Upscale restaurant company The One Group Hospitality (NASDAQ: STKS) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 7.1% year on year to $180.2 million. The company’s full-year revenue guidance of $822.5 million at the midpoint came in 1.5% below analysts’ estimates. Its GAAP loss of $2.75 per share was significantly below analysts’ consensus estimates.

Is now the time to buy The ONE Group? Find out by accessing our full research report, it’s free for active Edge members.

The ONE Group (STKS) Q3 CY2025 Highlights:

- Revenue: $180.2 million vs analyst estimates of $191.1 million (7.1% year-on-year decline, 5.7% miss)

- EPS (GAAP): -$2.75 vs analyst estimates of -$0.44 (significant miss)

- Adjusted EBITDA: $10.56 million vs analyst estimates of $16.75 million (5.9% margin, 37% miss)

- The company dropped its revenue guidance for the full year to $822.5 million at the midpoint from $852.5 million, a 3.5% decrease

- EBITDA guidance for the full year is $97.5 million at the midpoint, in line with analyst expectations

- Operating Margin: -4.4%, down from 2.1% in the same quarter last year

- Same-Store Sales fell 5.9% year on year (8.8% in the same quarter last year)

- Market Capitalization: $65.01 million

Company Overview

Doubling as a hospitality services provider for hotels and resorts, The One Group Hospitality (NASDAQ: STKS) is an upscale restaurant company that operates STK Steakhouse and Kona Grill.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $820.6 million in revenue over the past 12 months, The ONE Group is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can grow faster because it has more white space to build new restaurants.

