Casual restaurant chain Noodles & Company (NASDAQ: NDLS) reported Q3 CY2025 results beating Wall Street’s revenue expectations, but sales were flat year on year at $122.1 million. The company’s full-year revenue guidance of $493.5 million at the midpoint came in 0.8% above analysts’ estimates. Its non-GAAP loss of $0.10 per share was in line with analysts’ consensus estimates.

Is now the time to buy Noodles? Find out by accessing our full research report, it’s free for active Edge members.

Noodles (NDLS) Q3 CY2025 Highlights:

- Revenue: $122.1 million vs analyst estimates of $119.8 million (flat year on year, 1.9% beat)

- Adjusted EPS: -$0.10 vs analyst estimates of -$0.11 (in line)

- Adjusted EBITDA: $6.50 million vs analyst estimates of $5.78 million (5.3% margin, 12.4% beat)

- The company slightly lifted its revenue guidance for the full year to $493.5 million at the midpoint from $491 million

- Operating Margin: -5.2%, down from -1.8% in the same quarter last year

- Locations: 435 at quarter end, down from 471 in the same quarter last year

- Same-Store Sales rose 4% year on year (-3.3% in the same quarter last year)

- Market Capitalization: $31.74 million

Company Overview

Offering pasta, mac and cheese, pad thai, and more, Noodles & Company (NASDAQ: NDLS) is a casual restaurant chain that serves all manner of noodles from around the world.

