Envista has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 18.7% to $20.15 per share while the index has gained 19.8%.

Is now the time to buy Envista, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Do We Think Envista Will Underperform?

We're sitting this one out for now. Here are three reasons there are better opportunities than NVST and a stock we'd rather own.

1. Weak Constant Currency Growth Points to Soft Demand

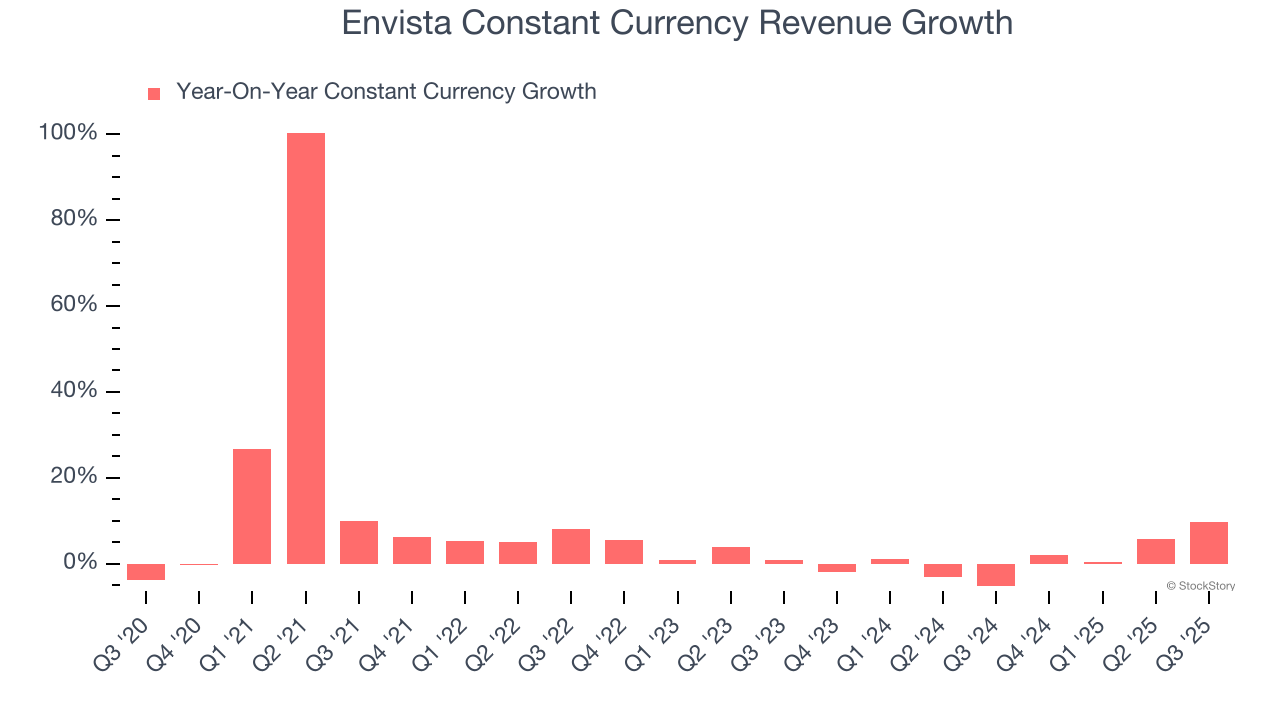

We can better understand Dental Equipment & Technology companies by analyzing their constant currency revenue. This metric excludes currency movements, which are outside of Envista’s control and are not indicative of underlying demand.

Over the last two years, Envista’s constant currency revenue averaged 1% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Previous Growth Initiatives Have Lost Money

