Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Applied Digital (NASDAQ: APLD) and the best and worst performers in the it services & other tech industry.

The IT and tech services subsector is poised for growth as businesses accelerate cloud adoption, AI-driven network automation, and edge computing deployments. While these seem like big, nebulous trends, they require very real products like switches and firewalls as well as implementation services. On the other hand, challenges on the horizon include intensifying competition from cloud-native networking providers, regulatory scrutiny over data privacy and cybersecurity, and potential supply chain constraints for networking hardware. While AI and automation will enhance network efficiency and security, they also introduce risks related to algorithmic bias, compliance complexity, and increased energy consumption.

The 20 it services & other tech stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 2.7% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 2.9% on average since the latest earnings results.

Applied Digital (NASDAQ: APLD)

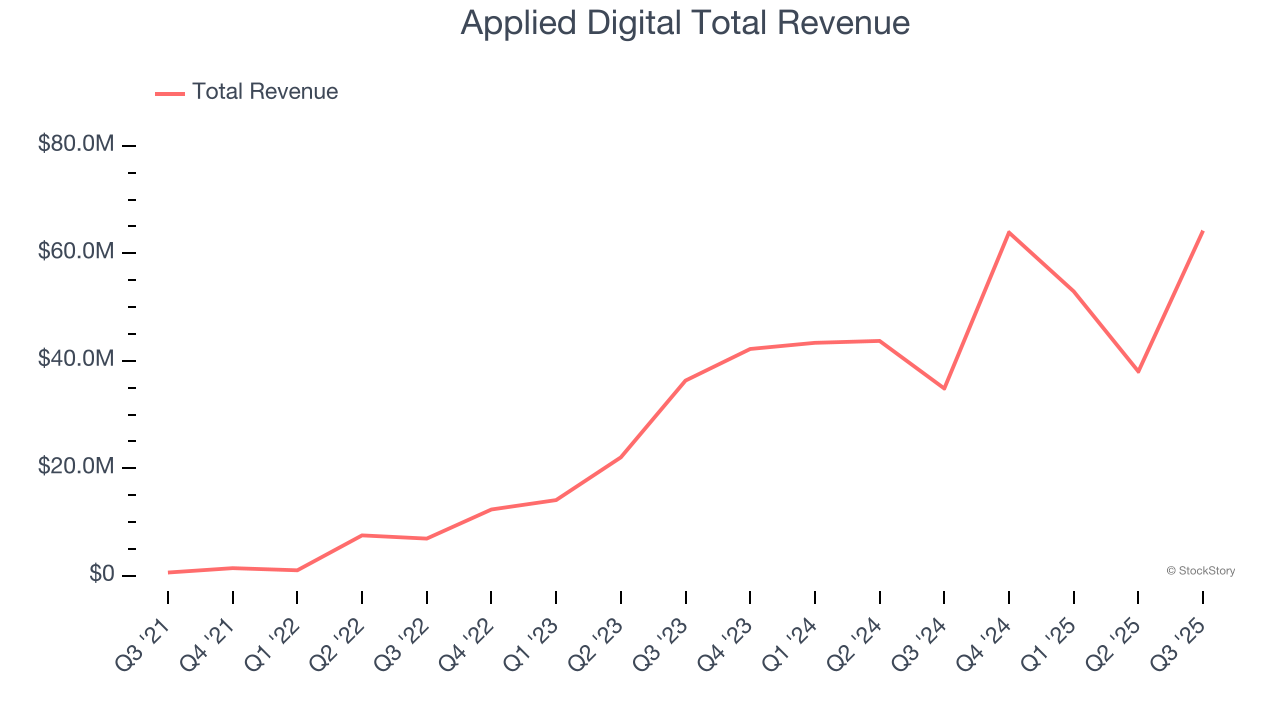

Pivoting from its origins in cryptocurrency mining to become a key player in the AI infrastructure boom, Applied Digital (NASDAQ: APLD) designs and operates specialized data centers that provide high-performance computing infrastructure for artificial intelligence and blockchain applications.

Applied Digital reported revenues of $64.22 million, up 84.3% year on year. This print exceeded analysts’ expectations by 17.6%. Overall, it was an incredible quarter for the company with a beat of analysts’ EPS estimates and an impressive beat of analysts’ revenue estimates.

“We feel this third lease validates our platform and execution, positioning Applied Digital as a trusted strategic partner to the world’s largest technology companies,” said Wes Cummins, Chairman and CEO of Applied Digital.

Interestingly, the stock is up 3.5% since reporting and currently trades at $30.43.

Is now the time to buy Applied Digital? Access our full analysis of the earnings results here, it’s free for active Edge members.