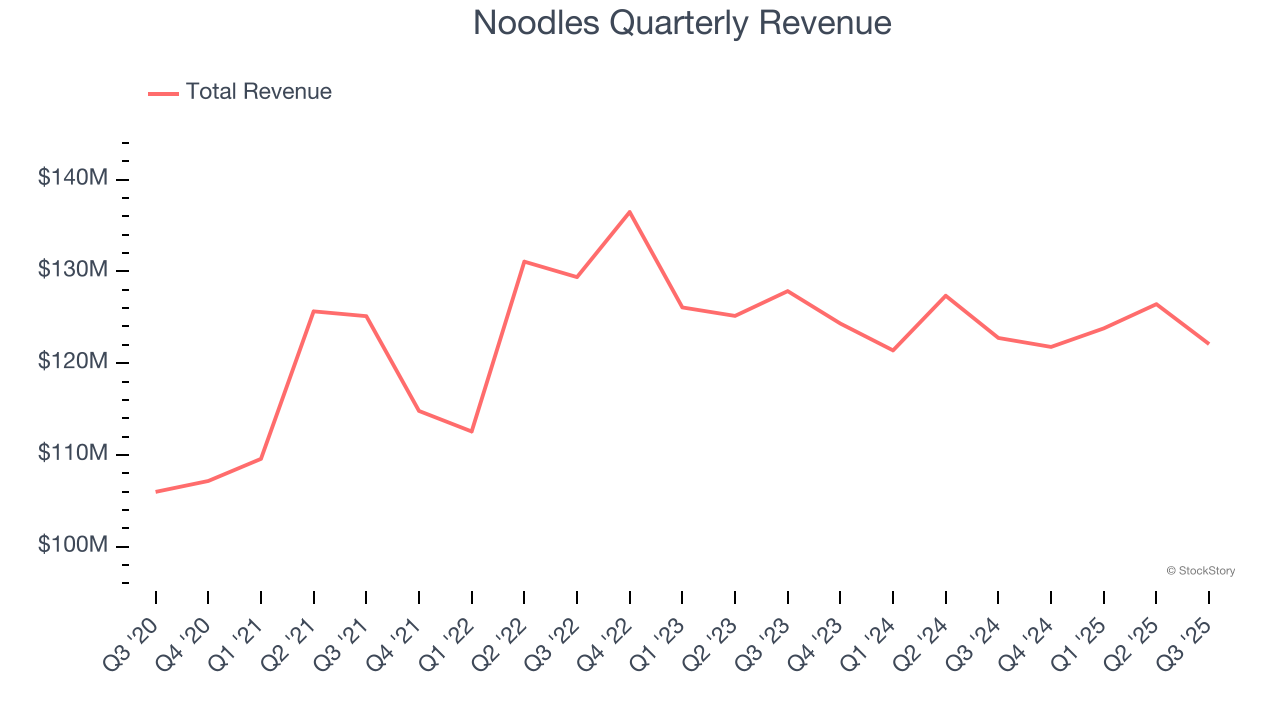

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $494.1 million in revenue over the past 12 months, Noodles is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

As you can see below, Noodles’s sales grew at a weak 1.1% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it didn’t open many new restaurants.

This quarter, Noodles’s $122.1 million of revenue was flat year on year but beat Wall Street’s estimates by 1.9%.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Restaurant Performance

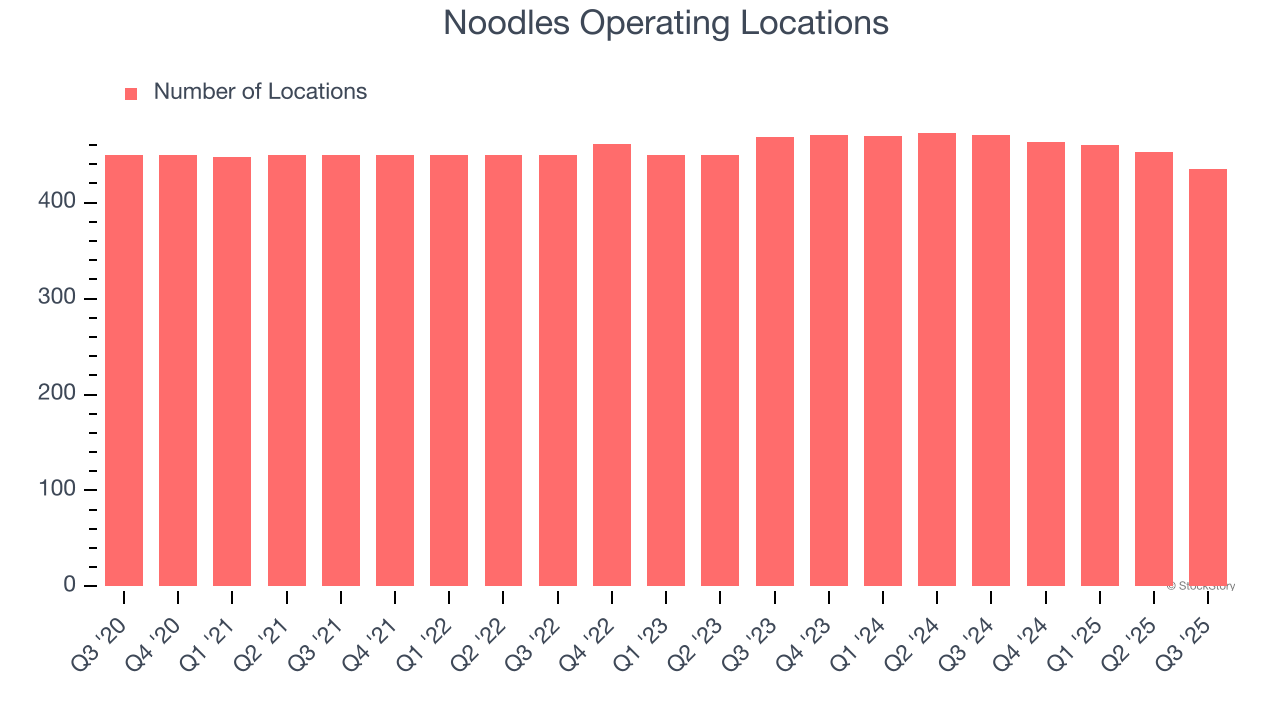

Number of Restaurants

The number of dining locations a restaurant chain operates is a critical driver of how quickly company-level sales can grow.