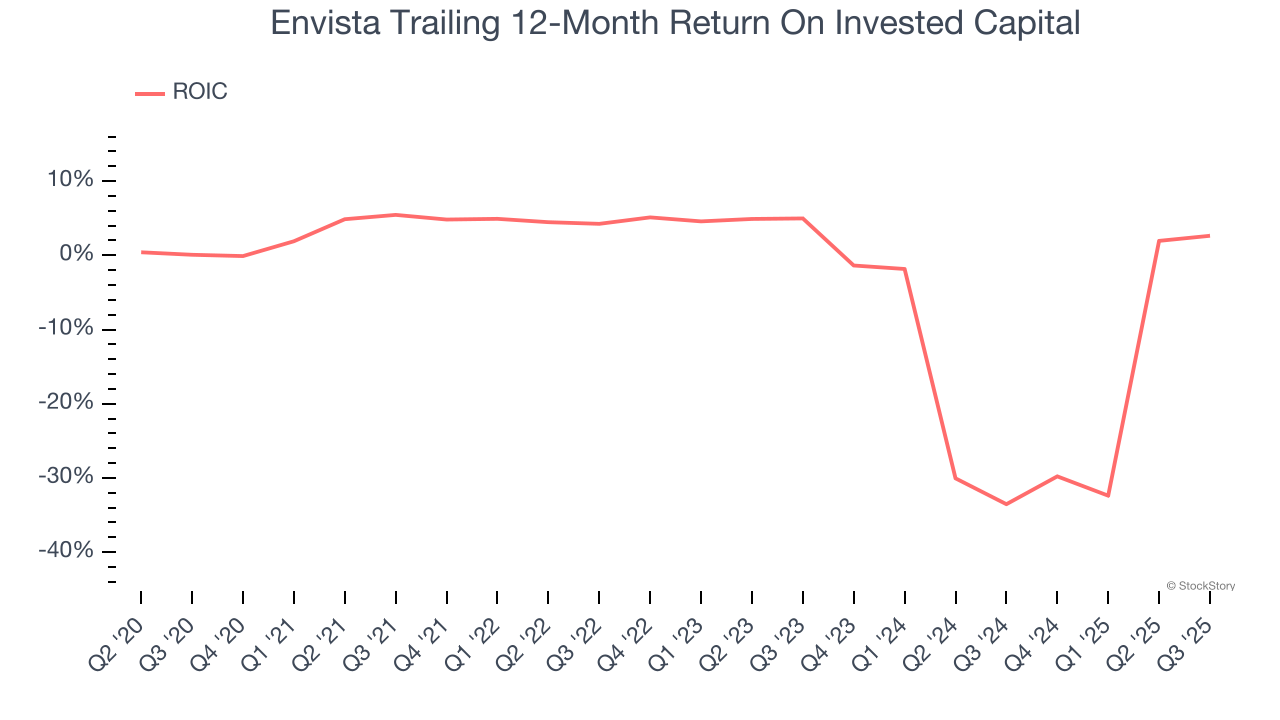

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Envista’s five-year average ROIC was negative 3.2%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

3. New Investments Fail to Bear Fruit as ROIC Declines

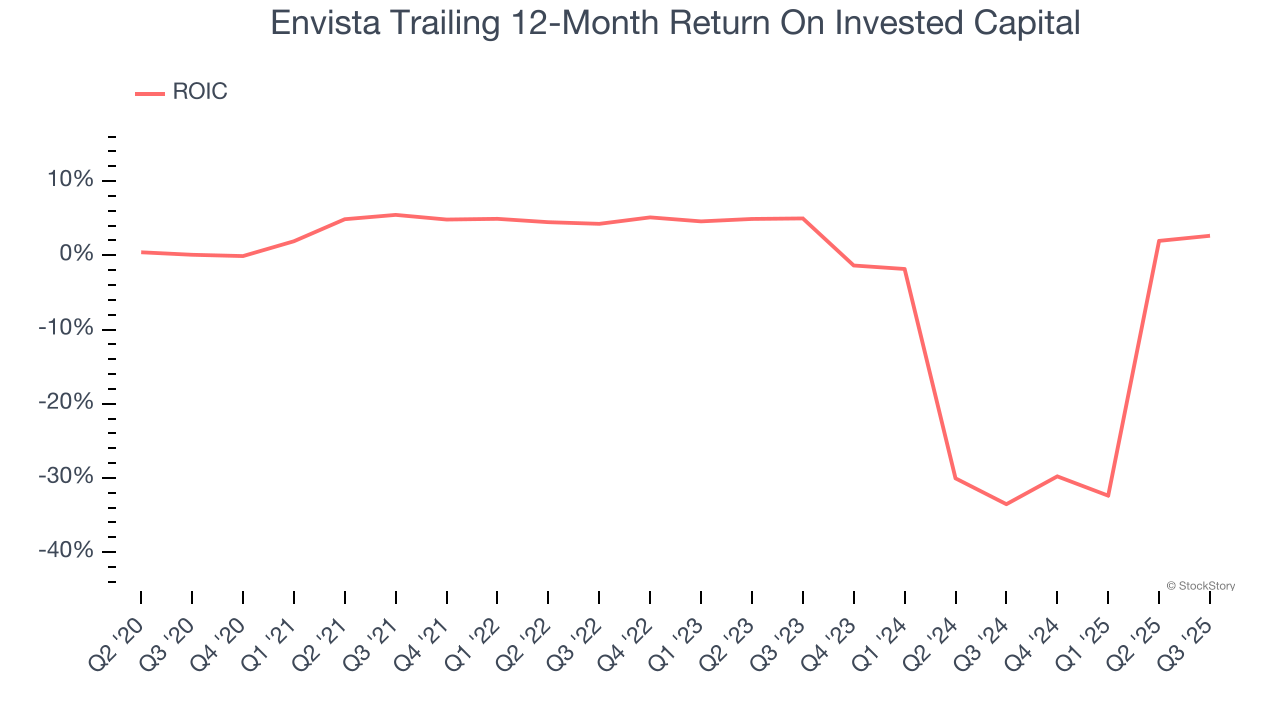

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Envista’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Envista doesn’t pass our quality test. That said, the stock currently trades at 16.5× forward P/E (or $20.15 per share). At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere. We’d recommend looking at the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of Envista

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.