Over the past six months, Grid Dynamics’s stock price fell to $9.70. Shareholders have lost 15.7% of their capital, which is disappointing considering the S&P 500 has climbed by 13%. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Given the weaker price action, is now the time to buy GDYN? Find out in our full research report, it’s free for active Edge members.

Why Does GDYN Stock Spark Debate?

With engineering centers across the Americas, Europe, and India serving Fortune 1000 companies, Grid Dynamics (NASDAQ: GDYN) provides technology consulting, engineering, and analytics services to help large enterprises modernize their technology systems and business processes.

Two Positive Attributes:

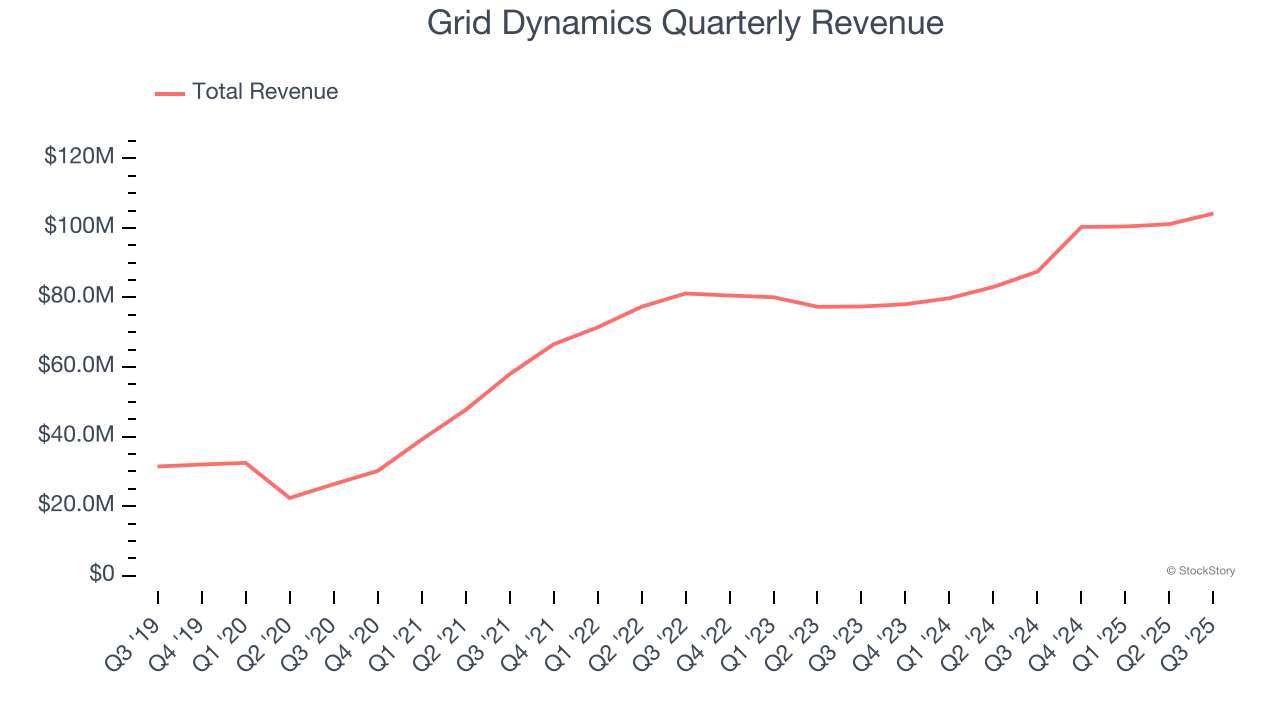

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Grid Dynamics grew its sales at an incredible 29.1% compounded annual growth rate. Its growth surpassed the average business services company and shows its offerings resonate with customers.