Noodles listed 435 locations in the latest quarter and has kept its restaurant count flat over the last two years while other restaurant businesses have opted for growth.

When a chain doesn’t open many new restaurants, it usually means there’s stable demand for its meals and it’s focused on improving operational efficiency to increase profitability.

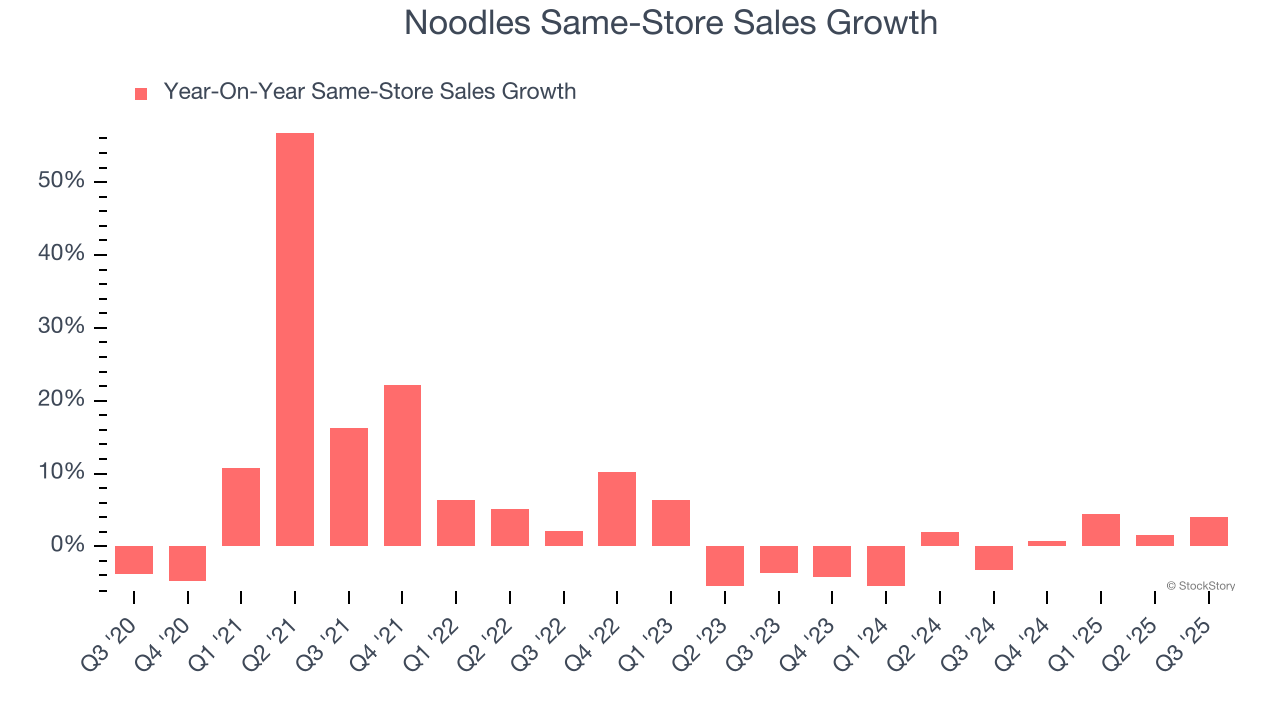

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

Noodles’s demand within its existing dining locations has barely increased over the last two years as its same-store sales were flat. This performance isn’t ideal, and we’d be skeptical if Noodles starts opening new restaurants to artificially boost revenue growth.

In the latest quarter, Noodles’s same-store sales rose 4% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Noodles’s Q3 Results

We were impressed by how significantly Noodles blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 10.6% to $0.74 immediately following the results.

Noodles may have had a good quarter, but does that mean you should invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.