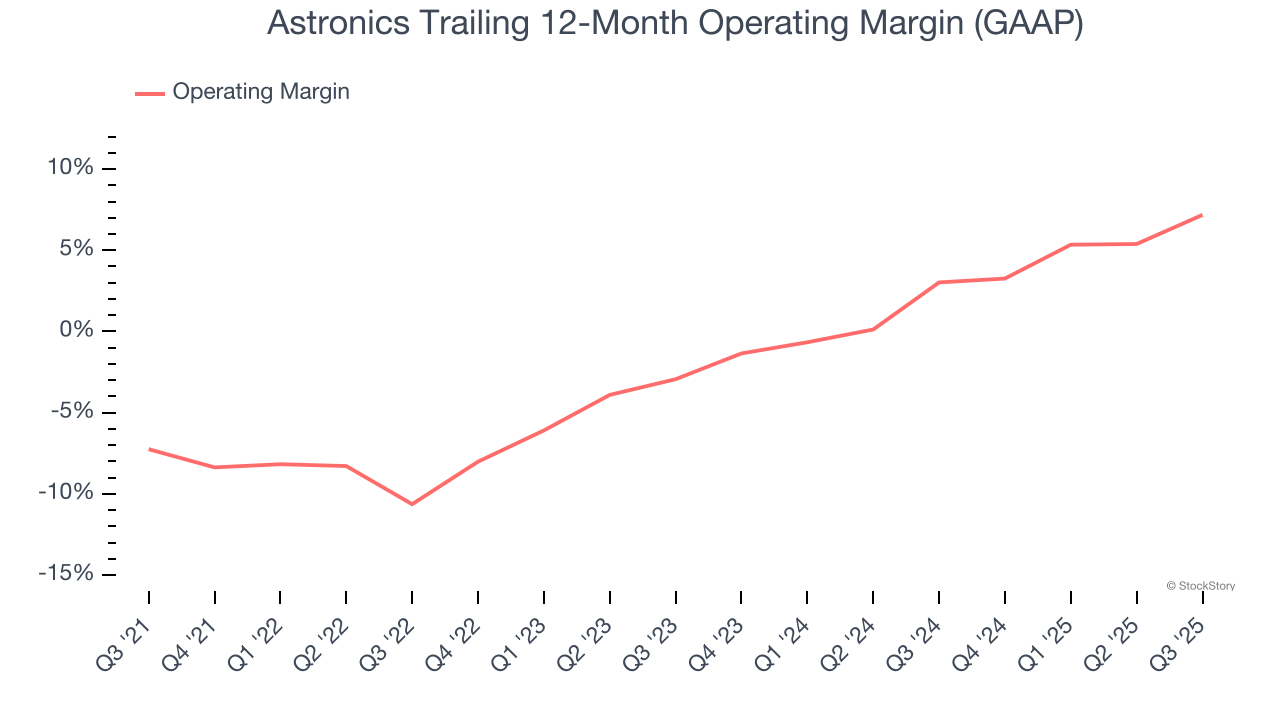

Astronics was roughly breakeven when averaging the last five years of quarterly operating profits, one of the worst outcomes in the industrials sector.

On the plus side, Astronics’s operating margin rose by 14.4 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Astronics generated an operating margin profit margin of 10.9%, up 7.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

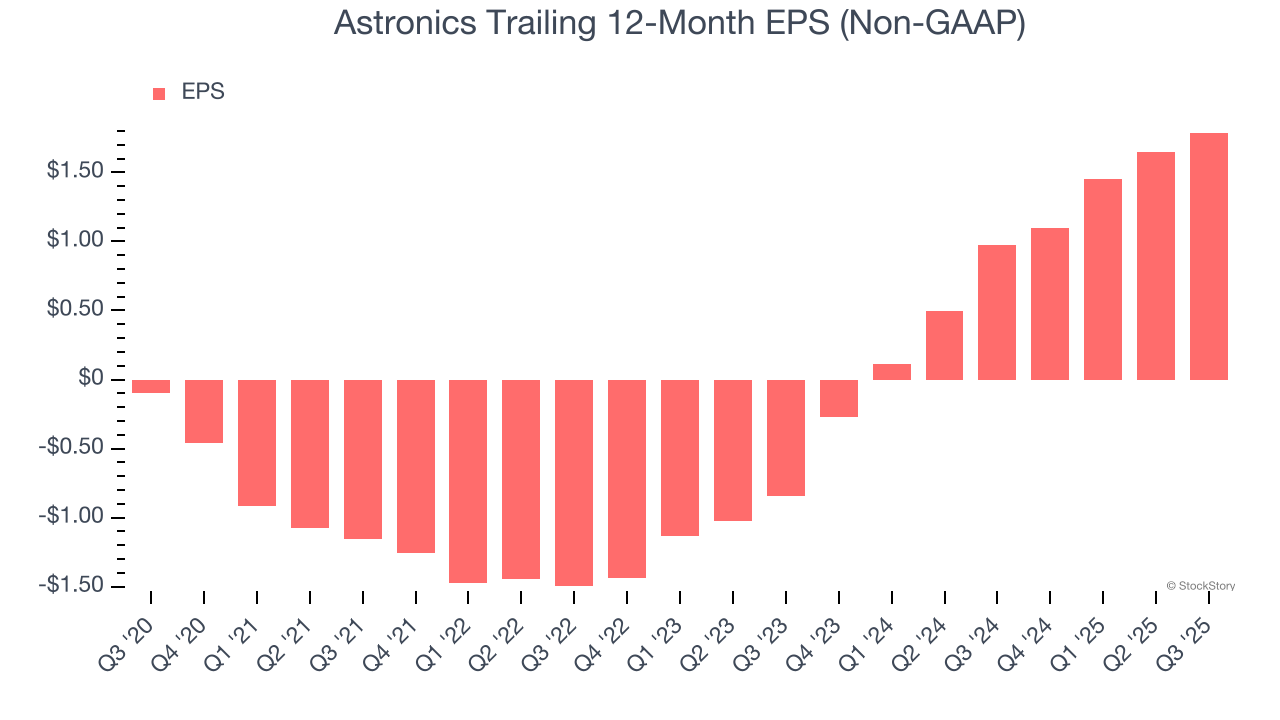

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Astronics’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Astronics, its two-year annual EPS growth of 103% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Astronics reported adjusted EPS of $0.49, up from $0.35 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Astronics’s full-year EPS of $1.79 to grow 11.1%.

Key Takeaways from Astronics’s Q3 Results

We enjoyed seeing Astronics beat analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue was in line. Overall, this print had some key positives. The stock traded up 3.9% to $49.80 immediately after reporting.

Astronics may have had a good quarter, but does that mean you should invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.