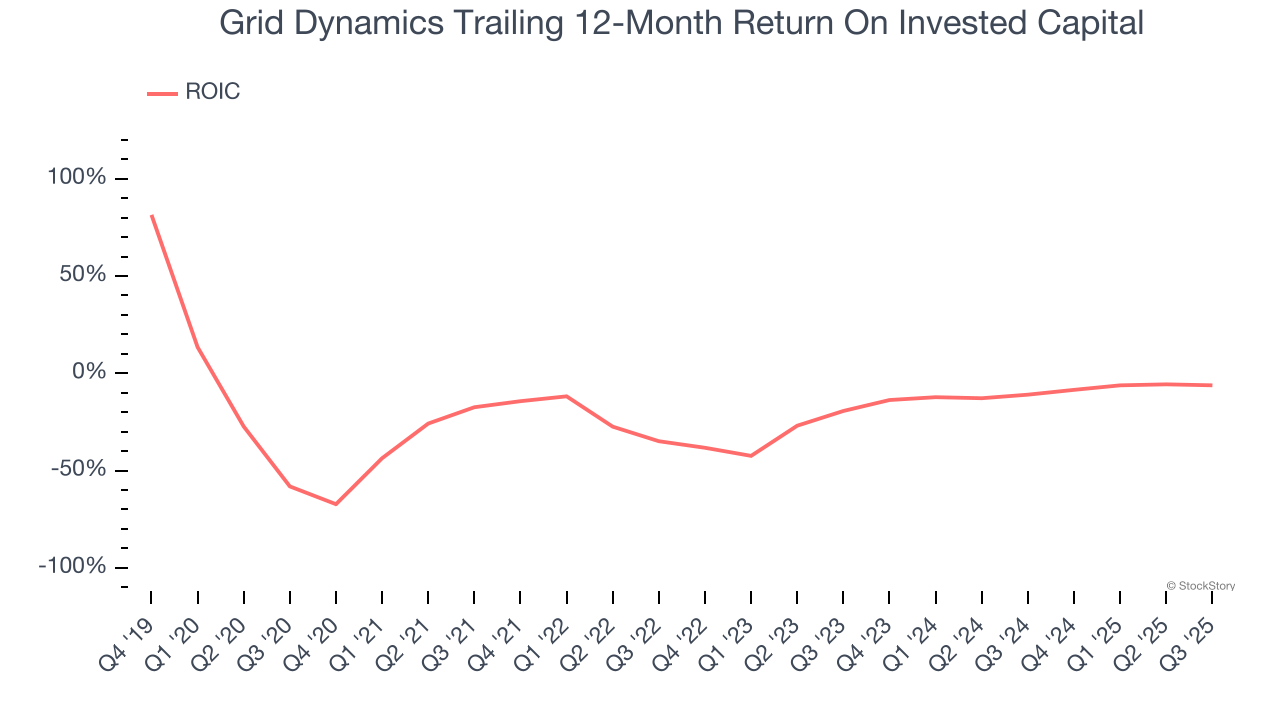

2. New Investments Bear Fruit as ROIC Jumps

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Grid Dynamics’s ROIC has increased significantly over the last few years. its rising ROIC is a good sign and could suggest its competitive advantage or profitable growth opportunities are expanding.

One Reason to be Careful:

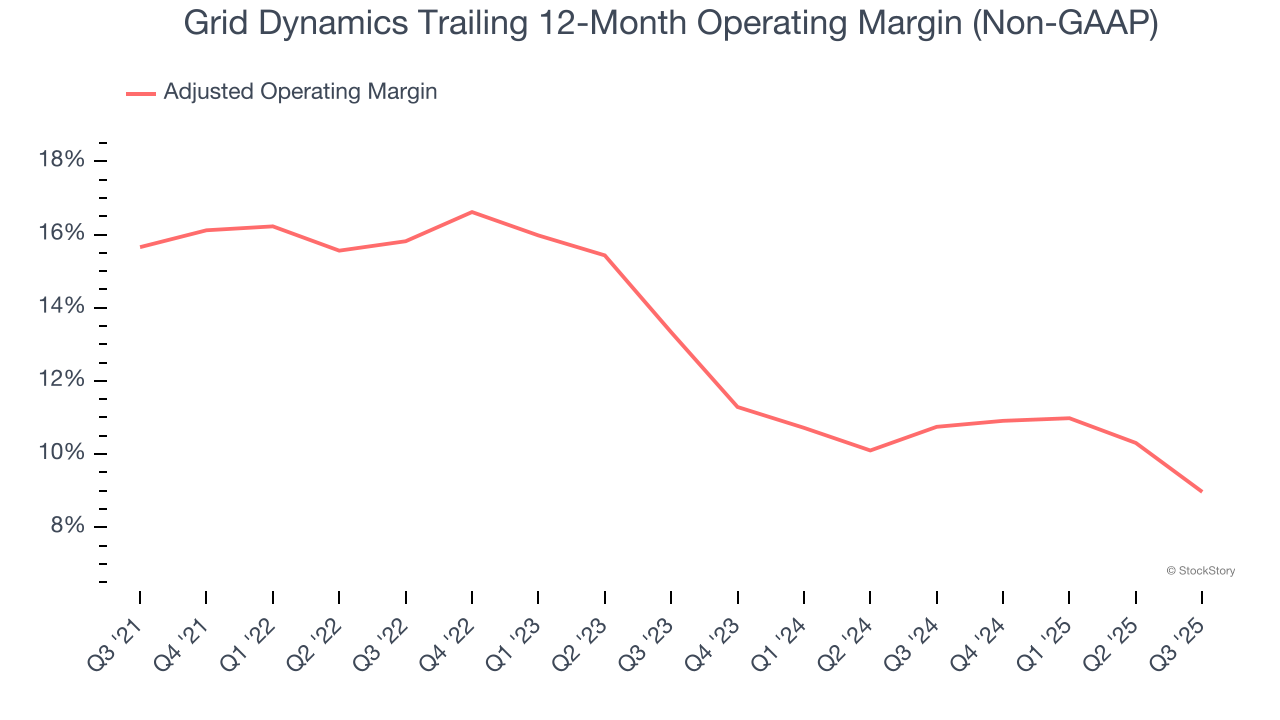

Shrinking Adjusted Operating Margin

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

Looking at the trend in its profitability, Grid Dynamics’s adjusted operating margin decreased by 6.7 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its adjusted operating margin for the trailing 12 months was 9%.

Final Judgment

Grid Dynamics has huge potential even though it has some open questions. After the recent drawdown, the stock trades at 22.2× forward P/E (or $9.70 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.