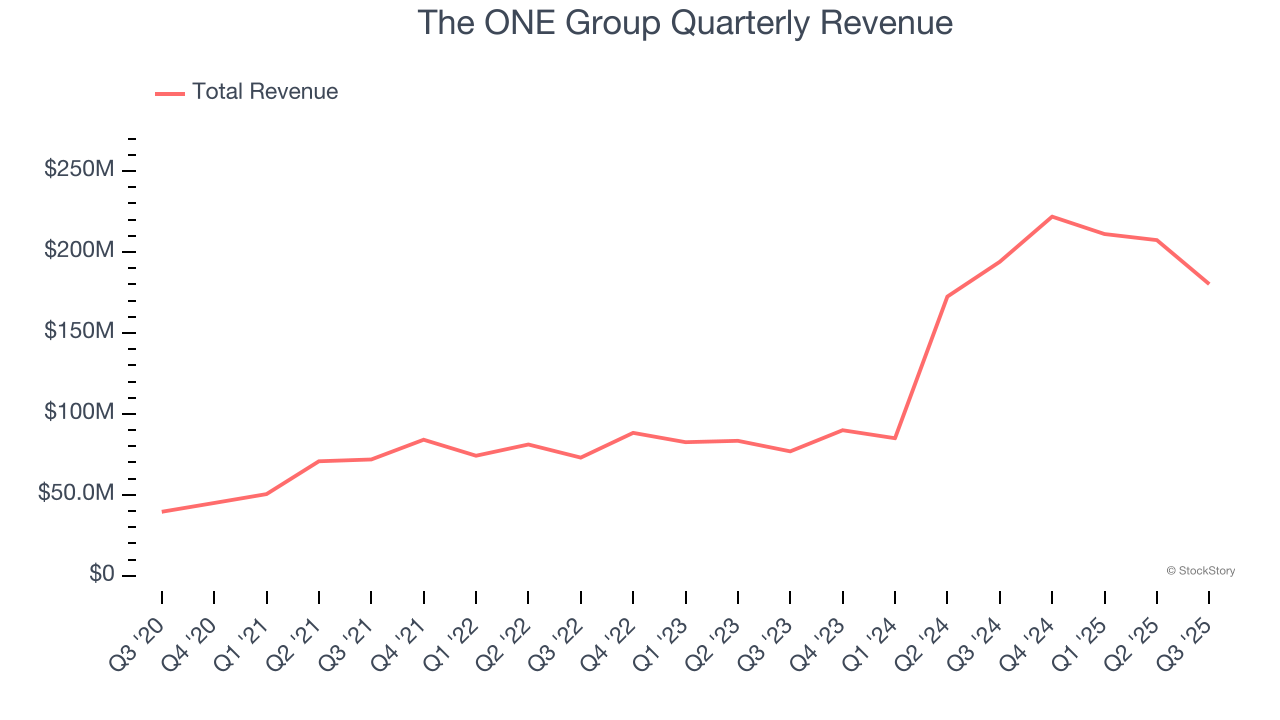

As you can see below, The ONE Group’s 43.4% annualized revenue growth over the last six years (we compare to 2019 to normalize for COVID-19 impacts) was incredible. This shows it had high demand, a useful starting point for our analysis.

This quarter, The ONE Group missed Wall Street’s estimates and reported a rather uninspiring 7.1% year-on-year revenue decline, generating $180.2 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 5.3% over the next 12 months, a deceleration versus the last six years. This projection is underwhelming and implies its menu offerings will face some demand challenges.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Restaurant Performance

Number of Restaurants

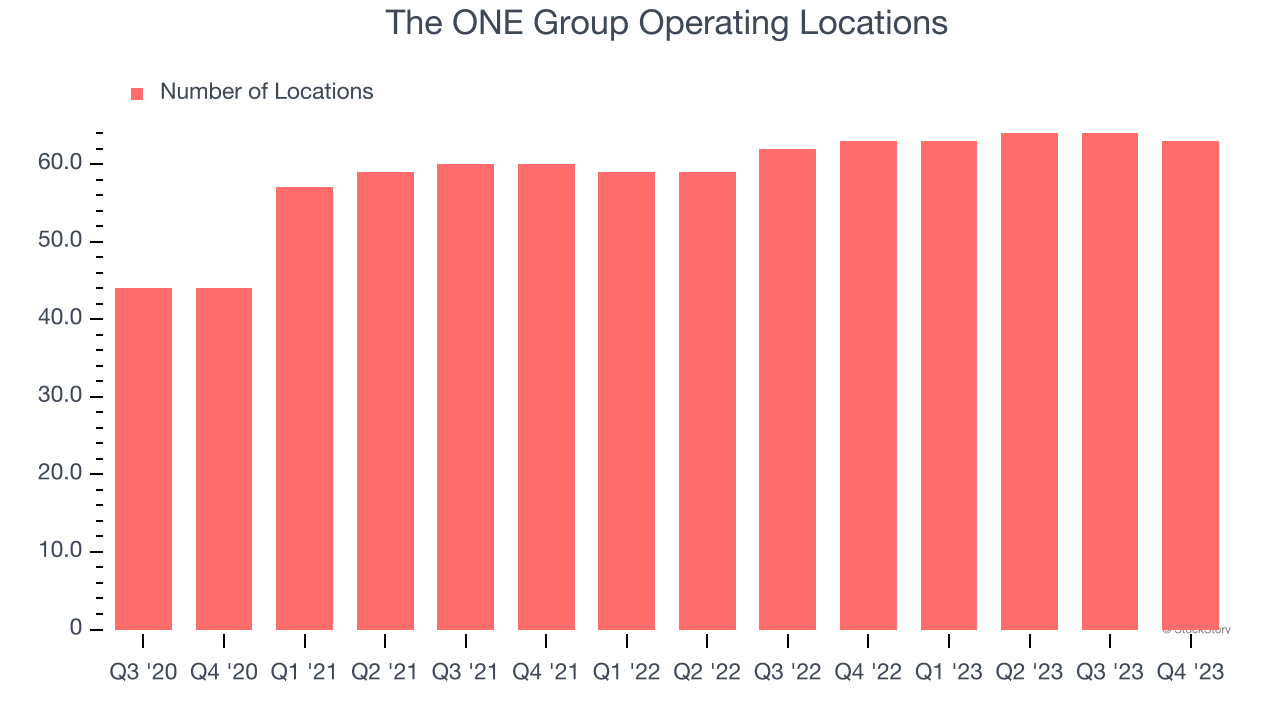

Over the last two years, The ONE Group has kept its restaurant count flat while other restaurant businesses have opted for growth.