IonQ (NYSE: IONQ)

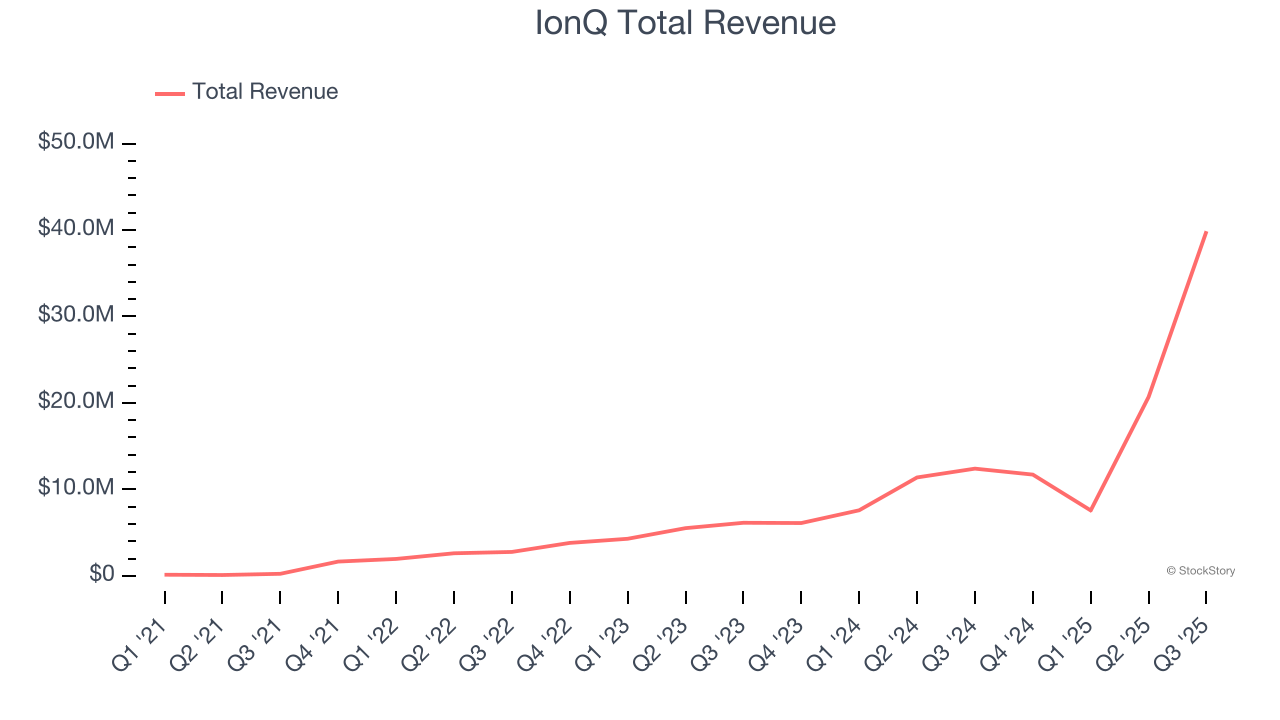

Founded by quantum physics pioneers from the University of Maryland and Duke University in 2015, IonQ (NYSE: IONQ) develops quantum computers that process information using trapped ions to solve complex computational problems beyond the capabilities of traditional computers.

IonQ reported revenues of $39.87 million, up 222% year on year, outperforming analysts’ expectations by 47.8%. The business had an incredible quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ revenue estimates.

IonQ pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 5.5% since reporting. It currently trades at $52.38.

Is now the time to buy IonQ? Access our full analysis of the earnings results here, it’s free for active Edge members.

Slowest Q3: Grid Dynamics (NASDAQ: GDYN)

With engineering centers across the Americas, Europe, and India serving Fortune 1000 companies, Grid Dynamics (NASDAQ: GDYN) provides technology consulting, engineering, and analytics services to help large enterprises modernize their technology systems and business processes.

Grid Dynamics reported revenues of $104.2 million, up 19.1% year on year, in line with analysts’ expectations. It was a softer quarter as it posted revenue guidance for next quarter missing analysts’ expectations significantly and EPS in line with analysts’ estimates.

Interestingly, the stock is up 29.3% since the results and currently trades at $9.83.

Read our full analysis of Grid Dynamics’s results here.

Xerox (NASDAQ: XRX)

Pioneering the modern office copier and inventing technologies like Ethernet and the laser printer, Xerox (NASDAQ: XRX) provides document management systems, printing technology, and workplace solutions to businesses of all sizes across the globe.

Xerox reported revenues of $1.96 billion, up 28.3% year on year. This result lagged analysts' expectations by 3.2%. Zooming out, it was a satisfactory quarter as it also recorded a beat of analysts’ EPS estimates but a significant miss of analysts’ revenue estimates.

The stock is down 23.5% since reporting and currently trades at $2.63.

Read our full, actionable report on Xerox here, it’s free for active Edge members.

Accenture (NYSE: ACN)

With a workforce of approximately 774,000 people serving clients in more than 120 countries, Accenture (NYSE: ACN) is a professional services firm that helps organizations transform their businesses through consulting, technology, operations, and digital services.

Accenture reported revenues of $17.6 billion, up 7.3% year on year. This print beat analysts’ expectations by 1.3%. Aside from that, it was a mixed quarter as it also logged a narrow beat of analysts’ revenue estimates but a slight miss of analysts’ full-year EPS guidance estimates.

The stock is up 13.4% since reporting and currently trades at $271.70.

Read our full, actionable report on Accenture here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.