When a chain doesn’t open many new restaurants, it usually means there’s stable demand for its meals and it’s focused on improving operational efficiency to increase profitability.

Note that The ONE Group reports its restaurant count intermittently, so some data points are missing in the chart below.

Same-Store Sales

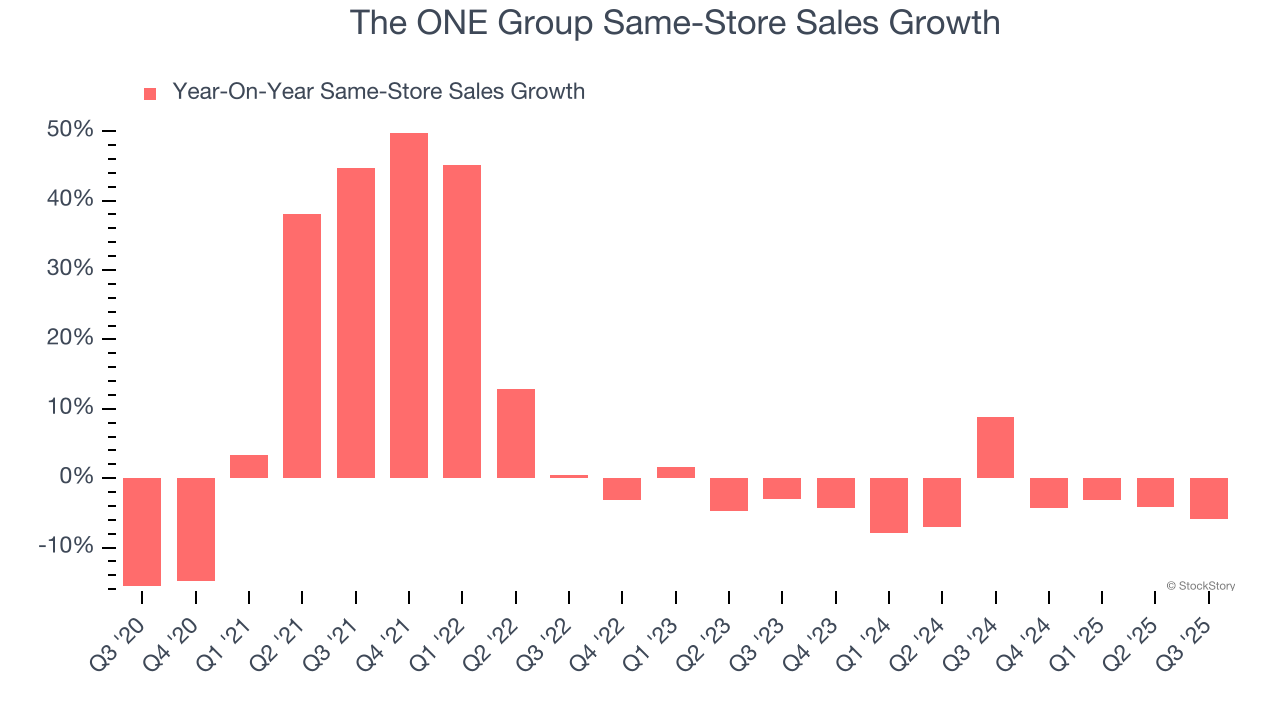

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at restaurants open for at least a year.

The ONE Group’s demand has been shrinking over the last two years as its same-store sales have averaged 3.5% annual declines. This performance isn’t ideal, and we’d be concerned if The ONE Group starts opening new restaurants to artificially boost revenue growth.

In the latest quarter, The ONE Group’s same-store sales fell by 5.9% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from The ONE Group’s Q3 Results

We struggled to find many positives in these results, as its revenue, EPS, and EBITDA fell short of Wall Street’s estimates. The company also lowered its full-year revenue guidance. Overall, this quarter could have been better, but the stock traded up 2.1% to $1.99 immediately after reporting.

Is The ONE Group an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.